1. What is the projected Compound Annual Growth Rate (CAGR) of the Tetraphenylphosphonium Bromide?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tetraphenylphosphonium Bromide

Tetraphenylphosphonium BromideTetraphenylphosphonium Bromide by Type (Purity 98%, Purity 99%, World Tetraphenylphosphonium Bromide Production ), by Application (Chemical Industry, Medicine, Semiconductor, Others, World Tetraphenylphosphonium Bromide Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

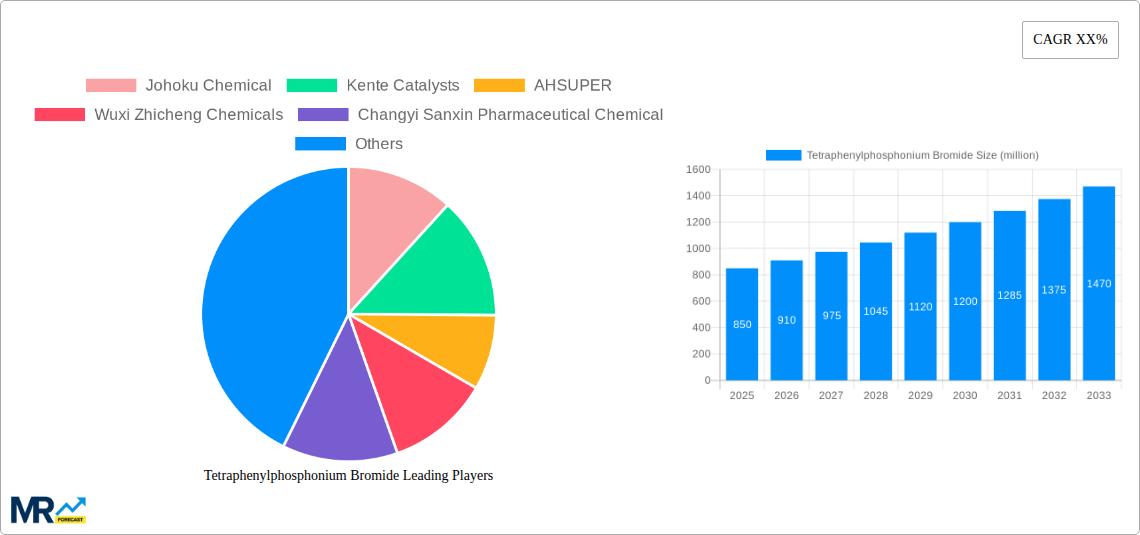

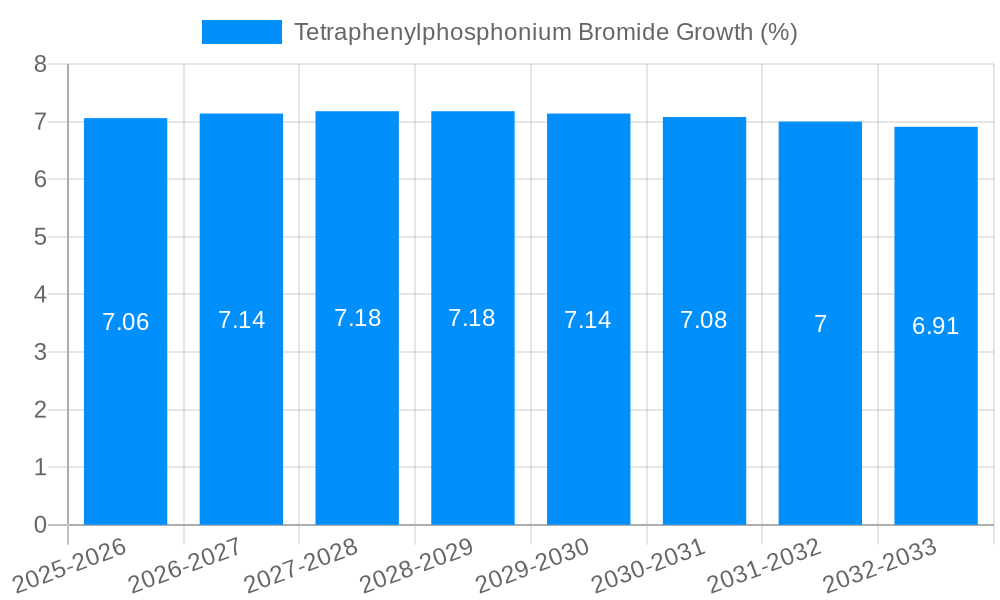

The global Tetraphenylphosphonium Bromide (TPPB) market is poised for significant expansion, projected to reach an estimated value of $XXX million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of XX% between 2019 and 2033. This robust growth is primarily propelled by the increasing demand from the chemical industry, where TPPB serves as a crucial phase-transfer catalyst and intermediate in various synthesis processes. Its unique properties also lend themselves to applications in medicine and the burgeoning semiconductor sector, further fueling market expansion. The market is segmented by purity levels, with 98% and 99% grades dominating the landscape due to their widespread industrial use. The production of Tetraphenylphosphonium Bromide, particularly for global consumption, is a key indicator of its market vitality.

