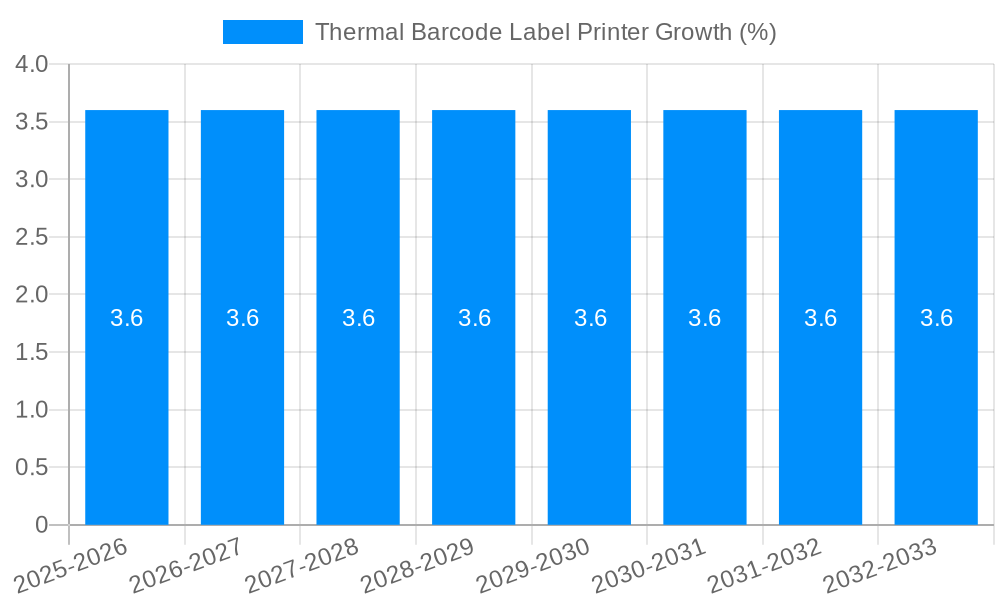

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Barcode Label Printer?

The projected CAGR is approximately 3.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Thermal Barcode Label Printer

Thermal Barcode Label PrinterThermal Barcode Label Printer by Application (Transportation and Logistics, Manufacturing, Retail, Medical, Others), by Type (Color Label Printer, Monochrome Label Printer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

