1. What is the projected Compound Annual Growth Rate (CAGR) of the Vertical Farming Tomato?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vertical Farming Tomato

Vertical Farming TomatoVertical Farming Tomato by Type (Hydroponics Planting, Aeroponics Planting, Others), by Application (Fruit Tomato, Vegetable Tomato), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

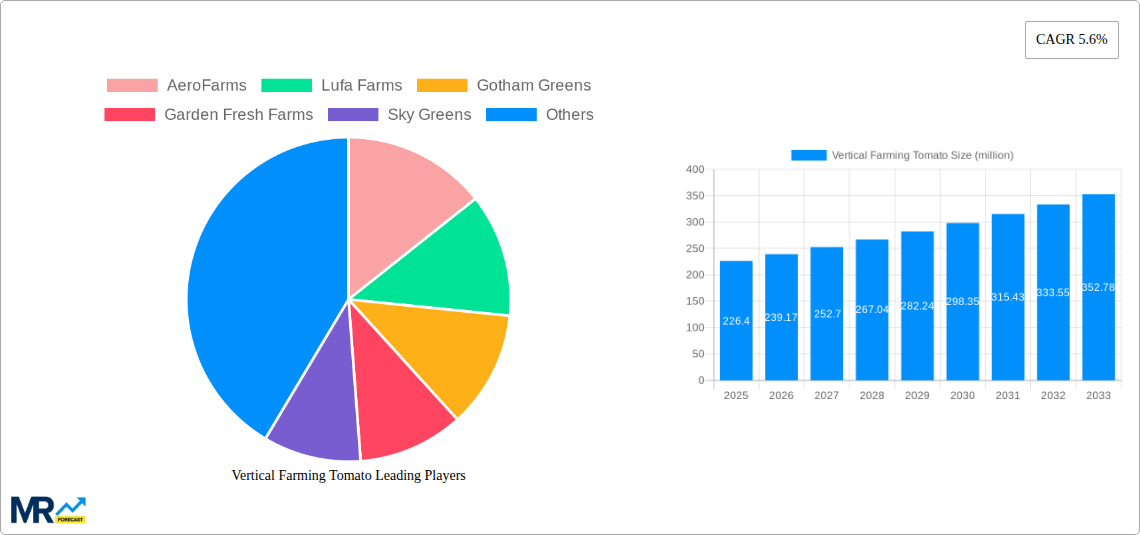

The global Vertical Farming Tomato market is poised for significant expansion, projected to reach an estimated USD 226.4 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.6% anticipated from 2019 to 2033. This impressive growth trajectory is fueled by a confluence of compelling drivers, including the escalating demand for fresh, locally sourced produce, increasing urbanization, and a growing awareness of the environmental benefits associated with controlled environment agriculture. Vertical farming offers a sustainable solution to traditional farming challenges such as land scarcity, water conservation, and reduced reliance on pesticides, making it an attractive alternative for tomato cultivation. Advancements in hydroponic and aeroponic technologies are further enhancing efficiency and yield, contributing to the sector's upward momentum. The market's dynamism is also evident in the diverse range of applications, with fruit and vegetable tomato varieties both showing strong adoption within vertical farming systems.

