1. What is the projected Compound Annual Growth Rate (CAGR) of the Terephthaloyl Chloride Reagent?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Terephthaloyl Chloride Reagent

Terephthaloyl Chloride ReagentTerephthaloyl Chloride Reagent by Type (Purity 95%, Purity 99%, Purity Greater Than 99%), by Application (Medical, Research, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

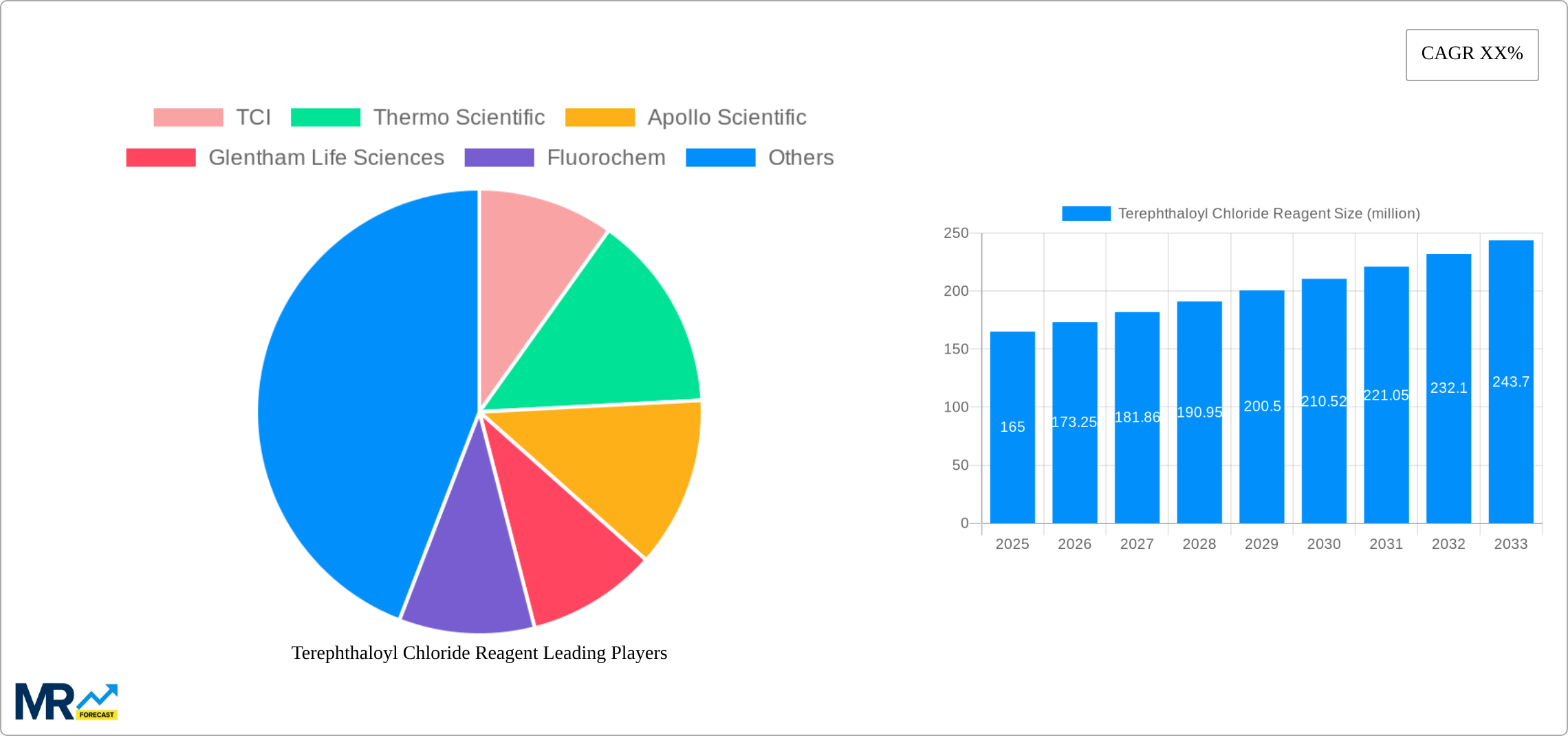

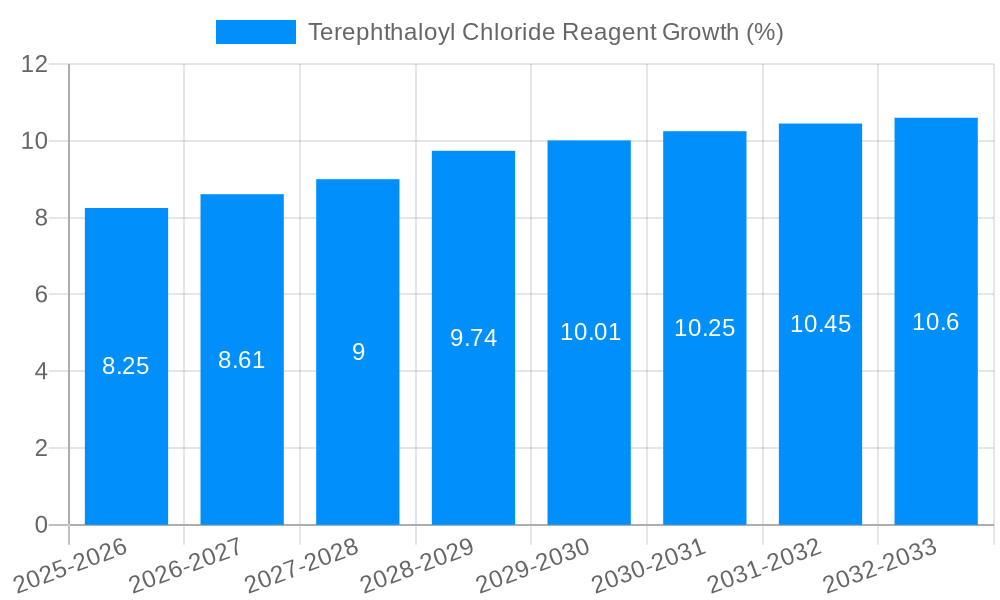

The global Terephthaloyl Chloride Reagent market is poised for significant expansion, projected to reach an estimated XXX million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating demand from the medical and research sectors, where terephthaloyl chloride serves as a crucial intermediate in the synthesis of various pharmaceuticals, advanced polymers, and specialized chemicals. The increasing investment in drug discovery and development, coupled with advancements in material science, is creating a sustained need for high-purity terephthaloyl chloride reagents. Furthermore, its application in the production of high-performance plastics and fibers, utilized in industries ranging from automotive to textiles, contributes substantially to market growth. The preference for Purity 99% and Purity Greater Than 99% grades is on the rise, reflecting stringent quality requirements in its end-use applications, particularly in pharmaceuticals and advanced materials manufacturing.

Despite the promising growth, certain factors present challenges to the market. The highly regulated nature of chemical manufacturing, including stringent environmental and safety compliance, can increase operational costs and potentially slow down production expansion. Fluctuations in the prices of raw materials, such as p-xylene, can also impact profit margins for manufacturers. However, ongoing research into more efficient synthesis routes and the exploration of new application areas are expected to mitigate these restraints. Emerging economies, particularly in the Asia Pacific region, represent significant untapped potential due to growing industrialization and increasing R&D activities. Key players are focusing on strategic collaborations and product innovation to solidify their market positions and capitalize on these emerging opportunities.

