1. What is the projected Compound Annual Growth Rate (CAGR) of the Tape Holder?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tape Holder

Tape HolderTape Holder by Type (Plastic Shell, Metal Case, World Tape Holder Production ), by Application (Household, For Shopping Malls, Office Use, World Tape Holder Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

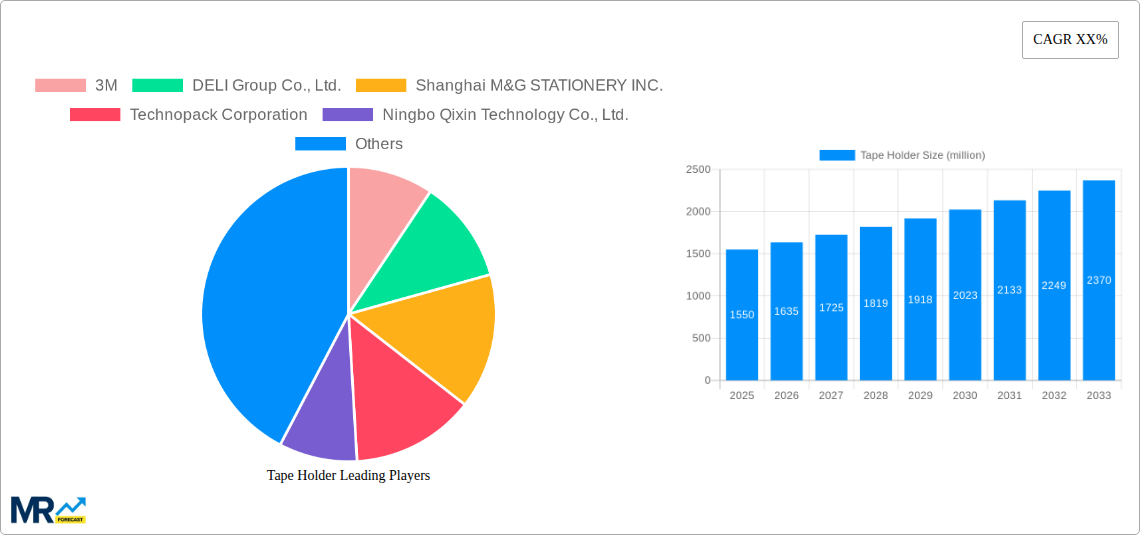

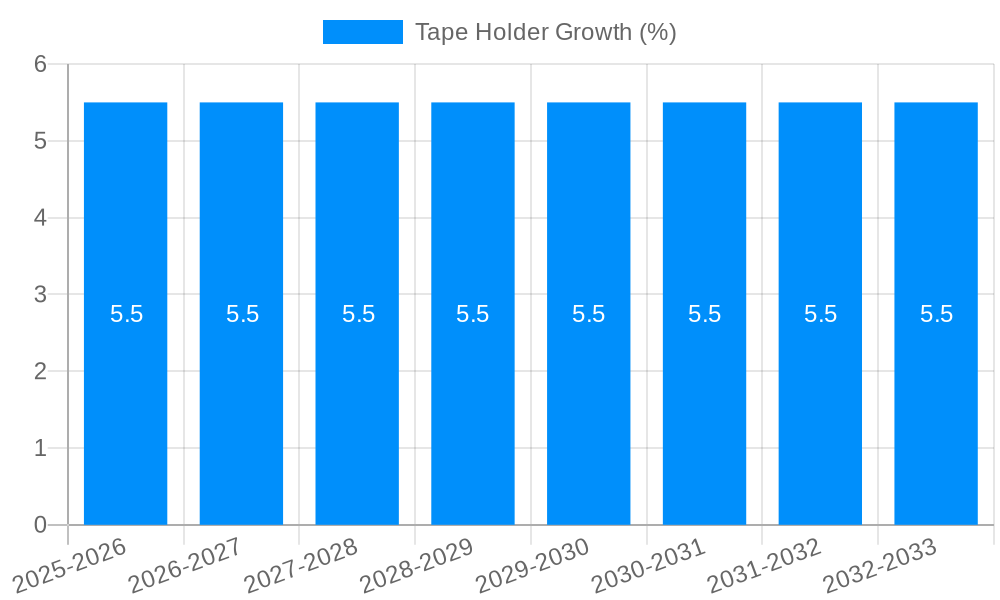

The global tape holder market is projected to experience significant growth, reaching an estimated value of over $1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% expected through 2033. This expansion is fueled by increasing demand across diverse applications, from everyday household use to specialized needs in shopping malls and offices. The market is characterized by a growing preference for innovative and durable tape holder solutions, driving the development of both plastic shell and metal case variants. The increasing adoption of automation and efficiency-driven solutions in commercial spaces, coupled with the convenience offered by well-designed tape dispensers in homes and small businesses, are key market drivers. Furthermore, the rise of e-commerce and the associated packaging needs indirectly contribute to the demand for effective tape holding solutions.

