1. What is the projected Compound Annual Growth Rate (CAGR) of the Taps and Mixers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Taps and Mixers

Taps and MixersTaps and Mixers by Type (Kitchen Taps and Mixers, Bathroom Taps and Mixers), by Application (Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

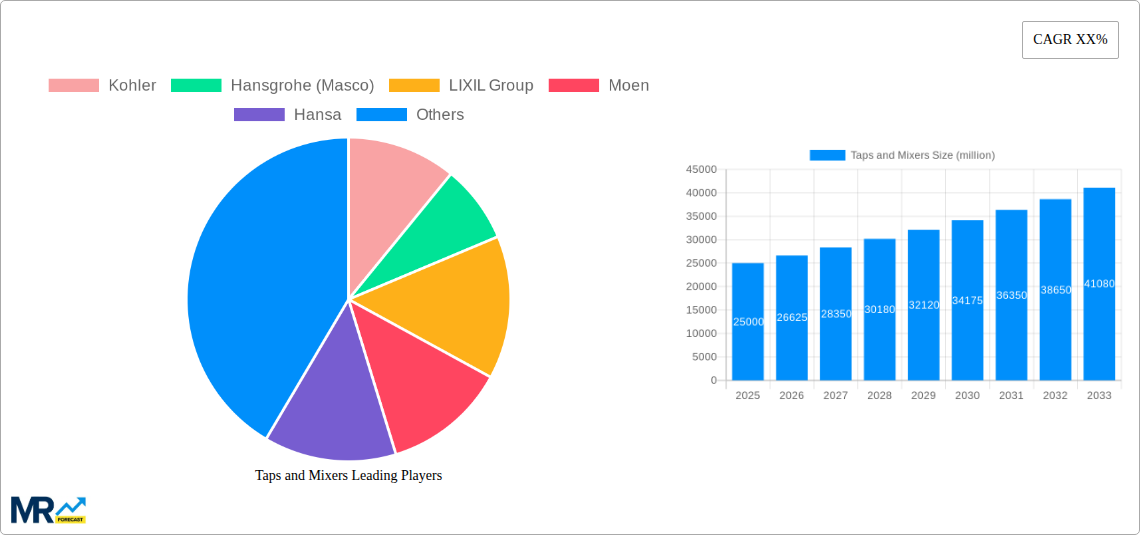

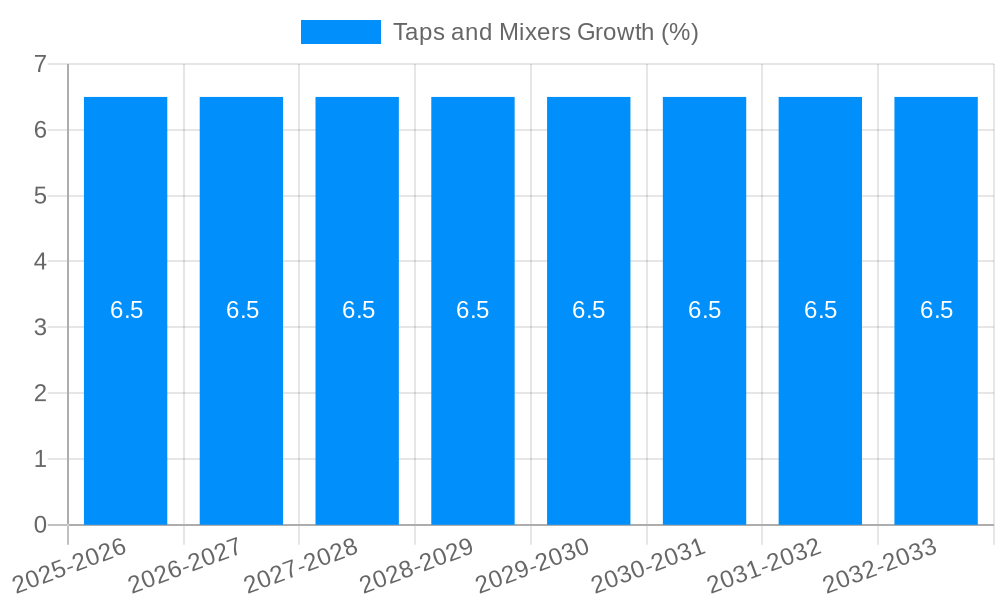

The global taps and mixers market is projected to witness robust growth, driven by increasing construction activities, rising disposable incomes, and a growing emphasis on modern bathroom and kitchen aesthetics. The market, valued at approximately $25,000 million in 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025-2033. This upward trajectory is significantly fueled by the residential sector, which constitutes a substantial portion of the market due to new home constructions and renovation projects. The rising demand for smart and water-efficient fixtures, coupled with advancements in design and functionality, further propels market expansion. Moreover, the commercial segment, encompassing hospitality, healthcare, and institutional sectors, is also a key contributor, driven by the need for durable, hygienic, and aesthetically pleasing fixtures.

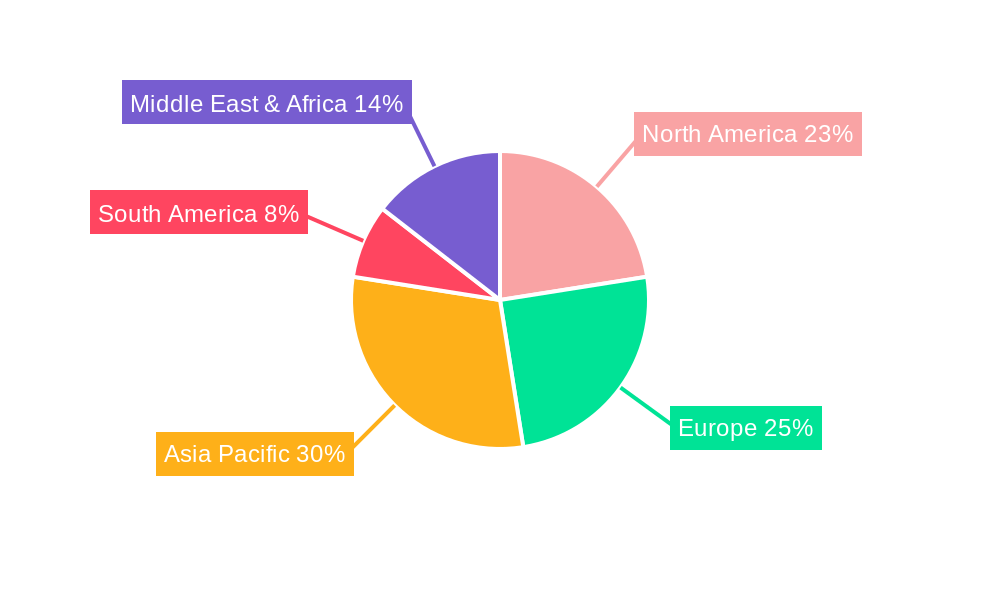

Key drivers for this market growth include increasing urbanization, leading to higher demand for new housing and associated bathroom and kitchen fittings. The growing awareness among consumers about water conservation is also a significant factor, spurring demand for advanced taps and mixers with features like flow regulators and temperature control. Emerging economies, particularly in the Asia Pacific region, are expected to be major growth engines, owing to rapid infrastructure development and a burgeoning middle class with increasing purchasing power. However, the market faces restraints such as the high cost of raw materials and the presence of counterfeit products in certain regions, which can impact revenue streams and brand reputation. Despite these challenges, the continued innovation in product design, integration of smart technology, and a focus on sustainable manufacturing practices are poised to shape the future of the taps and mixers industry.

This comprehensive report delves into the global Taps and Mixers market, providing an in-depth analysis from the historical period of 2019-2024 through to a robust forecast extending to 2033. Utilizing 2025 as the base and estimated year, the study offers invaluable insights for stakeholders navigating this dynamic industry. The market valuation is presented in millions of US dollars, reflecting the significant scale of global trade in these essential bathroom and kitchen fixtures.

