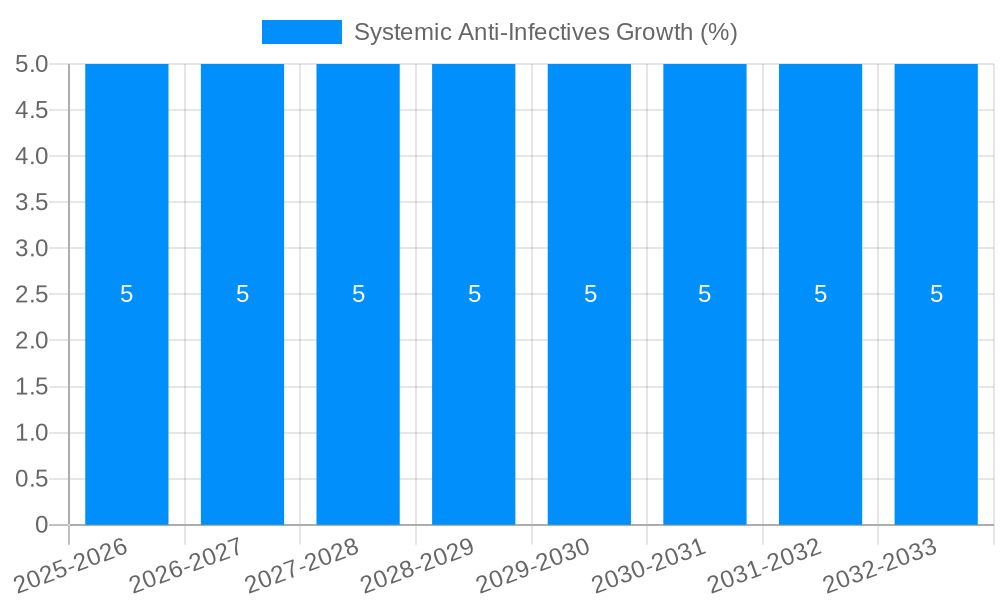

1. What is the projected Compound Annual Growth Rate (CAGR) of the Systemic Anti-Infectives?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Systemic Anti-Infectives

Systemic Anti-InfectivesSystemic Anti-Infectives by Type (/> Injections, Tablets, Capsules & Pellets, Others), by Application (/> Hospital, Clinic, Drugstores, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Systemic Anti-Infectives market is poised for significant expansion, projected to reach a substantial size of $19,720 million by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 5%. This robust growth trajectory is primarily fueled by the escalating prevalence of infectious diseases worldwide, a rising global population, and increasing healthcare expenditure, particularly in emerging economies. Advancements in drug discovery and development, leading to the introduction of novel and more effective anti-infective agents, are also key drivers. Furthermore, improved diagnostic capabilities and a greater emphasis on early and accurate treatment of infections are contributing to market buoyancy. The market is segmented by type into injections, tablets, capsules & pellets, and others, with injections and oral formulations like tablets and capsules likely dominating due to their established efficacy and ease of administration. Applications span hospitals, clinics, and drugstores, reflecting the diverse settings where systemic anti-infectives are prescribed and dispensed.

