1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-Small MEMS Oscillator?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ultra-Small MEMS Oscillator

Ultra-Small MEMS OscillatorUltra-Small MEMS Oscillator by Type (All-Silicon MEMS Oscillator, MEMS Temperature Compensated Oscillator, Other), by Application (Consumer Electronics, Health Care, Electricity Meters, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

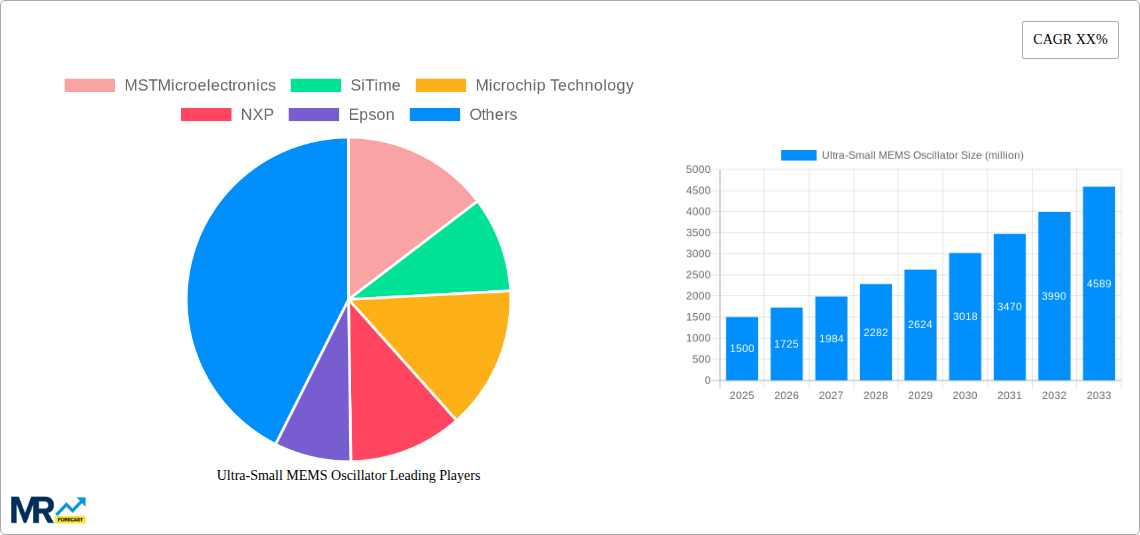

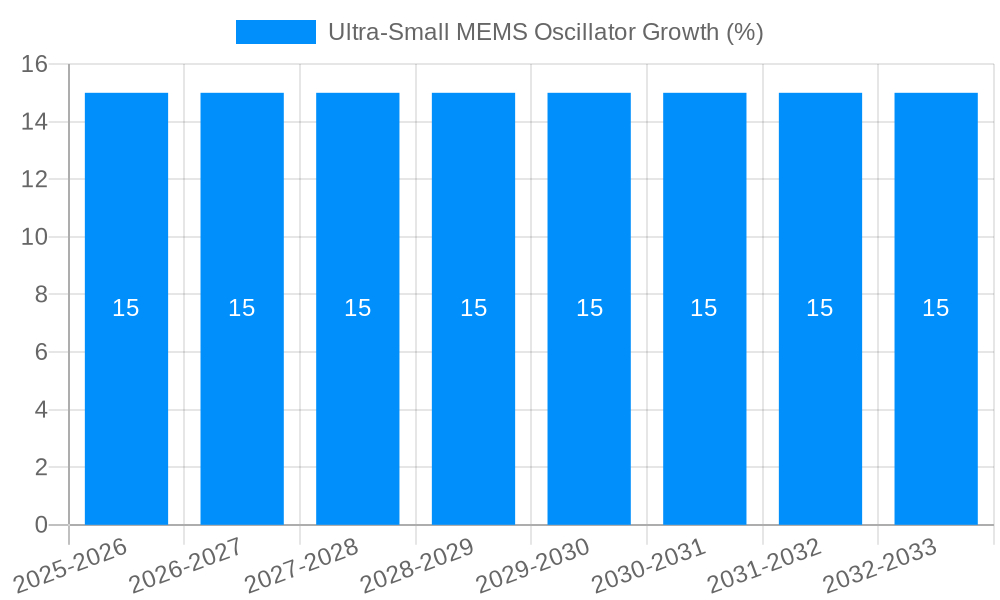

The Ultra-Small MEMS Oscillator market is experiencing robust expansion, driven by the increasing demand for miniaturized and power-efficient electronic components across a multitude of sectors. With a projected market size of approximately $1,500 million in 2025 and a Compound Annual Growth Rate (CAGR) of roughly 15%, this market is poised for significant value creation over the forecast period of 2025-2033. Key growth catalysts include the relentless innovation in consumer electronics, such as smartphones, wearables, and IoT devices, all of which necessitate compact yet high-performance timing solutions. The healthcare industry is also a substantial contributor, with the proliferation of portable medical devices and advanced diagnostic equipment demanding the precision and small form factor offered by MEMS oscillators. Furthermore, the ongoing electrification of infrastructure, including smart grids and advanced electricity meters, fuels demand for reliable and energy-efficient timing components.

The market is characterized by rapid technological advancements, with a clear trend towards the development of All-Silicon MEMS Oscillators due to their superior integration capabilities, lower power consumption, and reduced manufacturing costs compared to traditional quartz-based solutions. While MEMS Temperature Compensated Oscillators offer enhanced accuracy, the broader adoption is steered by the overall trend of miniaturization and cost-effectiveness. Challenges, such as the initial development costs and the need for greater reliability in extremely harsh environments, are being addressed through continuous research and development. The competitive landscape features established players like SiTime, Microchip Technology, and Epson, alongside emerging innovators, all vying for market share through product differentiation, strategic partnerships, and global expansion. The Asia Pacific region, particularly China and South Korea, is expected to lead market growth due to its dominance in electronics manufacturing and a burgeoning demand for advanced consumer electronics.

Here's a unique report description for Ultra-Small MEMS Oscillators, incorporating your specified elements:

