1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Occupant Detection System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vehicle Occupant Detection System

Vehicle Occupant Detection SystemVehicle Occupant Detection System by Type (/> Occupant Status Monitoring, Crew Health Monitoring, Other), by Application (/> Passenger Car, Commercial Vehicle, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

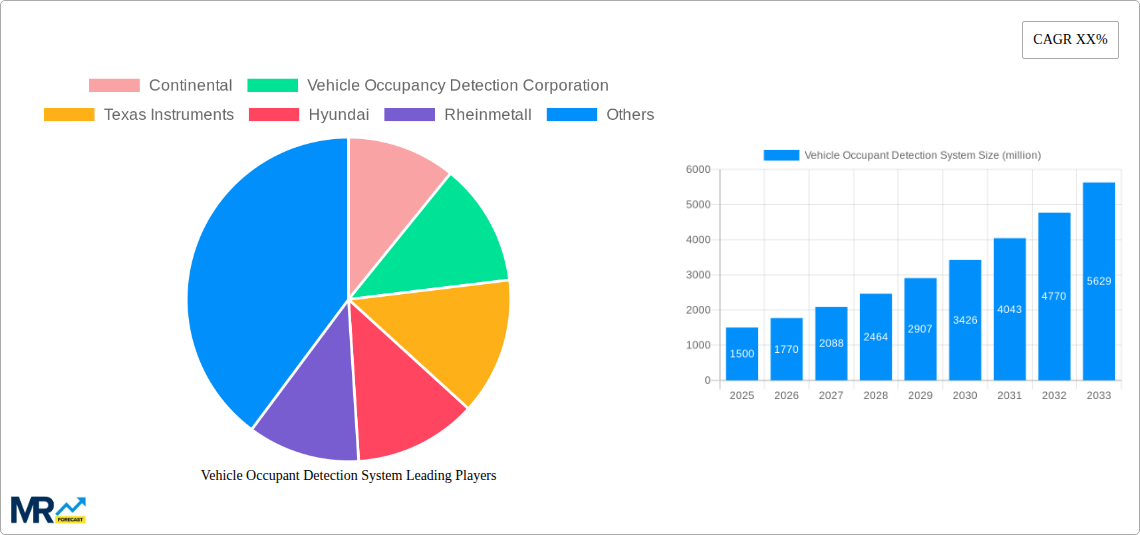

The global Vehicle Occupant Detection System market is poised for significant expansion, driven by increasing concerns for passenger safety, comfort, and the burgeoning adoption of advanced driver-assistance systems (ADAS). With an estimated market size of approximately \$1.5 billion in 2025, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of around 18% through 2033. This robust growth is fueled by stringent safety regulations mandating features like seatbelt reminders and airbag deployment optimization based on occupant presence and weight. Furthermore, the demand for enhanced in-cabin experiences, including personalized climate control and infotainment, is pushing manufacturers to integrate sophisticated occupant detection technologies. The market is segmented into Occupant Status Monitoring, Crew Health Monitoring, and Other. Occupant Status Monitoring, encompassing features like presence detection, posture analysis, and even rudimentary health monitoring, is expected to dominate the market due to its direct impact on safety and comfort. The Passenger Car segment is the primary application, accounting for the largest share, followed by Commercial Vehicles, as fleet operators increasingly recognize the benefits of optimized safety and resource management.

