1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermally Conductive Adhesives for Automotive?

The projected CAGR is approximately 6.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Thermally Conductive Adhesives for Automotive

Thermally Conductive Adhesives for AutomotiveThermally Conductive Adhesives for Automotive by Application (Commercial Vehicle, Passenger Car), by Type (Silicone Thermal Conductive Adhesives, Acrylic Thermal Conductive Adhesives, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

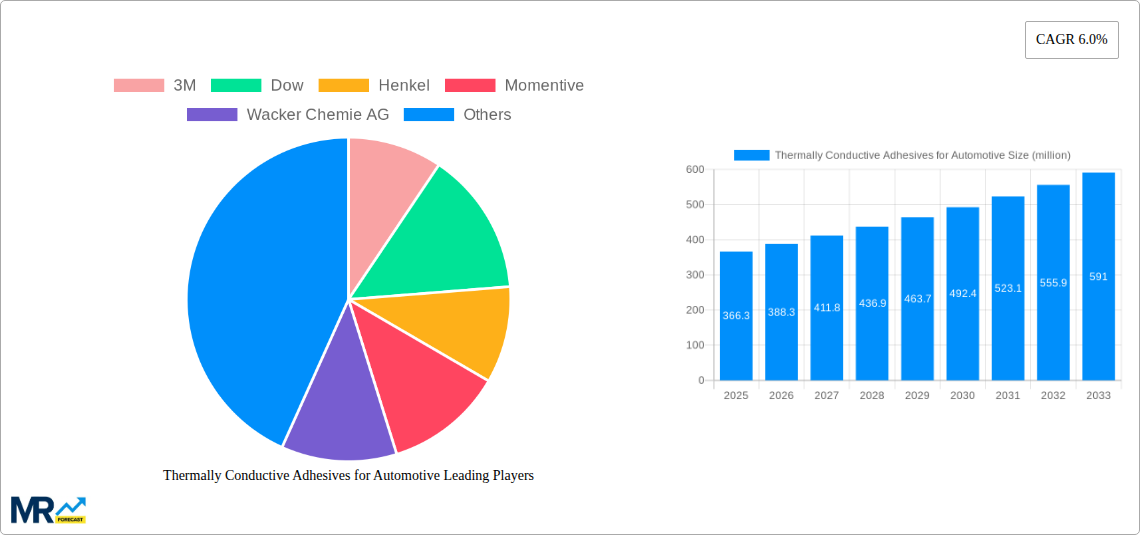

The global market for Thermally Conductive Adhesives for Automotive is projected for robust expansion, valued at approximately $366.3 million in 2025 and expected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% through 2033. This growth is primarily fueled by the escalating demand for advanced thermal management solutions in electric vehicles (EVs) and the increasing integration of complex electronic components within conventional automobiles. As the automotive industry pivots towards electrification and enhanced in-car technologies, efficient heat dissipation becomes paramount for the longevity and performance of batteries, power electronics, and sensor systems. Silicone thermal conductive adhesives are anticipated to dominate the market due to their superior temperature resistance, flexibility, and dielectric properties, making them ideal for critical applications like battery pack assembly and inverter encapsulation. The increasing adoption of advanced driver-assistance systems (ADAS) and infotainment systems also necessitates effective thermal management, further propelling the market forward.

