1. What is the projected Compound Annual Growth Rate (CAGR) of the Tufted and Needle Punched Carpets?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tufted and Needle Punched Carpets

Tufted and Needle Punched CarpetsTufted and Needle Punched Carpets by Type (Tufted Carpets, Needle Punched Carpets, World Tufted and Needle Punched Carpets Production ), by Application (Automobile, Hotel, Public Places, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

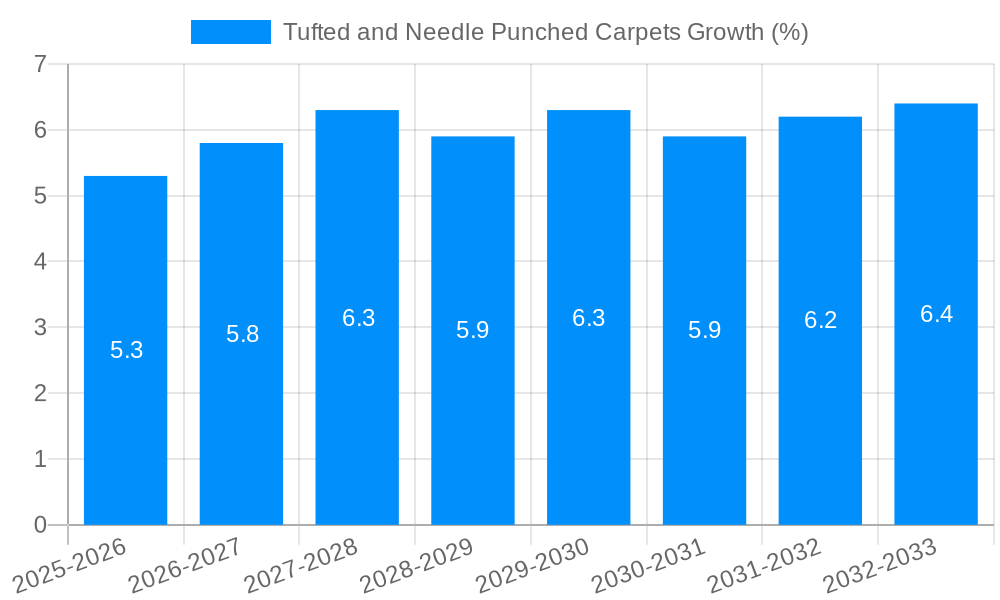

The global Tufted and Needle Punched Carpets market is poised for substantial growth, estimated at a market size of USD 550 million in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust expansion is fueled by escalating demand from key sectors such as the automotive industry, where these carpets are integral for enhancing vehicle interiors and providing sound insulation, and the hospitality sector, which relies on durable and aesthetically pleasing flooring solutions for hotels and public spaces. The increasing trend of commercial and residential construction, coupled with a growing emphasis on interior aesthetics and comfort, further propels the market forward. Innovations in material science and manufacturing processes are leading to the development of more sustainable, eco-friendly, and high-performance carpet options, catering to a broader consumer base and specific industrial requirements.