The Terephthaloyl Chloride (TPC) reagent market is poised for significant expansion, driven by its indispensable role in the synthesis of high-performance polymers and advanced materials. During the Study Period of 2019-2033, the market has witnessed consistent growth, with the Base Year of 2025 serving as a crucial inflection point. The Estimated Year of 2025 projects a robust valuation, with projections suggesting a global market size potentially reaching into the hundreds of millions of dollars. This upward trajectory is primarily attributed to the increasing demand for materials exhibiting exceptional thermal stability, mechanical strength, and chemical resistance, attributes directly imparted by TPC-derived polymers.

The Forecast Period of 2025-2033 is anticipated to see this growth accelerate, fueled by burgeoning applications across diverse industrial sectors. From advanced composites in aerospace and automotive industries to specialized films and coatings, the versatility of TPC as a building block for robust polymers is becoming increasingly recognized. The Historical Period of 2019-2024 laid the groundwork for this anticipated surge, demonstrating steady adoption and increasing research interest in novel TPC-based material formulations. Key trends observed during this period include a gradual shift towards higher purity grades of TPC, as manufacturers strive to achieve superior performance characteristics in their end products. Furthermore, the growing emphasis on sustainable manufacturing practices and the development of eco-friendlier polymer alternatives are also influencing the TPC reagent landscape, albeit with a longer-term impact. The intricate synthesis pathways and stringent quality control required for TPC production underscore its position as a specialty chemical, demanding significant technical expertise and investment from market players. The market's dynamics are therefore closely tied to advancements in chemical synthesis and the evolving requirements of end-use industries.