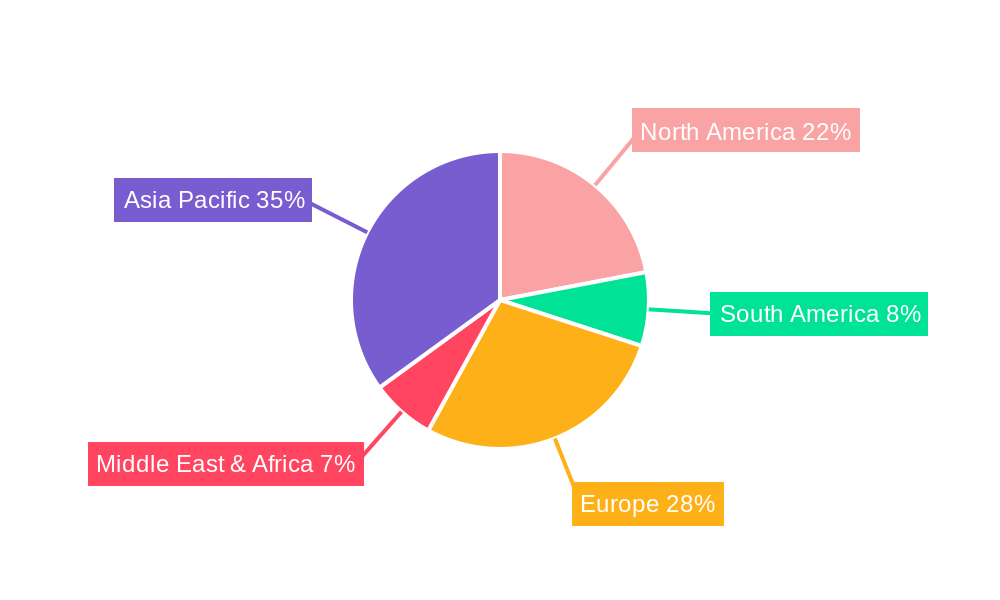

The market is segmented into key applications, with Commercial Vehicles and Passenger Cars representing the primary demand drivers. Within the Type segment, Silicone Thermal Conductive Adhesives are expected to lead, followed by Acrylic Thermal Conductive Adhesives, catering to diverse performance requirements and cost considerations. Geographically, the Asia Pacific region, particularly China, is poised to be the largest and fastest-growing market, driven by its expansive automotive manufacturing base and rapid EV adoption. North America and Europe are also significant markets, owing to stringent regulations on vehicle emissions and a strong consumer preference for technologically advanced vehicles. Key players such as 3M, Dow, Henkel, Momentive, and Wacker Chemie AG are actively innovating to develop next-generation thermally conductive adhesives that offer improved performance, easier application, and enhanced sustainability, thus shaping the competitive landscape and driving market evolution.

The automotive industry is undergoing a profound transformation, driven by the relentless pursuit of enhanced performance, increased efficiency, and the burgeoning electrification of vehicles. This evolution necessitates advanced material solutions, with thermally conductive adhesives emerging as critical enablers. The global market for thermally conductive adhesives in automotive applications is experiencing robust growth, projected to reach USD 2.2 billion by 2025 and forecast to expand significantly to USD 4.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 8.9% during the forecast period of 2025-2033. This impressive trajectory is underpinned by several key market insights.

The increasing prevalence of electric vehicles (EVs) is a paramount driver, demanding efficient thermal management for battery packs, power electronics, and electric motors. These components generate substantial heat, and effective dissipation is crucial for optimizing performance, extending lifespan, and ensuring safety. Thermally conductive adhesives play a pivotal role in bridging the gap between heat-generating components and heat sinks, facilitating rapid heat transfer and preventing thermal runaway. The passenger car segment, currently the largest application area, is expected to continue its dominance, driven by the sheer volume of vehicle production and the growing integration of sophisticated electronic systems. However, the commercial vehicle segment is exhibiting a higher growth rate, fueled by the increasing adoption of electric powertrains in trucks and buses to meet stringent emission regulations and operational efficiency demands.