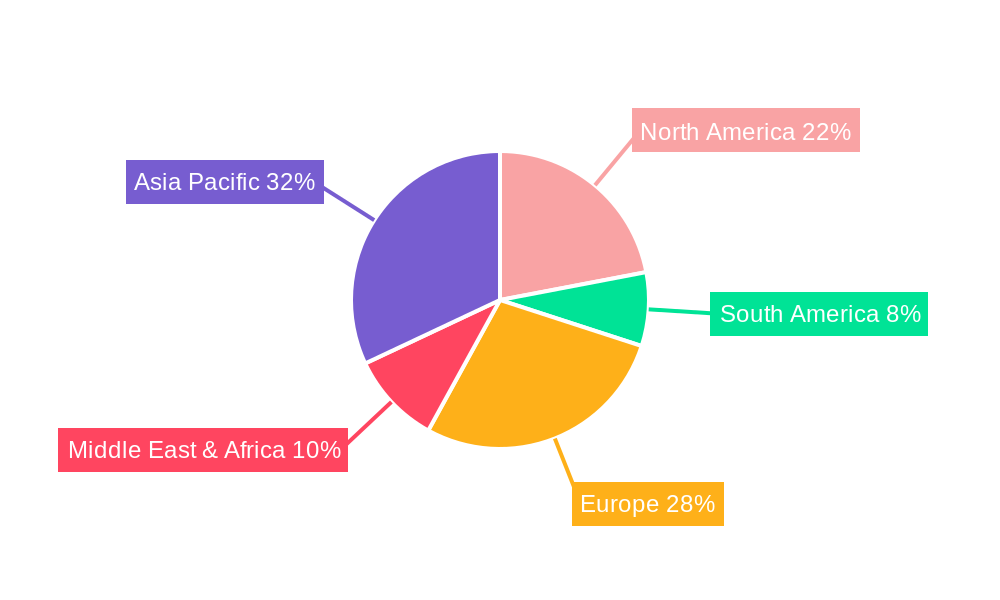

Several key trends are shaping the TPPB market. The growing emphasis on developing more efficient and sustainable chemical processes is driving the adoption of phase-transfer catalysts like TPPB. Advancements in manufacturing techniques are also contributing to improved product quality and potentially lower costs, making it more accessible for a wider range of applications. Furthermore, the increasing research and development in niche areas such as materials science and advanced pharmaceuticals are expected to unlock new avenues for TPPB utilization. However, the market also faces certain restraints, including the fluctuating raw material prices, stringent environmental regulations surrounding chemical production, and the availability of alternative catalysts in specific applications. Asia Pacific, particularly China and India, is expected to be a major growth hub, driven by its substantial chemical manufacturing base and increasing investments in R&D.

Here is a unique report description on Tetraphenylphosphonium Bromide, incorporating the requested elements and focusing on a report analyzing the market from 2019 to 2033, with a base year of 2025.

The global Tetraphenylphosphonium Bromide (TPPB) market is poised for significant expansion and dynamic evolution throughout the study period of 2019-2033, with a concentrated focus on the estimated year of 2025 and the subsequent forecast period of 2025-2033. Historical data from 2019-2024 reveals a foundational growth trajectory, driven by its indispensable role as a phase transfer catalyst, a reagent in organic synthesis, and an electrolyte component. Key market insights indicate a projected market size exceeding 150 million USD by the base year of 2025, with estimations pointing towards a robust upward trend, potentially reaching 250 million USD by the end of the forecast period in 2033. This growth is intrinsically linked to the increasing demand across its primary application sectors, most notably the chemical industry. The growing sophistication of chemical manufacturing processes, the pursuit of higher reaction efficiencies, and the development of novel chemical entities are all contributing factors. Furthermore, advancements in pharmaceutical research and development, particularly in areas requiring complex organic synthesis, are expected to amplify demand. The semiconductor industry, while a smaller but significant consumer, is also witnessing a rise in TPPB utilization for specialized etching and cleaning processes, further bolstering market projections. The increasing emphasis on high-purity grades, such as Purity 99%, is a notable trend, reflecting the stringent requirements of advanced technological applications. The World Tetraphenylphosphonium Bromide Production landscape is characterized by a gradual increase in output, driven by capacity expansions and the adoption of more efficient manufacturing techniques by leading global players. Understanding these underlying trends is crucial for stakeholders to navigate the competitive environment and capitalize on emerging opportunities within this vital chemical intermediate market. The market's trajectory is largely dictated by the interplay of technological advancements, regulatory landscapes, and the evolving needs of downstream industries, all of which are meticulously examined within this comprehensive report.

