1. What is the projected Compound Annual Growth Rate (CAGR) of the Tunnel Operation Monitoring System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tunnel Operation Monitoring System

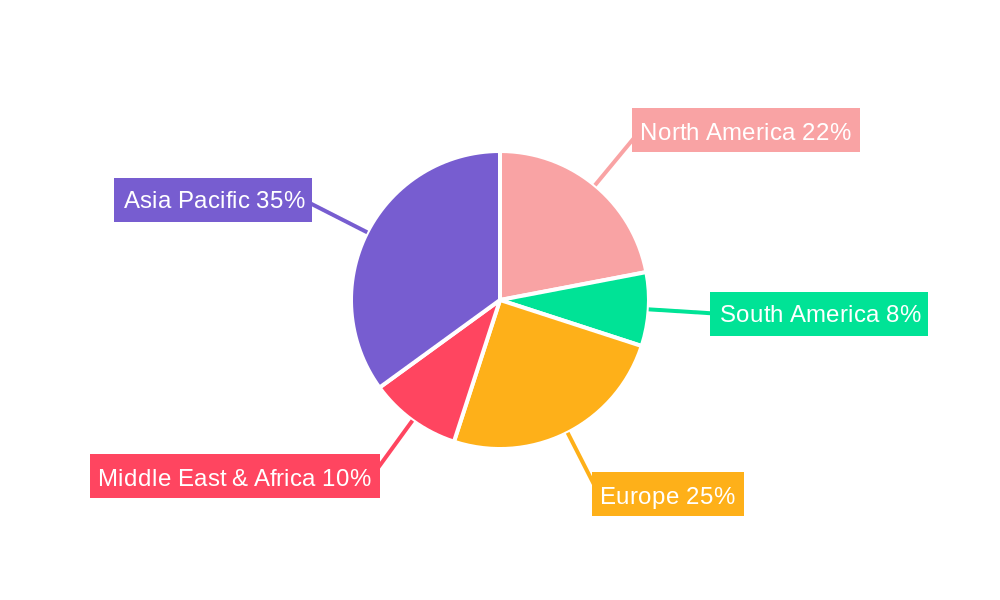

Tunnel Operation Monitoring SystemTunnel Operation Monitoring System by Type (Wired, Wireless, World Tunnel Operation Monitoring System Production ), by Application (Highway Tunnels, Railway Tunnels, Others, World Tunnel Operation Monitoring System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

