1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Dairy Processing and Packaging Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Dairy Processing and Packaging Equipment

Used Dairy Processing and Packaging EquipmentUsed Dairy Processing and Packaging Equipment by Type (Processing Equipment, Packaging Equipment), by Application (Cheese, Processed Milk, Yogurt, Protein Ingredients, Milk Powder, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

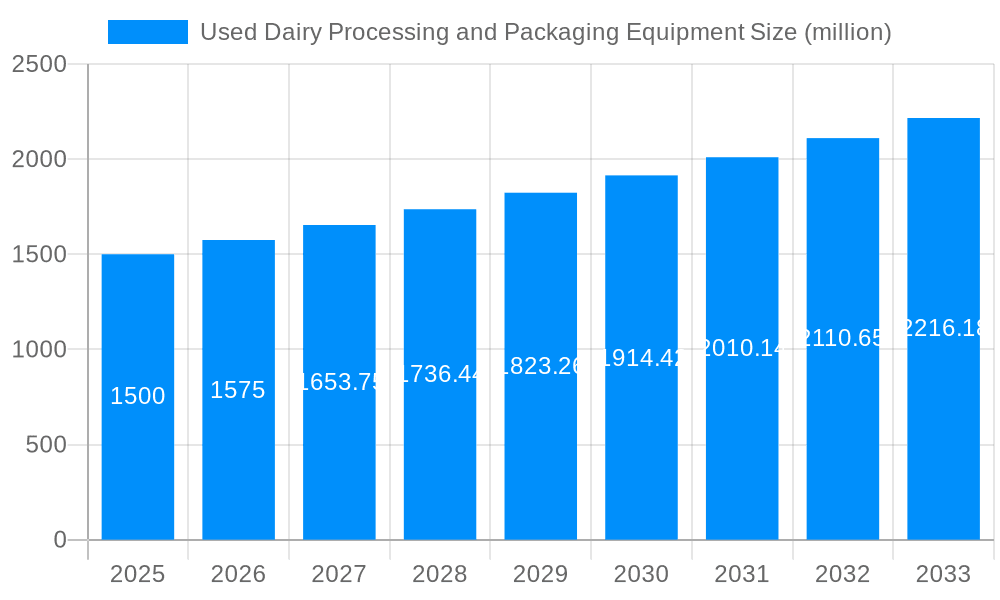

The used dairy processing and packaging equipment market is experiencing robust growth, driven by increasing demand for cost-effective solutions within the dairy industry. The market's expansion is fueled by several factors, including the rising adoption of sustainable practices, the need for efficient production upgrades without significant capital expenditure, and the growing prevalence of smaller-scale dairy operations seeking affordable equipment. The market is segmented by equipment type (processing and packaging), processing method (pasteurization, homogenization, etc.), and geographic region. Key players in this competitive landscape include established multinational corporations like GEA Group, Tetra Pak, and Krones AG, alongside specialized regional manufacturers. While precise market sizing figures for 2025 and beyond necessitate further research, a conservative estimate based on industry growth patterns in related sectors suggests a market value of approximately $1.5 billion in 2025. Given a plausible CAGR of 5-7%, this market is poised for significant expansion throughout the forecast period, reaching potentially $2.25 billion to $2.75 billion by 2033. However, the market faces challenges, including the availability of reliable, well-maintained used equipment and the need for efficient refurbishment and parts sourcing.

Furthermore, the growth trajectory is influenced by fluctuating dairy prices, technological advancements in new equipment which impacts the demand for used equipment, and the regulatory landscape governing used machinery. Successful companies in this sector must focus on efficient inventory management, strong customer service networks for equipment refurbishment and parts supply, and a deep understanding of specific regional market needs. The increasing focus on digitalization and automation within the dairy sector will also shape the demand for specific types of used equipment, creating opportunities for companies specializing in upgrading and retrofitting older models with modern controls. Strategic partnerships with dairy producers and equipment refurbishers are crucial for navigating the dynamic challenges and capturing a greater share of the growing market.

