1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car E-commerce Platforms?

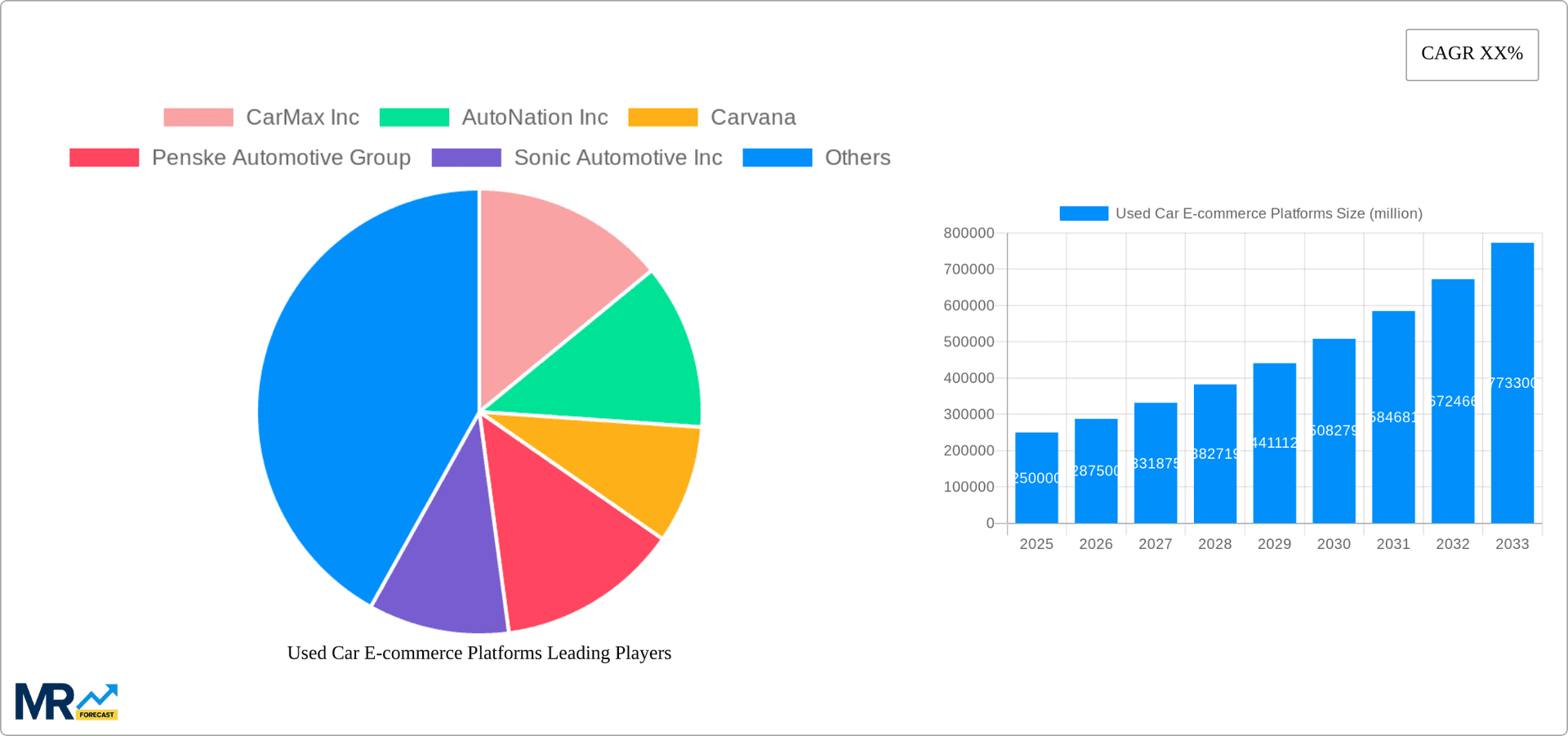

The projected CAGR is approximately 13.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Car E-commerce Platforms

Used Car E-commerce PlatformsUsed Car E-commerce Platforms by Type (Cloud Based, On-premises), by Application (Sedan, SUV, Commercial Vehicle, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