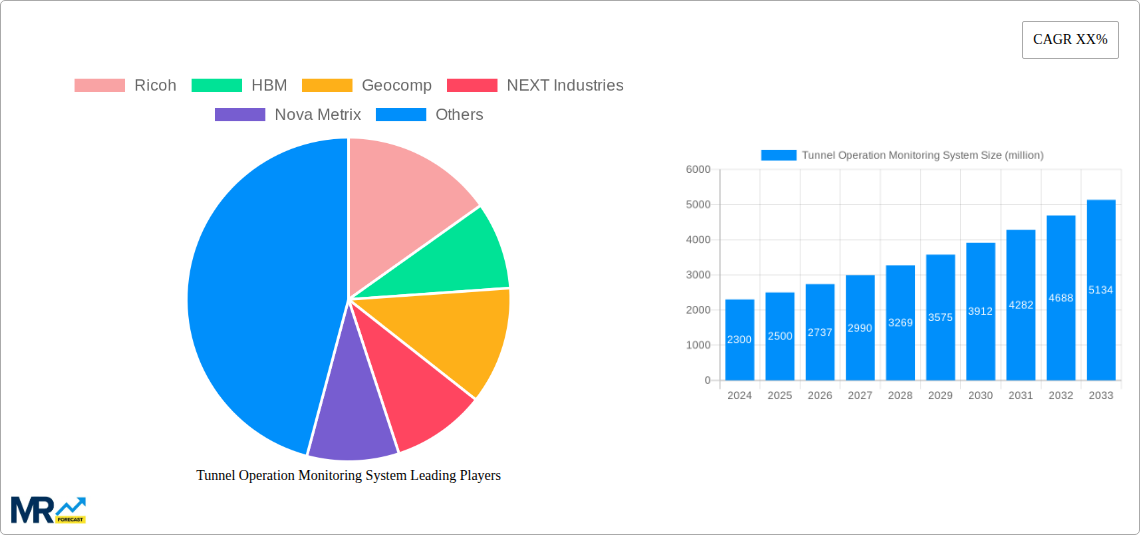

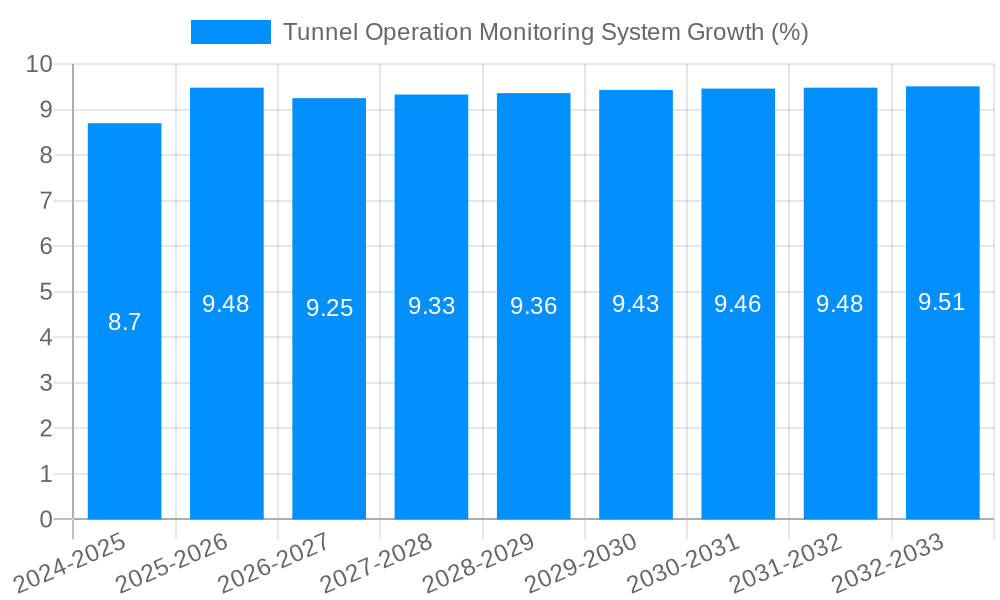

The global Tunnel Operation Monitoring System market is poised for significant growth, projected to reach an estimated USD 2,500 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of approximately 9.5% through 2033. This expansion is primarily driven by the increasing infrastructure development worldwide, particularly in the transportation sector. Governments are heavily investing in new tunnel constructions for highways and railways to alleviate traffic congestion and enhance connectivity. The growing emphasis on safety and security within these critical infrastructure assets further fuels the demand for advanced monitoring systems. These systems are crucial for detecting potential structural issues, environmental hazards like gas leaks or fires, and for ensuring the smooth and efficient operation of tunnels. The wireless segment is expected to witness particularly strong growth, owing to its ease of installation and flexibility in complex tunnel environments. The Asia Pacific region, led by China and India, is anticipated to be a dominant force, fueled by substantial infrastructure projects and rapid urbanization.

Key market drivers include the stringent safety regulations being implemented globally, necessitating continuous monitoring and proactive maintenance of tunnel structures. The integration of IoT and AI technologies into tunnel monitoring systems is another significant trend, enabling real-time data analysis, predictive maintenance, and enhanced operational efficiency. Companies are investing in developing sophisticated sensor technologies and integrated software platforms to provide comprehensive solutions. However, the market faces some restraints, including the high initial investment costs associated with sophisticated monitoring systems and the complexity of integration with existing tunnel infrastructure. Cybersecurity concerns also present a challenge, as these connected systems are vulnerable to potential threats. Despite these challenges, the sustained global demand for safer and more efficient transportation networks ensures a positive outlook for the Tunnel Operation Monitoring System market.

The global Tunnel Operation Monitoring System (TOMS) market is poised for substantial growth, projected to reach an estimated $2,500 million by 2025, escalating to a staggering $6,000 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 9.2% during the forecast period of 2025-2033. This impressive expansion is underpinned by a confluence of critical factors, including the escalating need for enhanced safety, optimized operational efficiency, and proactive infrastructure management within the increasingly complex and vital tunnel networks worldwide. The study period, spanning from 2019 to 2033, encompasses significant historical developments and future projections, with 2025 serving as both the base year and estimated year for key market valuations.

Several key trends are shaping the TOMS landscape. The burgeoning adoption of advanced sensor technologies, such as fiber optic sensors, MEMS accelerometers, and strain gauges, is enabling more precise and real-time data acquisition. This enhanced data granularity is crucial for early detection of structural anomalies, seismic activity, and environmental changes within tunnels. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing data analysis, moving beyond simple data logging to predictive maintenance and intelligent decision-making. This shift towards proactive and predictive approaches is a significant differentiator, offering a substantial return on investment by preventing costly failures and disruptions.

The increasing urbanization and the subsequent demand for efficient transportation infrastructure, particularly in densely populated regions, are driving the construction of new tunnels and the retrofitting of existing ones. This surge in tunnel development directly translates into a greater need for robust monitoring systems. Moreover, regulatory bodies and infrastructure owners are placing a higher emphasis on tunnel safety standards, mandating the implementation of comprehensive monitoring solutions to ensure public well-being and compliance. The evolution from traditional, reactive maintenance to a more sophisticated, data-driven, and preventive monitoring paradigm is a defining characteristic of the current and future TOMS market. The market is witnessing a steady shift towards integrated systems that combine structural health monitoring, environmental sensing, and operational traffic management, offering a holistic view of tunnel performance and safety. The increasing prevalence of smart city initiatives further fuels the demand for interconnected and intelligent infrastructure solutions, with TOMS playing a pivotal role in ensuring the reliability and resilience of urban transportation arteries.