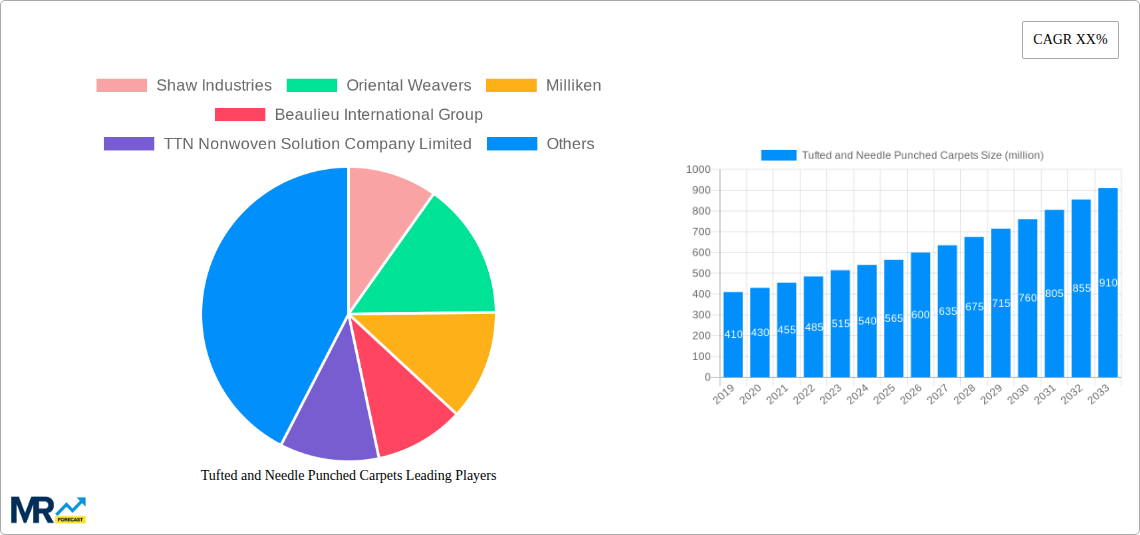

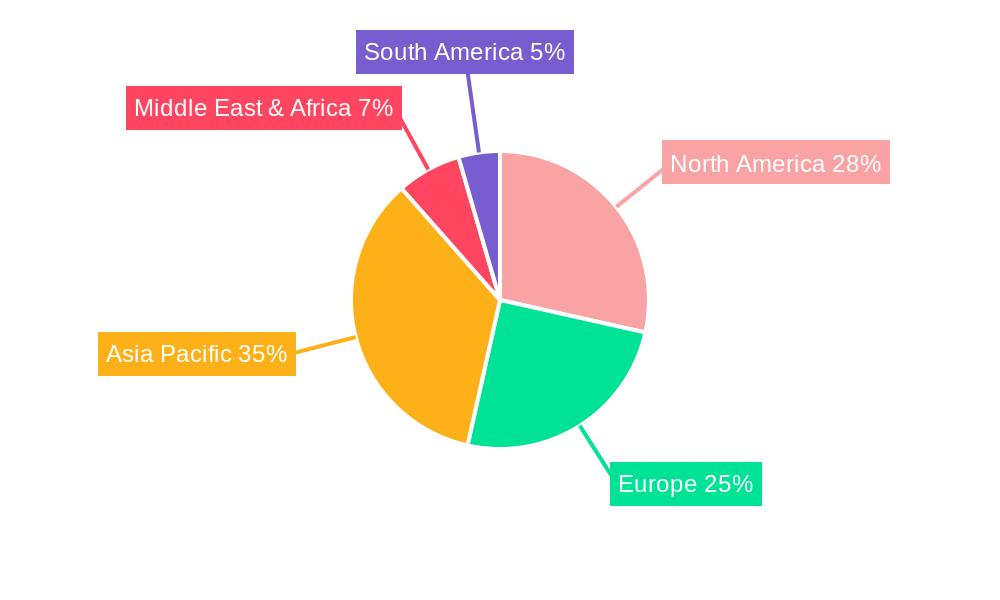

The market is characterized by a dynamic competitive landscape with numerous global and regional players, including Shaw Industries, Oriental Weavers, and Milliken, actively engaging in product innovation, strategic partnerships, and market expansion initiatives. While opportunities abound, the market also faces certain restraints, such as the volatility in raw material prices, particularly for synthetic fibers, and the increasing competition from alternative flooring solutions like luxury vinyl tile (LVT) and laminate flooring. However, the inherent advantages of tufted and needle-punched carpets in terms of cost-effectiveness, durability, and design flexibility are expected to mitigate these challenges. Geographically, Asia Pacific is anticipated to emerge as a dominant region, driven by rapid industrialization and urbanization in countries like China and India, followed by North America and Europe, which continue to exhibit steady demand due to established infrastructure and consumer preferences for comfort and design.

This comprehensive report delves into the dynamic global market for tufted and needle-punched carpets, offering in-depth analysis and forecasts from 2019 to 2033. With the base and estimated year set at 2025, the report meticulously examines the historical landscape (2019-2024) and projects future trends throughout the forecast period (2025-2033). The analysis encompasses a detailed breakdown of market segments, including "Tufted Carpets" and "Needle Punched Carpets," and provides an overarching view of "World Tufted and Needle Punched Carpets Production." Furthermore, it scrutinizes the diverse "Applications" driving demand, such as "Automobile," "Hotel," "Public Places," and "Other," while also highlighting significant "Industry Developments." The report is designed to equip stakeholders with actionable insights into market drivers, challenges, regional dominance, and leading players shaping this multi-million dollar industry.