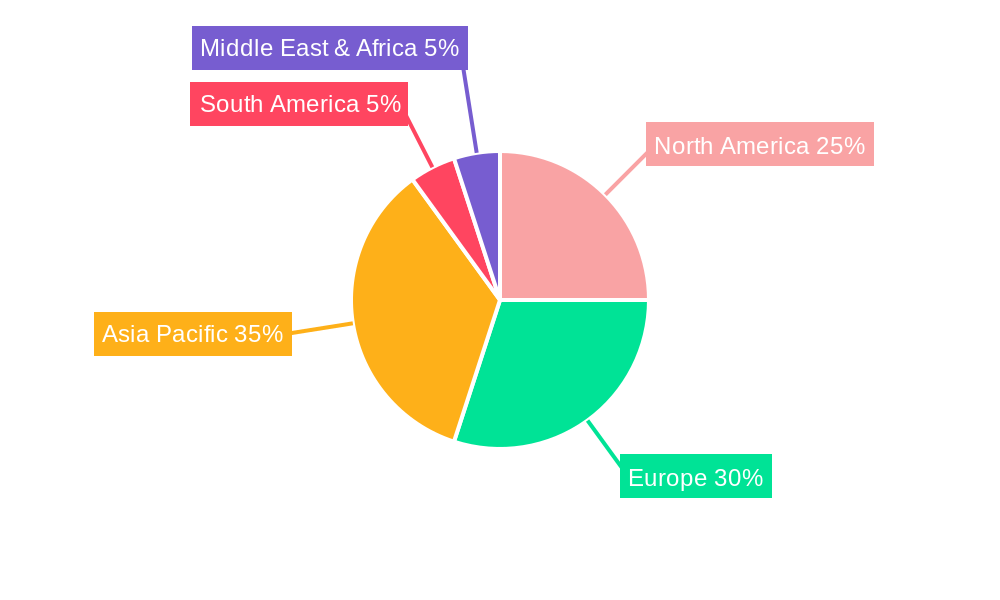

Key players such as Continental, Texas Instruments, Valeo, and Hyundai are at the forefront of innovation, investing heavily in research and development to create more accurate, cost-effective, and integrated occupant detection solutions. Emerging trends include the integration of artificial intelligence and machine learning for advanced behavioral analysis and proactive safety interventions, alongside the development of non-intrusive sensing technologies like radar and infrared. However, challenges such as high implementation costs for certain advanced systems and data privacy concerns need to be addressed for broader market penetration. Geographically, Asia Pacific, led by China and India, is expected to witness the fastest growth due to a rapidly expanding automotive sector and increasing consumer awareness of vehicle safety. North America and Europe, already mature markets, will continue to be significant contributors, driven by strong regulatory frameworks and a high adoption rate of premium vehicle features.

This comprehensive report delves into the intricate landscape of the Vehicle Occupant Detection System (VODS) market, offering a meticulous analysis spanning the historical period of 2019-2024, a crucial base year of 2025, and an extensive forecast period extending to 2033. The study aims to provide unparalleled insights into market dynamics, technological advancements, and strategic initiatives shaping this rapidly evolving sector. The global VODS market, valued in the millions of dollars, is poised for substantial growth, driven by an increasing emphasis on automotive safety, passenger well-being, and the proliferation of advanced driver-assistance systems (ADAS). We will meticulously examine the interplay of various stakeholders, including prominent companies like Continental, Vehicle Occupancy Detection Corporation, Texas Instruments, Hyundai, Rheinmetall, Delphi Automotive PLC, Fraunhofer-Gesellschaft, and Valeo, alongside diverse market segments such as Occupant Status Monitoring, Crew Health Monitoring, and Other, and applications spanning Passenger Cars, Commercial Vehicles, and Other vehicle types.

The Vehicle Occupant Detection System (VODS) market is undergoing a transformative evolution, moving beyond basic seatbelt reminders to sophisticated, multi-faceted sensing and monitoring solutions. Over the study period of 2019-2033, a significant trend observed is the integration of VODS as a fundamental component of modern automotive safety architectures. This integration is no longer an optional add-on but a critical feature for achieving higher safety ratings and meeting stringent regulatory requirements. The base year of 2025 marks a pivotal point where consumer awareness and demand for enhanced in-cabin safety features have reached a new zenith. Looking ahead, the forecast period (2025-2033) will witness an accelerated adoption of advanced VODS technologies, including those leveraging radar, camera, and ultrasonic sensors, to provide real-time occupant monitoring for a multitude of purposes.

