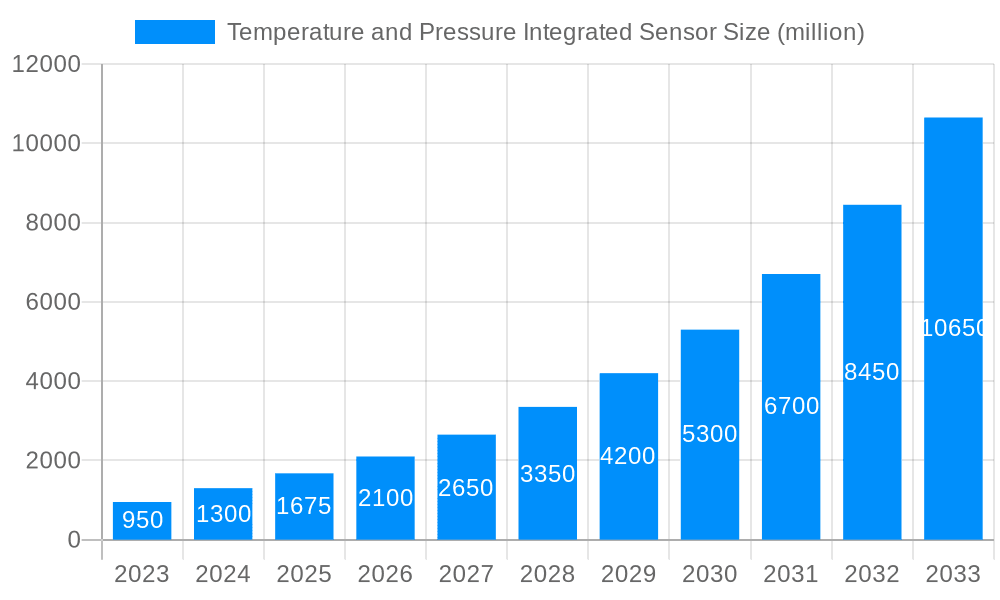

1. What is the projected Compound Annual Growth Rate (CAGR) of the Temperature and Pressure Integrated Sensor?

The projected CAGR is approximately 24.7%.

Temperature and Pressure Integrated Sensor

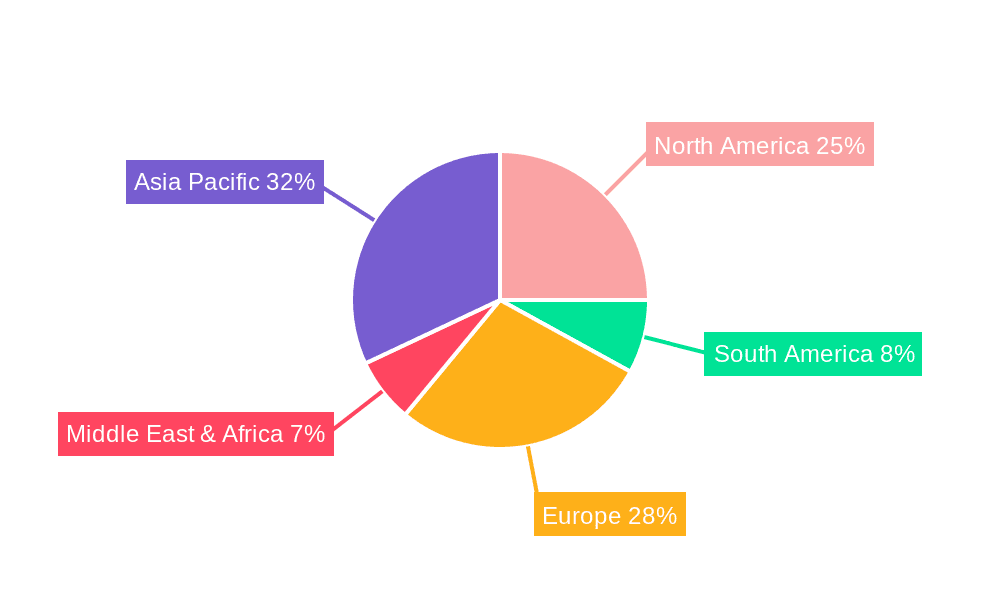

Temperature and Pressure Integrated SensorTemperature and Pressure Integrated Sensor by Type (Embedded Installation, Thread Installation), by Application (Automobile, Internet Of Things, Industrial, Oil and Gas Transportation, Medical Instruments, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global market for Temperature and Pressure Integrated Sensors is experiencing remarkable growth, projected to reach $1675 million by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of 24.7% through 2033. This robust expansion is fueled by increasing demand across a multitude of high-growth sectors. The burgeoning Internet of Things (IoT) ecosystem, with its vast network of interconnected devices requiring precise environmental monitoring, is a primary driver. Similarly, the automotive industry's relentless pursuit of enhanced safety features, fuel efficiency, and advanced driver-assistance systems (ADAS) necessitates sophisticated integrated sensors for critical applications like engine management and tire pressure monitoring. Furthermore, the expanding industrial automation landscape, characterized by smart factories and Industry 4.0 initiatives, is a significant contributor, demanding reliable sensors for process control and predictive maintenance. The oil and gas transportation sector also plays a crucial role, requiring robust sensor solutions for pipeline integrity and safe fluid management, while the medical instruments segment is witnessing an uptick in demand for accurate and miniaturized sensors in diagnostic and therapeutic devices.

