1. What is the projected Compound Annual Growth Rate (CAGR) of the Vacuum Membranes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vacuum Membranes

Vacuum MembranesVacuum Membranes by Application (Woodworking, Solar and Glass), by Type (Natural Rubber Vacuum Membrane, Silicone Vacuum Membrane, Latex Sheet Vacuum Membrane, Polyurethane Vacuum Membrane), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

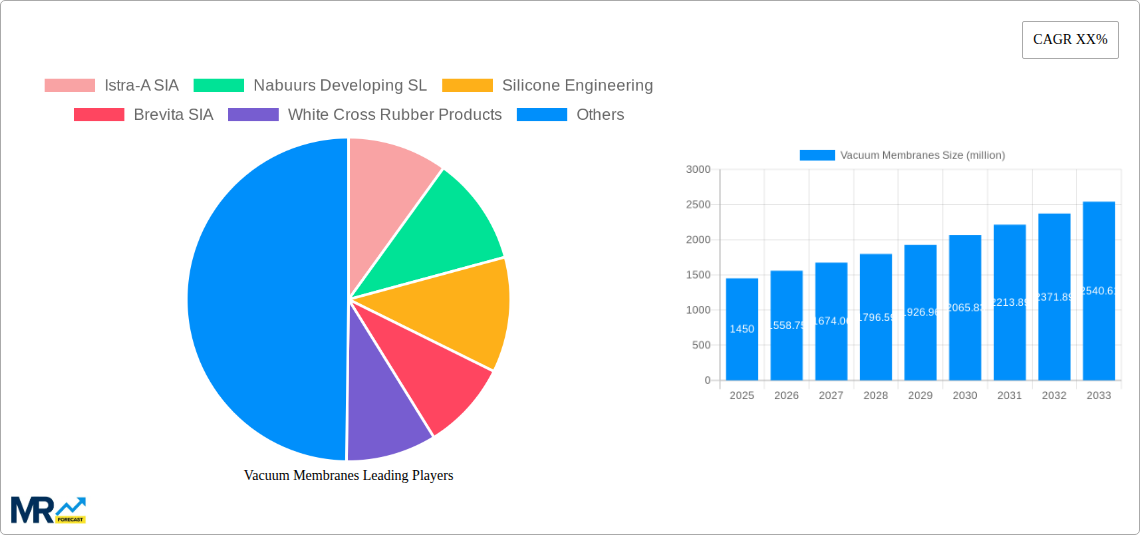

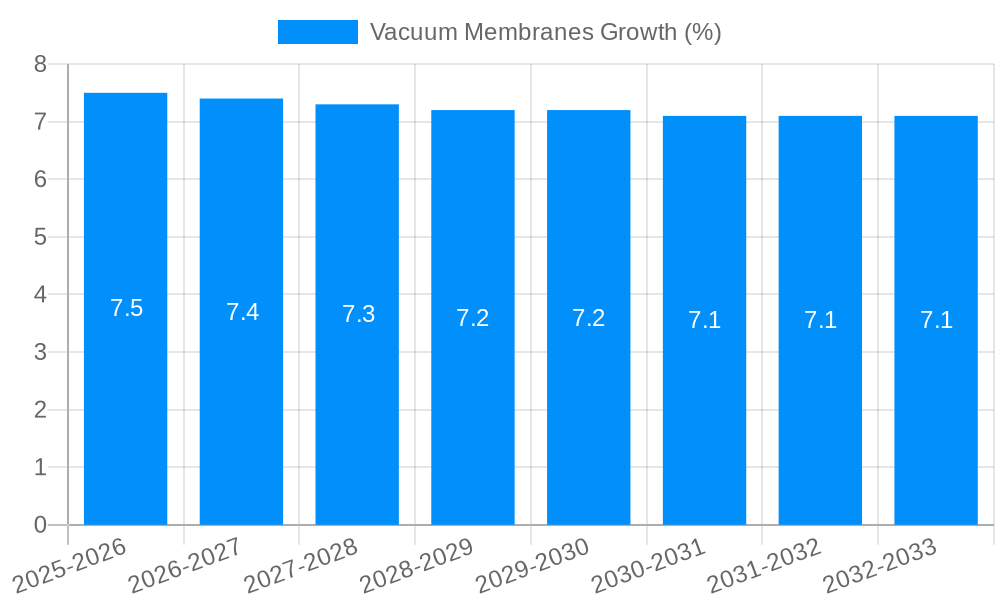

The global Vacuum Membranes market is poised for significant expansion, projected to reach an estimated \$1,450 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated through 2033. This impressive growth is primarily fueled by the escalating demand for advanced manufacturing processes across diverse industries. The woodworking sector, a cornerstone of this market, continues to drive adoption due to the efficiency and precision vacuum membranes offer in lamination, edge banding, and veneering. Concurrently, the burgeoning solar and glass industries are presenting substantial opportunities, with vacuum membranes playing a critical role in the manufacturing of photovoltaic panels and insulated glass units, enhancing both production quality and energy efficiency. The market's upward trajectory is further supported by continuous innovation in membrane materials, leading to enhanced durability, flexibility, and resistance to chemicals and extreme temperatures.

The market's dynamics are shaped by a complex interplay of drivers and restraints. Key drivers include the increasing need for cost-effective and high-precision manufacturing solutions, growing investments in automation across industrial sectors, and the development of new applications for vacuum membrane technology. The rise of sustainable manufacturing practices also indirectly benefits the market, as vacuum pressing can contribute to reduced material waste. However, challenges such as the initial capital investment required for vacuum systems and the fluctuating prices of raw materials, particularly natural rubber, could temper growth. Despite these restraints, the inherent advantages of vacuum membranes in terms of product quality, operational efficiency, and versatility are expected to outweigh these concerns, ensuring sustained market development. The increasing penetration of silicone and polyurethane membranes, offering superior performance in demanding applications, is a notable trend contributing to market evolution.

This comprehensive report delves into the dynamic landscape of the vacuum membranes market, meticulously analyzing trends, driving forces, challenges, and future projections. Spanning a significant study period from 2019 to 2033, with a base year of 2025, the report offers invaluable insights for stakeholders. The historical period (2019-2024) lays the groundwork for understanding past market behaviors, while the estimated year of 2025 and the extensive forecast period (2025-2033) provide a clear roadmap for anticipated growth and strategic opportunities. The report aims to equip businesses with the knowledge needed to navigate this evolving sector and capitalize on emerging trends, with market valuations projected to reach 2,500 million by the end of the forecast period.