The global tufted and needle-punched carpets market is poised for significant evolution, driven by a confluence of aesthetic preferences, functional demands, and technological advancements. Over the study period of 2019-2033, we anticipate a steady upward trajectory, with the market size projected to reach several hundred million dollars in revenue by the end of the forecast period. A key trend is the growing demand for sustainable and eco-friendly carpeting solutions. Consumers are increasingly seeking carpets made from recycled materials, natural fibers, and those manufactured using environmentally conscious processes. This has spurred innovation in material science and production techniques, leading to the development of high-performance carpets that also minimize their ecological footprint. The aesthetic appeal of tufted carpets continues to be a dominant factor, with intricate patterns, a wide array of textures, and vibrant color palettes catering to both residential and commercial design needs. Innovations in tufting machinery have enabled greater design complexity and customization, allowing manufacturers to offer bespoke solutions. Needle-punched carpets, on the other hand, are witnessing a surge in demand due to their inherent durability, excellent acoustic properties, and cost-effectiveness. Their application is expanding beyond traditional industrial settings into more sophisticated commercial spaces and even specialized residential areas where high traffic and resilience are paramount. The automotive sector, in particular, represents a substantial and growing segment for both types of carpets, driven by the pursuit of enhanced comfort, noise reduction, and interior aesthetics in vehicles. The hospitality industry continues to be a robust consumer, demanding carpets that are not only visually appealing but also highly durable, stain-resistant, and easy to maintain. Public spaces, including airports, convention centers, and retail environments, are also contributing significantly to market growth, prioritizing longevity and ease of cleaning. The integration of smart technologies, such as antimicrobial coatings and enhanced fire retardancy, is another emerging trend, particularly in healthcare and hospitality applications. The overall market sentiment is optimistic, with projections indicating sustained growth fueled by these evolving consumer preferences and industry-specific requirements. The market is expected to witness strategic collaborations and mergers, alongside significant investments in research and development to stay ahead of the curve and capitalize on emerging opportunities.

The expansion of the global tufted and needle-punched carpets market is underpinned by a robust set of driving forces that are reshaping demand and production. A primary catalyst is the burgeoning construction and renovation sector worldwide. As new residential and commercial buildings are erected, and existing structures undergo upgrades, the demand for floor coverings, including tufted and needle-punched carpets, naturally escalates. This is further amplified by a growing global population and increasing urbanization, leading to a higher need for housing and commercial spaces. The automotive industry's relentless pursuit of enhanced passenger experience is another significant driver. Tufted and needle-punched carpets play a crucial role in vehicle interiors, contributing to comfort, sound insulation, and overall aesthetics. As car manufacturers strive to differentiate their products with premium interiors, the demand for high-quality carpeting solutions is on the rise. The hospitality industry, encompassing hotels, resorts, and restaurants, continues to be a consistent and substantial consumer of these carpets. The desire for visually appealing, durable, and easily maintainable floor coverings in high-traffic areas within hotels and public spaces directly fuels market growth. Furthermore, evolving consumer preferences and lifestyle changes are contributing to the demand for carpets that offer both aesthetic appeal and practical benefits. This includes a growing awareness of the acoustic and thermal insulation properties of carpets, making them a preferred choice in noise-sensitive environments and for energy efficiency. The increasing disposable income in developing economies is also playing a vital role, enabling more consumers to invest in home improvement and furnishing, thus boosting demand for carpeting.

Despite the promising growth trajectory, the tufted and needle-punched carpets market is not without its share of challenges and restraints. A significant hurdle is the intense price competition within the industry. The commoditization of certain types of carpets, particularly those with standard designs and materials, leads to squeezed profit margins for manufacturers. This necessitates a continuous focus on cost optimization and efficiency throughout the supply chain. The volatility in raw material prices, such as polypropylene, nylon, and polyester, presents another considerable challenge. Fluctuations in the cost of these key inputs can directly impact production costs and, consequently, the final pricing of carpets, making it difficult for manufacturers to maintain stable pricing strategies. Environmental regulations and sustainability concerns are also becoming increasingly stringent. While sustainability is a growth driver, adhering to evolving regulations regarding waste disposal, emissions, and the use of certain chemicals can require significant investment in new technologies and processes. Disposal of end-of-life carpets also poses an environmental challenge, with limited effective recycling infrastructure in many regions. The growing popularity of alternative flooring solutions, such as luxury vinyl tiles (LVT), laminate flooring, and hardwood, poses a competitive threat. These alternatives often boast perceived advantages in terms of water resistance, ease of installation, and a modern aesthetic, siphoning off market share from traditional carpet segments. Furthermore, the global economic uncertainties and potential recessions can lead to reduced consumer spending on discretionary items like home furnishings, impacting overall demand for carpets. Supply chain disruptions, as witnessed in recent years due to global events, can also affect the availability of raw materials and the timely delivery of finished products, leading to increased lead times and potential order cancellations.

The global tufted and needle-punched carpets market is characterized by distinct regional dominance and segment leadership, driven by varying economic conditions, consumer preferences, and industrial demand.

Dominant Regions/Countries:

North America (United States, Canada): This region consistently leads the market owing to its mature construction industry, high disposable incomes, and strong demand from both residential and commercial sectors. The automotive industry in North America, with its significant manufacturing base, also contributes substantially. The preference for comfort and luxury in homes, coupled with the need for durable and aesthetically pleasing carpets in hotels and public spaces, solidifies its leading position. The presence of major industry players like Shaw Industries and Milliken further bolsters its market influence. The market size in this region is projected to be in the range of hundreds of millions of dollars.