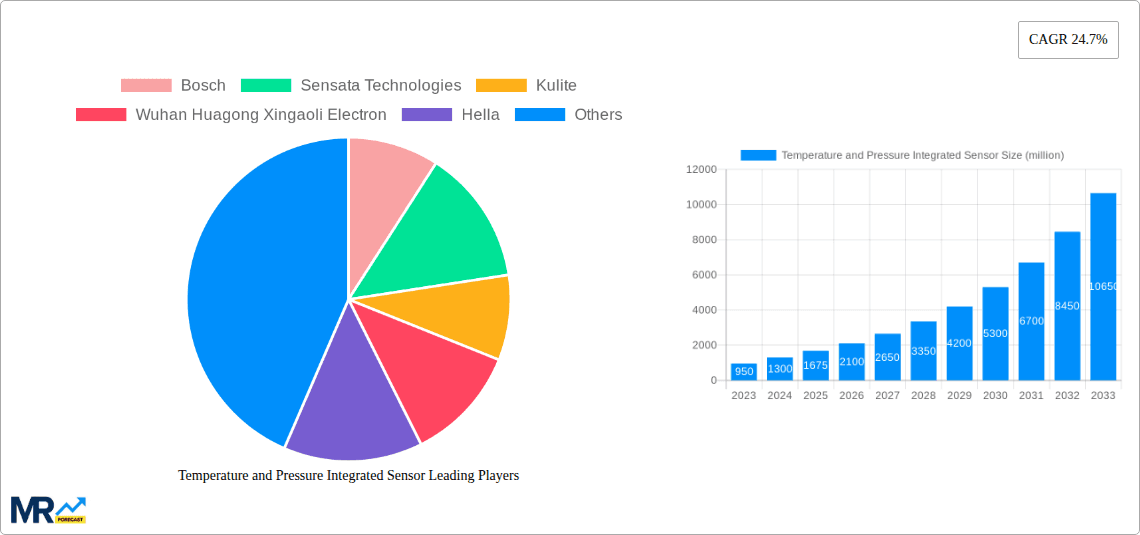

The market is further segmented by installation type, with embedded installations leading due to their seamless integration into finished products and thread installations catering to retrofitting and specific industrial needs. Key players like Bosch, Sensata Technologies, Kulite, and TE Connectivity are at the forefront of innovation, driving advancements in sensor accuracy, miniaturization, and cost-effectiveness. While the market's growth is largely positive, potential restraints include the high initial investment required for advanced sensor development and manufacturing, as well as the stringent regulatory compliance across various end-use industries that can sometimes slow down product adoption. However, the overarching trend towards digitalization, automation, and the increasing need for real-time data analytics across all sectors strongly supports sustained market expansion and innovation in temperature and pressure integrated sensor technology.

The global Temperature and Pressure Integrated Sensor market is poised for substantial growth over the study period of 2019-2033, with a projected market size expected to reach several million dollars. The base year of 2025 and the estimated year also being 2025 underscore the immediate relevance and anticipated trajectory of this technology. The forecast period from 2025 to 2033 will witness a significant expansion driven by the increasing demand for sophisticated monitoring and control systems across a multitude of industries. During the historical period of 2019-2024, the market laid the groundwork, characterized by steady adoption and initial technological advancements. Moving forward, the market is expected to transcend the traditional limitations of discrete sensor components, offering integrated solutions that provide enhanced accuracy, reduced complexity, and improved reliability. The convergence of miniaturization trends, advanced material science, and sophisticated signal processing algorithms is fundamentally reshaping the landscape. As industries increasingly prioritize operational efficiency, safety, and data-driven decision-making, the demand for these integrated sensors will only intensify. The market is also witnessing a growing emphasis on wireless connectivity and IoT integration, further amplifying the utility and reach of temperature and pressure sensing capabilities. This evolution signifies a paradigm shift from simple data acquisition to intelligent sensing, where these integrated devices play a pivotal role in enabling smarter, more autonomous systems. The continued innovation in packaging technologies and manufacturing processes will also contribute to a reduction in costs, making these advanced sensors accessible to a broader spectrum of applications and thereby driving further market penetration and expansion in terms of revenue, reaching into the multi-million dollar figures.