Key market insights reveal a strong impetus towards occupant status monitoring systems that can differentiate between adult occupants, children, and even pets, crucial for preventing heatstroke incidents in parked vehicles. Furthermore, the burgeoning field of crew health monitoring is gaining significant traction, especially within the commercial vehicle segment. This involves the deployment of sensors capable of tracking vital signs like heart rate, respiration, and even detecting signs of fatigue or drowsiness, thereby proactively mitigating risks associated with driver incapacitation. The "Other" category within segments is also expanding, encompassing applications such as personalized climate control based on occupant presence and number, and even sophisticated in-cabin gesture recognition for user interaction.

The market is also experiencing a surge in demand for unobtrusive and seamlessly integrated VODS solutions. Manufacturers are increasingly prioritizing technologies that are aesthetically pleasing and do not compromise the interior design of the vehicle. This has led to advancements in miniaturization of sensors and the development of intelligent algorithms that can process data from multiple sources to provide a comprehensive understanding of the cabin environment. The transition from reactive safety measures to proactive occupant well-being is a defining characteristic of this market. As autonomous driving technologies mature, the role of VODS will become even more critical in ensuring a safe handover of control and monitoring occupant readiness and attention levels. The interplay between passenger car and commercial vehicle applications will continue to diversify, with commercial vehicles often leading in the adoption of advanced health and status monitoring due to operational safety mandates and the potential for improved fleet management. The historical period of 2019-2024 laid the groundwork, with initial deployments and technological advancements, setting the stage for the more comprehensive and integrated VODS solutions anticipated in the coming years.

The escalating global demand for enhanced automotive safety is the primary propellant behind the robust growth of the Vehicle Occupant Detection System (VODS) market. Governments worldwide are implementing stricter safety regulations and incentivizing the adoption of advanced safety features, directly impacting the mandate and desirability of VODS. The increasing prevalence of Advanced Driver-Assistance Systems (ADAS) further fuels this growth, as VODS systems are often an integral part of the ADAS ecosystem, providing crucial input for features like adaptive cruise control, automatic emergency braking, and driver monitoring systems. The growing awareness among consumers regarding the critical importance of in-cabin safety, particularly concerning vulnerable occupants like children, is also a significant driving force. Incidents of accidental heatstroke in vehicles, sadly, have become a stark reminder of the need for intelligent occupant detection, pushing manufacturers to integrate such solutions proactively. Furthermore, the burgeoning commercial vehicle sector, with its emphasis on driver well-being and operational efficiency, is actively adopting VODS for crew health monitoring, aiming to reduce accidents caused by driver fatigue or health-related incapacitation. The pursuit of higher safety ratings by automotive manufacturers, a key factor in consumer purchasing decisions, necessitates the inclusion of sophisticated VODS.

Despite the promising trajectory, the Vehicle Occupant Detection System (VODS) market faces several challenges and restraints that could temper its growth. One of the primary hurdles is the cost of implementation. Integrating advanced VODS technologies, particularly those involving complex sensor arrays and sophisticated processing units, can significantly increase the overall cost of a vehicle, potentially making it less accessible for budget-conscious consumers. Another significant challenge lies in data privacy concerns. VODS systems collect sensitive information about occupants, including their presence, position, and potentially even vital signs. Ensuring the secure storage and ethical use of this data is paramount to maintaining consumer trust and complying with evolving data protection regulations. The complexity of integration with existing vehicle architectures can also pose a restraint. Retrofitting or integrating VODS into older vehicle platforms can be technically demanding and expensive, limiting its widespread adoption in the aftermarket. Furthermore, false positive or negative detection rates can impact user experience and trust. Inaccurate detection of an occupant or a false alarm can lead to frustration and a reluctance to rely on the system. The development and validation of robust algorithms capable of accurately distinguishing between various occupant types and states in diverse environmental conditions remain an ongoing challenge. Lastly, consumer education and awareness about the benefits and functionalities of VODS are still crucial. A lack of understanding can lead to underutilization of the system's capabilities or a general lack of demand.

The Passenger Car segment is anticipated to be a dominant force in the global Vehicle Occupant Detection System (VODS) market. This dominance stems from several interwoven factors, making it a critical area for market growth and innovation.

