1. What is the projected Compound Annual Growth Rate (CAGR) of the Textured Faba Bean Protein?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Textured Faba Bean Protein

Textured Faba Bean ProteinTextured Faba Bean Protein by Type (Chunks, Flakes, Slices, Granules, Others, World Textured Faba Bean Protein Production ), by Application (Food Additives, Meat Substitutes, Snack foods, Pet Foods, Others, World Textured Faba Bean Protein Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

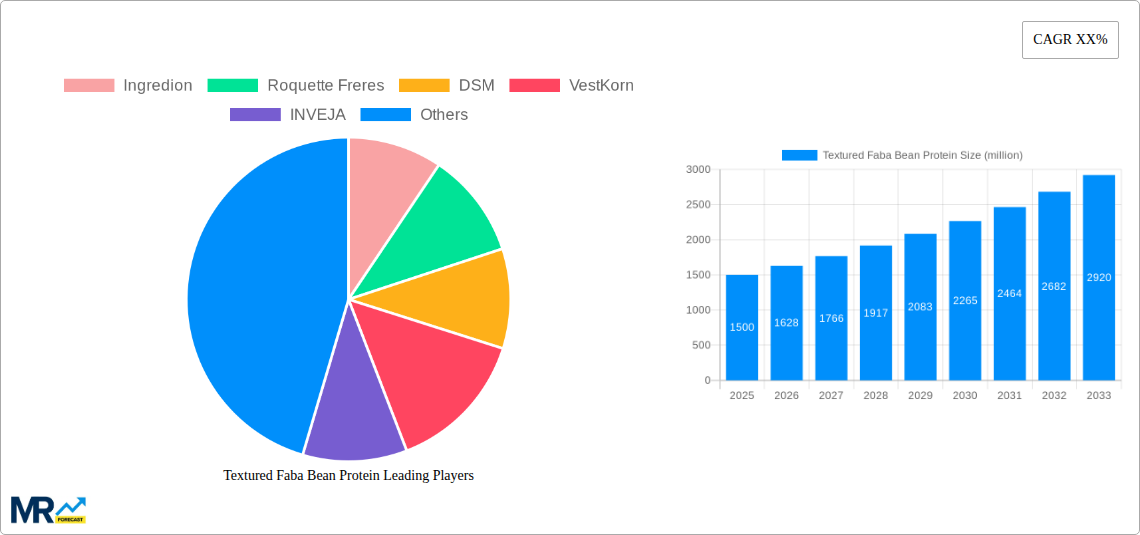

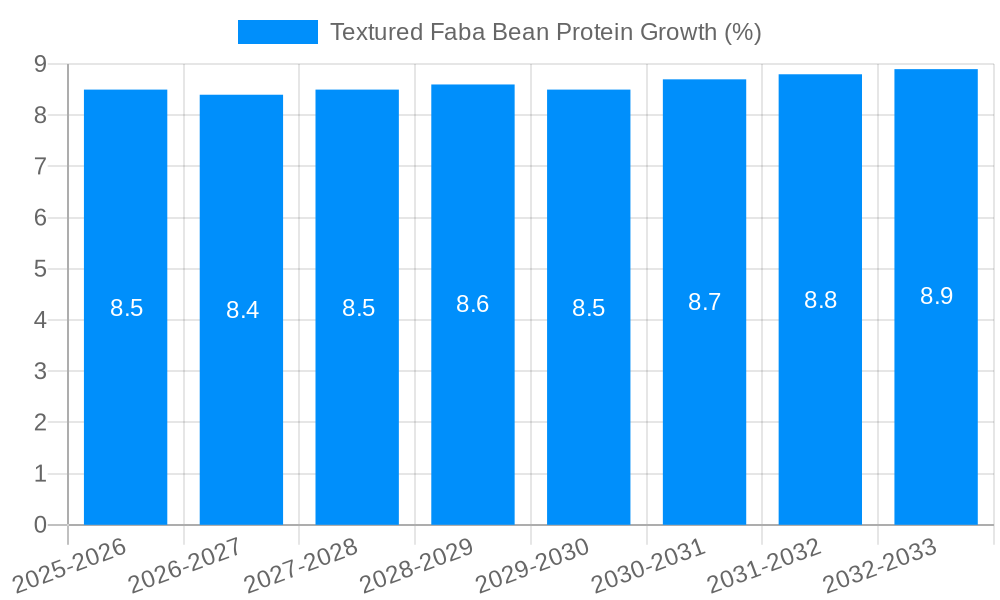

The global Textured Faba Bean Protein market is poised for substantial growth, projected to reach an estimated USD 1.5 billion in 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 8.5% from 2019 to 2033. This upward trajectory is primarily fueled by the escalating consumer demand for plant-based protein alternatives driven by health consciousness and environmental concerns. The market is experiencing a significant shift towards sustainable and ethically sourced food options, with textured faba bean protein emerging as a versatile and cost-effective ingredient. Its unique ability to mimic the texture and mouthfeel of animal protein makes it an attractive substitute across a wide array of food applications, including meat substitutes, snack foods, and even pet foods. This widespread applicability, coupled with ongoing innovation in processing techniques and product development by key players like Ingredion, Roquette Freres, and DSM, will further propel market expansion. The rising adoption of faba bean protein in processed foods as a functional ingredient, enhancing nutritional profiles and texture, further solidifies its market position.