The burgeoning demand for high-performance polymers stands as the primary driver propelling the Terephthaloyl Chloride (TPC) reagent market forward. TPC is a critical intermediate in the synthesis of polyamides, polyesters, and polybenzimidazoles, polymers renowned for their exceptional thermal stability, high tensile strength, chemical inertness, and flame-retardant properties. These attributes make them indispensable in demanding applications across various sectors. For instance, the aerospace industry increasingly relies on lightweight yet robust composites derived from TPC for aircraft components, contributing to fuel efficiency and enhanced safety. Similarly, the automotive sector is leveraging these advanced polymers to reduce vehicle weight, improve durability, and meet stringent regulatory standards. The ever-growing need for materials that can withstand extreme temperatures and harsh chemical environments in industries such as oil and gas, electronics, and protective coatings further amplifies the demand for TPC. Moreover, ongoing research and development efforts are continuously uncovering new applications for TPC-based materials, expanding their market penetration and driving innovation in material science. The intrinsic versatility of TPC as a monomer allows for tailor-made polymer structures, catering to specific performance requirements that commodity plastics simply cannot meet, thus solidifying its strategic importance in the specialty chemicals domain.

Despite the optimistic growth trajectory, the Terephthaloyl Chloride (TPC) reagent market faces several inherent challenges and restraints that warrant careful consideration. The production of TPC is a complex multi-step chemical process that often involves hazardous raw materials and stringent reaction conditions. This complexity translates to higher manufacturing costs, which can impact the overall affordability and accessibility of TPC, particularly for smaller end-users or in price-sensitive markets. Furthermore, the handling and transportation of TPC require specialized infrastructure and adherence to strict safety protocols due to its corrosive and reactive nature. This adds to logistical complexities and operational expenses for both manufacturers and distributors. Environmental regulations concerning the disposal of by-products and wastewater generated during TPC synthesis can also pose a significant challenge, necessitating investment in advanced waste treatment technologies. The development of alternative materials that offer comparable performance characteristics at a lower cost or with a reduced environmental footprint also represents a potential restraint. Moreover, the market is susceptible to fluctuations in the prices of key raw materials, such as para-xylene, which can impact profit margins and create price volatility for TPC itself. Supply chain disruptions, whether due to geopolitical factors, natural disasters, or trade policies, can also hinder consistent availability and affect market stability.

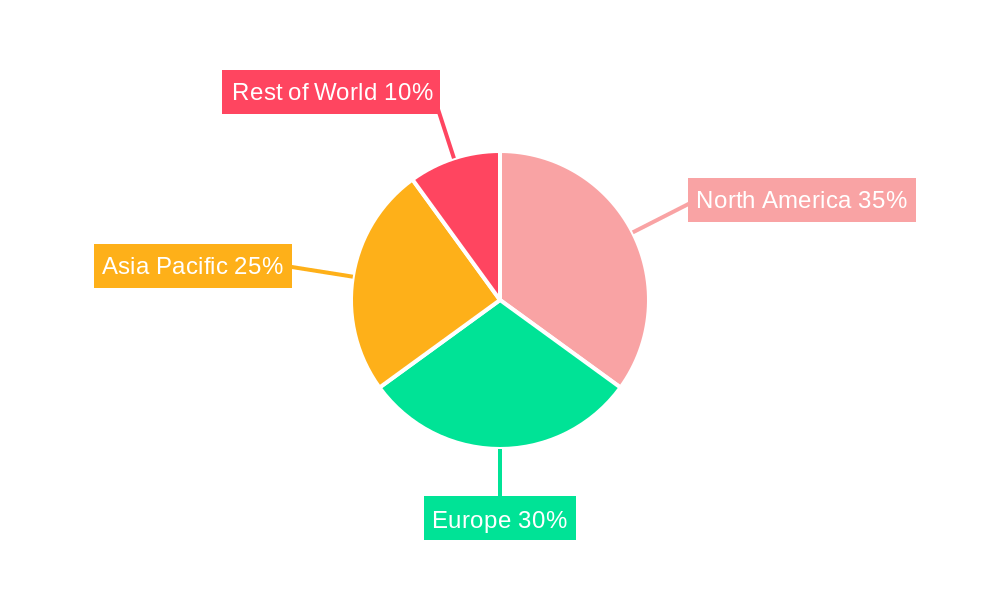

The Terephthaloyl Chloride (TPC) reagent market is anticipated to witness significant dominance from specific regions and segments, driven by a confluence of industrial demand, research infrastructure, and manufacturing capabilities.

