1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Imaging Camera for Smartphone?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Thermal Imaging Camera for Smartphone

Thermal Imaging Camera for SmartphoneThermal Imaging Camera for Smartphone by Application (Android, iOS, World Thermal Imaging Camera for Smartphone Production ), by Type (Clip-on or Attachments, Integrated, World Thermal Imaging Camera for Smartphone Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

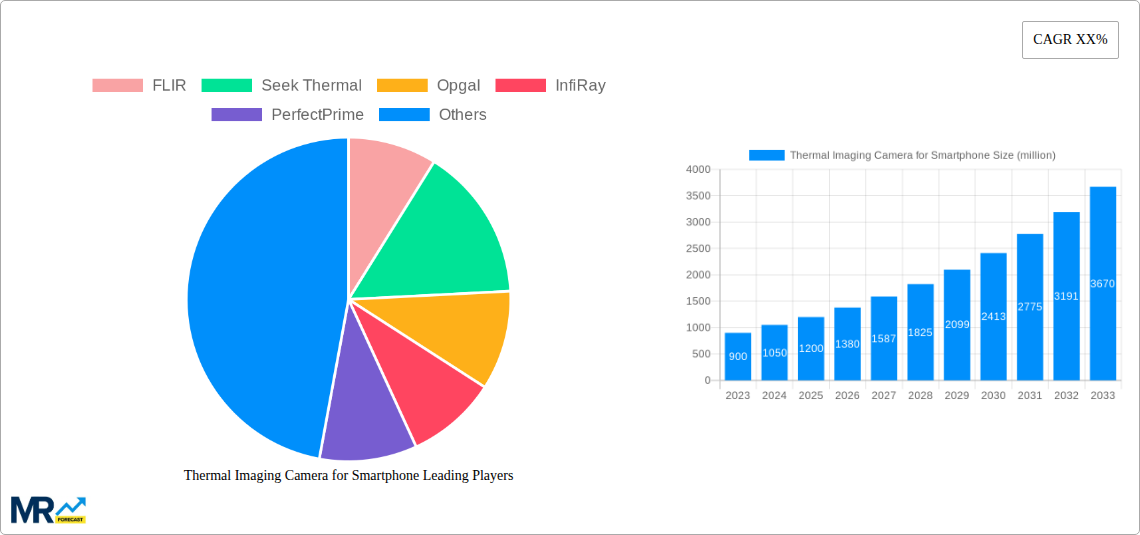

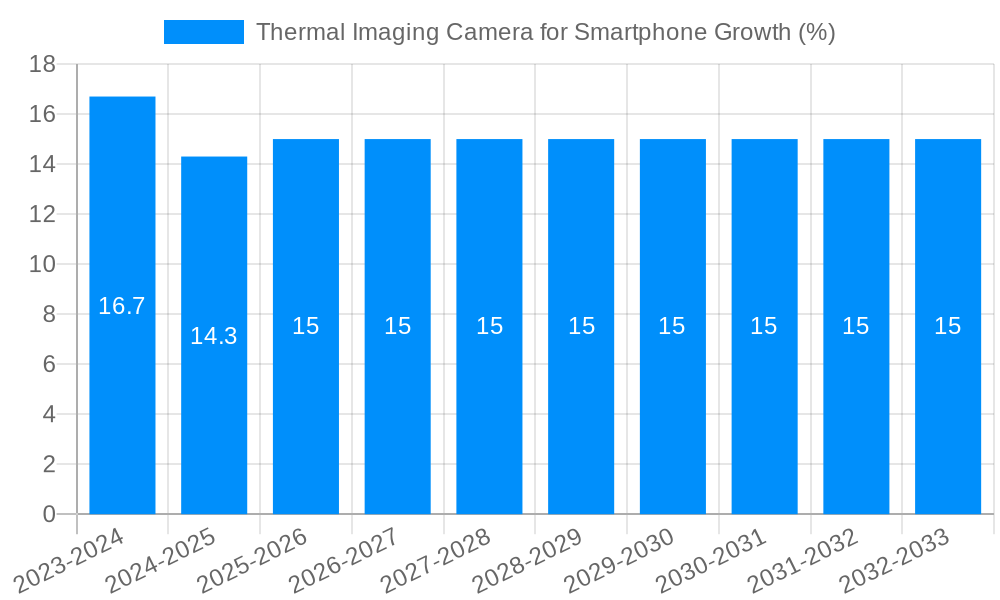

The global market for Thermal Imaging Cameras for Smartphones is poised for significant expansion, projected to reach approximately $1,200 million by the end of 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of around 15% through 2033. The burgeoning demand for enhanced visual inspection and diagnostic capabilities across various sectors, including industrial maintenance, construction, public safety, and even consumer applications, is a primary driver. The increasing affordability and accessibility of these devices, coupled with advancements in smartphone technology and thermal sensor miniaturization, are making thermal imaging a mainstream feature rather than a niche tool. Key applications are experiencing substantial uptake, particularly in asset management and predictive maintenance, where early detection of anomalies can prevent costly failures. The integration of these cameras, either as clip-on attachments or fully integrated units, is becoming more sophisticated, offering seamless user experiences and richer data analytics.

While the market presents a promising outlook, certain factors could influence its trajectory. High manufacturing costs for advanced thermal sensors and the need for specialized software for data interpretation represent potential restraints. However, these challenges are being mitigated by ongoing technological innovation and economies of scale. The competitive landscape is characterized by the presence of established players like FLIR and Seek Thermal, alongside emerging innovators such as HIKMICRO and InfiRay, all vying for market share through product differentiation and strategic partnerships. Emerging markets, particularly in Asia Pacific and rapidly developing economies in South America and Africa, are expected to witness accelerated adoption rates due to increasing industrialization and infrastructure development, presenting significant growth opportunities for thermal imaging camera manufacturers. The evolution towards higher resolution, greater sensitivity, and user-friendly interfaces will continue to shape market trends.