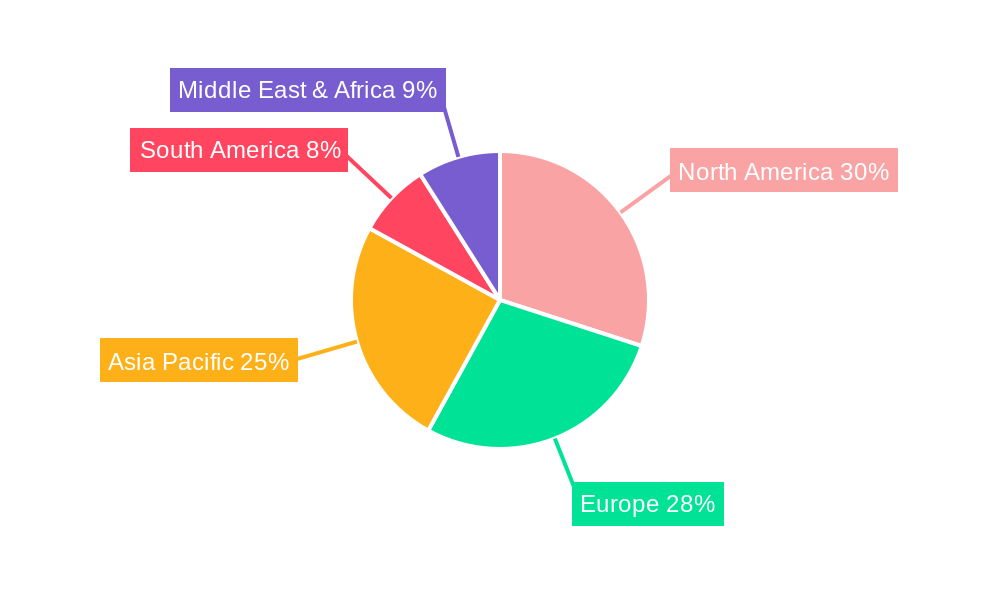

The landscape of systemic anti-infectives is characterized by intense competition among a diverse range of global and regional players, including industry giants like Pfizer, MSD, Bayer, and Johnson & Johnson, alongside prominent Asian pharmaceutical companies such as Sinopharm and CSPC Pharmaceutical. This competitive environment fosters innovation and drives market dynamics. Emerging trends include a growing focus on combating antimicrobial resistance (AMR) through the development of new classes of antibiotics and alternative therapies, as well as a surge in the use of combination therapies to enhance treatment outcomes and prevent resistance. The market is also witnessing increased investment in research and development to address the unmet needs for treating complex and multi-drug resistant infections. Geographically, North America and Europe currently lead the market, driven by advanced healthcare infrastructure and high disease burden, but the Asia Pacific region is expected to emerge as a significant growth engine due to its large population, increasing disposable income, and rising healthcare awareness.

The global systemic anti-infectives market is on an upward trajectory, projected to reach significant figures, with an estimated market size of 150,000 million units in the base year 2025. This robust growth is anticipated to continue through the forecast period of 2025-2033, building upon the historical performance from 2019-2024. The study period of 2019-2033 provides a comprehensive view of the market's evolution and future potential. A key insight into the market trends is the increasing prevalence of infectious diseases globally, coupled with a growing awareness and demand for effective treatment options. The aging global population, a demographic segment more susceptible to various infections, is a significant contributor to this demand. Furthermore, advancements in pharmaceutical research and development are leading to the introduction of novel anti-infective agents with improved efficacy and reduced resistance profiles, thus expanding the market's reach. The rise of antibiotic resistance remains a critical concern, but paradoxically, it also fuels innovation, pushing companies to invest in new drug discovery and development, thereby driving market expansion in the long term. The shift towards more specialized and targeted therapies, as opposed to broad-spectrum antibiotics, is another discernible trend. This is particularly evident in the treatment of complex and hospital-acquired infections. The market is also witnessing a growing emphasis on combination therapies, which aim to enhance treatment outcomes and combat emerging resistant strains. The increasing penetration of healthcare services in developing economies, leading to improved access to diagnostics and treatments, is also playing a pivotal role in market growth. The market's trajectory is marked by a steady increase in the volume of anti-infective drugs prescribed and administered across various healthcare settings. This growth is underpinned by the continuous need to manage and treat a wide spectrum of bacterial, viral, fungal, and parasitic infections that affect millions worldwide. The market dynamics are also influenced by evolving regulatory landscapes and the ongoing efforts to ensure the safety and efficacy of anti-infective drugs.

The systemic anti-infectives market is being propelled by a confluence of powerful driving forces. A primary driver is the persistent and, in many regions, increasing global burden of infectious diseases. From common bacterial infections to more complex and potentially life-threatening conditions like sepsis and tuberculosis, the continuous need for effective treatments underpins the market's sustained demand. The emergence of novel pathogens and the resurgence of previously controlled diseases further amplify this need. Secondly, the escalating issue of antimicrobial resistance (AMR) acts as a significant catalyst. While a challenge, AMR necessitates the development of new and more potent anti-infective agents, driving R&D investments and market growth. This pressure forces a constant cycle of innovation, with pharmaceutical companies actively seeking solutions to combat resistant strains. Moreover, advancements in medical technology and diagnostics enable earlier and more accurate identification of infections, leading to prompt and appropriate treatment with systemic anti-infectives. The expanding global healthcare infrastructure, particularly in emerging economies, means a larger population gains access to these essential medications, contributing significantly to market volume. Furthermore, an aging global population is inherently more susceptible to infections, thereby increasing the demand for anti-infective treatments. Finally, supportive government initiatives and increasing healthcare spending worldwide are creating a more favorable environment for the growth and accessibility of systemic anti-infectives.