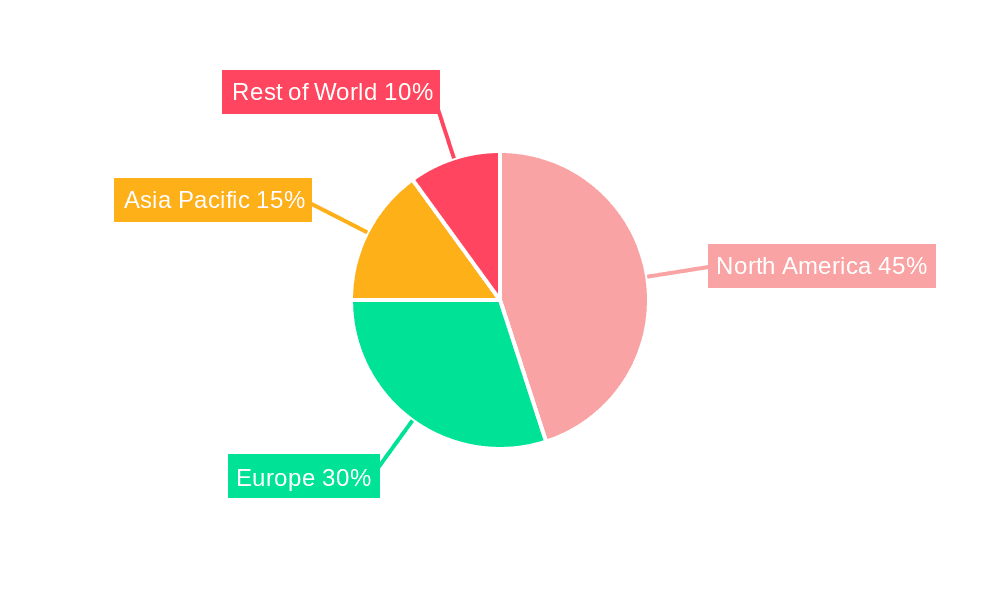

The used car e-commerce market is experiencing robust growth, driven by increasing consumer preference for online car buying, the convenience of digital platforms, and a wider selection compared to traditional dealerships. The market's expansion is fueled by technological advancements, including improved online vehicle listings, virtual inspections, and streamlined financing options. This shift towards digitalization is transforming the customer journey, leading to a more transparent and efficient process. The market segmentation shows strong demand across vehicle types, with sedans, SUVs, and commercial vehicles all contributing significantly. While cloud-based platforms dominate, on-premises solutions still hold a substantial share, catering to specific needs and security concerns. Geographic distribution reveals a significant concentration in North America and Europe, although the Asia-Pacific region is experiencing rapid growth, fueled by rising disposable incomes and increasing internet penetration. Competition is fierce, with both established automotive giants and innovative startups vying for market share. This competitive landscape encourages constant innovation and improvement in user experience, further accelerating market growth.

While the exact market size in 2025 requires further data, reasonable estimations, considering the global nature of the market and the rapid growth in e-commerce, place the market size between $200 billion to $300 billion in 2025. This range accounts for variations across regions and platform types. A conservative estimate of a 15% CAGR over the forecast period (2025-2033) is used, aligning with observed trends in the online retail sector. This growth is anticipated to be driven by factors such as increasing smartphone penetration in developing markets, enhanced online car financing options, and the growing adoption of AI-powered features for vehicle valuation and matching. Challenges include maintaining trust and transparency, addressing concerns about vehicle quality and condition, and navigating stringent regulations regarding online vehicle sales in various jurisdictions. The market will see continued innovation in areas like virtual reality inspections, personalized recommendation engines, and AI-powered fraud detection.

The used car e-commerce market is experiencing explosive growth, projected to reach tens of billions of dollars in value by 2033. Key market insights reveal a shift from traditional brick-and-mortar dealerships towards online platforms, driven by consumer demand for convenience, transparency, and competitive pricing. The market is witnessing a significant increase in the adoption of cloud-based platforms, offering scalability and flexibility to both buyers and sellers. Furthermore, the rising popularity of online vehicle inspections and virtual appraisals is streamlining the buying process, reducing friction and enhancing customer experience. The proliferation of mobile applications and user-friendly interfaces is also contributing to the market's expansion, making car purchasing accessible to a wider demographic. The increasing integration of data analytics and AI-powered tools for pricing optimization and personalized recommendations are enhancing the efficiency and effectiveness of the platforms, further fueling market growth. However, challenges remain, such as addressing consumer concerns about vehicle condition and ensuring secure online transactions. The market is segmented based on vehicle type (sedan, SUV, commercial vehicle, others), platform type (cloud-based, on-premises), and geographical location, with significant variations in growth rates across segments and regions. Millions of units are being transacted online, and the numbers are only increasing yearly. By 2033, the market is projected to see a compound annual growth rate (CAGR) in the double digits, signifying substantial growth potential. The continued integration of innovative technologies and improved consumer trust will be crucial factors determining the future trajectory of this dynamic market.

