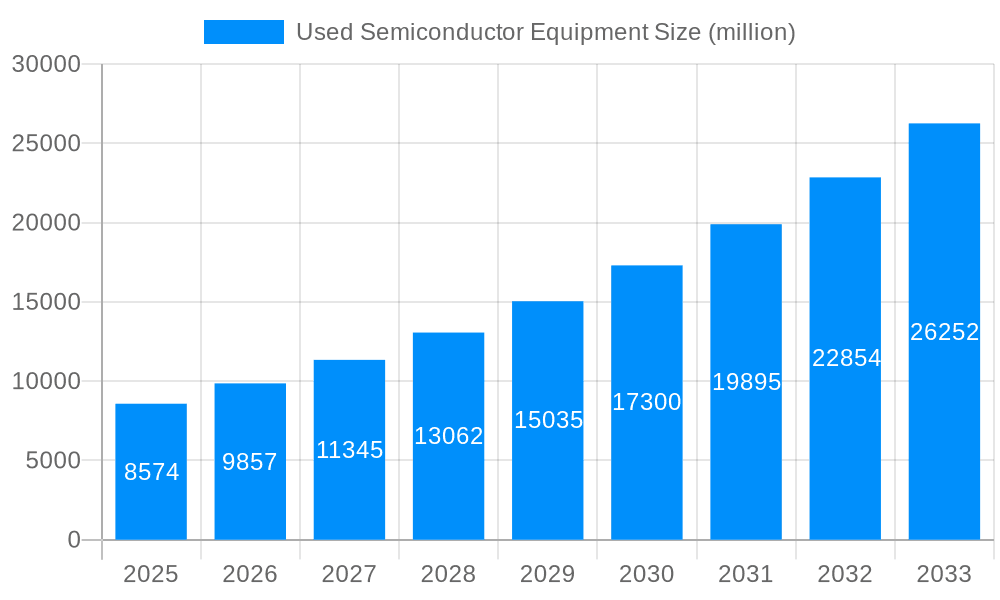

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Semiconductor Equipment?

The projected CAGR is approximately 15.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Semiconductor Equipment

Used Semiconductor EquipmentUsed Semiconductor Equipment by Type (300mm Used Equipment, 200mm Used Equipment, 150mm and Others), by Application (Refurbished Deposition Equipment, Refurbished Etch Equipment, Refurbished Lithography Machines, Refurbished Ion Implant, Refurbished Heat Treatment Equipment, Refurbished CMP Equipment, Refurbished Metrology and Inspection Equipment, Refurbished Track Equipment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The used semiconductor equipment market, valued at $8,574 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 15% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing demand for semiconductor chips across various industries, from consumer electronics to automobiles and healthcare, necessitates greater manufacturing capacity. Secondly, the high cost of new equipment pushes many semiconductor manufacturers, especially smaller companies and startups, to explore the cost-effective alternative of refurbished equipment. This trend is further amplified by the current global economic climate that encourages businesses to prioritize cost optimization. Furthermore, technological advancements leading to improved refurbishment processes and extended lifespans of used equipment contribute to this market's expansion. The market is segmented by equipment type (300mm, 200mm, 150mm, and others) and application (deposition, etch, lithography, ion implant, heat treatment, CMP, metrology, track, and others), reflecting the diverse range of equipment available in the secondary market.