The global thermal imaging camera for smartphone market is poised for substantial expansion, projected to reach an impressive $2,450 million by 2033, a significant leap from its valuation in the historical period. This growth trajectory underscores the increasing integration of thermal imaging technology into everyday consumer devices, transforming how individuals perceive and interact with their environments. The market, which saw its base year at $890 million in 2025, is expected to experience a Compound Annual Growth Rate (CAGR) of 13.2% during the forecast period of 2025-2033. This surge is fueled by a confluence of factors, including the increasing demand for advanced diagnostic tools in various industries, the growing adoption of smartphones as ubiquitous computing platforms, and continuous technological advancements driving down costs and improving performance.

The evolution of thermal imaging technology, initially confined to high-end industrial and military applications, is now democratizing, making its way into the pockets of millions. This shift is largely attributable to the development of compact, affordable thermal sensors that can seamlessly integrate with smartphones, either as clip-on attachments or as built-in components. The World Thermal Imaging Camera for Smartphone Production segment, encompassing both Android and iOS platforms, is witnessing a robust demand. While Android has historically held a larger market share due to its open ecosystem and wider device diversity, iOS is rapidly catching up, driven by Apple's premium device segment and a growing ecosystem of compatible accessories. The report analyzes the interplay between these platforms and their respective market penetration.

Furthermore, the market is observing a bifurcation in product types: clip-on or attachments and integrated solutions. Clip-on devices offer flexibility and cost-effectiveness, allowing users to add thermal imaging capabilities to their existing smartphones. Integrated solutions, on the other hand, provide a more seamless user experience and are often found in higher-end, specialized smartphone models. The study highlights the growing preference for integrated solutions, especially in professional applications, while clip-on variants continue to cater to a broader consumer base. The historical period from 2019-2024 laid the groundwork for this explosive growth, marked by steady innovation and increasing consumer awareness of the benefits of thermal imaging. The base year of 2025 represents a critical juncture, with the market poised to capitalize on emerging opportunities and solidify its presence across diverse sectors.

The escalating demand for thermal imaging cameras for smartphones is a multifaceted phenomenon, driven by an intricate interplay of technological advancements, evolving consumer needs, and the expanding utility of smartphones. A primary driver is the democratization of thermal imaging technology. Historically, thermal cameras were prohibitively expensive and complex, limiting their use to specialized professional fields. However, significant miniaturization and cost reductions in sensor technology, coupled with advancements in smartphone processing power, have made these devices accessible and affordable for a wider audience. This has unlocked a plethora of new applications beyond traditional industrial uses.