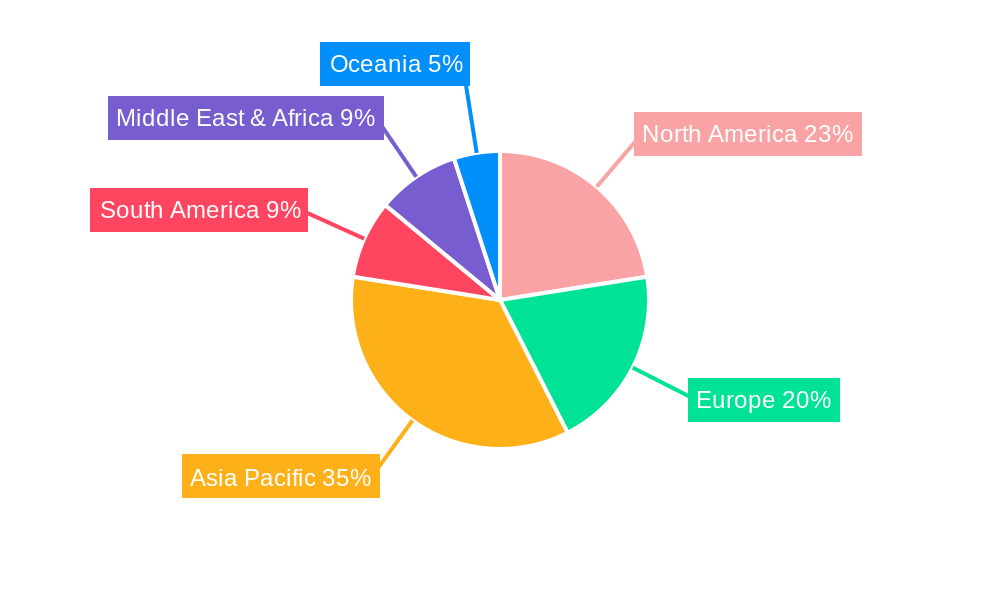

Looking ahead, the tape holder market is poised for continued evolution, influenced by emerging trends such as the integration of eco-friendly materials and smart functionalities. While the market offers substantial opportunities, certain restraints, such as intense price competition and the availability of generic alternatives, may pose challenges. However, the persistent need for organized and efficient tape management across various sectors, from manufacturing and logistics to retail and domestic environments, underpins a steady and upward trajectory for the market. Key players like 3M, DELI Group, and Shanghai M&G Stationery are actively innovating, focusing on product design, material quality, and expanding their distribution networks to capture a larger market share in this dynamic landscape. Asia Pacific is anticipated to lead market growth due to its rapidly expanding industrial base and burgeoning consumer market.

Here's a unique report description for a "Tape Holder" market analysis, incorporating your specific requirements:

The global tape holder market is poised for significant evolution, driven by a confluence of consumer needs and technological advancements. During the study period of 2019-2033, with a base year of 2025, the market has witnessed a consistent upward trajectory. The historical period (2019-2024) laid a strong foundation, characterized by increasing demand from both industrial and consumer sectors. As we move into the estimated year of 2025 and the forecast period of 2025-2033, key trends are emerging that will shape the market's future.

XXX the market is experiencing a pronounced shift towards more ergonomic and aesthetically pleasing designs. Consumers are no longer solely focused on functionality but are actively seeking tape dispensers that blend seamlessly into their workspaces or homes. This aesthetic appeal, coupled with enhanced ease of use, is a significant driver for product innovation. Furthermore, the integration of sustainable materials is gaining momentum. As environmental consciousness rises, manufacturers are exploring recycled plastics and biodegradable components, aligning with global sustainability goals and appealing to eco-aware consumers. The advent of smart features, though still nascent, is another noteworthy trend. Imagine tape dispensers with integrated cutting mechanisms that optimize tape usage or even connectivity features for inventory management in commercial settings.

The increasing sophistication of packaging and shipping processes across various industries is a major underpinning of this growth. From small e-commerce businesses to large-scale manufacturing units, the efficient and safe application of adhesive tape is paramount. This translates directly into a sustained demand for reliable and user-friendly tape holders. The World Tape Holder Production landscape is also diversifying, with an increasing number of regional manufacturers contributing to the global supply chain, fostering healthy competition and driving down costs in some segments. This globalized production, however, also introduces complexities in terms of supply chain resilience and quality control, which are critical considerations for market players. The Office Use segment, in particular, is a steady performer, with businesses continually investing in tools that enhance productivity and streamline operations. Similarly, the Household application, driven by DIY enthusiasts and general home organization needs, presents a stable and growing demand base. The For Shopping Malls segment, though perhaps niche, highlights the specialized requirements of retail environments for efficient display setup and maintenance.

The global tape holder market is propelled by a robust interplay of several key factors, ensuring its continued expansion. The ever-increasing volume of e-commerce logistics stands as a primary driver. As online retail continues its exponential growth, the demand for efficient and reliable packaging solutions, including high-quality tape dispensers, escalates. Businesses of all sizes rely on these tools to securely seal shipments, directly impacting operational efficiency and customer satisfaction. Furthermore, the ongoing industrialization and manufacturing activities worldwide necessitate consistent use of adhesive tapes for assembly, sealing, and packaging. This broad industrial application forms a significant and stable demand base.