The global market for Ultra-Small MEMS Oscillators is poised for a transformative surge, projected to reach an impressive market size exceeding $500 million by the close of the forecast period in 2033. This burgeoning demand is intrinsically linked to the relentless miniaturization trend across a spectrum of electronic devices. Historically, traditional quartz crystal oscillators, while reliable, presented significant size constraints that hampered the development of ever more compact and power-efficient systems. The advent of Micro-Electro-Mechanical Systems (MEMS) technology has fundamentally altered this landscape, offering minuscule oscillator solutions with remarkable performance characteristics.

During the study period of 2019-2033, the market has witnessed a steady and accelerating adoption of MEMS oscillators. The base year of 2025 marks a critical juncture, with the estimated market value in this year already indicating robust growth from the historical period of 2019-2024. This expansion is not merely about replacing legacy components; it's about enabling entirely new product categories and enhancing existing ones. The forecast period of 2025-2033 is expected to be characterized by sustained double-digit compound annual growth rates, driven by innovations in silicon fabrication and packaging technologies that continue to shrink the physical footprint and improve the electrical specifications of these critical timing components. Furthermore, the increasing prevalence of connected devices, the Internet of Things (IoT), and advanced wearable technology, all of which demand ultra-compact and energy-conscious solutions, will act as powerful tailwinds for this market. The shift towards integrated silicon solutions also offers potential cost advantages and simplified bill-of-materials for manufacturers, further cementing the strategic importance of ultra-small MEMS oscillators in the contemporary electronics ecosystem. The intrinsic advantages of MEMS technology, such as superior shock and vibration resistance and programmability, are also contributing to its widespread adoption across diverse applications.

The propulsion behind the ultra-small MEMS oscillator market is a multifaceted interplay of technological advancements and evolving consumer and industrial demands. Foremost among these drivers is the unyielding quest for miniaturization across all sectors of the electronics industry. Devices are becoming progressively smaller and thinner, from smartphones and wearables to medical implants and compact communication modules. MEMS oscillators, with their microscopic dimensions, are perfectly positioned to fulfill these stringent space requirements, often occupying a fraction of the volume previously needed by quartz-based solutions.