Moreover, the increasing smartphone penetration and its role as a central hub for various activities are undeniable growth engines. As smartphones become indispensable tools for communication, information, and entertainment, users are increasingly seeking to augment their functionalities. Thermal imaging offers a unique visual dimension, enabling users to "see" heat patterns invisible to the naked eye. This capability is highly valued in applications ranging from home inspection and energy auditing to personal safety and even hobbyist pursuits like wildlife observation. The adaptability of smartphones as platforms further enhances this, allowing for intuitive app integration, data analysis, and sharing of thermal imagery. The proliferation of powerful mobile applications designed to leverage thermal data is directly contributing to the adoption of these devices, making them more than just cameras but comprehensive diagnostic and analytical tools.

The growing awareness of energy efficiency and safety concerns also plays a pivotal role. In residential and commercial settings, thermal imaging cameras for smartphones can quickly identify heat leaks, insulation deficiencies, and potential electrical or plumbing issues, leading to cost savings and improved safety. This readily available diagnostic capability empowers homeowners and small businesses to proactively address problems without the need for expensive specialized equipment or professional call-outs for preliminary assessments. This practical, hands-on benefit directly translates into a demand for affordable thermal imaging solutions that can be readily deployed from a smartphone.

Despite the promising growth outlook, the thermal imaging camera for smartphone market faces several inherent challenges and restraints that could temper its expansion. A significant hurdle is price sensitivity and perceived value proposition for the average consumer. While prices have fallen dramatically, the cost of a thermal imaging attachment or an integrated smartphone model can still be a barrier for mass adoption, especially for individuals who may not immediately see a clear, recurring need for thermal imaging capabilities beyond niche applications. The market needs to effectively communicate the tangible benefits and return on investment to a broader consumer base.

Furthermore, technical limitations and performance expectations remain a concern. While sensor technology has advanced, the resolution and sensitivity of smartphone-integrated or clip-on thermal cameras may not always match those of dedicated, professional-grade thermal imagers. This can limit their efficacy in highly demanding industrial or scientific applications where precise measurements and detailed thermal analysis are critical. Users accustomed to high-resolution visual cameras might find the thermal imagery less detailed than anticipated, leading to disappointment if not properly managed. The accuracy and consistency of readings across different environmental conditions can also be a challenge, requiring sophisticated calibration and software to ensure reliable data.

Another significant restraint is lack of widespread consumer awareness and understanding of thermal imaging. Many potential users are simply unaware of the technology's capabilities or how it can be applied to their daily lives. Educating the public about the diverse applications, from detecting hidden water leaks and faulty wiring to identifying pests or monitoring engine performance, is crucial for driving demand. Without this understanding, the market will struggle to move beyond early adopters and specialized professional segments. The report will delve into these factors, providing insights into how manufacturers are addressing these challenges and the potential impact on market growth.

