1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Exterior Wall Systems Market?

The projected CAGR is approximately 7.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

U.S. Exterior Wall Systems Market

U.S. Exterior Wall Systems MarketU.S. Exterior Wall Systems Market by Material (Vinyl, Ceramic Tiles, Gypsum/Plasterboard, Glass Panel, EIFS, Fiber Cement, Wood Board, HPL Board, Fiberglass Panel, Bricks & Stone, Others), by Type (Ventilated, Curtain Wall, Non-Ventilated), by End-Use (Residential, Non-Residential), by Forecast 2026-2034

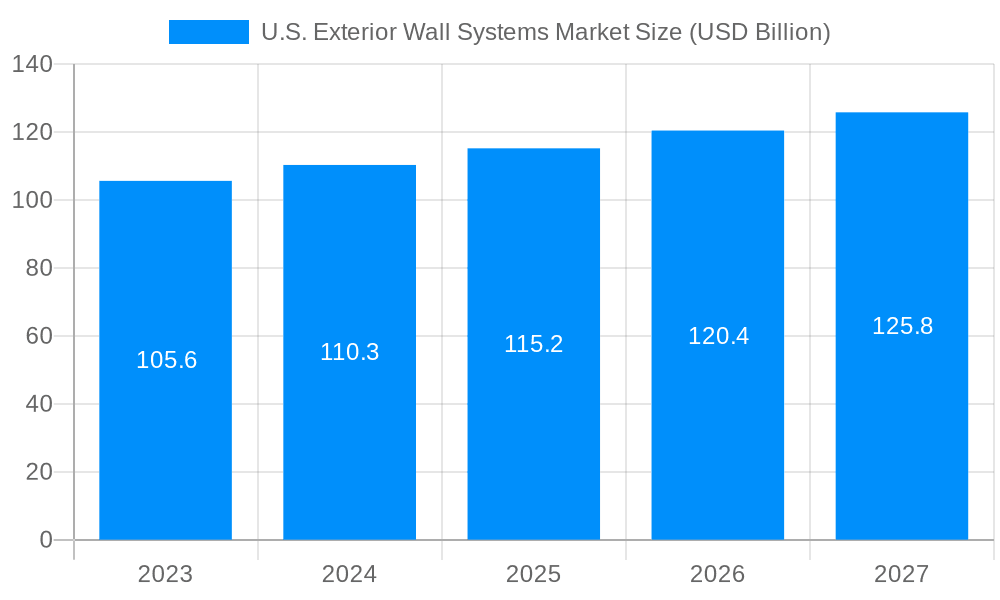

The U.S. Exterior Wall Systems Market size was valued at USD 27.43 USD Billion in 2023 and is projected to reach USD 46.10 USD Billion by 2032, exhibiting a CAGR of 7.7 % during the forecast period. Exterior wall systems in the United States are the components of a building and structure that offer defence from different weather conditions, as well as improve the looks of a building. These systems include conventional construction including masonry, curtain, walls and insulated concrete forms (ICF). This construction type entails the use of brick, stone, or concrete blocks that assure durability and heat storage capacity. Curtain walls consist of thin accomplished external facings of glass, mineral or metallic, aluminium, or composite panels to allow natural light and architectural flexibility. Whereas ICF systems incorporate insulation foam between and among the layers of concrete to improve energy efficiency and durability. These systems are used in various constructions; residential, commercial, and industrial constructions, and they are flexible to suit different architectural types and climatic conditions. There are various advantages of these systems, namely energy conservation, low maintenance, and comfort within the structures.

Material:

Type:

End-Use:

The report provides a detailed analysis of the U.S. exterior wall systems market, covering key market dynamics, growth drivers, restraints, challenges, and future opportunities. The report also provides insights into the competitive landscape and profiles key industry players.

The U.S. exterior wall systems market spans five key regions: Northeast, Midwest, South, West, and Alaska/Hawaii. While the South currently commands the largest market share, driven by robust construction activity and a burgeoning population, regional growth dynamics are diverse. The Northeast, with its focus on renovation and restoration projects in established urban areas, presents a distinct market segment. The Midwest experiences consistent demand fueled by industrial and agricultural construction, while the West, characterized by significant infrastructural development and a rapidly expanding housing market, shows considerable potential for growth. Alaska and Hawaii, although smaller markets, exhibit unique needs and opportunities related to extreme weather conditions and specialized building materials. Further analysis reveals variations in material preferences across these regions, influenced by local building codes, climate conditions, and architectural styles, impacting the overall market segmentation and strategic planning for manufacturers and installers.

Consumer preferences play a significant role in the selection of exterior wall systems. Consumers are increasingly demanding materials that are durable, energy-efficient, and aesthetically pleasing.

The demand for exterior wall systems is mainly driven by the construction industry. The residential sector accounts for the majority of the demand, followed by the non-residential sector.

The U.S. is a net importer of exterior wall systems. The major import sources include Canada, Mexico, and China. The U.S. also exports exterior wall systems to a number of countries, including Mexico, Canada, and the United Kingdom.

The pricing of exterior wall systems varies depending on the material, type, and end-use application. Vinyl and ceramic tiles are typically the most cost-effective options, while glass panels and curtain walls are more expensive.

The U.S. exterior wall systems market is segmented based on material, type, end-use, and geographical region. The report provides a thorough analysis of each segment and its contribution to the overall market size.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.7%.

Key companies in the market include PPG Industries, Inc. (U.S.), Owens Corning (U.S.), DuPont (U.S.), Dow (U.S.), AGC Inc. (Japan), Sika AG (Switzerland), 3A Composite Holding AG (Switzerland), Etex Group (Belgium), Evonik Industries AG (Germany), LafargeHolcim (Switzerland).

The market segments include Material, Type, End-Use.

The market size is estimated to be USD 27.43 USD Billion as of 2022.

Expanding Packaging Industry to Propel the Market Growth.

Rising Emphasis on Environmentally Sustainable Iron Production to Create New Growth Opportunities.

Strict Regulations by Governments on Carbon Emissions May Hinder Market Growth.

PPG Industries launched a new series of exterior coatings designed for increased durability and weather resistance. Owens Corning introduced a lightweight, high-performance insulation system for exterior walls. DuPont developed a transparent insulation panel system that provides thermal insulation without compromising natural lighting.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2850, USD 3850, and USD 4850 respectively.

The market size is provided in terms of value, measured in USD Billion and volume, measured in Million Tons.

Yes, the market keyword associated with the report is "U.S. Exterior Wall Systems Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the U.S. Exterior Wall Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.