1. What is the projected Compound Annual Growth Rate (CAGR) of the USB 2.0 Webcam?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

USB 2.0 Webcam

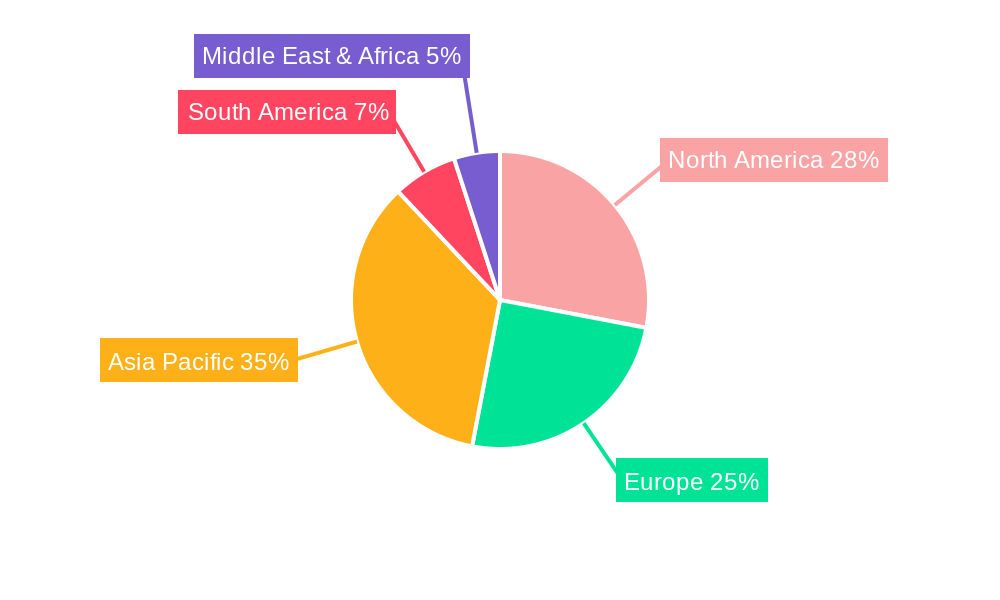

USB 2.0 WebcamUSB 2.0 Webcam by Application (Personal Use, Enterprise Use, World USB 2.0 Webcam Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