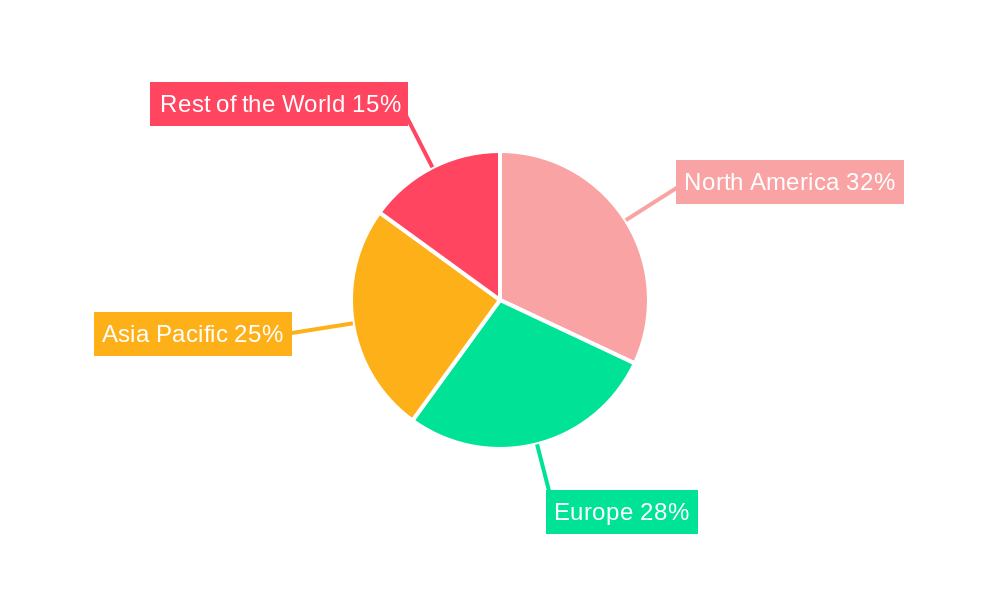

The global thermal imaging camera for smartphone market is characterized by significant regional variations and segment dominance, driven by economic factors, technological adoption rates, and specific industry needs. Among the various segments, Android currently holds a commanding position in the Application category, primarily due to its widespread global adoption across a vast spectrum of smartphone manufacturers and price points. The open-source nature of Android allows for greater flexibility in hardware integration and software development, leading to a wider array of thermal imaging camera options available for the platform. This broad accessibility translates into a larger user base, especially in emerging markets where Android devices are the prevalent choice.

In terms of Type, the Clip-on or Attachments segment is expected to continue its dominance, particularly in the forecast period of 2025-2033. This is largely driven by cost-effectiveness and the ability for users to leverage their existing smartphones. For many consumers and small businesses, purchasing an add-on device offers a more budget-friendly entry into thermal imaging compared to buying a new, integrated smartphone. The versatility of clip-on devices, which can be easily detached and used with different compatible phones, also contributes to their popularity. This segment caters to a broader market, including DIY enthusiasts, home inspectors, plumbers, electricians, and automotive technicians who require occasional thermal imaging capabilities.

Geographically, North America is projected to emerge as a dominant region, driven by a strong technological infrastructure, high disposable incomes, and a mature market for smart devices. The region's early adoption of advanced technologies and a well-established ecosystem for smart accessories position it favorably for the growth of thermal imaging cameras for smartphones. Furthermore, the significant presence of industries where thermal imaging is crucial, such as building inspection, energy auditing, and automotive maintenance, further bolsters demand. The high concentration of tech-savvy consumers and professionals who are keen on adopting innovative solutions also contributes to North America's market leadership.

However, the Asia Pacific region is anticipated to exhibit the highest growth rate during the forecast period. This is fueled by the rapidly expanding smartphone user base, increasing disposable incomes, and a growing emphasis on industrial automation and infrastructure development. Countries like China, India, and South Korea are witnessing a surge in smartphone penetration, creating a vast potential market for thermal imaging attachments. The increasing demand for energy efficiency and predictive maintenance in manufacturing and construction sectors within this region will also act as a significant catalyst for market expansion. While the initial adoption might be slower than in North America, the sheer volume of potential users and the rapid pace of technological assimilation suggest that Asia Pacific will be a crucial region to watch. The report will provide an in-depth analysis of these regional dynamics and segment preferences, offering valuable insights for market strategists.

Several key factors are acting as potent growth catalysts for the thermal imaging camera for smartphone industry. The relentless pace of technological innovation, leading to smaller, more powerful, and affordable thermal sensors, is fundamentally lowering the barrier to entry. This is directly enabling the development of a wider range of user-friendly and cost-effective smartphone attachments and integrated solutions. Furthermore, the increasing adoption of smartphones as multi-functional devices, coupled with the proliferation of intuitive mobile applications for data analysis and visualization, is creating new use cases and enhancing the perceived value of thermal imaging capabilities for both consumers and professionals.

This comprehensive report delves deep into the multifaceted global thermal imaging camera for smartphone market, offering an exhaustive analysis of its trajectory from 2019 to 2033. With the base year set at 2025 and the estimated year also in 2025, the study provides critical insights into the market's current standing and future potential. The meticulous forecast period of 2025-2033, built upon the foundations of the historical period from 2019-2024, meticulously details market dynamics, key trends, and growth drivers. The report examines the influence of leading companies such as FLIR, Seek Thermal, and InfiRay, alongside an in-depth exploration of significant industry developments. It aims to equip stakeholders with the strategic knowledge necessary to navigate this rapidly evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include FLIR, Seek Thermal, Opgal, InfiRay, PerfectPrime, Uni-T, TOPDON, HIKMICRO, Fluke, Guide Sensmart Tech, Noyafa.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Thermal Imaging Camera for Smartphone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Thermal Imaging Camera for Smartphone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.