1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Sales Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Video Sales Platform

Video Sales PlatformVideo Sales Platform by Type (Cloud-based, On-premises), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global video sales platform market is experiencing robust growth, driven by the increasing adoption of video marketing strategies across various industries. Businesses are leveraging video to enhance customer engagement, personalize sales interactions, and improve conversion rates. The shift towards remote and hybrid work models has further accelerated the demand for cloud-based video sales platforms, enabling seamless communication and collaboration among geographically dispersed teams. While on-premises solutions still hold a segment of the market, the convenience and scalability of cloud-based platforms are fueling their market dominance. Large enterprises are leading the adoption, primarily due to their higher budgets and sophisticated sales processes requiring advanced features. However, SMEs are also increasingly embracing video sales tools, driven by the need for cost-effective and efficient sales outreach. The market is fragmented, with a range of players offering diverse features and functionalities. Key players include established names like Vidyard and Vimeo, alongside emerging startups specializing in specific niches. Geographic analysis reveals strong market penetration in North America and Europe, with significant growth potential in Asia-Pacific regions fueled by increasing digital adoption and economic expansion. While challenges like high initial investment costs and the need for skilled personnel to manage video content exist, the overall market outlook remains positive, indicating continued expansion throughout the forecast period. Future growth will likely be driven by innovations like AI-powered video analytics, enhanced personalization capabilities, and integration with CRM systems.

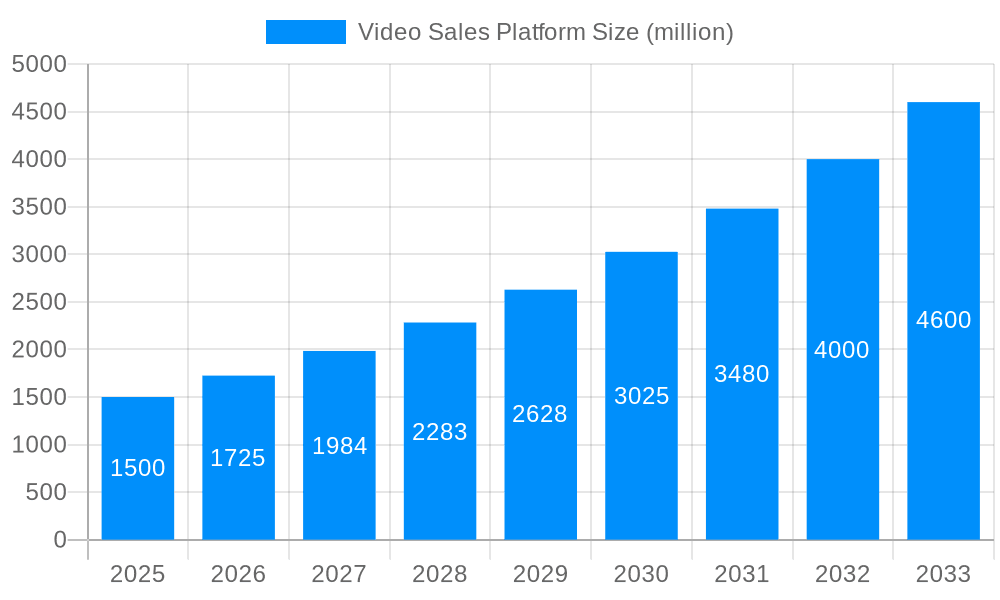

The market's Compound Annual Growth Rate (CAGR) is estimated to be around 15% during the forecast period of 2025-2033. This growth is attributed to the aforementioned factors, including increasing digital adoption, the rise of remote work, and the ongoing demand for more engaging and effective sales techniques. Competition is expected to intensify, with both established players and new entrants vying for market share. Strategic partnerships, product innovations, and targeted marketing initiatives will be crucial for success. Companies are focusing on improving user experience, integrating with other sales tools, and offering robust analytics dashboards to provide valuable insights into sales performance. The market segmentation, based on deployment type (cloud-based vs. on-premises) and user type (large enterprises vs. SMEs), will likely continue to evolve as the market matures and technology advances.

