1. What is the projected Compound Annual Growth Rate (CAGR) of the Underwater Security Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Underwater Security Equipment

Underwater Security EquipmentUnderwater Security Equipment by Type (Underwater Surveillance Camera, Sonar System, Underwater Communication Equipment, Under Water Robot, Others, World Underwater Security Equipment Production ), by Application (Underwater Safety and Protection, Underwater Survey, Underwater Search and Rescue, Subsea Energy and Engineering, Underwater Archeology, Others, World Underwater Security Equipment Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

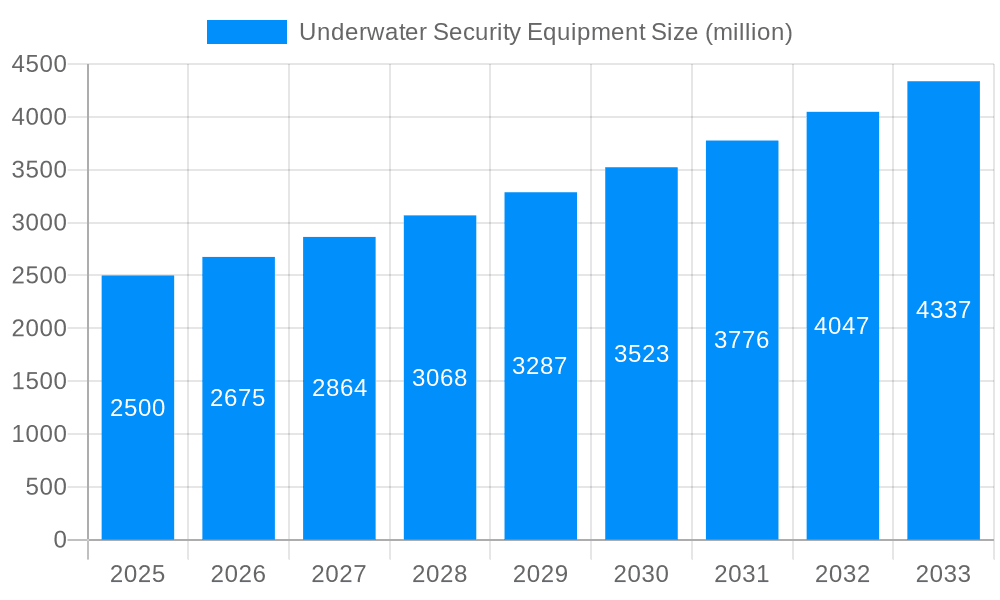

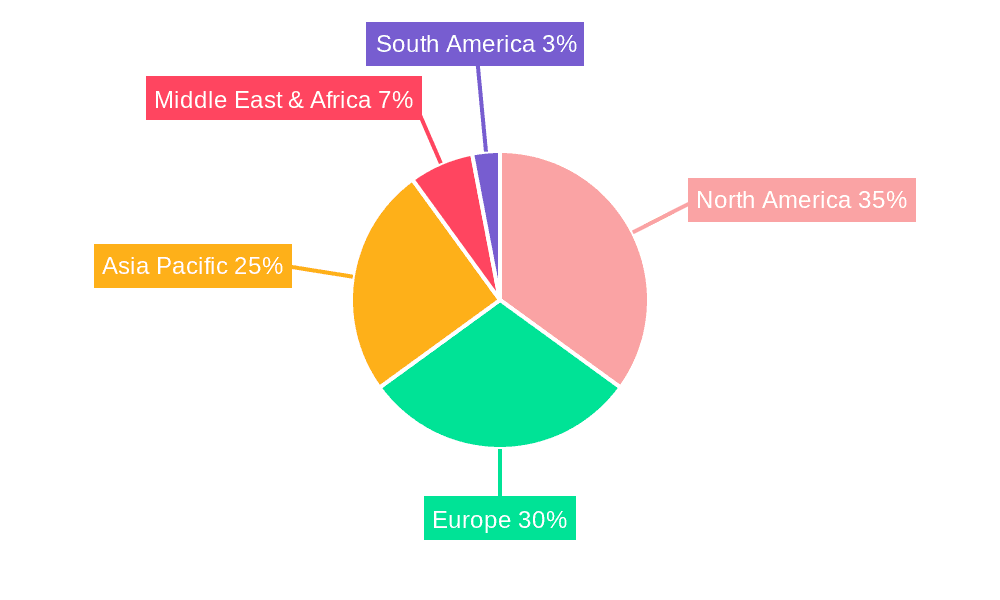

The global underwater security equipment market is experiencing robust growth, driven by increasing demand for enhanced maritime security, offshore energy exploration, and underwater infrastructure development. The market, currently valued at approximately $2.5 billion (estimated based on typical market sizes for related technologies and the provided CAGR), is projected to witness a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. Key drivers include rising concerns about maritime terrorism and piracy, the need for improved underwater infrastructure inspection and maintenance, particularly in the oil and gas sectors, and a growing interest in underwater archaeology and scientific research. The expanding adoption of advanced technologies such as autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs), improved sonar systems, and high-resolution underwater cameras is further propelling market expansion. North America and Europe currently hold significant market shares due to substantial investments in maritime security and established technological infrastructure. However, the Asia-Pacific region is anticipated to witness the fastest growth due to rapid industrialization, infrastructure development, and increasing government spending on maritime security.

Market segmentation highlights significant opportunities within specific application areas. Underwater safety and protection represents a substantial segment, followed by underwater survey and search and rescue operations. The subsea energy and engineering sector is also a significant contributor, demanding robust equipment for pipeline inspection, subsea asset monitoring, and offshore construction. While technological advancements are driving growth, challenges remain, including the high cost of sophisticated underwater equipment, the need for specialized expertise for operation and maintenance, and the complex regulatory environment surrounding underwater operations in many regions. Nevertheless, the long-term outlook for the underwater security equipment market remains positive, with substantial potential for innovation and market expansion across various sectors and geographical regions.

