1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Retailing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Travel Retailing

Travel RetailingTravel Retailing by Application (/> Airports, Airplanes, Cruise Ships, Downtown), by Type (/> Perfume & Cosmetics, Food, Wine & Spirits, Luxury Goods, Tobacco, Electronics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

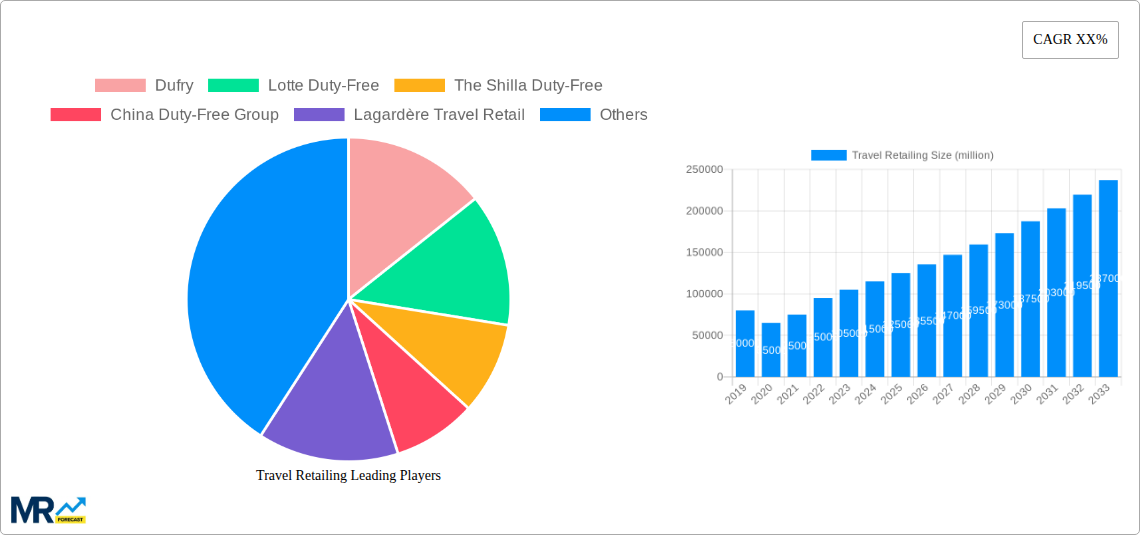

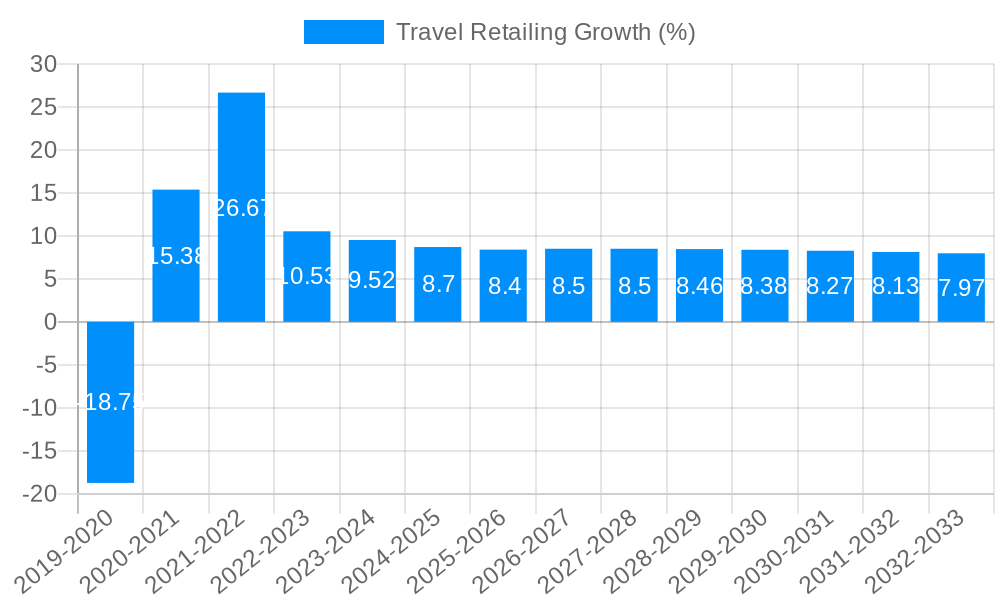

The global travel retailing market is poised for significant expansion, projected to reach an estimated USD 125 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5%. This growth trajectory is largely fueled by the burgeoning middle class in emerging economies, an increase in international tourist arrivals, and a strong consumer demand for premium and luxury goods, particularly in the Perfume & Cosmetics, Food, Wine & Spirits, and Luxury Goods segments. The post-pandemic recovery in air travel and the resurgence of cruise tourism are further accelerating this market expansion. Travel retail, encompassing diverse channels such as airports, airplanes, and cruise ships, is evolving beyond traditional product offerings to incorporate experiential retail, personalized services, and seamless omnichannel integration. This shift caters to the modern traveler's desire for convenience and unique purchasing opportunities.

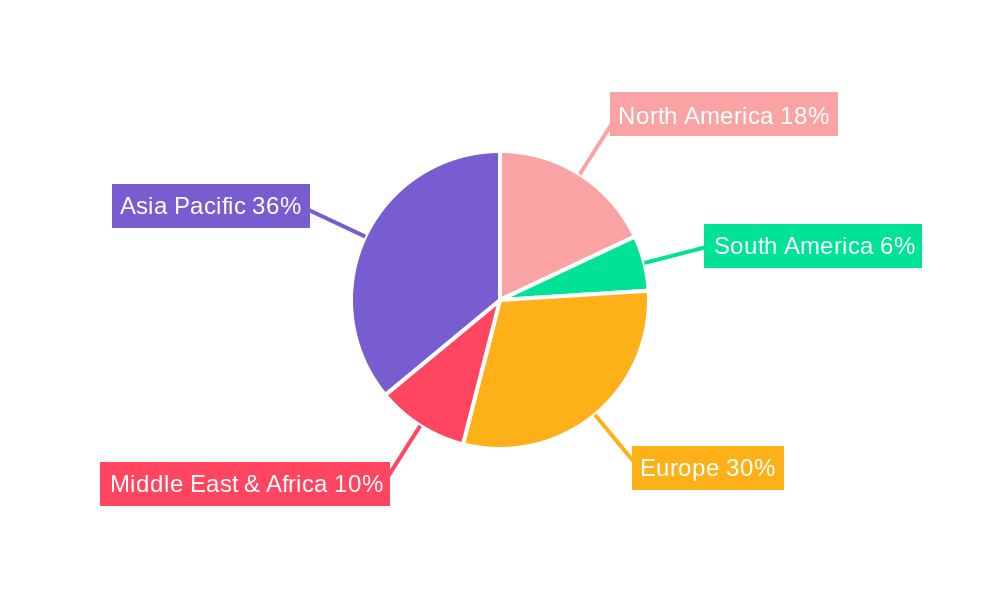

Key drivers of this market include the increasing disposable incomes globally, leading to higher spending on discretionary items during travel. Furthermore, the expansion of duty-free allowances in various regions and the strategic placement of retail outlets in high-traffic travel hubs are significant contributors to market growth. However, the market faces certain restraints, including the volatility of global economic conditions, geopolitical instability that can impact travel patterns, and the increasing shift towards online shopping, which necessitates travel retailers to enhance their in-store and online experiences to remain competitive. The Asia Pacific region is expected to dominate the market, driven by the rapid growth of travel and tourism in countries like China and India, coupled with a rising consumer appetite for branded products.

This comprehensive report delves into the intricate world of travel retailing, a sector characterized by its unique consumer behavior, evolving operational models, and significant economic impact. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this analysis leverages historical data from 2019-2024 to provide robust market insights. The global travel retailing market, projected to be valued in the hundreds of millions of units (note: specific monetary values in millions are not provided for the overall market size in the prompt, but the unit value implies substantial scale), is undergoing a profound transformation driven by shifts in global travel patterns, technological advancements, and a heightened consumer demand for personalized and experiential retail.