The expansion of the Tunnel Operation Monitoring System (TOMS) market is primarily driven by an unwavering commitment to enhancing tunnel safety and operational longevity. As tunnel infrastructure ages and the demands on these vital transportation arteries increase, the imperative to proactively identify and mitigate potential risks becomes paramount. The historical period from 2019-2024 has seen a growing awareness of the financial and human cost associated with tunnel failures, leading to increased investment in preventative measures.

Furthermore, advancements in sensing technology, including the miniaturization and cost reduction of high-precision sensors, have made comprehensive monitoring solutions more accessible. The proliferation of wireless communication technologies has also significantly reduced the complexity and cost of data transmission from remote or difficult-to-access tunnel locations, enabling wider deployment of monitoring systems. The increasing adoption of data analytics and AI for pattern recognition and anomaly detection allows operators to move from reactive repairs to predictive maintenance, thereby optimizing resource allocation and minimizing downtime. The global push for sustainable infrastructure development and the need to prolong the lifespan of existing assets further bolster the demand for TOMS, ensuring that investments in these critical structures are protected. The continuous need to comply with stringent safety regulations across various regions also acts as a significant impetus for market growth.

Despite the robust growth trajectory, the Tunnel Operation Monitoring System (TOMS) market faces certain hurdles that could temper its expansion. The initial capital investment for sophisticated monitoring systems, particularly for extensive tunnel networks, can be substantial. For many infrastructure owners, especially in developing economies, the upfront cost associated with deploying a comprehensive suite of sensors, data acquisition hardware, and software platforms can represent a significant financial barrier.

Another considerable challenge lies in the complexity of integrating new TOMS with legacy infrastructure and existing control systems. Many older tunnels were not designed with integrated monitoring in mind, making retrofitting a technically demanding and costly endeavor. Ensuring interoperability between different vendor solutions and establishing standardized data protocols can also be a significant undertaking. Furthermore, the sheer volume of data generated by continuous monitoring systems requires robust data management and analysis capabilities. Without adequate IT infrastructure and skilled personnel to interpret the data effectively, the insights gained from TOMS may not be fully leveraged, leading to underutilization and a diminished return on investment. Cybersecurity concerns are also a growing apprehension, as connected monitoring systems can be vulnerable to cyber threats, necessitating robust security measures to protect sensitive operational data and prevent system disruptions. The availability of skilled labor to install, maintain, and operate these advanced systems also presents a potential bottleneck in certain regions.

The Wireless segment is poised to exhibit the most dynamic growth and dominance within the global Tunnel Operation Monitoring System (TOMS) market, projected to represent a significant portion of the estimated $2,500 million market by 2025 and an even larger share of the $6,000 million by 2033. This ascendancy is driven by several compelling factors that address key limitations of traditional wired systems, particularly in the context of extensive and complex tunnel infrastructure.

The Highway Tunnels application segment is also expected to be a major contributor to market dominance. The sheer volume of traffic and the critical role of highways in national and international trade necessitate stringent safety standards and continuous operational efficiency.

While other segments like Railway Tunnels also present significant opportunities, the pervasive use of highway tunnels and the inherent advantages of wireless technology in deployment and cost-effectiveness position the Wireless segment within Highway Tunnels as the dominant force in the global Tunnel Operation Monitoring System market.

The Tunnel Operation Monitoring System (TOMS) industry is propelled by several key growth catalysts. The increasing global focus on infrastructure resilience and disaster preparedness, particularly in light of rising seismic activity and extreme weather events, is a primary driver. Governments and private operators are investing heavily in ensuring the structural integrity of vital transportation networks. Furthermore, the ongoing digital transformation of infrastructure management, coupled with the growing adoption of IoT (Internet of Things) and AI technologies, is enabling more sophisticated and proactive monitoring capabilities, allowing for predictive maintenance and early anomaly detection, thereby reducing operational costs and enhancing safety.

This comprehensive report delves into the intricate dynamics of the Tunnel Operation Monitoring System (TOMS) market, offering an in-depth analysis of its evolution and future trajectory. Covering the historical period from 2019 to 2024 and projecting forward to 2033 with a base year of 2025, it provides invaluable insights into market trends, growth drivers, and emerging opportunities. The report meticulously examines the impact of technological advancements, regulatory landscapes, and economic factors on the market's expansion, estimated to reach $2,500 million by 2025 and soar to $6,000 million by 2033. It also identifies and analyzes the challenges and restraints hindering market growth, alongside the key regions and segments poised for dominance, with a particular emphasis on the burgeoning wireless and highway tunnel applications. This thorough research equips stakeholders with the knowledge to navigate this complex market and capitalize on its significant potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ricoh, HBM, Geocomp, NEXT Industries, Nova Metrix, Sisgeo, Sixense Soldata, James Fisher, Geokon, Cowi, Resensys, Leica Geosystems, Measurand, Smartec, Worldsensing.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tunnel Operation Monitoring System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tunnel Operation Monitoring System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.