The global underwater security equipment market is experiencing significant growth, driven by increasing concerns about maritime security, expanding offshore energy exploration, and the rising demand for underwater infrastructure inspections. The market, valued at approximately $XX billion in 2025 (estimated year), is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This growth is fueled by technological advancements in areas like autonomous underwater vehicles (AUVs), improved sonar systems, and enhanced underwater communication technologies. The demand for sophisticated underwater surveillance systems is particularly high, especially in military and defense applications, as nations bolster their coastal security measures and counter-terrorism strategies. Furthermore, the burgeoning subsea energy and engineering sectors, along with the increasing investments in underwater archaeology and research, are contributing significantly to market expansion. The adoption of remotely operated vehicles (ROVs) and AUVs is streamlining underwater operations, reducing risks to human divers, and improving the efficiency and effectiveness of underwater tasks. However, the high initial investment costs associated with advanced underwater security equipment and the need for specialized expertise remain major challenges. The market is witnessing a shift towards smaller, more portable, and user-friendly devices designed for a wider range of applications, which is expected to broaden market accessibility and drive further growth. The ongoing development of robust and reliable wireless underwater communication systems will unlock new possibilities for real-time data transmission and remote control, accelerating the overall market advancement.

Several factors are driving the expansion of the underwater security equipment market. Firstly, escalating concerns about maritime security, including piracy, smuggling, and illegal fishing, are compelling governments and private entities to invest heavily in advanced surveillance and monitoring systems. Secondly, the exploration and exploitation of offshore oil and gas reserves are pushing the demand for robust underwater inspection and maintenance equipment to ensure operational safety and prevent environmental disasters. The growth of renewable energy sources, particularly offshore wind farms, further contributes to this demand. Thirdly, the advancement of underwater robotics and AI is enabling the development of autonomous and remotely operated underwater vehicles capable of performing complex tasks with increased precision and efficiency. This automation reduces reliance on human divers, mitigating risks associated with underwater operations. Fourthly, increasing government funding for research and development in underwater technologies, particularly for defense and scientific purposes, is stimulating innovation and fostering the development of sophisticated security solutions. Finally, the rising awareness of underwater environmental protection and the need for effective monitoring of marine ecosystems are contributing to the growth of the underwater security equipment market, as these tools become indispensable for conservation efforts.