Key Dominating Segments:

Type: Purity Greater Than 99%: This segment is expected to be a major growth engine. The increasing sophistication of end-use applications, particularly in the medical and advanced materials sectors, necessitates TPC of exceptionally high purity. Purity levels exceeding 99% are crucial for ensuring the optimal performance, reliability, and safety of polymers used in critical applications like medical implants, high-performance fibers for protective gear, and advanced composites where even trace impurities can compromise structural integrity and long-term stability. As research and development continue to push the boundaries of material science, the demand for ultra-high purity TPC will only intensify, making this segment a cornerstone of market growth.

Application: Research: The research segment, encompassing academic institutions and industrial R&D laboratories, will continue to be a vital consumer of TPC. Researchers are actively exploring novel applications of TPC in areas such as functional polymers, smart materials, and sustainable chemical synthesis. This segment acts as an incubator for future market growth, driving the discovery of new uses and the development of advanced TPC-based materials that will eventually transition into commercial applications. The need for a diverse range of TPC grades, from standard to highly specialized, caters to the varied experimental requirements of this segment.

Dominating Regions/Countries:

North America (particularly the United States): North America, with its strong presence in the aerospace, automotive, and advanced materials industries, is projected to be a leading market for TPC. The region boasts a robust research and development ecosystem, with leading universities and private sector companies investing heavily in material science innovation. The demand for high-performance polymers in defense, medical devices, and specialized coatings contributes significantly to TPC consumption. Stringent quality standards and a focus on innovation further bolster the market for high-purity TPC grades in this region. The presence of key players and a well-established supply chain infrastructure also supports market dominance.

Asia Pacific (particularly China and Japan): The Asia Pacific region is poised for substantial growth and is expected to emerge as a dominant force in the TPC market. China, with its rapidly expanding manufacturing sector across automotive, electronics, and textiles, presents a vast market for TPC-based polymers. The government's focus on developing advanced manufacturing capabilities and increasing domestic production of specialty chemicals further fuels this growth. Japan, on the other hand, is a hub for innovation in high-performance materials and has a strong demand for TPC in its advanced electronics, automotive, and medical device industries. The increasing investments in R&D and the growing adoption of cutting-edge technologies in these countries will drive the demand for TPC, particularly for applications requiring superior material properties. The availability of competitive manufacturing capabilities also positions the region favorably for TPC production and supply.

The interplay between these dominant segments and regions creates a dynamic market landscape. The demand for high-purity TPC in research and specialized industrial applications, coupled with the manufacturing prowess and burgeoning end-use industries in North America and Asia Pacific, will collectively shape the future of the Terephthaloyl Chloride reagent market.

The Terephthaloyl Chloride (TPC) reagent industry is experiencing significant growth catalysts that are shaping its future trajectory. The relentless pursuit of lightweight, high-strength, and heat-resistant materials across various sectors, including aerospace, automotive, and electronics, is a primary driver. Innovations in polymer science leading to the development of advanced polyamides and polyesters utilizing TPC are creating new application avenues. Furthermore, the increasing demand for specialized medical devices and advanced protective textiles, where TPC-derived materials offer superior biocompatibility and performance, acts as a crucial growth catalyst. Government initiatives promoting advanced manufacturing and investments in research and development for specialty chemicals are also playing a pivotal role in fostering market expansion.

This comprehensive report on the Terephthaloyl Chloride (TPC) reagent market offers an in-depth analysis of its dynamic landscape. It provides invaluable insights into the market's growth trajectory from 2019 to 2033, with a detailed examination of the Base Year (2025) and the Forecast Period (2025-2033). The report meticulously covers key market drivers, including the escalating demand for high-performance polymers in aerospace, automotive, and medical sectors, alongside significant challenges such as production complexities and environmental considerations. It identifies dominant regions and segments, particularly highlighting the importance of Purity Greater Than 99% and the Research application segment, alongside the market influence of North America and the Asia Pacific. Furthermore, the report delves into the growth catalysts, leading industry players, and significant historical and anticipated developments within the TPC reagent sector, providing a holistic understanding for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TCI, Thermo Scientific, Apollo Scientific, Glentham Life Sciences, Fluorochem, Toronto Research Chemicals, Sisco Research Laboratories, Biosynth, Merck, Santa Cruz Biotechnology, Spectrum Chemical, AECOCHEM, Sincere Chemical, Transpex, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Terephthaloyl Chloride Reagent," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Terephthaloyl Chloride Reagent, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.