The global taps and mixers market is undergoing a significant metamorphosis, driven by an increasing consumer demand for sophisticated aesthetics, enhanced functionality, and a paramount focus on water conservation. During the historical period (2019-2024), the market witnessed a steady ascent, fueled by a burgeoning global population and rising disposable incomes in emerging economies. The base year of 2025 stands as a pivotal point, where we observe an intensified integration of smart technologies, such as touchless operation, digital temperature control, and water usage monitoring, becoming mainstream. The forecast period (2025-2033) is projected to be characterized by an accelerated adoption of these intelligent solutions, transforming ordinary faucets into sophisticated water management systems. A key trend is the growing preference for minimalist and contemporary designs, with manufacturers like Kohler and Hansgrohe (Masco) leading the charge in introducing sleek, space-saving fixtures that seamlessly blend with modern interior design. Material innovation is another significant trend, with a shift towards durable, antimicrobial, and eco-friendly materials like brushed stainless steel, PVD (Physical Vapor Deposition) finishes offering superior scratch and corrosion resistance, and recycled alloys. The influence of smart homes is palpable, pushing manufacturers to develop integrated solutions that communicate with other smart devices. Furthermore, the growing awareness surrounding water scarcity is propelling the demand for low-flow and water-efficient taps and mixers, with companies like Moen and LIXIL Group investing heavily in research and development for advanced flow restrictor technologies. The industry is also witnessing a rise in customization options, allowing consumers to personalize their fixtures with various finishes, handle styles, and even embedded lighting. This bespoke approach caters to the evolving consumer desire for unique and personalized living spaces. The commercial and industrial segments, while traditionally more focused on durability and functionality, are increasingly adopting aesthetic and water-saving features, especially in hospitality and healthcare sectors, reflecting a broader industry-wide commitment to sustainability and premium user experiences. The market is moving beyond mere utility, embracing taps and mixers as integral elements of interior design and intelligent living.

Several powerful forces are actively propelling the global taps and mixers market towards sustained growth. A primary driver is the unprecedented urbanization and infrastructure development occurring worldwide. As cities expand and populations concentrate, the demand for new residential and commercial buildings, each requiring extensive plumbing installations, directly translates into increased demand for taps and mixers. This is particularly evident in rapidly developing economies across Asia and Africa. Secondly, the rising disposable incomes and an escalating standard of living in many parts of the world are fostering a greater emphasis on home improvement and renovation. Consumers are increasingly willing to invest in higher-quality, aesthetically pleasing, and feature-rich taps and mixers to enhance their living spaces. This shift from basic functionality to premium design and advanced features is a significant growth catalyst. Furthermore, the growing global consciousness regarding water conservation and environmental sustainability is a crucial driving force. With increasing awareness of water scarcity, consumers and developers are actively seeking out water-efficient taps and mixers, pushing manufacturers to innovate and offer solutions that reduce water consumption without compromising performance. Regulatory mandates and green building certifications are also incentivizing the adoption of such products. The technological advancements in manufacturing and product design are also playing a pivotal role. Innovations in materials science, precision engineering, and the integration of smart technologies are leading to the development of more durable, functional, and aesthetically appealing taps and mixers, opening up new market segments and capturing consumer interest. Finally, the resurgence in the construction of hotels, restaurants, and other hospitality venues, particularly post-pandemic, is a significant contributor, as these establishments often prioritize high-end fixtures to enhance guest experience.