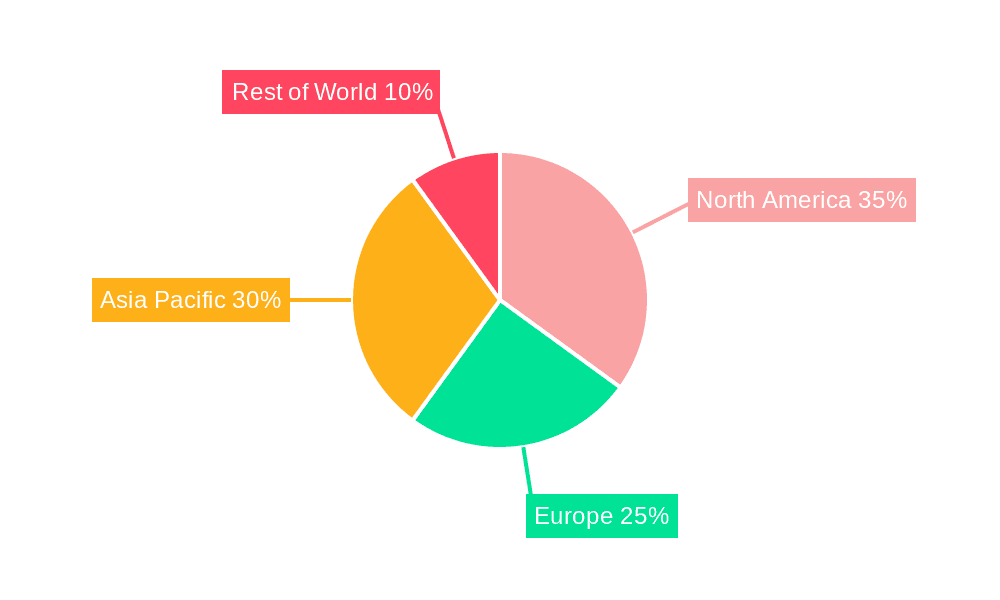

The geographic distribution of the used semiconductor equipment market is expected to be fairly diverse, with North America and Asia Pacific holding significant shares. The robust semiconductor manufacturing base in these regions, coupled with the presence of major players in the used equipment market, fuels this regional concentration. However, other regions, especially those experiencing rapid technological advancement and industrialization, such as certain parts of Europe and Southeast Asia, are projected to show notable growth in demand for used equipment in the coming years. The competitive landscape is highly fragmented, with both large multinational corporations like ASML, Lam Research, and Applied Materials, alongside numerous smaller specialized companies and equipment resellers vying for market share. This competitive dynamic ensures continuous innovation in refurbishment technologies and services, further stimulating the market's growth trajectory.

The global used semiconductor equipment market is experiencing significant growth, driven by increasing demand from emerging economies and the rising need for cost-effective manufacturing solutions within the semiconductor industry. The market, valued at USD XXX million in 2025, is projected to reach USD YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of ZZZ% during the forecast period (2025-2033). This growth is fueled by several factors, including the rising adoption of advanced semiconductor technologies in various applications such as consumer electronics, automotive, and healthcare. The historical period (2019-2024) witnessed a steady increase in demand, laying the foundation for the robust growth anticipated in the coming years. The market is segmented by equipment type (300mm, 200mm, 150mm, and others) and application (deposition, etch, lithography, ion implant, heat treatment, CMP, metrology, track, and others). The 300mm equipment segment currently holds a major market share due to the widespread adoption of this technology in advanced semiconductor manufacturing. However, the demand for 200mm and 150mm equipment remains significant, particularly among smaller fabrication facilities and those focusing on mature technologies. Furthermore, the refurbished equipment segment is gaining traction due to its cost-effectiveness and reduced environmental impact compared to new equipment. Key players in the market are strategically focusing on offering refurbished equipment with guaranteed performance and warranties, driving market growth. The competitive landscape is marked by the presence of both large multinational corporations and specialized equipment providers. The market is witnessing increased mergers and acquisitions, strategic partnerships, and technological advancements, further shaping its trajectory. Overall, the used semiconductor equipment market presents lucrative opportunities for businesses in the coming years.

Several factors are contributing to the robust growth of the used semiconductor equipment market. The high capital expenditure associated with new semiconductor equipment is a primary driver. Used equipment offers a significantly more affordable alternative, making advanced manufacturing technology accessible to smaller companies and those in developing economies. This cost advantage is particularly crucial in a competitive landscape where optimizing production costs is essential. The growing need for increased capacity in the semiconductor industry also fuels demand. As the industry expands to meet the rising global demand for semiconductor chips, the need for additional equipment increases rapidly. Used equipment provides a quicker and more cost-effective way to meet this surge in demand compared to building new fabrication facilities or purchasing new equipment. Additionally, the increasing focus on sustainability and reducing the environmental footprint of manufacturing processes is another factor. Using refurbished equipment reduces the need for raw materials and energy consumption associated with producing new equipment, aligning with industry-wide sustainability goals. Furthermore, technological advancements in refurbishment processes lead to better-quality used equipment, extending their lifespan and improving performance. The continuous improvement in the refurbishment process and rigorous quality control ensures that these used machines meet stringent industry standards.