Secondly, the exponential growth of the Internet of Things (IoT) ecosystem is a significant propellant. Billions of connected devices, deployed in diverse environments, necessitate highly reliable, low-power, and cost-effective timing components. MEMS oscillators excel in these areas, offering superior power efficiency and the ability to be integrated directly onto silicon chips, thereby reducing component count and manufacturing complexity. Furthermore, the increasing demand for advanced functionalities in consumer electronics, such as augmented reality (AR) and virtual reality (VR) headsets, sophisticated automotive electronics requiring robust timing for advanced driver-assistance systems (ADAS), and next-generation communication infrastructure demanding precise synchronization, all rely on the superior performance and scalability that MEMS oscillators provide. The inherent programmability of MEMS oscillators also allows for greater design flexibility and faster time-to-market, a crucial advantage in today's competitive landscape.

Despite the promising trajectory, the ultra-small MEMS oscillator market is not without its hurdles and restraining factors. One primary challenge lies in the perceived performance gap between MEMS oscillators and their established quartz counterparts, particularly in terms of phase jitter and long-term frequency stability for highly demanding applications. While MEMS technology has made significant strides, certain high-performance niches within telecommunications and high-frequency instrumentation may still prefer the established performance benchmarks of quartz.

Another restraint is the initial investment required for MEMS fabrication facilities and process development. While the per-unit cost can be competitive at high volumes, the upfront capital expenditure for foundries specializing in MEMS can be substantial, potentially limiting the number of players and influencing pricing dynamics, especially for lower volume segments. Furthermore, the established supply chain and long-standing relationships within the quartz oscillator market can create inertia, making it challenging for MEMS solutions to displace deeply entrenched legacy components in certain mature product lines. The need for specialized design expertise and testing protocols for MEMS devices also adds another layer of complexity for manufacturers and designers. Finally, while reliability has improved dramatically, the long-term field performance and susceptibility to extreme environmental conditions in certain niche applications might still be a point of consideration for some end-users, leading to a cautious adoption rate in some segments.