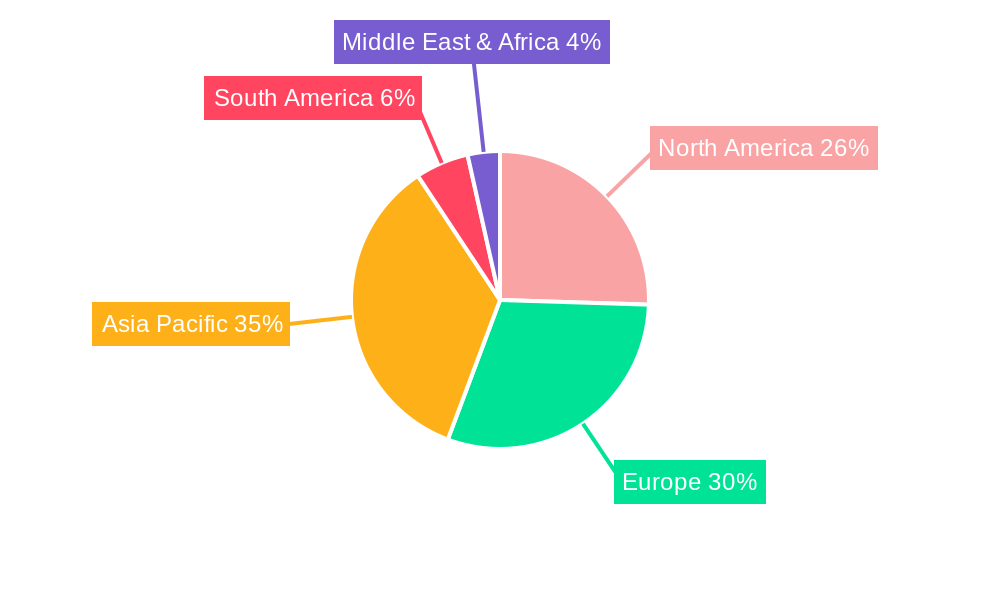

The market's growth is further supported by emerging trends such as the development of novel faba bean protein isolates and concentrates, catering to specific functional requirements in food formulations. Companies are investing in research and development to improve the flavor profile and solubility of faba bean protein, addressing previous limitations. While the market exhibits strong growth potential, certain restraints, such as the initial higher cost of some faba bean protein products compared to conventional protein sources and potential allergen concerns for a niche segment of the population, need to be carefully managed through clear labeling and consumer education. Geographically, the Asia Pacific region, particularly China and India, is expected to be a significant growth engine due to its large population, increasing disposable incomes, and a growing appetite for plant-based diets. North America and Europe continue to be mature yet strong markets driven by established consumer preferences for plant-based options. The diversification of textured faba bean protein into various forms like chunks, flakes, slices, and granules will cater to a broader spectrum of food manufacturers, underpinning sustained market penetration.