The global vacuum membranes market is poised for significant expansion, driven by increasing adoption across diverse industrial applications. During the historical period of 2019-2024, the market demonstrated steady growth, fueled by the rising demand for efficient and precise manufacturing processes. As we move into the estimated year of 2025 and the subsequent forecast period extending to 2033, several key trends are expected to shape the trajectory of this industry. One of the most prominent trends is the escalating adoption of silicone vacuum membranes due to their superior heat resistance, flexibility, and durability compared to traditional materials. This is particularly evident in the solar and glass industries, where precision and high-temperature handling are paramount. The growing emphasis on energy efficiency and sustainability in manufacturing processes is also a significant driver, encouraging industries to invest in advanced vacuum membrane technologies that reduce energy consumption and waste. Furthermore, the development of innovative membrane formulations, such as advanced polyurethane variants offering enhanced abrasion resistance and chemical inertness, is creating new market opportunities. The integration of smart technologies and IoT capabilities into vacuum membrane systems, enabling real-time monitoring and predictive maintenance, is another emerging trend that will enhance operational efficiency and reliability. The woodworking sector, in particular, is witnessing an increased demand for high-performance natural rubber and latex vacuum membranes for complex shaping and lamination processes, where flexibility and conformability are crucial. The market is also seeing a diversification in applications, moving beyond traditional manufacturing into specialized fields requiring precise vacuum sealing and forming. The report anticipates that the market value will surpass 2,000 million by 2028, underscoring the robust growth trajectory. The increasing complexity of manufactured goods and the stringent quality control requirements across industries are further bolstering the demand for reliable and high-performance vacuum membranes. As manufacturing processes become more automated and sophisticated, the role of vacuum membranes as critical components in ensuring precision and efficiency will only continue to grow. The market is projected to reach a valuation of 2,500 million by 2033, reflecting a compound annual growth rate (CAGR) of approximately 6.5% over the forecast period. This sustained growth highlights the indispensable nature of vacuum membranes in modern industrial operations.