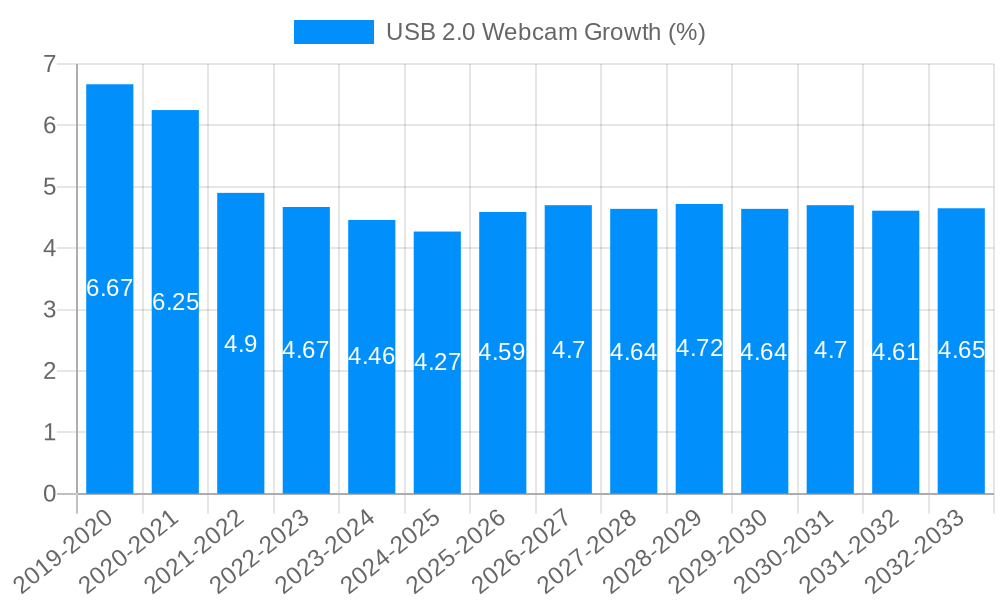

The global USB 2.0 webcam market, while facing competition from higher-resolution alternatives, maintains a significant presence, particularly in niche applications and budget-conscious segments. Driven by the persistent demand for affordable video conferencing and basic video capture solutions, the market exhibits a steady, albeit moderate, growth trajectory. While the overall market size is contracting due to the rise of USB 3.0 and higher-resolution webcams, the continued use of legacy systems and the availability of inexpensive USB 2.0 models sustains a considerable consumer base. This segment caters to users with older computers, budget constraints, or applications where high resolution isn't critical. Factors such as the increasing popularity of remote work and online education, particularly in developing economies, continue to support demand. However, the market faces constraints stemming from technological advancements; the superior performance and features of newer webcam technologies consistently push users towards upgrading, thus limiting long-term growth potential for USB 2.0 webcams. Market segmentation likely includes variations based on resolution (VGA, QVGA), features (built-in microphone, adjustable stand), and intended use (personal, business).

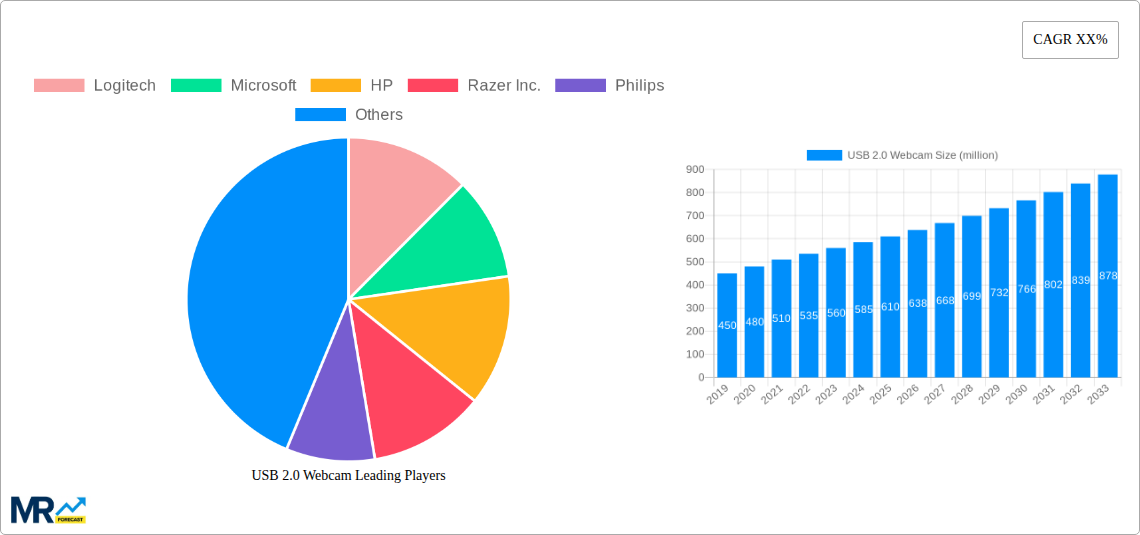

Despite the presence of major players like Logitech, Microsoft, and HP in the broader webcam market, smaller manufacturers and regional brands dominate the USB 2.0 segment due to their ability to offer competitive pricing. The market's regional distribution is likely skewed towards developing nations where cost-effectiveness is a crucial factor in technology adoption. Although precise regional market share data is unavailable, it's reasonable to anticipate that regions with a large population base and developing economies contribute significantly to the sales volume of USB 2.0 webcams. The market's future outlook involves a gradual decline in overall market size, but a stable niche market will continue to exist, driven by price sensitivity and the longevity of existing hardware. Sustained growth will hinge on the ability of manufacturers to innovate within the constraints of the technology, focusing on improved features, durability, and integration with legacy systems.

