1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Application Program Interface?

The projected CAGR is approximately 16.88%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Telecom Application Program Interface

Telecom Application Program InterfaceTelecom Application Program Interface by Type (SMS, MMS and RCS API, WebRTC API, Payment API, Location API, M2M and IoT API, Content Delivery API, Others), by Application (Partner Developer, Enterprise Developer, Long-tail Developer, Internal Developer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Telecom Application Program Interface (API) market is projected for substantial expansion. Driven by the increasing adoption of cloud-based communication solutions and the imperative for seamless platform integration, the market is forecast to reach $248.754 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 16.88%. Key growth drivers include the proliferation of mobile applications and the Internet of Things (IoT), necessitating robust and scalable communication APIs. Enterprises undergoing digital transformation are accelerating API integration for enhanced communication functionalities. The market is segmented by API type, including SMS, MMS, RCS, WebRTC, Payment, Location, M2M/IoT, Content Delivery, and Others, serving applications for Partner, Enterprise, Long-tail, and Internal Developers. Intense competition among established players such as Hewlett-Packard, Huawei, Ericsson, and Oracle, alongside innovative companies like Twilio and Nexmo, fosters continuous advancement and competitive pricing. Geographically, North America and Europe currently lead, with Asia-Pacific poised for significant growth due to rising smartphone penetration and digital adoption.

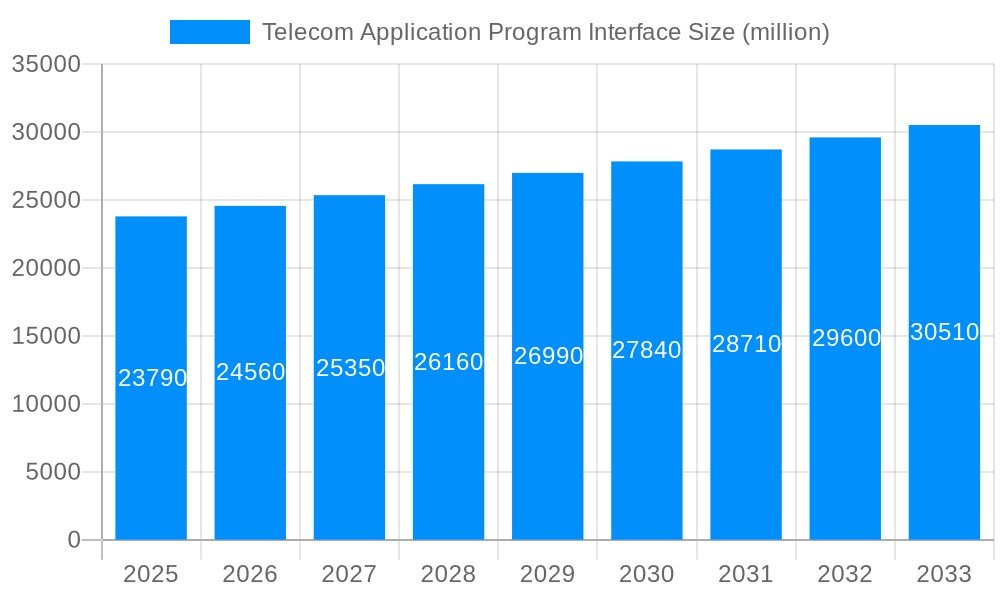

Market growth is counterbalanced by challenges including security and data privacy concerns, integration complexities, and the potential for vendor lock-in. To address these, API providers are prioritizing enhanced security protocols, simplified integration tools, and adaptable pricing strategies. The ongoing development of advanced API capabilities, such as 5G integration and real-time communication enhancements, will further propel market expansion. The forecast period (2025-2033) anticipates considerable growth for the Telecom API market as businesses increasingly depend on these solutions to optimize communication infrastructure and unlock new opportunities. Strategic partnerships, stringent security measures, and sustained innovation will be critical for success in this dynamic market.

The global Telecom Application Program Interface (API) market is experiencing explosive growth, projected to reach tens of billions of USD by 2033. Driven by the increasing demand for seamless integration of communication services across various applications and platforms, the market witnessed significant expansion during the historical period (2019-2024). The base year 2025 shows a consolidated market value in the multi-billion dollar range, with the forecast period (2025-2033) indicating sustained high growth. This expansion is fueled by the widespread adoption of cloud-based solutions, the rise of the Internet of Things (IoT), and the increasing need for enhanced customer experience. The market is witnessing a shift towards more sophisticated APIs, including those supporting advanced features such as WebRTC for real-time communication and payment APIs for integrated financial transactions. The competitive landscape is characterized by a mix of established telecom giants and innovative technology companies, constantly striving for market share and technological advancements. The diverse range of APIs catering to varied application types (Partner Developer, Enterprise Developer, Long-tail Developer, Internal Developer) and industry sectors further contributes to the market's complexity and dynamism. This report offers a comprehensive analysis of this evolving landscape, focusing on key trends, driving forces, challenges, and the leading players shaping its future.

Several key factors contribute to the rapid growth of the Telecom API market. The increasing adoption of cloud-based services has significantly reduced the barriers to entry for developers, allowing them to integrate communication functionalities into their applications more easily and cost-effectively. Furthermore, the proliferation of IoT devices necessitates seamless communication and data transfer, fueling the demand for robust and scalable M2M and IoT APIs. The growing emphasis on personalized customer experiences is another driving force, as businesses leverage APIs to offer tailored communication solutions, enhancing customer engagement and loyalty. The continuous advancements in communication technologies, including 5G and the evolution of messaging services like RCS (Rich Communication Services), are creating new opportunities for API providers. Finally, the rise of digital businesses and the increasing adoption of mobile applications are driving the demand for APIs that enable secure and reliable communication functionalities within these platforms. This convergence of factors creates a favorable environment for significant market growth in the coming years.