High Production Volumes: Passenger cars represent the largest segment of global vehicle production. The sheer volume of vehicles manufactured globally translates directly into a substantial demand for VODS components and solutions. As VODS transitions from a niche safety feature to a standard offering, its integration into the mass production of passenger cars will naturally lead to market dominance.

Stringent Safety Regulations and Consumer Demand: Regulatory bodies worldwide are increasingly mandating advanced safety features in passenger vehicles. This includes features like occupant detection for airbag deployment optimization, seatbelt reminders for all occupants, and child presence detection to prevent dangerous situations. Alongside regulatory pressure, consumers are becoming more safety-conscious, actively seeking vehicles equipped with advanced safety technologies, including those that monitor occupant status. This dual pressure from regulators and consumers creates a powerful impetus for VODS adoption in passenger cars.

Technological Advancements and Feature Differentiation: Manufacturers are leveraging VODS to differentiate their passenger car models by offering innovative features. For example, Occupant Status Monitoring systems that can differentiate between adults, children, and even pets are becoming increasingly sought after to prevent tragic heatstroke incidents. This ability to provide tangible safety benefits beyond basic occupant presence detection makes VODS a highly attractive feature for passenger car buyers.

Comfort and Convenience Applications: Beyond pure safety, VODS is also being integrated for enhanced passenger comfort and convenience in passenger cars. Personalized climate control that adjusts based on the number and location of occupants, or infotainment systems that automatically adjust settings for different occupants, are examples of how VODS contributes to a superior in-cabin experience. This expansion of application beyond just safety further solidifies its importance in the passenger car segment.

Market Maturity and R&D Investment: The passenger car market is generally more mature in terms of R&D investment and consumer acceptance of new technologies compared to some other segments. This allows for greater experimentation and faster adoption of VODS technologies, driving down costs and increasing the sophistication of available solutions.

Geographically, North America and Europe are projected to lead the VODS market. Both regions have highly developed automotive industries, stringent safety standards, and a high level of consumer awareness regarding automotive safety. The presence of major automotive manufacturers and Tier-1 suppliers in these regions further contributes to their market leadership. For instance, countries like the United States and Germany are at the forefront of implementing and adopting advanced automotive technologies. The robust regulatory frameworks in these regions, coupled with a strong consumer preference for vehicles equipped with the latest safety innovations, create a fertile ground for VODS market growth. The historical period of 2019-2024 has seen significant investment in VODS research and development within these regions, paving the way for their continued dominance in the forecast period of 2025-2033.

The Vehicle Occupant Detection System (VODS) industry is experiencing significant growth fueled by several key catalysts. The relentless push for enhanced automotive safety, driven by regulatory mandates and consumer demand, is a primary driver. Advanced Driver-Assistance Systems (ADAS) integration, where VODS plays a crucial role, further amplifies this growth. The increasing awareness and concern around child safety in vehicles, leading to the development and adoption of child presence detection systems, are also significant catalysts. Moreover, the burgeoning trend of crew health monitoring in commercial vehicles, aimed at preventing accidents due to driver fatigue or health issues, is opening up new avenues for market expansion.

This report provides an exhaustive analysis of the Vehicle Occupant Detection System (VODS) market, offering deep insights into trends, driving forces, challenges, regional dynamics, and key players. Covering the historical period from 2019-2024, a crucial base year of 2025, and an extensive forecast period through 2033, the study details market valuations in the millions, examining segments like Occupant Status Monitoring and Crew Health Monitoring, and applications in Passenger Cars and Commercial Vehicles. The report meticulously dissects the technological advancements, regulatory landscapes, and competitive strategies shaping this vital automotive sector, ensuring stakeholders are equipped with the knowledge to navigate and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Continental, Vehicle Occupancy Detection Corporation, Texas Instruments, Hyundai, Rheinmetall, Delphi Automotive PLC, Fraunhofer-Gesellschaft, Valeo, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Vehicle Occupant Detection System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vehicle Occupant Detection System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.