The used dairy processing and packaging equipment market exhibited robust growth during the historical period (2019-2024), exceeding $XXX million in 2024. This surge is primarily attributed to the increasing demand for cost-effective solutions within the dairy industry, particularly among small and medium-sized enterprises (SMEs). SMEs often find purchasing pre-owned equipment a more financially viable option compared to investing in new machinery. Furthermore, the rising global dairy production, fueled by growing populations and increasing consumption in developing economies, has created a significant demand for processing and packaging capabilities. This demand, coupled with the increasing need for efficient and sustainable operations, has driven the growth of the used equipment market. However, the quality and reliability of used equipment can be a concern, leading to fluctuating market trends. The availability of refurbished equipment with warranties and reliable maintenance services is playing a crucial role in stabilizing the market and increasing consumer confidence. This trend is further supported by the emergence of online marketplaces and specialized equipment dealers specializing in pre-owned dairy equipment, enhancing transparency and facilitating easier transactions. The forecast period (2025-2033) is projected to witness continued expansion, although at a slightly moderated pace, reaching an estimated value of $YYY million by 2033. This moderation might be influenced by factors like technological advancements in new equipment, stricter regulations on food safety, and the need for higher production capacity in larger dairy plants opting for new, more efficient technologies. The market's long-term trajectory, however, remains positive due to the consistent demand for affordable, reliable processing and packaging solutions within the dairy sector.

Several key factors are driving the growth of the used dairy processing and packaging equipment market. The primary driver is the significant cost advantage associated with purchasing used equipment compared to new machinery. This is particularly appealing to smaller dairy processors and those operating on tighter budgets. The availability of high-quality, refurbished equipment with warranties is further enhancing market appeal. The rising adoption of automation and improved technology in used equipment, albeit older generation technology, also contributes to the market's growth. This allows smaller businesses to adopt modernized processes at a lower investment. The increasing global dairy production, particularly in developing regions, is another major factor creating a continuous need for processing and packaging solutions, stimulating demand for both new and used equipment. The sustainability aspect cannot be ignored; purchasing used equipment reduces waste and contributes to a more environmentally conscious industry. Finally, the emergence of online platforms and specialized dealers is simplifying the buying and selling processes, further bolstering market growth.

Despite the positive growth trajectory, the used dairy processing and packaging equipment market faces several challenges. The primary concern revolves around the quality and reliability of used equipment. Determining the operational lifespan, maintenance history, and overall condition of pre-owned machinery can be difficult, potentially leading to unexpected downtime and repair costs. This uncertainty can deter some potential buyers, especially larger dairy companies seeking high levels of operational efficiency and reliability. The lack of standardized quality control and certification processes for used equipment further compounds this challenge. The risk of acquiring equipment with obsolete technology or components that are difficult to source for repairs represents another significant impediment. Furthermore, the market is subject to fluctuations based on the availability of quality used equipment. Seasonal variations in dairy production and economic downturns can also impact the supply and demand dynamics of the used equipment market, leading to price volatility and supply chain disruptions. Addressing these challenges through improved quality control mechanisms, better transparency in equipment history, and the development of reliable after-sales service networks is crucial for the continued healthy growth of the market.