The vacuum membranes market is experiencing a robust upswing, propelled by a confluence of factors that underscore their critical role in modern industrial operations. Foremost among these is the burgeoning demand from the solar and glass industries. The manufacturing of solar panels, particularly thin-film photovoltaic cells, and the fabrication of large, complex glass structures, necessitate highly precise and uniformly distributed vacuum pressure. Vacuum membranes are instrumental in laminating solar cells and in the bending and shaping of glass, ensuring flawless adhesion and preventing defects. This surge in renewable energy initiatives and the increasing use of advanced glass in architectural and automotive applications directly translate into higher demand for specialized vacuum membranes. The woodworking industry also represents a significant growth driver. The adoption of advanced CNC machinery and the increasing trend towards sophisticated furniture design, intricate inlays, and veneering processes rely heavily on the conformity and sealing capabilities of vacuum membranes. These membranes enable the secure holding of irregularly shaped workpieces during routing, sanding, and gluing, thereby enhancing production efficiency and product quality. Furthermore, the global push towards automation and Industry 4.0 is a pervasive force. As manufacturing facilities increasingly embrace automated workflows and intelligent systems, the need for reliable and high-performance components like vacuum membranes becomes paramount. These membranes are integral to automated pick-and-place operations, robotic assembly, and vacuum clamping systems, all of which contribute to increased throughput, reduced labor costs, and improved safety. The growing emphasis on product quality and precision across all manufacturing sectors, from electronics to automotive, further amplifies the demand for vacuum membranes. They play a crucial role in ensuring consistent pressure distribution, preventing air leaks, and achieving tight tolerances, which are essential for producing high-value goods. The market is expected to reach a valuation of 2,200 million by 2030, demonstrating a clear upward trend.

Despite the promising growth trajectory, the vacuum membranes market is not without its challenges and restraints that could impede its full potential. One of the primary hurdles is the high cost of certain advanced materials, particularly specialized silicone and polyurethane formulations. While these materials offer superior performance, their premium pricing can be a deterrent for smaller manufacturers or those operating in cost-sensitive segments, limiting widespread adoption. The need for specialized handling and maintenance can also pose a challenge. Vacuum membranes, especially those made from delicate materials or used in demanding applications, require careful handling during installation and regular maintenance to ensure optimal performance and longevity. Improper handling can lead to premature wear, punctures, or loss of sealing integrity, resulting in costly downtime and replacements. The fluctuating raw material prices for rubber and other polymers can also impact the cost-effectiveness of vacuum membranes. Volatility in the prices of natural rubber, synthetic polymers, and curing agents can directly affect production costs and, consequently, the final pricing of vacuum membranes, creating uncertainty for both manufacturers and end-users. Furthermore, the technical expertise required for selection and application can be a restraint. Choosing the right type of vacuum membrane for a specific application, considering factors such as temperature resistance, chemical compatibility, flexibility, and vacuum pressure requirements, demands a certain level of technical knowledge. Insufficient understanding can lead to the selection of inappropriate membranes, resulting in suboptimal performance or premature failure. The market, though growing, is subject to these limitations which the industry will need to address to sustain its growth. The report estimates that these challenges could temper the market's growth to around 2,500 million by 2033, rather than reaching higher projections.