The Tetraphenylphosphonium Bromide market's ascent is primarily propelled by its multifaceted utility and the accelerating demand from key industrial sectors. The indispensable nature of TPPB as a phase transfer catalyst (PTC) is a paramount driver. PTCs facilitate the reaction between reactants residing in different phases, significantly enhancing reaction rates, improving yields, and enabling milder reaction conditions. This directly translates to cost savings and increased efficiency in chemical manufacturing, making TPPB an attractive choice for a wide array of synthetic processes. Furthermore, the escalating complexity of organic synthesis in the pharmaceutical industry, driven by the continuous need for novel drug discovery and development, necessitates the use of highly effective reagents like TPPB. Its ability to promote nucleophilic substitutions, alkylations, and other crucial transformations makes it a cornerstone in the synthesis of complex organic molecules. Beyond pharmaceuticals, the burgeoning semiconductor industry’s reliance on high-purity chemicals for etching, cleaning, and the development of advanced materials is another significant growth catalyst. As electronic devices become more sophisticated, the demand for specialized chemicals that can meet stringent purity requirements, such as Purity 99% TPPB, is set to rise. The broader chemical industry's adoption of more sustainable and efficient chemical processes, often facilitated by PTC technology, further underscores the market’s growth potential. The continuous research and development efforts aimed at exploring new applications for TPPB in emerging fields are also contributing to its sustained demand and market expansion.

Despite its promising growth trajectory, the Tetraphenylphosphonium Bromide market encounters several challenges and restraints that warrant careful consideration. One of the primary concerns revolves around the price volatility of raw materials. The production of TPPB relies on phosphorus and phenyl-containing precursors, the costs of which can fluctuate significantly due to global supply-demand dynamics, geopolitical factors, and energy prices. These fluctuations can directly impact the profitability of TPPB manufacturers and potentially lead to increased prices for end-users, thus dampening demand. Another significant restraint is the stringent regulatory landscape and environmental concerns. The chemical industry, in general, is subject to increasingly rigorous environmental regulations regarding the handling, disposal, and potential environmental impact of chemical substances. While TPPB is widely used, concerns regarding its ecotoxicity and the need for responsible waste management practices can necessitate additional compliance costs and potentially limit its application in certain sensitive areas. The development of alternative catalysts or synthetic pathways also poses a potential threat. Ongoing research in catalysis aims to discover more cost-effective, environmentally friendly, or higher-performing alternatives that could substitute TPPB in specific applications. Furthermore, supply chain disruptions, as witnessed in recent global events, can impact the availability and timely delivery of TPPB, leading to production delays for downstream industries. Finally, the high cost associated with achieving ultra-high purity grades, such as Purity 99% and above, can be a barrier for some smaller-scale applications or price-sensitive markets, thereby limiting market penetration in those segments.

The global Tetraphenylphosphonium Bromide market is characterized by distinct regional dominance and segment leadership, with particular emphasis on the Chemical Industry application segment and the Asia-Pacific region, especially China, as key drivers of growth.

Asia-Pacific Region & China's Dominance:

Dominant Segment: Chemical Industry Application:

While other segments like Medicine and Semiconductor also contribute to the market, their current scale of consumption is generally lower compared to the pervasive use of TPPB in the broad spectrum of chemical manufacturing. The "Others" category also represents a growing area of interest, particularly in emerging technological applications, but the Chemical Industry remains the bedrock of TPPB market demand. The interplay between the manufacturing prowess of the Asia-Pacific region and the foundational role of TPPB in the Chemical Industry solidifies their position as the dominant forces shaping the global Tetraphenylphosphonium Bromide market landscape.

The Tetraphenylphosphonium Bromide industry's growth is catalyzed by several key factors. The relentless pursuit of enhanced efficiency and sustainability in chemical manufacturing processes worldwide is a primary driver, as TPPB excels as a phase transfer catalyst, enabling milder reaction conditions and higher yields. The expanding pharmaceutical sector, with its continuous need for complex organic synthesis for drug discovery and development, presents a robust demand avenue. Furthermore, the semiconductor industry's increasing requirement for high-purity chemicals for advanced manufacturing processes is a significant, albeit smaller, growth catalyst. Research into novel applications and the development of more cost-effective production methods also serve to propel market expansion.

This comprehensive report offers an in-depth analysis of the global Tetraphenylphosphonium Bromide market, covering the historical period from 2019 to 2024, the base year of 2025, and projecting trends through 2033. It meticulously examines market trends, driving forces, and challenges, providing valuable insights for stakeholders. The report delves into the dominant regions and key market segments, including Purity 98% and Purity 99%, and the significant Application segments of Chemical Industry, Medicine, and Semiconductor. It also identifies leading players and significant market developments, offering a holistic view of the TPPB landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Johoku Chemical, Kente Catalysts, AHSUPER, Wuxi Zhicheng Chemicals, Changyi Sanxin Pharmaceutical Chemical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tetraphenylphosphonium Bromide," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tetraphenylphosphonium Bromide, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.