Several potent forces are propelling the growth of the Temperature and Pressure Integrated Sensor market. The relentless pursuit of enhanced efficiency and optimized performance in industrial processes is a primary driver. Integrated sensors, by providing simultaneous and correlated data on both temperature and pressure, allow for more precise control loops, minimizing waste and maximizing output. The burgeoning Internet of Things (IoT) ecosystem is another significant contributor. As more devices become connected, the need for robust, miniaturized, and reliable sensors to feed data into these networks is paramount. Temperature and pressure are fundamental parameters in a vast array of IoT applications, from smart homes and agriculture to industrial automation and environmental monitoring. Furthermore, the increasing stringent safety regulations across industries such as automotive and oil & gas necessitate advanced monitoring systems. Integrated sensors offer a more comprehensive safety net by detecting anomalies that could lead to hazardous situations. The continuous advancements in semiconductor technology and microelectromechanical systems (MEMS) are enabling the development of smaller, more accurate, and cost-effective integrated sensors, making them viable for a wider range of applications and pushing the market into the millions. This technological progression, coupled with a growing awareness of the benefits of precise environmental control and condition monitoring, fuels the demand for these sophisticated sensing solutions.

Despite the promising outlook, the Temperature and Pressure Integrated Sensor market faces several challenges and restraints that could impede its growth. One significant hurdle is the initial cost of advanced integrated sensors. While prices are decreasing, some highly sophisticated or specialized integrated solutions can still be more expensive than their discrete counterparts, limiting adoption in price-sensitive markets or for less critical applications. Another restraint is the complexity of integration and calibration. Implementing and calibrating integrated sensors, especially in legacy systems, can require specialized expertise and infrastructure, adding to the overall implementation cost and time. Interoperability and standardization also remain a concern. With a diverse range of manufacturers and proprietary communication protocols, ensuring seamless integration of sensors from different vendors into a single system can be challenging, potentially hindering widespread adoption. Furthermore, environmental factors and durability can pose limitations. While advancements are being made, harsh operating conditions, such as extreme temperatures, corrosive media, or high vibration environments, can still impact the long-term reliability and lifespan of some integrated sensors, requiring robust designs and protective measures. The market's overall expansion, reaching into the multi-million figures, is contingent on overcoming these obstacles.

The Automobile segment is poised to be a dominant force in the Temperature and Pressure Integrated Sensor market, with particular regions like North America and Europe leading the charge in its adoption and development. This dominance is underpinned by several interconnected factors that highlight the growing importance of these sensors in modern vehicle design and functionality.

Within the automobile segment, integrated temperature and pressure sensors are becoming indispensable for a multitude of critical applications.

North America and Europe are anticipated to dominate due to a combination of factors:

While other segments like the Internet of Things and Industrial applications are also significant, the sheer volume of automobile production and the critical nature of integrated sensor functions within vehicles position this segment and these regions for sustained market leadership in the foreseeable future, reaching into the tens of millions of units and revenue.

The Temperature and Pressure Integrated Sensor industry is experiencing significant growth catalyzed by the escalating demand for automation and predictive maintenance across diverse industrial sectors. The proliferation of the Internet of Things (IoT) is a paramount catalyst, as integrated sensors provide the fundamental data streams for smart devices and intelligent systems. Furthermore, the increasing emphasis on energy efficiency and resource optimization in industrial processes necessitates precise real-time monitoring of temperature and pressure, driving the adoption of these advanced sensors. The continuous miniaturization of electronics and the development of novel sensing materials are also acting as powerful catalysts, making these integrated solutions more accessible, versatile, and cost-effective, thereby expanding their application scope into new markets and pushing the industry's revenue into the multi-million dollar range.

This comprehensive report delves deep into the intricacies of the Temperature and Pressure Integrated Sensor market, analyzing trends, drivers, and challenges throughout the historical period of 2019-2024 and projecting the market's trajectory from the base year of 2025 through to 2033. The report provides an in-depth examination of market dynamics, including the influence of key players, significant technological advancements, and emerging regional opportunities. It forecasts market growth into the multi-million dollar figures, highlighting the critical role of integrated sensors in driving innovation and efficiency across industries such as automotive, IoT, and industrial automation. The report also addresses potential restraints and offers strategic recommendations for stakeholders seeking to capitalize on the expanding opportunities within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 24.7%.

Key companies in the market include Bosch, Sensata Technologies, Kulite, Wuhan Huagong Xingaoli Electron, Hella, TE Connectivity, Gems Sensors, Stellar Technology, EMA Electronics, Variohm, Micron Instruments, Hydrotechnik UK Ltd, KA Sensors Ltd, Shenzhen Ampron Technology, Micro Sensor.

The market segments include Type, Application.

The market size is estimated to be USD 1675 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Temperature and Pressure Integrated Sensor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Temperature and Pressure Integrated Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.