XXX, the global travel retailing market is poised for significant evolution, with a strong emphasis on digital integration and experiential retail experiences. The study period of 2019-2033 encapsulates a dynamic era marked by the COVID-19 pandemic's disruptive influence and subsequent recovery, underscoring the sector's resilience and adaptability. By 2025, the market is expected to have firmly established new norms, with estimated growth driven by a rebound in international travel and a sustained interest in duty-free and travel-exclusive products. A key trend is the burgeoning importance of omnichannel retailing, where the lines between physical and digital shopping blur. Passengers increasingly expect seamless integration, allowing them to browse online, reserve products, and pick them up at designated airport locations or even have them delivered to their seats on flights or cruise ships. This convenience-driven approach is paramount in the fast-paced travel environment.

Furthermore, the Perfume & Cosmetics and Luxury Goods segments are anticipated to continue their dominance. These categories inherently benefit from the gifting culture and the aspirational nature of travel, allowing consumers to indulge in premium products they might not purchase in their everyday lives. The historical period of 2019-2024 has laid the groundwork for these trends, showcasing consistent demand for high-value items. Looking ahead to the forecast period of 2025-2033, expect to see a greater personalization of offerings. Leveraging data analytics and AI, travel retailers will be able to tailor product recommendations and promotions to individual traveler profiles, enhancing engagement and increasing conversion rates. The rise of sustainable and ethically sourced products is also gaining traction, appealing to a growing segment of environmentally conscious travelers. This conscious consumerism will influence purchasing decisions, pushing brands and retailers to adopt more responsible practices. Finally, the integration of augmented reality (AR) and virtual reality (VR) technologies will offer immersive shopping experiences, allowing travelers to virtually try on products or explore destinations through retail displays, further enriching the travel retail journey.

The travel retailing sector is being propelled by a confluence of powerful forces, all working in tandem to reshape its trajectory and expand its market potential. At the forefront is the undeniable rebound and projected growth of global travel. As international borders reopen and travel restrictions ease, the sheer volume of passengers transiting through airports, boarding cruise ships, and embarking on flights directly fuels the demand for retail opportunities. This surge in footfall is a fundamental driver for the sector. Complementing this is the inherent allure of duty-free and travel-exclusive offerings. The promise of tax savings and access to unique product assortments continues to be a significant incentive for travelers, encouraging impulse purchases and planned acquisitions. This unique value proposition remains a cornerstone of the industry.

Moreover, the increasing sophistication of the travel consumer plays a crucial role. Travelers today are more connected, informed, and digitally savvy than ever before. They expect convenience, personalization, and engaging experiences, pushing retailers to innovate and adapt their strategies. The integration of technology, from mobile apps for pre-ordering to in-store digital displays, is no longer a novelty but a necessity. The estimated year of 2025 is expected to see a more widespread adoption of these technologies. Furthermore, the growing middle class in emerging economies, particularly in Asia, represents a massive and expanding consumer base with increasing disposable income and a desire to participate in global travel and luxury consumption. This demographic shift is a significant long-term growth engine for travel retailing.

Despite the promising outlook, the travel retailing sector is not without its significant hurdles and constraints. Foremost among these is the inherent volatility of the global travel landscape itself. Geopolitical instability, economic downturns, and unforeseen events like pandemics can drastically impact passenger volumes, leading to unpredictable revenue streams. The historical period of 2019-2024, particularly the impact of COVID-19, serves as a stark reminder of this vulnerability. Another significant challenge lies in the intense competition within the sector. With numerous players vying for a share of the traveler's wallet, maintaining profitability and differentiation requires constant innovation and strategic pricing. This competitive pressure can erode margins, especially for smaller operators.