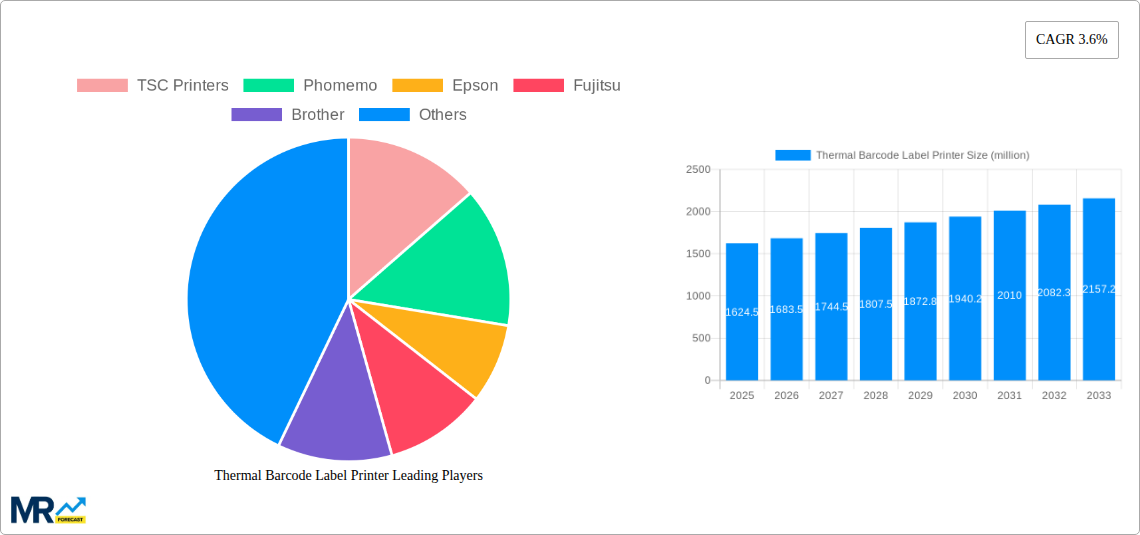

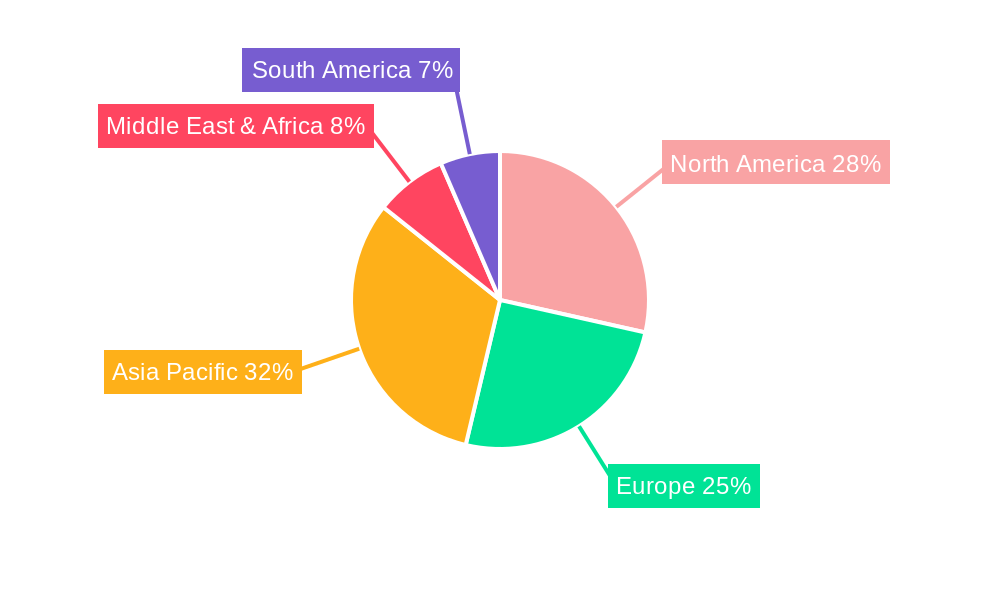

The global Thermal Barcode Label Printer market is poised for significant expansion, with an estimated market size of $1624.5 million in 2025. Driven by the increasing adoption of automated data capture and tracking systems across diverse industries, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.6% from 2025 to 2033. This robust growth is primarily fueled by the escalating demand for efficient inventory management, supply chain optimization, and product traceability. The manufacturing sector, with its need for precise labeling on production lines and finished goods, represents a substantial segment. Similarly, the transportation and logistics industry relies heavily on thermal barcode labels for package tracking, shipping documentation, and warehouse management, making it another key growth engine. The retail sector's drive for improved customer experience through efficient checkout processes and product information also contributes significantly to market expansion. Furthermore, the burgeoning healthcare industry's stringent requirements for patient identification, medication tracking, and specimen labeling are opening new avenues for market penetration. Emerging economies, particularly in the Asia Pacific region, are expected to be major contributors to this growth due to rapid industrialization and increasing e-commerce penetration.

The market dynamics for thermal barcode label printers are characterized by continuous innovation and a growing emphasis on specialized applications. While color label printers are gaining traction for branding and enhanced product information, monochrome printers continue to dominate in core operational functions due to their cost-effectiveness and speed. Key industry players are focusing on developing advanced printing solutions that offer higher print speeds, improved durability, and enhanced connectivity options to cater to evolving industry needs. The demand for portable and ruggedized label printers is also on the rise, particularly for field service applications and warehouse environments. However, challenges such as the initial investment cost for advanced printers and the availability of alternative labeling technologies might pose some constraints. Despite these, the overall outlook remains exceptionally positive, with ongoing technological advancements and a persistent need for accurate and efficient labeling solutions ensuring sustained market growth throughout the forecast period.