Despite the promising growth trajectory, the underwater security equipment market faces several challenges. The high cost of acquisition and maintenance of sophisticated equipment presents a significant barrier to entry for smaller companies and developing nations. The need for specialized training and expertise to operate and maintain these systems also limits widespread adoption. The harsh and unpredictable nature of the underwater environment poses operational challenges and can lead to equipment malfunctions or damage. Furthermore, the development of robust and reliable underwater communication systems remains a technological hurdle, limiting the range and effectiveness of some applications. Concerns about data security and the potential misuse of advanced surveillance technologies are also emerging as regulatory and ethical considerations. Finally, the fluctuating prices of raw materials and the complexity of supply chains can impact the cost and availability of equipment. Overcoming these hurdles requires collaboration between technology providers, governments, and regulatory bodies to foster innovation, address affordability issues, and promote responsible technological development.

The North American and European markets currently hold significant shares in the underwater security equipment market, owing to substantial investments in defense, offshore energy, and research. However, the Asia-Pacific region is poised for rapid growth due to increasing infrastructure development, rising maritime activities, and growing concerns over coastal security.

Dominant Segments:

Underwater Robots (AUVs & ROVs): This segment is experiencing the fastest growth, driven by technological advancements, reduced operational costs (compared to human divers), and increased efficiency in tasks ranging from underwater inspections to search and rescue operations. The versatility of these robots across various applications, from military surveillance to scientific research, makes them a key driver of market expansion. The global market for underwater robots is estimated at $XX billion in 2025 and is expected to reach $YY billion by 2033.

Sonar Systems: Sonar systems are crucial for underwater navigation, object detection, and mapping. The development of advanced sonar technologies, including high-resolution imaging and multibeam sonar, is expanding their applications in various sectors, including defense, offshore energy, and fisheries management. The high accuracy and effectiveness of modern sonar systems make them an essential component of many underwater security operations.

Underwater Surveillance Cameras: The demand for high-definition, remotely controlled underwater cameras is rising rapidly. The ability to gather real-time visual data from underwater environments is paramount for various applications, including security, research, and maintenance. Improvements in camera technology, including better low-light performance and enhanced image processing, are driving increased market penetration.

These segments are projected to collectively contribute to a significant portion of the overall market growth, fueled by technological innovation, increased adoption, and diverse applications across several industries.

The underwater security equipment industry is experiencing robust growth driven by several key catalysts. Firstly, technological advancements in robotics, sensor technology, and communication systems are continuously improving the capabilities and affordability of underwater equipment. Secondly, the rising awareness of the need for enhanced maritime security and the growing importance of protecting critical underwater infrastructure are driving substantial investments in this sector. Thirdly, the exploration and development of offshore resources, especially renewable energy sources, are creating substantial demand for underwater inspection, maintenance, and surveillance technologies. Finally, government regulations and policies promoting marine environmental protection are pushing the development of innovative underwater monitoring systems.

This report provides a comprehensive analysis of the global underwater security equipment market, offering in-depth insights into market trends, drivers, challenges, and growth prospects. It covers key segments, including underwater robots, sonar systems, cameras, and communication equipment, and analyzes their performance across various applications. The report also profiles leading players in the industry, highlighting their market share, competitive strategies, and recent developments. Furthermore, the report provides detailed forecasts for the market's growth trajectory, offering valuable insights for stakeholders seeking to understand and capitalize on opportunities in this dynamic sector. The report's detailed analysis enables informed strategic decision-making regarding investments, partnerships, and future market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