The global video sales platform market is experiencing explosive growth, projected to reach multi-million unit sales by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, driven by several converging factors. The base year, 2025, provides a critical benchmark, allowing for accurate forecasting (2025-2033) and analysis of the historical period (2019-2024). Key market insights point to a significant shift in sales strategies, with video emerging as a powerful tool for engagement and conversion. Businesses of all sizes, from SMEs to large enterprises, are increasingly adopting video sales platforms to enhance customer interactions, streamline sales processes, and ultimately boost revenue. This trend is further fueled by the rising adoption of cloud-based solutions, offering scalability, flexibility, and cost-effectiveness compared to on-premises deployments. The ease of integration with existing CRM systems and marketing automation tools is another crucial factor contributing to the market's expansion. Furthermore, advancements in video analytics provide valuable data insights, enabling businesses to optimize their video sales strategies and measure their return on investment (ROI) effectively. The increasing demand for personalized video messaging, facilitated by these platforms, is also a major growth driver. Finally, the ongoing digital transformation across various industries is accelerating the adoption of video sales platforms, making it a vital component of modern sales and marketing strategies. The estimated market value for 2025 itself showcases a substantial leap forward compared to previous years, reinforcing the prediction of continued strong growth through the forecast period.

Several factors are synergistically driving the expansion of the video sales platform market. The increasing preference for personalized communication, particularly in a saturated marketplace, is a primary driver. Video allows businesses to connect with potential clients on a more human level, fostering stronger relationships and building trust. The enhanced engagement rates offered by video compared to traditional text-based communication significantly improve conversion rates. The cost-effectiveness of video sales platforms, particularly cloud-based solutions, makes them accessible to businesses of all sizes, furthering market penetration. Integration capabilities with existing software ecosystems (CRMs, marketing automation platforms) seamlessly incorporate video into existing workflows, eliminating the need for significant infrastructural changes. The emergence of advanced analytics capabilities allows for detailed tracking of video performance, enabling data-driven optimization of sales strategies and targeted advertising. The rising adoption of remote work and virtual selling environments has also contributed significantly, as video becomes essential for maintaining client relationships and closing deals in a geographically dispersed landscape. The simplicity and convenience of creating and sharing professional-quality videos empowers even non-technical users, broadening the market's reach and further fueling its growth.

Despite the impressive growth trajectory, several challenges and restraints could hinder the expansion of the video sales platform market. The initial investment required for adopting a video platform, although relatively low compared to traditional sales methods, can be a barrier for some SMEs with limited budgets. The need for high-quality internet connectivity to effectively utilize video platforms can pose a challenge in regions with inadequate digital infrastructure. Concerns surrounding data security and privacy, particularly concerning the storage and handling of sensitive customer information, can also restrict adoption. The complexity of integrating video platforms with existing sales and marketing technologies, despite improved integration capabilities, may still pose challenges for certain businesses lacking the technical expertise. The need for consistent content creation and management can be a burden for businesses with limited resources, requiring dedicated personnel or external outsourcing. Lastly, competition among various providers can impact market growth, necessitating continuous innovation and value-added service offerings to maintain a competitive edge.

The cloud-based segment is poised to dominate the video sales platform market throughout the forecast period. This is largely attributable to its inherent scalability, flexibility, and cost-effectiveness. Cloud-based solutions eliminate the need for significant upfront investments in hardware and IT infrastructure, making them particularly appealing to SMEs. The ease of access and scalability ensures that businesses can easily adapt their video sales strategies as their needs evolve. Furthermore, cloud-based platforms often offer superior security features compared to on-premises solutions, mitigating data breach risks. The seamless integration capabilities with other cloud-based applications, such as CRMs and marketing automation tools, further contribute to its widespread adoption.

Several factors are catalyzing growth within the video sales platform industry. The rising adoption of personalized video messaging allows businesses to tailor their sales pitches to individual customer needs, significantly improving engagement and conversion rates. The integration of advanced analytics provides valuable data insights, enabling companies to optimize their video content and sales processes. Furthermore, the increasing use of video in social media marketing creates opportunities for viral reach and brand awareness. Finally, the continued advancements in video technology, including improvements in video quality, accessibility, and ease of use, are making video sales platforms increasingly attractive to businesses of all sizes.

This report provides a comprehensive analysis of the video sales platform market, covering market trends, driving forces, challenges, key players, and future growth projections. It offers valuable insights for businesses seeking to leverage video for improved sales outcomes, and for investors looking to understand the dynamics of this rapidly evolving market. The detailed segmentation analysis and regional breakdown allow for focused decision-making and strategic planning. The report's forecast period, extending to 2033, provides a long-term perspective on the market's potential, enabling informed investments and business strategies.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dubb, Hippo Video, Bonjoro, Sendspark, BombBomb, Covideo, Maverick, Videoform, OneMob, Vidyard, Quickpage, OneDay, Wistia, Videolicious, Vimeo, Cincopa, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Video Sales Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Video Sales Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.