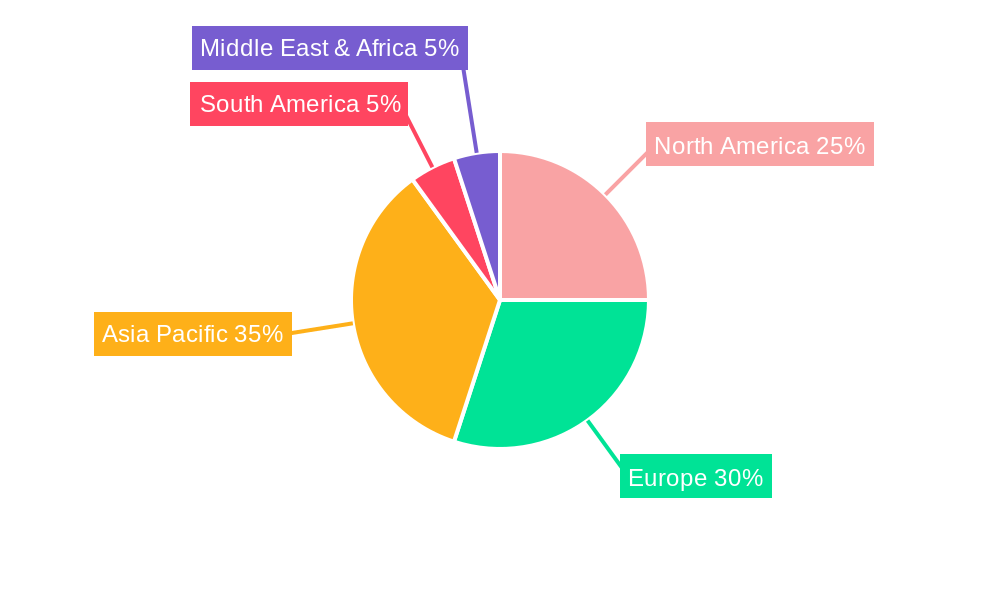

The global vacuum membranes market is characterized by regional dominance and the significant contribution of specific application and type segments.

Dominant Application Segments:

Dominant Type Segments:

Key Dominant Region:

The combined strength of these dominant segments and regions is expected to drive the market towards a valuation of 2,500 million by 2033, with Asia Pacific playing a pivotal role in this expansion.

Several factors are acting as significant catalysts for the growth of the vacuum membranes industry. The relentless pursuit of increased manufacturing efficiency and automation across industries is a primary driver, as vacuum membranes are essential for precise clamping and handling in automated systems. The escalating global demand for renewable energy solutions, particularly solar power, directly fuels the need for specialized vacuum membranes in photovoltaic cell manufacturing. Furthermore, the expansion of the construction and interior design sectors, coupled with a growing consumer preference for high-quality, customized furniture, is boosting demand from the woodworking industry. The development of new material formulations offering enhanced durability, heat resistance, and chemical compatibility is also opening up new application areas and driving market penetration.

This report provides an exhaustive examination of the vacuum membranes market, offering deep insights into its present state and future trajectory. It meticulously covers market size projections, anticipated growth rates, and key trends influencing the industry. The analysis delves into the primary drivers propelling market expansion, such as the growing adoption in woodworking and solar manufacturing, alongside the overarching shift towards industrial automation. Conversely, the report also addresses the challenges and restraints that could impede growth, including material costs and the requirement for specialized expertise. Furthermore, it highlights the dominant regional markets and pivotal application and type segments, such as the woodworking sector and silicone vacuum membranes, predicting their continued influence. The report also identifies the leading companies operating in this space and outlines significant technological developments and innovations that are shaping the future of vacuum membranes, with the market expected to reach a substantial 2,500 million by 2033. This comprehensive approach ensures that stakeholders are equipped with the necessary information for strategic decision-making in this evolving industrial landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Istra-A SIA, Nabuurs Developing SL, Silicone Engineering, Brevita SIA, White Cross Rubber Products, J-Flex, Comitec, Aflatek, Black Bros, Steinbach AG, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vacuum Membranes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vacuum Membranes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.