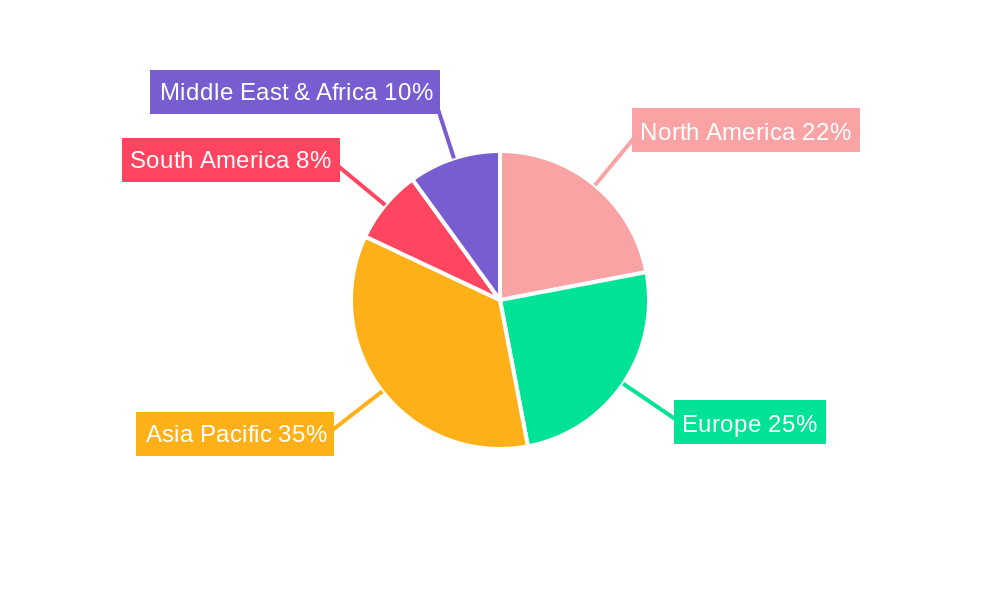

The landscape of ultra-small MEMS oscillator market dominance is shaped by both geographical strengths and the adoption of specific technological segments. Asia Pacific is anticipated to emerge as a dominant region, driven by its colossal manufacturing prowess in consumer electronics, automotive, and telecommunications. Countries like China, Taiwan, South Korea, and Japan are hubs for the production of a vast array of electronic devices that are increasingly reliant on miniaturized and high-performance timing solutions. The presence of major electronics manufacturers, coupled with robust research and development initiatives, positions these nations at the forefront of MEMS oscillator adoption and innovation.

Within the market segments, the All-Silicon MEMS Oscillator type is projected to command the largest share and exhibit the most significant growth. This dominance is fueled by the inherent advantages of all-silicon construction, which allows for seamless integration with other silicon components on a single chip. This integration leads to reduced form factors, lower power consumption, and enhanced reliability through reduced interconnects. The ability to mass-produce these oscillators using standard semiconductor fabrication processes also contributes to their cost-effectiveness and widespread availability.

The Consumer Electronics application segment is a critical engine of this market dominance. The relentless demand for smaller, thinner, and more power-efficient smartphones, tablets, wearables, gaming consoles, and smart home devices directly translates into a massive requirement for ultra-small MEMS oscillators. These devices often require precise timing for everything from display synchronization and audio processing to wireless communication and sensor data management. As consumer expectations for advanced features and longer battery life continue to rise, so too will the demand for the compact and efficient timing solutions that MEMS oscillators provide.

Furthermore, the burgeoning Health Care segment is increasingly contributing to market growth. The miniaturization of medical devices, including portable diagnostic equipment, implantable sensors, and wearable health trackers, necessitates extremely small and low-power oscillators. These devices often operate on limited battery power and require consistent, accurate timing for data acquisition, signal processing, and patient monitoring. The non-magnetic properties and inherent reliability of MEMS oscillators make them particularly well-suited for use in sensitive medical environments, further driving their adoption. The growing trend of remote patient monitoring and telehealth services will further accelerate the demand for these compact and dependable timing components in the healthcare industry.

The ultra-small MEMS oscillator industry is experiencing significant growth catalysts, primarily driven by the pervasive demand for miniaturization and enhanced performance in an ever-expanding array of electronic devices. The burgeoning Internet of Things (IoT) ecosystem, with its billions of connected sensors and devices, requires compact, low-power, and cost-effective timing solutions. Furthermore, advancements in semiconductor manufacturing processes are continually enabling smaller, more integrated, and more power-efficient MEMS oscillators. The increasing adoption of these oscillators in advanced automotive electronics, particularly for ADAS and infotainment systems, and in next-generation communication infrastructure, also acts as a powerful growth catalyst.

This comprehensive report delves deep into the dynamic global ultra-small MEMS oscillator market. It meticulously analyzes market trends, identifies the key driving forces such as the relentless pursuit of miniaturization and the proliferation of IoT devices, and thoroughly examines the challenges and restraints that the industry faces, including performance perceptions and manufacturing complexities. The report highlights the dominant regions and segments, with a particular focus on the Asia Pacific region and the burgeoning All-Silicon MEMS Oscillator and Consumer Electronics application segments. It also outlines the critical growth catalysts that are propelling the industry forward and provides an extensive list of leading players. Furthermore, the report offers a timeline of significant past and projected future developments, ensuring stakeholders have a complete understanding of the current market landscape and its future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include MSTMicroelectronics, SiTime, Microchip Technology, NXP, Epson, Murata, Kyocera Corporation, TXC Corporation, NDK America Inc., ON Semiconductor, Rakon, Abracon, Taitien, Crystek, CTS, Silicon Laboratories, AVX, IDT (Renesas), Bliley Technologies, IQD Frequency Products, NEL Frequency Controls Inc., Pletronics, Ecliptek.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ultra-Small MEMS Oscillator," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ultra-Small MEMS Oscillator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.