The global USB 2.0 webcam market, while facing competition from newer technologies like USB 3.0 and higher-resolution cameras, maintains a significant presence, particularly in niche segments and price-sensitive markets. The study period from 2019-2033 reveals a complex trajectory. While the historical period (2019-2024) showcased a gradual decline in overall unit sales, driven primarily by the increasing adoption of higher-bandwidth USB standards offering superior video quality and features, the market has shown surprising resilience. The estimated year 2025, and the projected forecast period (2025-2033), suggest a potential stabilization, even a modest resurgence in specific sectors. This is primarily due to the ongoing demand for low-cost, reliable webcams in applications like basic video conferencing, remote education, and surveillance systems where high-resolution isn't a critical requirement. Millions of units are still being sold annually, indicating a substantial market base that remains underserved by the higher-priced alternatives. The continued presence of legacy systems that support USB 2.0 and the cost-effectiveness of these webcams for budget-conscious consumers and businesses contribute to their sustained market share. The report analyzes this nuanced market trend, factoring in the technological advancements and persistent demand for affordable video solutions. Further investigation reveals regional variations, with developing economies showing a stronger continuing demand for USB 2.0 webcams than developed markets.

The persistent demand for affordable video solutions is a primary driver for the USB 2.0 webcam market. Millions of users, especially in developing countries and budget-conscious environments, find USB 2.0 webcams sufficiently functional for their needs. The lower manufacturing cost translates to lower retail prices, making them an attractive option for individuals and businesses with limited budgets. Compatibility with a wide range of legacy systems is another key factor. Many older computers and laptops still utilize USB 2.0 ports, ensuring a broad range of potential users. This compatibility advantage persists, offering a readily available solution without requiring upgrades. Furthermore, the simplicity of USB 2.0 webcams is a compelling advantage. Their ease of use, plug-and-play functionality, and minimal driver requirements make them highly accessible to users of all technical skill levels. This straightforward operation eliminates the complexity often associated with newer, more advanced webcams, widening their appeal to a broader user base. Finally, the stability and reliability of USB 2.0 technology, having been around for a considerable time, provide a level of confidence in their functionality, reassuring users seeking dependable performance.

The most significant challenge faced by the USB 2.0 webcam market is the emergence of higher-bandwidth USB standards like USB 3.0 and USB-C. These newer technologies offer substantially improved video quality, higher frame rates, and enhanced features, making USB 2.0 webcams seem comparatively dated. The resolution limitations and slower data transfer speeds of USB 2.0 are increasingly detrimental in a market demanding superior visual clarity and seamless video conferencing experiences. The growing prevalence of integrated webcams in laptops and tablets further diminishes the market for standalone USB 2.0 models. Many modern devices include high-definition webcams directly, negating the need for an external device. Furthermore, technological advancements are rendering even the most basic features of USB 2.0 webcams less compelling, leading to a gradual decrease in demand in many sectors. The limited functionalities compared to modern webcams with advanced features such as autofocus, better low-light performance, and various resolutions are significant drawbacks.

The paragraph below elaborates further. The continued dominance of developing economies stems from the strong correlation between affordability and demand. The price advantage of USB 2.0 webcams is amplified in these regions, making them a highly accessible option compared to the often more expensive, newer USB technologies. While developed nations' markets exhibit a decline in USB 2.0 webcam usage, the sheer volume of the developing economies’ market continues to sustain this sector. Similarly, the educational and security sectors demonstrate a unique reliance on affordability and simplicity, factors that USB 2.0 webcams inherently offer. The basic needs of these sectors are well-served by the existing capabilities of USB 2.0 technology, resulting in a persistent demand in this niche.

The ongoing presence of legacy systems and the persistent need for low-cost, reliable video solutions in certain applications will continue to fuel limited growth within the USB 2.0 webcam market, albeit at a slower pace than higher-end technologies. This niche demand, primarily from developing nations and budget-conscious sectors, ensures continued sales in the millions of units annually, preventing a complete market collapse.

This report provides a detailed analysis of the USB 2.0 webcam market, offering insights into trends, growth drivers, challenges, and key players. The study thoroughly covers market dynamics, regional variations, and segment-specific analyses to provide a comprehensive understanding of this evolving sector within the broader webcam market. Specific data on unit sales in millions and financial projections are included, offering businesses crucial insights into strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Teledyne Lumenera, Logitech, Microsoft, HP, Razer Inc., Philips, Lenovo, Dell, Elecom, Spedal, Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co.,Ltd., Yealink, Skyworth Digital Co.,Ltd., DongGuan YuTong Optical Technology Co.,Ltd., Shenzhen Aoni Electronic CO.,LTD., Shenzhen ValueHD Corporation, .

The market segments include Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "USB 2.0 Webcam," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the USB 2.0 Webcam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.