Within the types of adhesives, Silicone Thermal Conductive Adhesives are expected to maintain a significant market share due to their excellent thermal stability, flexibility, and ease of application, particularly in high-temperature environments. Acrylic Thermal Conductive Adhesives are also gaining traction, offering a good balance of thermal conductivity, adhesion strength, and cost-effectiveness. The "Others" category, encompassing epoxies and polyurethanes, will also contribute to market growth, offering specialized properties for niche applications. Geographically, Asia-Pacific, led by China, is poised to be the largest and fastest-growing market, owing to its dominant position in global automotive manufacturing and the rapid adoption of EVs. North America and Europe are also significant markets, with strong demand for advanced automotive materials driven by technological innovation and regulatory frameworks. The study encompasses the historical period from 2019-2024, with the base year and estimated year both set at 2025, providing a comprehensive understanding of market dynamics and future projections through 2033.

The exponential growth of the thermally conductive adhesives market in the automotive sector is propelled by a confluence of powerful driving forces, primarily centered around the ongoing technological revolution within the industry. The most significant catalyst is the accelerating shift towards electric vehicles (EVs). As the automotive landscape electrifies, the need for effective thermal management becomes paramount. Battery packs, the heart of EVs, generate considerable heat during charging and discharging cycles. Efficiently dissipating this heat is crucial for maintaining optimal battery performance, extending battery life, and preventing thermal runaway, thus ensuring passenger safety. Thermally conductive adhesives serve as indispensable components in this thermal management strategy, acting as reliable interfaces between battery cells, modules, and cooling systems.

Beyond EVs, the increasing complexity and miniaturization of electronic components in all vehicle types are further amplifying the demand for advanced thermal management solutions. Modern vehicles are equipped with an array of sophisticated electronic control units (ECUs), sensors, and infotainment systems, all of which generate heat. Thermally conductive adhesives enable the efficient transfer of this heat away from these sensitive components, preventing overheating and ensuring their reliable operation, thereby contributing to overall vehicle longevity and performance. Furthermore, stringent governmental regulations regarding fuel efficiency and emissions are pushing automakers to adopt lighter and more integrated designs. Thermally conductive adhesives facilitate the integration of components and reduce the need for bulky mechanical fastening methods, contributing to weight reduction and improved fuel economy. The quest for enhanced passenger comfort through advanced climate control systems and the integration of powerful audio-visual systems also indirectly drives the demand for effective thermal dissipation, creating a fertile ground for thermally conductive adhesives.

Despite the robust growth trajectory, the market for thermally conductive adhesives in automotive applications is not without its challenges and restraints, which can impact the pace and extent of its expansion. One of the primary challenges revolves around achieving a delicate balance between thermal conductivity, adhesive strength, and cost-effectiveness. While high thermal conductivity is desired, it often comes at the expense of other crucial properties like adhesion, flexibility, or processing ease. Manufacturers are constantly striving to develop formulations that offer superior thermal performance without compromising on the structural integrity or application feasibility. The cost of raw materials and the complex manufacturing processes involved in producing high-performance thermally conductive adhesives can also be a restraining factor, particularly for entry-level vehicle segments where cost sensitivity is higher.

The stringent and evolving regulatory landscape governing automotive materials presents another hurdle. Adhesives used in automotive applications must meet rigorous standards for safety, durability, and environmental impact. Obtaining certifications and ensuring compliance with these varied global regulations can be a time-consuming and resource-intensive process for manufacturers. Furthermore, the rapid pace of technological innovation, particularly in EV battery technology, necessitates continuous research and development to keep pace with emerging thermal management requirements. If adhesive solutions fail to evolve at the same speed as battery chemistries or power electronics, their market penetration could be limited. Finally, the skilled labor required for precise application of these specialized adhesives and the initial investment in dispensing equipment can also pose a barrier for some automotive manufacturers, especially smaller tiers or those in emerging markets.

The global market for Thermally Conductive Adhesives for Automotive is characterized by a dynamic interplay of regional strengths and segment preferences. The Asia-Pacific region is poised to dominate both in terms of market share and growth rate. This dominance is intrinsically linked to its unparalleled position as the world's largest automotive manufacturing hub. Countries like China, Japan, South Korea, and India are at the forefront of vehicle production, and consequently, represent the largest consumers of automotive materials, including thermally conductive adhesives. China, in particular, stands out as a key driver due to its aggressive push towards electrification, supported by strong government policies and a burgeoning domestic EV market. The country's vast manufacturing ecosystem, coupled with significant investments in battery technology and advanced automotive components, creates an insatiable demand for high-performance thermal management solutions.