The evolving workspace dynamics also contribute significantly. With the rise of hybrid and remote work models, there's a growing emphasis on optimizing home office environments. This translates into an increased purchase of office supplies, including ergonomic and aesthetically pleasing tape holders that enhance productivity and declutter workspaces. Moreover, advancements in tape technology itself, such as the development of stronger adhesives and specialized tapes for diverse applications, indirectly fuels the demand for tape holders capable of handling these new materials efficiently. The need for safety and compliance in industrial settings, where proper sealing is crucial for product integrity and transportation regulations, further underpins the demand for robust and dependable tape dispensers.

Despite the promising growth trajectory, the tape holder market is not without its impediments. One of the foremost challenges is the increasing commoditization of basic tape dispenser models. As production becomes more widespread and accessible, price competition intensifies, potentially eroding profit margins for manufacturers, especially those focusing on standard plastic shell variants. This can lead to a race to the bottom in terms of pricing, potentially sacrificing product quality or innovation. The emergence of automated packaging solutions, while a long-term trend, can also pose a restraint for manual tape dispensers in high-volume industrial settings. As automation becomes more integrated into manufacturing and logistics, the reliance on manual tape application might decrease in certain segments.

Furthermore, the susceptibility of the market to raw material price fluctuations presents another significant challenge. The cost of plastics and metals, primary components in tape holder manufacturing, can be volatile, directly impacting production costs and the final pricing of products. Supply chain disruptions, as witnessed in recent global events, can also hinder production and timely delivery, affecting both manufacturers and end-users. Consumer inertia and resistance to adopting new or improved tape dispenser technologies can also act as a restraint. Many users may be accustomed to existing, albeit less efficient, tools and may not immediately see the value proposition in upgrading, requiring significant marketing and educational efforts from manufacturers.

The global tape holder market's dominance is characterized by a dynamic interplay between regional strengths and specific product segment popularity. Among the various segments, Plastic Shell tape holders are poised to command a substantial market share. Their inherent advantages of being lightweight, cost-effective to produce, and easily moldable into diverse shapes and functionalities make them highly desirable across a wide spectrum of applications. The accessibility of raw materials and established manufacturing capabilities for plastics in many regions further solidify their leading position.

World Tape Holder Production itself is a crucial indicator, with regions boasting strong manufacturing infrastructure and a skilled workforce tending to dominate. Asia-Pacific, particularly China, is a significant hub for World Tape Holder Production, driven by large-scale manufacturing operations and competitive pricing. This dominance in production often translates into a strong market presence, both domestically and internationally. Within this overarching production landscape, the Office Use segment consistently emerges as a key driver of demand. The ubiquitous nature of offices, coupled with the continuous need for efficient document handling, packaging, and general organization, ensures a steady and substantial requirement for tape dispensers.

Key Regions and Countries to Dominate:

Asia-Pacific: This region is a powerhouse in both production and consumption.

North America: This region, particularly the United States, remains a key consumer of tape holders.

Europe: European markets exhibit a strong demand for high-quality and often specialized tape holders.

Key Segments to Dominate:

The tape holder industry's growth is significantly catalyzed by the booming e-commerce sector, which necessitates efficient and secure packaging solutions. The constant need for businesses to ship products globally fuels demand for reliable tape dispensers. Furthermore, an increasing global focus on workplace organization and ergonomics is driving consumers and businesses to invest in user-friendly and aesthetically pleasing tape holders for offices and home workspaces. Advancements in material science are also playing a crucial role, enabling the development of more durable, lightweight, and sustainable tape holder options.

This report offers an exhaustive analysis of the global tape holder market, spanning the historical period from 2019 to 2024 and projecting growth through 2033, with 2025 serving as the base year. It delves into intricate market dynamics, meticulously dissecting growth drivers such as the e-commerce boom and the demand for optimized workspaces. Simultaneously, it addresses critical challenges, including raw material price volatility and market commoditization. The report provides a detailed regional and segment-wise breakdown, identifying dominant areas of production and consumption, with a specific focus on the widespread appeal of plastic shell tape holders and the consistent demand from office environments. Leading industry players are profiled, alongside an examination of significant technological and material advancements that are shaping the future of tape holder innovation and sustainability. This comprehensive coverage ensures stakeholders possess the insights necessary to navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 3M, DELI Group Co., Ltd., Shanghai M&G STATIONERY INC., Technopack Corporation, Ningbo Qixin Technology Co., Ltd., Shanghai KACO Industrial Co., Ltd., Guangdong Huajie Culture Creativity Technology Co., Ltd., Shanghai Uee Zee Adhesive Product Co., Ltd., Otsuka Corp., Shanghai KW-triO Office Equipment Co., Ltd., Ningbo Newsay Technology Co., Ltd., Uline, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tape Holder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tape Holder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.