Despite the significant growth potential, the used semiconductor equipment market faces certain challenges. One key challenge is ensuring the quality and reliability of used equipment. Maintaining consistent performance and minimizing downtime are critical in semiconductor manufacturing, and the variability in the condition of used equipment poses a significant risk. This risk requires rigorous quality control and testing measures to guarantee equipment reliability and performance. Another challenge is the technological obsolescence of older equipment. Rapid advancements in semiconductor technology lead to older equipment becoming outdated, potentially reducing its functionality or compatibility with newer processes. This necessitates careful selection of equipment based on compatibility and future-proofing needs. The complexity of used equipment and the specialized expertise required for maintenance and repair also present a challenge. Finding qualified technicians and ensuring efficient after-sales services are crucial for mitigating equipment downtime and operational disruptions. Finally, logistical complexities in transporting and installing large, specialized equipment can add significant cost and complexity, particularly across international borders. These challenges must be addressed for the market to maintain its momentum.

The Asia-Pacific region, particularly Taiwan, South Korea, China, and Japan, is expected to dominate the used semiconductor equipment market due to the high concentration of semiconductor manufacturing facilities in the region. This dominance is driven by the robust growth of the semiconductor industry in these countries, which continues to fuel demand for both new and used equipment.

In summary, the 300mm used equipment segment, along with refurbished lithography machines, is expected to significantly contribute to the market growth. This combined with the robust presence and consistent growth of the Asia-Pacific region (particularly Taiwan and South Korea) makes them the key drivers of the used semiconductor equipment market.

The used semiconductor equipment market is experiencing accelerated growth due to several catalysts, including cost savings for manufacturers seeking to expand capacity without excessive capital outlay, the rising demand for semiconductor chips across various industries, and the increasing focus on sustainable manufacturing practices, making refurbished equipment a viable and environmentally responsible option.

This report provides a comprehensive overview of the used semiconductor equipment market, covering market size, growth trends, key drivers and restraints, competitive landscape, and future outlook. It analyzes various segments based on equipment type and application, providing in-depth insights into each segment's growth trajectory. The report also identifies key players and their strategies, highlighting significant developments and providing valuable forecasts for market growth. This detailed information is crucial for businesses involved in the semiconductor industry, helping them make informed decisions and gain a competitive edge.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.0% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.0%.

Key companies in the market include ASML, KLA Pro Systems, Lam Research, ASM International, Kokusai Electric, Applied Materials, Inc. (AMAT), Ichor Systems, Russell Co., Ltd, PJP TECH, Maestech Co., Ltd, Nikon Precision Inc, Ebara Technologies, Inc. (ETI), iGlobal Inc., Entrepix, Inc, Axus Technology, Axcelis Technologies Inc, ClassOne Equipment, Canon U.S.A., TEL (Tokyo Electron Ltd.), ULVAC TECHNO, Ltd., SCREEN, DISCO Corporation, Metrology Equipment Services, LLC, Semicat, Inc, Somerset ATE Solutions, SUSS MicroTec REMAN GmbH, Meidensha Corporation, Intertec Sales Corp., TST Co., Ltd., Bao Hong Semi Technology, Genes Tech Group, DP Semiconductor Technology, E-Dot Technology, GMC Semitech Co.,Ltd, SGSSEMI, Wuxi Zhuohai Technology, Shanghai Lieth Precision Equipment, Shanghai Nanpre Mechanical Engineering, EZ Semiconductor Service Inc., HF Kysemi, Joysingtech Semiconductor, Shanghai Vastity Electronics Technology, Jiangsu Sitronics Semiconductor Technology, Dobest Semiconductor Technology (Suzhou), Jiangsu JYD Semiconductor, AMTE (Advanced Materials Technology & Engineering), SurplusGLOBAL, Sumitomo Mitsui Finance and Leasing, Macquarie Semiconductor and Technology, Moov Technologies, Inc., CAE Online, Hightec Systems, AG Semiconductor Services (AGSS), Intel Resale Corporaton, EquipNet, Inc, Mitsubishi HC Capital Inc., Hangzhou Yijia Semiconductor Technology.

The market segments include Type, Application.

The market size is estimated to be USD 8574 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Used Semiconductor Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Semiconductor Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.