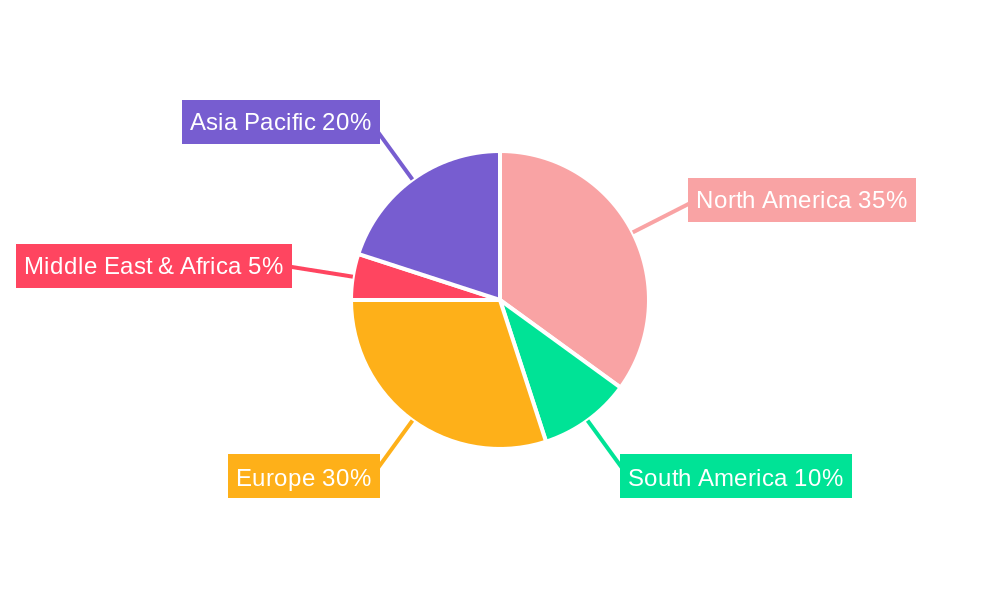

The market landscape for vertical farming tomatoes is characterized by innovation and strategic expansion by key players. Companies like AeroFarms, Lufa Farms, and Gotham Greens are at the forefront, leveraging cutting-edge technology and scalable business models to capture market share. While the market demonstrates strong growth potential, certain restraints such as high initial investment costs and energy consumption remain considerations. However, ongoing research and development in energy-efficient lighting and automation are steadily mitigating these challenges. Geographically, North America and Europe are leading the adoption, driven by supportive government policies and a strong consumer preference for sustainably grown produce. Asia Pacific, with its vast population and growing middle class, presents a significant untapped opportunity for future growth. The increasing emphasis on food security and the desire to reduce food miles are collectively shaping a future where vertical farming plays an increasingly vital role in meeting global tomato demand.

The global vertical farming tomato market is experiencing an unprecedented surge, driven by an increasing demand for fresh, locally sourced produce and a growing awareness of sustainable agricultural practices. During the study period of 2019-2033, with a base year of 2025, the market has witnessed significant growth and is poised for further expansion. The estimated market size for vertical farming tomatoes in 2025 is projected to reach an impressive USD 2.1 million in revenue, demonstrating a robust upward trajectory from its historical performance in the 2019-2024 period. This growth is fueled by a confluence of factors, including advancements in technology, evolving consumer preferences, and the pressing need for climate-resilient food production. Vertical farms offer a controlled environment, mitigating the impact of external weather conditions and pests, thereby ensuring consistent yields and superior quality tomatoes. This reliability is particularly attractive to urban centers and regions with unfavorable climates for traditional agriculture. Furthermore, the reduced transportation distances inherent in vertical farming contribute to a lower carbon footprint, aligning with global sustainability goals and attracting environmentally conscious consumers. The market is observing a diversification of tomato varieties cultivated within vertical farms, ranging from popular beefsteak and cherry tomatoes to specialty heirloom varieties, catering to a broader consumer base and niche culinary applications. Innovations in LED lighting, nutrient delivery systems, and automation are continuously enhancing efficiency and reducing operational costs, making vertical farming an increasingly viable and profitable agricultural model. The forecast period of 2025-2033 is expected to see this market mature, with continued technological integration and a widening adoption of vertical farming solutions for tomato cultivation worldwide. The ability to grow produce year-round, irrespective of seasonality, is a paramount advantage, ensuring a stable supply chain and mitigating the price volatility often associated with traditional agriculture. This consistent supply directly translates into greater market stability and profitability for vertical farming operators. The emphasis on reduced water usage and the elimination of pesticides further bolster the appeal of vertically farmed tomatoes as a healthier and more eco-friendly option. As more research and development are invested, and as economies of scale begin to take hold, the cost-effectiveness of vertical farming is expected to improve, further accelerating market penetration. The burgeoning interest in plant-based diets and the demand for premium, visually appealing produce also play a significant role in driving the market for high-quality, vertically grown tomatoes.

The vertical farming tomato market's remarkable ascent is underpinned by a powerful interplay of economic, environmental, and societal forces. A primary driver is the escalating global population, which necessitates more efficient and localized food production methods. Traditional agriculture faces limitations in land availability and is susceptible to climate change impacts, making vertical farming a compelling alternative for ensuring food security. The inherent benefits of controlled environment agriculture, such as reduced water consumption (up to 95% less than conventional farming), minimal pesticide use, and year-round production capabilities, resonate strongly with increasingly environmentally conscious consumers and regulatory bodies. These factors contribute to a more sustainable food system and a healthier end product. Furthermore, the growing urbanization trend concentrates populations in cities, creating a demand for fresh produce closer to consumption points. Vertical farms, often situated within or on the outskirts of urban centers, significantly reduce transportation distances, leading to fresher produce with a longer shelf life and a smaller carbon footprint associated with logistics. Technological advancements have also played a pivotal role. Innovations in LED lighting, climate control systems, nutrient film techniques, and aeroponics have significantly improved crop yields, energy efficiency, and overall operational viability. These advancements have lowered the barrier to entry for new players and improved the profitability of existing operations. Consumer preferences are also shifting towards healthier, traceable, and sustainably produced food. Vertically farmed tomatoes, with their controlled environment and minimal chemical inputs, meet these evolving demands, fostering brand loyalty and premium pricing potential. The desire for consistent quality and year-round availability, regardless of external weather conditions, further solidifies the market position of vertically farmed tomatoes.