Within the Asia-Pacific region, the Passenger Car segment is expected to continue its reign as the largest application area. The sheer volume of passenger cars produced globally, combined with the increasing integration of sophisticated electronic systems for enhanced safety, comfort, and infotainment, necessitates effective thermal management. However, the Commercial Vehicle segment is projected to exhibit a significantly higher growth rate. This surge is primarily driven by the global imperative to reduce carbon emissions and improve fuel efficiency in commercial fleets. Governments worldwide are implementing stricter emission standards, compelling manufacturers of trucks, buses, and other heavy-duty vehicles to adopt electric or hybrid powertrains. These electric commercial vehicles, with their larger battery packs and higher power demands, require robust thermal management systems, thereby boosting the demand for advanced thermally conductive adhesives.

Considering the Type of adhesives, Silicone Thermal Conductive Adhesives are anticipated to maintain a substantial market share. Their inherent properties – excellent thermal stability across a wide temperature range, high dielectric strength, flexibility, and resistance to moisture and chemicals – make them ideal for demanding automotive applications, particularly in areas prone to vibration and fluctuating temperatures, such as around battery modules and power electronics. Their ease of application in various forms, including pastes, sealants, and potting compounds, further contributes to their widespread adoption. The Passenger Car segment in Asia-Pacific, particularly driven by China's EV revolution, will be the largest consumer of Silicone Thermal Conductive Adhesives. The growing demand for advanced driver-assistance systems (ADAS), sophisticated infotainment, and electric powertrains in these vehicles will continue to fuel the need for reliable thermal management. The Commercial Vehicle segment within the same region, while smaller in current volume, will witness the most rapid expansion in the adoption of these adhesives, as electrification gains momentum in this sector.

The growth of the Thermally Conductive Adhesives for Automotive industry is significantly propelled by the rapid acceleration of electric vehicle (EV) adoption worldwide. EVs, with their complex battery systems and power electronics, inherently require sophisticated thermal management to optimize performance and ensure safety. Secondly, the increasing miniaturization and integration of electronic components within all vehicle types, from passenger cars to commercial vehicles, generate more heat in confined spaces, thus demanding more efficient heat dissipation solutions provided by these adhesives. Finally, the stringent global regulations aimed at reducing emissions and improving fuel efficiency are compelling automakers to adopt lighter, more integrated designs, where advanced adhesives play a crucial role.

This comprehensive report provides an in-depth analysis of the global Thermally Conductive Adhesives for Automotive market, covering the extensive study period from 2019 to 2033. It meticulously examines the market dynamics during the historical period (2019-2024), establishes a detailed base year (2025) analysis, and offers precise forecasts for the period 2025-2033. The report delves into key trends, identifies the critical driving forces and challenges shaping the market, and highlights the dominant regions and segments, with a particular focus on applications like Commercial Vehicle and Passenger Car, and types such as Silicone and Acrylic Thermal Conductive Adhesives. It further explores growth catalysts, profiles leading industry players, and details significant developments, providing a holistic understanding of this vital and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.0%.

Key companies in the market include 3M, Dow, Henkel, Momentive, Wacker Chemie AG, Shin-Etsu Chemical, Parker Hannifin, Zymet, Creative Materials, AGC, Hönle, CHT Group, Shanghai Huitian New Material, Beijing Comens New Materials, Kangda New Materials, Chengdu Guibao Science&Technology, Sirnice, Shenzhen Dover Technology.

The market segments include Application, Type.

The market size is estimated to be USD 366.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Thermally Conductive Adhesives for Automotive," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Thermally Conductive Adhesives for Automotive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.