The global thermal barcode label printer market is projected to experience robust growth over the study period of 2019-2033, with a projected market size reaching over $5,500 million by 2033. The base year of 2025 estimates the market at $2,200 million, with the estimated year also at $2,350 million, indicating a steady upward trajectory. The forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) of approximately 8.5%. This analysis delves into the intricate dynamics of the thermal barcode label printer industry, encompassing trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments.

The thermal barcode label printer market is currently experiencing a significant shift driven by increasing demand for efficiency, automation, and enhanced traceability across various industries. A key trend observed is the growing adoption of direct thermal printing technology, particularly in high-volume applications like retail receipts, shipping labels, and inventory management. This is attributed to its cost-effectiveness, simplicity of operation, and the absence of ink or toner, making it a preferred choice for many businesses. Furthermore, the market is witnessing a surge in the demand for mobile thermal printers, enabling on-the-go printing solutions essential for field service operations, warehouse management, and event ticketing. The integration of IoT capabilities into these printers is another burgeoning trend, allowing for remote monitoring, predictive maintenance, and seamless connectivity with other smart devices, thus optimizing operational workflows. The continuous evolution of printing technology is also leading to higher print resolutions and faster printing speeds, catering to the ever-increasing need for detailed and quickly generated labels. The market is also seeing a rise in the demand for specialized label printers capable of printing on a wider range of materials, including durable synthetic labels for harsh environments and chemical-resistant labels for industrial applications. The increasing emphasis on supply chain visibility and product authentication is further fueling the demand for advanced barcode printing solutions that can encode complex data and security features. The market is also experiencing growth in the adoption of color label printers for product branding and marketing, moving beyond monochrome solutions for enhanced visual appeal. This trend is particularly prevalent in the consumer goods and food and beverage sectors. The increasing regulatory compliance requirements across various industries, such as healthcare and pharmaceuticals, also necessitate the use of accurate and reliable barcode labeling solutions, further bolstering market growth.

Several potent factors are propelling the growth of the thermal barcode label printer market. Foremost among these is the relentless expansion of e-commerce and the subsequent boom in online retail. The surge in online orders necessitates efficient and rapid labeling of packages for shipping, directly translating to increased demand for thermal printers. Simultaneously, the manufacturing sector's continuous drive for operational efficiency and lean methodologies is a significant growth driver. Barcode labeling is critical for inventory tracking, work-in-progress management, and quality control, making thermal printers indispensable tools. The increasing adoption of automation and robotics in warehouses and production lines further amplifies this need, as automated systems rely heavily on accurate and scannable barcode labels for identification and tracking. Moreover, the healthcare industry's stringent requirements for patient identification, medication tracking, and sample labeling are creating a substantial demand for reliable and compliant thermal label printers. The imperative for enhanced supply chain visibility and product traceability, driven by consumer demand for transparency and regulatory mandates, is another key propellant. Businesses are increasingly investing in solutions that can track products from origin to consumption, with thermal barcode printers playing a crucial role in generating the necessary labels. The growing need for efficient asset management and inventory control across all sectors, from retail to IT, also contributes to the sustained demand for these printing solutions.

Despite the robust growth prospects, the thermal barcode label printer market is not without its challenges. One significant restraint is the initial capital investment required for purchasing high-quality thermal printers, which can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets. While direct thermal printing is cost-effective in the long run, the initial outlay for a reliable printer can be substantial. Another challenge is the perception of limited functionality compared to other printing technologies, particularly in applications requiring color printing or specialized finishes, although advancements are rapidly addressing these limitations. The reliance on specialized thermal paper and ribbons, which can be a recurring cost, also presents a challenge for some users, especially those dealing with extremely high print volumes. Furthermore, the increasing adoption of QR codes and RFID technology, while often used in conjunction with barcode printing, also represents a potential shift in how information is encoded and tracked, potentially impacting the volume of traditional barcode labels in certain niche applications. The ongoing need for technical expertise to set up, maintain, and troubleshoot these printers can also be a deterrent for less technologically inclined users, although user-friendly interfaces are becoming more common. Fluctuations in the cost of raw materials used in the production of thermal printers and consumables can also impact pricing and market dynamics. Lastly, the growing awareness and preference for sustainable printing solutions may pose a challenge for traditional thermal printing methods if eco-friendly alternatives gain significant traction.