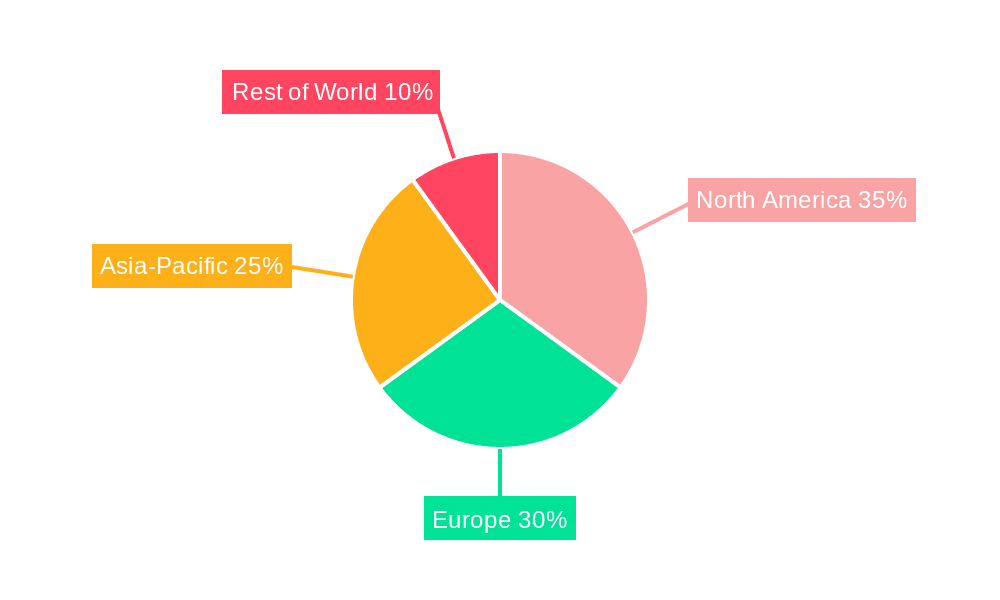

The used dairy processing and packaging equipment market is geographically diverse, with significant growth projected across various regions. However, certain regions and segments are expected to dominate the market during the forecast period (2025-2033):

Developing Economies: Countries in Asia (India, China, Southeast Asia), Africa, and parts of Latin America are experiencing rapid growth in their dairy sectors, driving strong demand for both new and used equipment. The cost-effectiveness of used equipment makes it particularly attractive in these regions, where budget constraints are often significant.

North America & Europe: While possessing more mature dairy industries, these regions still exhibit a sizeable market for used equipment. The focus on sustainability and cost optimization within the dairy industry in these regions continues to drive demand for pre-owned, well-maintained machines.

Processing Equipment: Demand for used processing equipment, including pasteurization units, homogenizers, separators, and evaporators, is consistently high across all regions. These components form the backbone of dairy processing, and the ability to acquire them at a lower cost makes them attractive.

Packaging Equipment: The packaging segment is also expected to see robust growth, driven by increasing demand for efficient and diverse packaging solutions. Used filling, sealing, and labeling machines, specifically those suited for various dairy products (milk, yogurt, cheese), will be highly sought after.

Small and Medium-Sized Enterprises (SMEs): This segment comprises a significant portion of the used equipment market. SMEs often favor used equipment due to its cost-effectiveness, allowing them to enter the market or expand operations with a smaller capital investment. This segment's growth is strongly correlated with the overall market growth.

In summary, the combination of rapid expansion in developing economies and sustained demand in established markets, coupled with the cost advantages of used equipment for SMEs, paints a picture of robust and varied growth across several key regions and segments of the used dairy processing and packaging equipment market.

Several factors are fueling the growth of this industry. The increasing affordability of used equipment compared to its new counterpart is a major catalyst. The rise of online marketplaces and specialized dealers is also crucial, enhancing market transparency and facilitating transactions. Furthermore, a growing emphasis on sustainability, which drives the adoption of pre-owned equipment to reduce waste, acts as a strong catalyst. Finally, technological improvements in used equipment, such as the integration of automation features, further enhance its appeal and drive market growth.

This report provides a detailed analysis of the used dairy processing and packaging equipment market, offering insights into market trends, growth drivers, challenges, and key players. It incorporates historical data, current market estimations, and future forecasts, providing a comprehensive understanding of this dynamic sector. The report is invaluable for industry stakeholders, investors, and anyone seeking to understand the opportunities and challenges within the used dairy equipment market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GEA Group, Krones AG, Tetra Pak International, IDMC Limited, SPX Corporation, Van Den Heuvel, John Bean Technologies Corporation, Alfa Laval Corporation, ISF Industries, Agrometal Limited, Coperion GmbH, Caloris Engineering LLC, Dui Ci Inox, IMA Industria Machine Automatiche SPA, Patkol Public Company Limited.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Used Dairy Processing and Packaging Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Dairy Processing and Packaging Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.