Despite the substantial growth potential, the Telecom API market faces several challenges. Security concerns remain a primary obstacle, as APIs are often gateways to sensitive user data. Maintaining robust security protocols is crucial to build trust and prevent breaches. Another challenge is the fragmentation of the market, with various API standards and protocols existing across different platforms and providers. This can lead to integration complexities and higher development costs. Furthermore, regulatory compliance, especially concerning data privacy and security regulations like GDPR, adds another layer of complexity for API providers. The need to manage API versions and ensure backward compatibility can also present a significant hurdle. Finally, competing with established communication platforms and overcoming the resistance to adopting new technologies from some businesses can slow down market adoption. Addressing these challenges will be key to ensuring the sustainable growth of the Telecom API market.

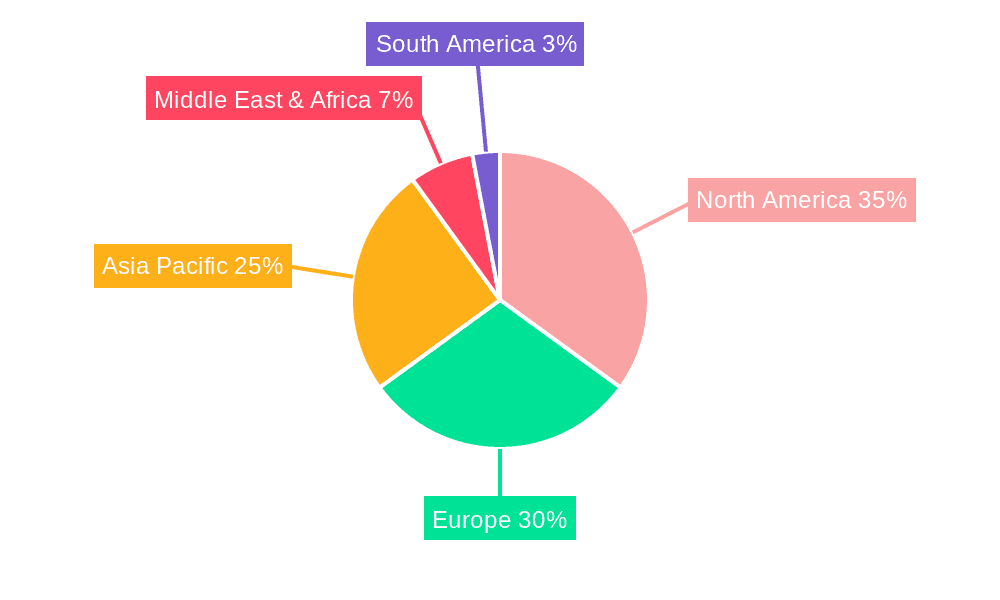

The North American and European regions are expected to dominate the Telecom API market throughout the forecast period (2025-2033), driven by the high adoption rates of advanced communication technologies and the presence of a significant number of tech-savvy developers and enterprises. Asia-Pacific will also show substantial growth, although at a potentially slower pace due to varying levels of technological development across the region.

Dominant Segment (Application): The Enterprise Developer segment is projected to hold a significant market share. Large enterprises are increasingly relying on APIs to integrate communication functionalities within their existing systems and applications, driving demand for scalable and robust API solutions. Their requirements for robust security, advanced features, and high availability translate into higher revenue generation for API providers. Moreover, enterprises often require dedicated support and customization, increasing the average revenue per user.

Dominant Segment (Type): The SMS, MMS, and RCS API segment continues to be a substantial driver due to the pervasive use of text messaging globally. While the emergence of richer communication methods like RCS is growing, the sheer volume and established infrastructure of SMS/MMS continue to ensure a strong market presence. The simplicity of SMS/MMS APIs also facilitates easy integration into various applications.

The WebRTC API segment is experiencing rapid growth due to the increasing demand for real-time communication capabilities in various applications, including video conferencing, live chat, and online gaming. The ease of integration and cost-effectiveness of WebRTC are key drivers of its adoption. Payment APIs also hold significant promise, providing convenient and secure payment integration, beneficial for e-commerce and digital transactions. However, high security standards and regulations needed for this segment make it a more complex and slower-growing one.

The Telecom API industry's growth is primarily fueled by the increasing adoption of cloud-based solutions, the exponential growth of IoT devices demanding seamless communication, and the ever-increasing focus on providing personalized and engaging customer experiences. These factors are creating a perfect storm for rapid expansion in the coming years. The market's evolution towards sophisticated APIs supporting advanced functionalities further enhances its potential.

This report provides a detailed analysis of the Telecom API market, covering historical data, current market trends, and future projections. It offers insights into key market drivers, challenges, and growth opportunities. The report also profiles the major players in the market and analyzes their strategies, market share, and competitive landscape. The extensive data and analysis provided will prove invaluable to businesses seeking to understand and navigate the dynamics of the rapidly evolving Telecom API market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.88% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.88%.

Key companies in the market include Hewlett-Packard Development Co., Huawei Technologies, LM Ericsson, Oracle Corp., Alcatel-Lucent, Axway Software, ZTE Soft Technology, Nexmo, Comverse, Aepona, Fortumo OU, Twilio, Tropo, LocationSmart, ATT, Apigee Corp, Orage, Tropo, .

The market segments include Type, Application.

The market size is estimated to be USD 248.754 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Telecom Application Program Interface," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Telecom Application Program Interface, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.