Despite the robust growth trajectory, the taps and mixers market is not without its significant challenges and restraints that could temper its expansion. One of the most prominent challenges is the volatility in raw material prices. The manufacturing of taps and mixers relies heavily on materials such as brass, stainless steel, and various alloys. Fluctuations in the global prices of these commodities, influenced by geopolitical factors, supply chain disruptions, and demand-supply imbalances, can significantly impact production costs and profit margins for manufacturers like American Standard and MAC Faucets. This necessitates careful procurement strategies and price adjustments. Another considerable restraint is the increasingly stringent environmental regulations and compliance requirements. While these regulations drive innovation towards sustainability, they also impose additional costs on manufacturers for research and development, testing, and adherence to specific standards related to water efficiency, lead content, and material sourcing. Companies like CERA Sanitary ware and Jaquar must invest substantial resources to meet these evolving mandates. The intense market competition and price wars among numerous established and emerging players, including Vitra International AG. and Ideal Standard, often lead to squeezed profit margins. This competitive landscape makes it challenging for smaller players to gain market share and for larger companies to maintain significant pricing power. Furthermore, the economic slowdowns and recessions in key markets can significantly curb consumer spending on discretionary items like high-end bathroom and kitchen fixtures, impacting sales for brands like Roca and Paini. Global economic instability, therefore, poses a recurring threat to market growth. The supply chain disruptions, exacerbated by recent global events, continue to pose a challenge. Delays in sourcing components, manufacturing, and logistics can lead to production backlogs and impact product availability, affecting companies such as Zucchetti Group and Damixa (FM Mattsson Mora Group). Finally, the consumer's perception of taps and mixers as commodity products in certain segments, especially in budget-conscious markets, can limit the uptake of premium and technologically advanced options, representing a hurdle for brands like KWC (Franke Group) and Ritmonio.

The global taps and mixers market is poised for significant dominance by the Residential segment and is expected to witness substantial growth and leadership in the Asia Pacific region. This dominance is driven by a confluence of demographic, economic, and developmental factors.

Segment Dominance: Residential

The Residential segment is the primary engine of demand for taps and mixers. This dominance is underpinned by several interconnected factors:

Regional Dominance: Asia Pacific

The Asia Pacific region is projected to emerge as the leading market for taps and mixers, driven by a powerful combination of factors:

Companies like LIXIL Group, Jaquar, and CERA Sanitary ware are well-positioned to capitalize on the growth in this region. The combination of a massive and expanding residential market with rapid economic development and urbanization makes Asia Pacific the undisputed leader in the global taps and mixers landscape for the foreseeable future.

Several factors are acting as powerful catalysts for growth within the taps and mixers industry. The accelerated pace of smart home integration is a significant catalyst, driving demand for intelligent faucets with features like touchless operation, voice control, and water usage monitoring. Furthermore, increasing government initiatives focused on water conservation and sustainable building practices are compelling the adoption of water-efficient taps and mixers, creating a niche but rapidly expanding market segment. The surge in renovation and refurbishment activities globally, as homeowners seek to modernize their living spaces, presents a substantial opportunity for premium and design-led taps and mixers.

This report offers an exhaustive examination of the taps and mixers market, encompassing its intricate dynamics from 2019 to 2033, with a foundational analysis centered around 2025. It meticulously dissects market trends, identifies the key driving forces behind its expansion, and sheds light on the challenges and restraints that industry players must navigate. The report provides a granular view of dominant regions and market segments, offering strategic insights into areas poised for significant growth. Furthermore, it highlights the crucial growth catalysts that are shaping the future landscape of the industry. A comprehensive overview of leading companies, along with a timeline of significant developments, ensures stakeholders are equipped with the most up-to-date information and strategic foresight. The report's detailed segmentation by type (Kitchen Taps and Mixers, Bathroom Taps and Mixers) and application (Residential, Commercial, and Industry Developments) provides a multi-faceted understanding of market opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kohler, Hansgrohe (Masco), LIXIL Group, Moen, Hansa, Delta Faucet (Masco), American Standard, MAC Faucets, CERA Sanitary ware, Jaquar, Vitra International AG., Ideal Standard, Roca, Paini, Zucchetti Group, Damixa (FM Mattsson Mora Group), KWC (Franke Group), Ritmonio, Dornbracht, ARROW, KVK, KAKUDAI, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Taps and Mixers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Taps and Mixers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.