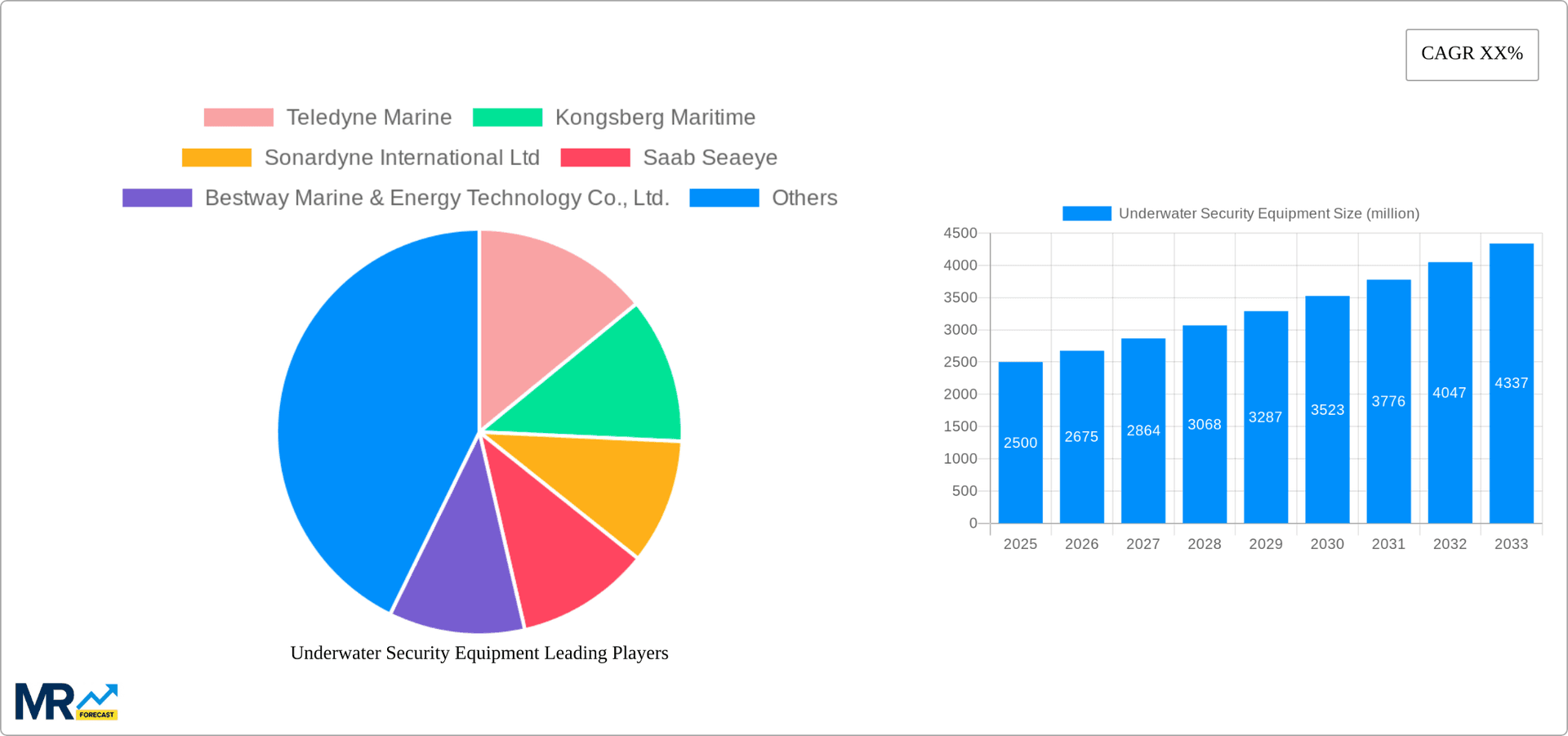

Key companies in the market include Teledyne Marine, Kongsberg Maritime, Sonardyne International Ltd, Saab Seaeye, Bestway Marine & Energy Technology Co., Ltd., EvoLogics GmbH, Oceaneering International, VideoRay, SeaBotix Inc., Blueye Robotics, Deep Trekker, JW Fishers, Subsea Tech, Outland Technology, Blue Robotics, China State Shipbuilding Corporation, YaGuang Technology Group Company Limited, Shanghai Ruiyang Marine Technology Co., Ltd., Deepinfar Ocean Technology Inc., Wuhan Haohan Electromechanical Equipment Co., Ltd., Xi`an Tianhe Maritime Technologies Co., Ltd., Jiaxing Zhongke Acoustics Technology Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Underwater Security Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Underwater Security Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.