Despite the promising growth, the systemic anti-infectives market faces substantial challenges and restraints that could impede its progress. Foremost among these is the relentless and growing threat of antimicrobial resistance (AMR). The widespread overuse and misuse of existing antibiotics have led to the evolution of superbugs, rendering many standard treatments ineffective and necessitating the development of complex, expensive, and often less accessible novel drugs. This directly impacts the market by increasing the cost of treatment and sometimes limiting available options. Another significant restraint is the challenging and lengthy drug development process for anti-infectives. The high failure rates in clinical trials, coupled with stringent regulatory requirements and the relatively low return on investment compared to other therapeutic areas like chronic disease management, disincentivize substantial investment in novel drug discovery. Economic factors also play a crucial role. The affordability and accessibility of advanced anti-infective therapies, particularly in low- and middle-income countries, remain a significant hurdle, limiting market penetration. Furthermore, the lack of robust stewardship programs in many healthcare settings contributes to the misuse of antibiotics, exacerbating AMR and potentially reducing the long-term effectiveness of existing drugs. The off-label use of antibiotics and the prevalence of counterfeit medications further complicate the market landscape and pose risks to patient safety, indirectly restraining growth. Finally, the economic downturns and the prioritization of healthcare budgets towards other pressing health concerns can also impact the demand and accessibility of systemic anti-infectives.

The global systemic anti-infectives market is characterized by dynamic regional and segmental dominance, with specific areas poised for substantial growth and influence.

Dominant Segments by Type:

Dominant Segments by Application:

Key Dominant Region:

The systemic anti-infectives industry is experiencing growth driven by several key catalysts. The increasing global burden of infectious diseases, including both common and rare infections, creates a perpetual demand for effective treatments. Furthermore, the escalating challenge of antimicrobial resistance (AMR) is a critical catalyst, compelling pharmaceutical companies to invest in research and development for novel and more potent anti-infectives, thereby expanding the market. Advancements in medical diagnostics allow for earlier and more accurate identification of infections, leading to timely and appropriate prescription of systemic anti-infectives. The continuous expansion of healthcare infrastructure and access, particularly in emerging economies, significantly broadens the patient population that can benefit from these medications.

This comprehensive report delves deep into the systemic anti-infectives market, offering an in-depth analysis across its entire value chain. It provides a granular examination of market trends, drivers, and restraints, supported by robust data from the historical period of 2019-2024 and forward-looking projections for 2025-2033, with 2025 serving as the estimated and base year. The report meticulously segments the market by type (Injections, Tablets, Capsules & Pellets, Others) and application (Hospital, Clinic, Drugstores, Others), offering insights into the dominant segments and their growth trajectories. It also highlights key regions and countries influencing market dynamics. Furthermore, the report identifies and profiles leading players, including Pfizer, MSD, GSK, and Johnson & Johnson, examining their strategies and contributions. Significant industry developments and technological advancements are detailed, providing a holistic view of the market's evolution and future potential, estimated to reach 150,000 million units by 2025.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Pfizer, Sumitomo Dainippon Pharma, MSD, Bayer, Bristol-Myers Squibb, Dechra, Alandalous, GSK, Teva, Johnson & Johnson, NOVARTIS, MYLAN, Sun Pharma, CR SANJIU, Cipla, Chiatai Tianqing, Hailing Pharm, Southwest Pharmaceutical Co., Ltd., Guangzhou Baiyunshan, Harbin Pharmaceutical Group, CSPC Pharmaceutical, North China Pharmaceutical, Sinopharm, Luoxin Pharmaceutical, CR Pharma, Duopharma Biotech Group, PT Infion Pharma, Bright-gene, .

The market segments include Type, Application.

The market size is estimated to be USD 19720 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Systemic Anti-Infectives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Systemic Anti-Infectives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.