The North America region is poised to dominate the thermal barcode label printer market, driven by its highly developed industrial infrastructure, advanced technological adoption, and the presence of a large number of e-commerce giants and logistics companies. The United States, in particular, is a major consumer of thermal barcode label printers due to its expansive retail sector, a robust manufacturing base, and stringent regulatory requirements in industries like healthcare. The rapid adoption of automation in warehouses and distribution centers across North America further fuels demand for efficient labeling solutions.

Within the application segments, Transportation and Logistics is expected to be the dominant segment in the thermal barcode label printer market. The sheer volume of goods that move through supply chains globally necessitates constant and efficient labeling for tracking, sorting, and inventory management. The growth of e-commerce has directly translated into an exponential increase in the number of packages needing labels, making thermal printers a critical component of this industry. From shipping labels on individual parcels to pallet labels in distribution centers, thermal printers are indispensable. The need for real-time tracking and proof of delivery further enhances the reliance on scannable barcode labels.

Another significant segment contributing to market dominance is Retail. Retailers utilize thermal barcode label printers for a myriad of applications, including point-of-sale (POS) receipts, shelf labeling, inventory management, price tags, and customer loyalty program cards. The fast-paced nature of the retail environment demands quick and on-demand printing of labels, making direct thermal and thermal transfer printers the preferred choice. The increasing use of promotional labels, product identification labels, and return labels in both brick-and-mortar stores and online retail operations further solidifies the dominance of this segment.

Considering the types of printers, Monochrome Label Printers will continue to hold a substantial market share. The primary function of most barcode labels is identification and tracking, which can be effectively achieved with monochrome printing. Cost-effectiveness, speed, and simplicity make monochrome printers the go-to solution for high-volume labeling needs where color is not a critical requirement.

Dominant Region: North America (primarily the United States)

Dominant Application Segment: Transportation and Logistics

Significant Application Segment: Retail

Dominant Type: Monochrome Label Printer

The thermal barcode label printer industry is being propelled by several key growth catalysts. The exponential growth of e-commerce, necessitating efficient and rapid package labeling, is a primary driver. Furthermore, the increasing implementation of automation and robotics in manufacturing and logistics relies heavily on accurate barcode identification, boosting demand. The ongoing need for enhanced supply chain visibility and traceability across all industries to meet regulatory requirements and consumer expectations also fuels market expansion. The growing adoption of the Internet of Things (IoT) in industrial settings, allowing for connected devices and data-driven operations, further integrates thermal printers into smart ecosystems.

This report offers a holistic and in-depth analysis of the global thermal barcode label printer market, encompassing a comprehensive review of its historical performance, current landscape, and future projections. The study meticulously examines key market trends, including the rise of mobile printing, IoT integration, and the increasing demand for color label printing solutions. It thoroughly investigates the driving forces, such as the burgeoning e-commerce sector and the relentless pursuit of operational efficiency in manufacturing and logistics, alongside the challenges and restraints that shape market dynamics, like initial investment costs and the emergence of alternative technologies. The report highlights dominant regions and application segments, providing granular insights into their market penetration and growth potential. Furthermore, it identifies crucial growth catalysts, leading industry players, and significant technological advancements, offering a well-rounded perspective for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.6%.

Key companies in the market include TSC Printers, Phomemo, Epson, Fujitsu, Brother, HP, Panduit, Zebra Technologies, Citizen Systems, Honeywell, LabelTac, Intermec, Afinia, Printronix, Toshiba TEC, TVS ELECTRONICS, cab Produkttechnik, Star, DYMO, Advantech, .

The market segments include Application, Type.

The market size is estimated to be USD 1624.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Thermal Barcode Label Printer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Thermal Barcode Label Printer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.