Europe (Germany, France, UK): Europe represents another substantial market, driven by a well-established construction sector, a strong emphasis on interior design, and increasing awareness of sustainable building materials. The automotive sector in Germany, in particular, is a key consumer of tufted and needle-punched carpets for its high-end vehicles. The hospitality sector also contributes significantly to demand. While some European countries face challenges related to stringent environmental regulations, the push towards eco-friendly products is creating new opportunities for innovation and market growth. The market size in Europe is also estimated to be in the hundreds of millions of dollars.

Asia Pacific (China, India, Japan): This region is emerging as the fastest-growing market. Rapid urbanization, a booming construction industry, and a burgeoning middle class in countries like China and India are creating immense demand for carpeting solutions. The significant manufacturing base for automobiles in these countries also fuels the demand for automotive carpets. While traditionally needle-punched carpets have dominated in industrial applications, the growing adoption of tufted carpets for residential and commercial interiors is a notable trend. The market size in this region, while currently lower than North America and Europe, is experiencing the most dynamic growth and is projected to reach hundreds of millions of dollars within the forecast period.

Dominant Segments:

Type: Tufted Carpets: Tufted carpets, known for their versatility in design, texture, and pile height, are expected to continue their dominance. Their ability to replicate intricate patterns and offer a premium feel makes them highly sought after in residential, hospitality, and high-end commercial applications. The demand for customized designs and varied aesthetic options further strengthens the position of tufted carpets.

Application: Automobile: The automotive segment is a critical growth engine for both tufted and needle-punched carpets. As vehicle interiors evolve to become more sophisticated and comfortable, the demand for specialized carpets that offer sound insulation, durability, and aesthetic appeal is on the rise. The increasing production of vehicles globally, coupled with the trend towards premiumization in car interiors, ensures the sustained importance of this segment.

Application: Hotel: The hospitality sector is a perennial strong performer. Hotels, resorts, and convention centers require carpeting that can withstand heavy foot traffic, offer excellent stain resistance, and contribute to the overall ambiance and brand image. The continuous renovation and expansion of hotel properties worldwide ensure a consistent demand for high-quality carpeting solutions from this segment.

The interplay between these regions and segments creates a complex yet predictable market dynamic. For instance, the automotive segment's growth in Asia Pacific, driven by increasing vehicle production, is a significant factor in the region's overall market expansion. Similarly, the demand for premium tufted carpets in the hotel sector of North America and Europe underscores the continued importance of aesthetic and functional versatility.

Several key factors are acting as potent catalysts for the growth of the tufted and needle-punched carpets industry. The accelerating pace of global construction and infrastructure development projects, encompassing both residential and commercial buildings, directly translates into increased demand for flooring solutions. Furthermore, the growing emphasis on interior aesthetics and comfort in both residential and commercial spaces is a significant driver, with consumers and businesses alike investing in high-quality carpeting to enhance their environments. The expanding automotive sector, with its constant innovation in vehicle interiors, presents a substantial opportunity for specialized tufted and needle-punched carpets that offer improved comfort, sound insulation, and design. The increasing disposable incomes in emerging economies are empowering a larger segment of the population to invest in home improvements and furnishings, thereby boosting demand for carpeting.

This comprehensive report provides an unparalleled view of the global tufted and needle-punched carpets market, spanning from 2019 to 2033. It offers detailed market segmentation, including analysis of "Tufted Carpets," "Needle Punched Carpets," and "World Tufted and Needle Punched Carpets Production." The report meticulously examines key "Application" segments such as "Automobile," "Hotel," "Public Places," and "Other," providing granular insights into the demand drivers within each. Furthermore, it highlights crucial "Industry Developments," enabling stakeholders to stay abreast of the latest technological innovations and market trends. The report's extensive coverage ensures a deep understanding of market dynamics, competitive landscapes, and future growth opportunities, making it an indispensable resource for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shaw Industries, Oriental Weavers, Milliken, Beaulieu International Group, TTN Nonwoven Solution Company Limited, Delaware Valley Corporation, Feltol, Zarif Mosavar Industrial Production Group, LIS INTERNATIONAL CO., LTD., Veltex, SA, Doers, Suminoe Textile, Bouckaert Industrial Textiles, SKAPS Industries, Fynotej, Supreme Geotech Pvt. Ltd., Autotech Nonwovens, Firouzeh Moquette, Ningbo Tuopu Group Co.,Ltd., Shanghai Shenda Co.,Ltd., Shandong Kuntai New Material Technology Co., Ltd., Balta, Tarkett, Dixie Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tufted and Needle Punched Carpets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tufted and Needle Punched Carpets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.