Here's a comprehensive report description on Textured Faba Bean Protein, incorporating the requested elements:

The global Textured Faba Bean Protein (TFBP) market is experiencing a dynamic evolution, characterized by increasing consumer preference for sustainable and plant-based protein sources. XXX, the market is projected to witness significant expansion, driven by a confluence of factors including health consciousness, environmental concerns, and the demand for novel food ingredients. During the historical period of 2019-2024, the market laid a robust foundation, with early adopters and ingredient innovators paving the way for broader market acceptance. The base year, 2025, marks a critical juncture where TFBP is poised for accelerated growth, fueled by established production capacities and expanding applications. Projections for the forecast period of 2025-2033 indicate a sustained upward trajectory, with the market size potentially reaching into the hundreds of millions of dollars globally. Key trends include the diversification of TFBP formats, moving beyond traditional chunks and granules to include more sophisticated flakes and slices, catering to specific culinary needs. Furthermore, there's a discernible shift towards higher protein content and improved functional properties, such as enhanced water-holding capacity and texturization, making TFBP a more versatile ingredient in food formulations. The market is also seeing a rise in innovative processing techniques aimed at optimizing flavor profiles and mitigating any inherent beany notes, further enhancing consumer appeal. The increasing integration of TFBP into a wider array of food products, from processed meats and snacks to dairy alternatives and even pet foods, underscores its growing significance as a protein-building block. The sustainability narrative surrounding faba beans, including their lower water footprint and nitrogen-fixing capabilities, is a powerful market driver, resonating with environmentally conscious consumers and food manufacturers alike. This trend is expected to intensify as global food systems grapple with the environmental impact of conventional protein production. The research and development efforts are increasingly focused on unlocking the full potential of faba bean protein, exploring its use in extrusion technologies and other advanced food processing methods to create innovative and appealing plant-based food options. The market is also observing a growing demand for transparent sourcing and clean-label products, which TFBP, derived from a single-source legume, is well-positioned to meet.

The global Textured Faba Bean Protein market is being propelled by a powerful convergence of consumer demand, technological advancements, and a growing awareness of health and environmental sustainability. The persistent rise in consumer interest in plant-based diets, driven by health concerns such as the desire for lower cholesterol intake, improved digestion, and overall well-being, forms a primary impetus for TFBP adoption. This dietary shift is not confined to a niche demographic but is becoming mainstream, creating a substantial market for versatile and functional plant proteins. Furthermore, the escalating environmental consciousness among consumers and regulatory bodies is a significant driver. The production of faba beans is generally more sustainable compared to animal protein, requiring less land and water and contributing to soil health through nitrogen fixation. This eco-friendly attribute makes TFBP an attractive alternative for manufacturers looking to reduce their carbon footprint and appeal to environmentally responsible consumers. The intrinsic nutritional profile of faba beans, rich in essential amino acids and dietary fiber, further bolsters its appeal. As consumers become more discerning about the nutritional content of their food, ingredients that offer a complete protein profile and contribute to a balanced diet are gaining prominence. Coupled with these consumer-driven factors, technological innovations in processing TFBP are playing a crucial role. Advancements in extrusion techniques, for instance, are enabling the creation of diverse textures and forms of TFBP, such as chunks, flakes, and granules, making them suitable for a wider range of food applications, from meat substitutes to snack foods and even pet food formulations. This versatility is key to unlocking new market opportunities and expanding the application landscape of TFBP.

Despite its promising growth trajectory, the Textured Faba Bean Protein market faces several challenges and restraints that could temper its expansion. A significant hurdle is the inherent flavor profile of faba beans, which can sometimes present a 'beany' or earthy taste that may be undesirable to consumers accustomed to traditional protein sources. While advancements in processing are addressing this, eliminating these off-flavors completely and achieving a neutral taste that seamlessly integrates into various food products remains a complex undertaking. Furthermore, the cost-competitiveness of TFBP compared to established protein sources, particularly animal-based proteins and other widely available plant proteins like soy or pea protein, can be a restraint. The initial investment in specialized processing equipment and the scalability of faba bean cultivation and processing can contribute to higher production costs, impacting the final product price and potentially limiting its adoption by price-sensitive manufacturers and consumers. Consumer perception and awareness also play a role. While plant-based eating is gaining traction, faba beans as a primary protein source might not yet be as widely recognized or understood as other legumes. Educating consumers about the benefits and versatility of TFBP is crucial for broader market acceptance. Supply chain complexities and consistency can also pose challenges. Ensuring a stable and consistent supply of high-quality faba beans, free from contaminants and meeting stringent food-grade standards, can be intricate, especially as demand increases. Regulatory hurdles, although generally favorable for plant-based ingredients, can still add layers of complexity in terms of labeling, allergen information, and adherence to food safety regulations across different regions. Lastly, the development of new products incorporating TFBP requires significant R&D investment and reformulation efforts by food manufacturers, which can be a time-consuming and resource-intensive process.