Furthermore, the evolving regulatory environment across different countries and regions presents a complex web of compliance requirements. Changes in customs regulations, tax laws, and product import/export restrictions can impact operational efficiency and product availability. The study period of 2019-2033 will likely witness ongoing adjustments in these areas. The rising operational costs, including rent in prime airport locations, staffing, and supply chain logistics, also pose a considerable restraint. As airport authorities and cruise line operators seek to maximize their revenue, rental fees can become a significant burden for retailers. Finally, the changing consumer preferences and the growing emphasis on sustainability can act as a restraint if retailers are slow to adapt. Meeting demand for eco-friendly products and ethical sourcing requires investment and a potential shift in product portfolios, which may not be immediately feasible for all players.

The travel retailing market is projected to witness dominance from specific regions and segments, each contributing uniquely to its growth and character.

Asia-Pacific: This region is poised to be a powerhouse, driven by a burgeoning middle class with increasing disposable incomes and a burgeoning appetite for international travel and luxury goods.

Airports: As the primary gateway for a vast majority of international travelers, airports will continue to be the dominant application segment for travel retailing.

Perfume & Cosmetics: This segment is expected to maintain its leading position within the travel retail market.

Luxury Goods: The demand for luxury items, including watches, jewelry, designer fashion, and accessories, remains a strong driver within travel retailing.

The dominance of the Asia-Pacific region is underpinned by rapid economic growth and a cultural emphasis on gifting and status symbols. Major travel hubs within this region are continuously investing in world-class airport infrastructure, integrating extensive retail offerings that cater to both local and international travelers. This creates a self-reinforcing cycle of growth. Similarly, airports, as the nexus of travel, provide an unparalleled captive audience. The time spent by passengers in transit offers a prime opportunity for retail engagement, and the strategic placement of stores within terminals maximizes visibility and accessibility. The inherent desirability of Perfume & Cosmetics and Luxury Goods, driven by consumer aspirations and the unique gifting opportunities presented by travel, ensures their continued stronghold. These segments benefit from high margins and a consistent demand, making them a focal point for many travel retailers aiming for profitability and brand prestige.

Several key factors are acting as significant growth catalysts for the travel retailing industry. The projected recovery and sustained growth in international passenger traffic, following the pandemic-induced slowdown, represent a fundamental driver. Furthermore, the increasing adoption of digital technologies, enabling omnichannel experiences, personalized marketing, and efficient inventory management, is enhancing customer engagement and sales potential. The expanding middle class in emerging economies, particularly in Asia, is creating a new wave of affluent travelers with a growing propensity to spend on premium and luxury goods. Finally, the continuous innovation in product offerings, including the introduction of travel-exclusive items and the growing demand for sustainable and ethically sourced products, is attracting and retaining a wider customer base.

This report offers a holistic examination of the travel retailing industry, providing in-depth analysis across various facets. It meticulously dissects the historical period of 2019-2024, shedding light on the market's performance amidst significant global events. The estimated year of 2025 serves as a critical benchmark, outlining current market conditions and immediate future projections. The forecast period of 2025-2033 delves into anticipated trends, growth trajectories, and potential disruptions, equipping stakeholders with actionable insights for long-term strategic planning. The report covers a wide array of segments, including applications like Airports, Airplanes, Cruise Ships, and Downtown locations, as well as product types such as Perfume & Cosmetics, Food, Wine & Spirits, Luxury Goods, Tobacco, and Electronics. This comprehensive scope ensures that readers gain a nuanced understanding of the market's diverse landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dufry, Lotte Duty-Free, The Shilla Duty-Free, China Duty-Free Group, Lagardère Travel Retail, Gebr Heinemann, DFS Group, King Power International Group (Thailand), Sinsegae Duty-Free, Dubai Duty-Free, Ever Rich Duty-Free, Duty-Free Americas, Aer Rianta International, JATCO, Starboard Cruise Services, WHSmith, Doota Duty-Free, NAA Retailing, Flemingo International, 3Sixty Duty-Free, Sky Connection, Qatar Duty-Free, JR/Duty-Free, Tallink Group, King Power Group (Hong Kong), .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Travel Retailing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Travel Retailing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.