Despite its promising trajectory, the vertical farming tomato industry is not without its hurdles. A significant challenge revolves around the high initial capital investment required for establishing vertical farming facilities. The cost of advanced lighting systems, automated climate control, hydroponic or aeroponic infrastructure, and specialized shelving can be substantial, posing a barrier to entry for smaller enterprises. This initial outlay can be a considerable deterrent. Another crucial factor is energy consumption. While LED technology has become more efficient, lighting, climate control, and automation systems still represent a significant operational cost. The reliance on electricity grids, which may not always be powered by renewable sources, also raises concerns about the overall environmental footprint and can lead to fluctuating operational expenses. The scalability and economic viability for certain tomato varieties and market segments remain under scrutiny. While high-value, niche tomato varieties might prove profitable, achieving cost-competitiveness for staple tomato types against conventionally grown produce can be challenging. The market is still maturing, and optimizing production costs to compete with established agricultural economies of scale is an ongoing endeavor. Furthermore, technical expertise and skilled labor are crucial for operating and maintaining these sophisticated systems. The availability of trained professionals capable of managing complex hydroponic/aeroponic systems, plant nutrition, and disease management within a controlled environment is essential for success. Without adequate expertise, yields can suffer, and operational inefficiencies can arise. Finally, consumer perception and acceptance of vertically farmed produce, while improving, can still be a restraint. Some consumers may harbor skepticism about the taste, nutritional value, or the "naturalness" of produce grown in artificial environments, although this is progressively diminishing with increased education and product availability.

The vertical farming tomato market is poised for significant growth across several key regions and segments, with a strong indication that North America, particularly the United States, will emerge as a dominant force in the coming years. This dominance is attributed to a confluence of factors, including a robust and technologically advanced agricultural sector, a large and discerning consumer base with a growing appetite for fresh, locally sourced produce, and substantial investment in AgTech innovation. The presence of leading vertical farming companies with significant operational footprints further solidifies the US market's leadership. Countries within the European Union, such as the Netherlands and the United Kingdom, also represent crucial markets, driven by strong governmental support for sustainable agriculture, a commitment to reducing food miles, and a well-established infrastructure for importing and distributing fresh produce. Asian markets, especially Japan and Singapore, are also showing considerable promise due to high population densities, limited arable land, and a strong emphasis on food safety and quality.

In terms of market segments, Hydroponics Planting is anticipated to continue its dominance in the vertical farming tomato sector. This method, where plants are grown in nutrient-rich water solutions without soil, has proven highly effective for tomato cultivation due to its water efficiency, precise nutrient delivery, and ability to support robust plant growth and fruit development. Hydroponic systems allow for optimal control over the root environment, leading to faster growth cycles and higher yields, making it a commercially attractive option for large-scale vertical farms. The technology associated with hydroponics is well-established and continuously evolving, offering a reliable and scalable solution for tomato production.

However, Aeroponics Planting is projected to witness the fastest growth rate. Aeroponics, which involves suspending plant roots in the air and misting them with nutrient-rich solutions, offers even greater water efficiency and potentially superior oxygenation of roots, leading to enhanced plant health and potentially faster growth. While currently a smaller segment compared to hydroponics, ongoing research and development in aeroponic technology are addressing some of the initial cost and complexity barriers, paving the way for its wider adoption, especially for high-value tomato varieties where marginal gains in yield and quality can be highly significant.

The application segment of Fruit Tomato is expected to hold a larger market share within vertical farming. This is primarily due to the higher market value and consumer demand for fresh, ripe tomatoes used in salads, sandwiches, and as a culinary staple. Vertical farms are particularly adept at producing visually appealing and flavorful fruit tomatoes with consistent quality, meeting the expectations of both consumers and food service industries. While Vegetable Tomato cultivation is also present, the emphasis on sweetness, texture, and visual appeal often tilts the market towards fruit varieties in controlled environments. The ability of vertical farms to control factors like sunlight exposure (through LEDs), temperature, and nutrient composition allows for the optimization of sugar content and flavor profiles in fruit tomatoes, making them highly desirable.

The vertical farming tomato industry is experiencing significant growth catalysts. The increasing consumer demand for fresh, locally grown, and pesticide-free produce is a major driver. Technological advancements in LED lighting, automation, and climate control systems are making operations more efficient and cost-effective. Furthermore, government initiatives and incentives promoting sustainable agriculture and food security are providing crucial support. The growing awareness of the environmental impact of traditional agriculture and the need for climate-resilient food systems are also compelling more investment and adoption of vertical farming solutions for tomato production.

This comprehensive report on the vertical farming tomato market delves into a meticulous analysis of market dynamics from the historical period of 2019-2024, through the base year of 2025, and projects future trends up to 2033. It examines the intricate interplay of driving forces such as burgeoning consumer demand for sustainable and local produce, coupled with significant technological advancements in controlled environment agriculture. The report also critically assesses the challenges and restraints, including high initial capital expenditure and energy consumption, offering insights into mitigation strategies. Detailed regional and segment analyses, focusing on the dominance of hydroponics and the rapid growth of aeroponics, along with the application of fruit tomatoes, provide a granular view of market segmentation. Furthermore, the report highlights key growth catalysts and identifies leading industry players, culminating in a thorough understanding of the vertical farming tomato sector's present landscape and its promising future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include AeroFarms, Lufa Farms, Gotham Greens, Garden Fresh Farms, Sky Greens, Plenty (Bright Farms), Mirai, Spread, Green Sense Farms, Scatil.

The market segments include Type, Application.

The market size is estimated to be USD 226.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Vertical Farming Tomato," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vertical Farming Tomato, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.