Dominant Region/Country: Europe is poised to emerge as a leading region in the Textured Faba Bean Protein market, driven by its strong commitment to sustainability, growing vegetarian and vegan populations, and robust regulatory support for plant-based foods. Countries like Germany, the UK, France, and the Netherlands are at the forefront of this trend. Germany, with its established food processing industry and high consumer awareness regarding health and environmental issues, is expected to exhibit significant market penetration. The country's proactive stance on food innovation and its large vegetarian and vegan demographic create fertile ground for TFBP adoption. The UK, similarly, has witnessed a surge in demand for meat-free alternatives, further boosted by public health campaigns and the burgeoning plant-based food industry. France, despite its rich culinary heritage, is also seeing a growing interest in healthier and more sustainable food options, with TFBP finding its place in innovative culinary applications. The Netherlands, a significant agricultural exporter and a hub for food technology, is also expected to contribute substantially to market growth through its advanced processing capabilities and a strong focus on developing sustainable food solutions. The region benefits from favorable policies that encourage the use of plant-based proteins and a well-developed supply chain for agricultural products. Furthermore, European consumers are generally more willing to experiment with novel food ingredients and are often willing to pay a premium for products perceived as healthier and more environmentally friendly. This consumer receptiveness, coupled with the presence of major food ingredient manufacturers and innovative startups, positions Europe as a powerhouse in the TFBP market. The region's focus on clean labels and transparency also aligns well with the inherent characteristics of faba bean protein.

Dominant Segment: Within the Textured Faba Bean Protein market, the Meat Substitutes application segment is projected to dominate. This is driven by the massive global demand for plant-based alternatives to traditional meat products, a trend fueled by health consciousness, ethical considerations, and environmental concerns.

The dominance of the Meat Substitutes segment is a direct reflection of the broader plant-based food revolution, where TFBP's functional and nutritional attributes make it a star ingredient in the quest for palatable and sustainable meat alternatives.

The Textured Faba Bean Protein industry is experiencing significant growth catalysts that are shaping its future. A primary catalyst is the escalating consumer demand for plant-based and sustainable food options, driven by health consciousness and environmental concerns. The intrinsic nutritional profile of faba beans, rich in protein and fiber, further bolsters its appeal. Advancements in processing technology are enabling the creation of diverse textures and improved flavor profiles, expanding the application range of TFBP across various food categories. Furthermore, supportive government policies and initiatives aimed at promoting sustainable agriculture and alternative protein sources are creating a favorable market environment. The increasing investment in research and development by both established food ingredient companies and innovative startups is also a key growth driver, focusing on enhancing the functionality and versatility of TFBP.

This report offers a comprehensive analysis of the Textured Faba Bean Protein market, providing in-depth insights into its growth drivers, market trends, and challenges. It delves into the intricate dynamics of the global market, with a specific focus on the period from 2019 to 2033, establishing 2025 as the base and estimated year for crucial market evaluations. The report meticulously examines the historical performance from 2019-2024 and forecasts the market's trajectory through 2033, offering valuable data for strategic decision-making. It provides an exhaustive overview of key market segments, including types (Chunks, Flakes, Slices, Granules, Others) and applications (Food Additives, Meat Substitutes, Snack foods, Pet Foods, Others), alongside detailed analyses of regional market performance. The report also identifies leading companies, significant industry developments, and the crucial growth catalysts that are propelling the Textured Faba Bean Protein industry forward, ensuring stakeholders have a complete and actionable understanding of this burgeoning market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include lngredion, Roquette Freres, DSM, VestKorn, INVEJA, Raisio, Organic Plant Protein, Beneo, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Textured Faba Bean Protein," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Textured Faba Bean Protein, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.