Several factors are propelling the growth of used car e-commerce platforms. Firstly, the increasing preference for online shopping across various sectors is influencing car purchasing behavior. Consumers are seeking the convenience, transparency, and price comparison options offered by online platforms. Secondly, technological advancements, such as high-quality online vehicle photography, virtual tours, and detailed vehicle history reports, have enhanced the online car-buying experience. These advancements build trust and alleviate concerns about purchasing vehicles without physical inspection. Thirdly, the development of sophisticated algorithms and data analytics enables platforms to optimize pricing strategies, match buyers with suitable vehicles, and provide personalized recommendations. This contributes to an improved user experience and higher conversion rates. Fourthly, the rise of mobile technology and user-friendly apps has made accessing and using these platforms increasingly easy. Finally, the expanding reach of online advertising and marketing strategies, combined with strategic partnerships, has enabled these platforms to reach a wider audience and increase brand awareness. The combined effect of these factors has created a compelling proposition for both buyers and sellers, driving significant growth in the used car e-commerce market.

Despite the significant growth, several challenges hinder the full potential of used car e-commerce platforms. Firstly, the trust factor remains a major obstacle. Consumers may be hesitant to purchase a vehicle without physically inspecting it, leading to concerns about vehicle condition and potential hidden problems. Secondly, logistical complexities related to vehicle delivery, inspection, and financing can impact the customer experience. Efficient and reliable logistics are essential for ensuring customer satisfaction. Thirdly, the need for stringent security measures is critical to prevent fraudulent activities and protect both buyers and sellers. Data security and robust verification processes are vital. Fourthly, the high initial investment costs for developing and maintaining online platforms, coupled with competition from established dealerships, can pose a barrier to entry for new players. Finally, the lack of standardization across different platforms in terms of information presentation, pricing transparency, and warranty policies can cause confusion for consumers. Overcoming these challenges requires continuous innovation, investment in technology, and collaborative efforts to build trust and streamline the online buying experience.

The used car e-commerce market demonstrates significant regional variations in growth and adoption. North America, particularly the United States, currently holds a dominant position due to high internet penetration, established e-commerce infrastructure, and a large consumer base. However, Asia-Pacific, particularly China, is witnessing rapid growth fueled by increasing smartphone penetration and a growing middle class. Europe is also experiencing a steady rise in online car sales, although at a relatively slower pace compared to North America and parts of Asia.

Segments Dominating the Market:

Cloud-Based Platforms: This segment is expected to dominate due to its scalability, flexibility, and cost-effectiveness. Cloud-based platforms offer easy integration with other services, facilitating a seamless online buying experience. Millions of transactions are already conducted on cloud-based platforms, signifying its dominance in the market.

SUV Segment: The increasing demand for SUVs due to their versatility and practicality is driving significant growth in this segment. The higher price point of SUVs compared to sedans also contributes to a larger overall market value within the e-commerce sector. This sector is projected to account for a significant portion of the total sales volume and market value in the forecast period.

North America (Specifically the US): The mature e-commerce market, high internet and smartphone penetration, along with established logistical infrastructure, make North America (especially the US) a leading market. The regulatory environment is also relatively favorable, further encouraging growth.

In terms of unit sales volume, the SUV segment along with the cloud-based platforms, while driving immense volume in millions of units, is poised to experience even greater growth in the coming years. Geographic dominance is seen in North America, particularly the US, with robust e-commerce infrastructure and consumer acceptance driving a significant share of market transactions. The combination of these factors highlights the significant growth trajectory of the used car e-commerce market.

Several factors are catalyzing growth in the used car e-commerce industry. The rising consumer preference for online shopping, coupled with technological advancements like improved online vehicle inspections and virtual reality tours, is enhancing buyer confidence. The increasing adoption of AI-powered tools for pricing optimization and personalized recommendations improves the efficiency and effectiveness of the platforms. Additionally, strategic partnerships with financial institutions for online financing options are streamlining the buying process and boosting market expansion. The continued development of user-friendly mobile applications and robust data security measures will further propel market growth.

This report provides a comprehensive overview of the used car e-commerce platforms market, covering market trends, driving forces, challenges, key players, and significant developments. The report offers detailed insights into various market segments, including platform type and vehicle type, providing a granular understanding of market dynamics. It also presents regional analyses, highlighting key growth areas and potential opportunities. The comprehensive nature of this report makes it a valuable resource for stakeholders interested in understanding and navigating this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.4%.

Key companies in the market include CarMax Inc, AutoNation Inc, Carvana, Penske Automotive Group, Sonic Automotive Inc, Van Tuyl Group, Group 1 Automotive Inc, Asbury Automotive Group, Hendrick Automotive Group, Lithia Motors Inc, Larry H. Miller Group of Cos, AutoTrader, CarsDirect, Autolist, CarGurus, AutoTempest, Kelley Blue Book, Car enthusiast Forums, TrueCar, Instamotor, Cars.com, Inc, iSeeCars, Guazi.com, UXIN GROUP, Renrenche.com, Hemmings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Used Car E-commerce Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Car E-commerce Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.