1. What is the projected Compound Annual Growth Rate (CAGR) of the Syrup Glass Bottles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Syrup Glass Bottles

Syrup Glass BottlesSyrup Glass Bottles by Type (Low Borosilicate Glass, Soda Lime Glass, World Syrup Glass Bottles Production ), by Application (5ml Oral Solution, 10ml Oral Solution, 15ml Oral Solution, 20ml Oral Solution, 25ml Oral Solution, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

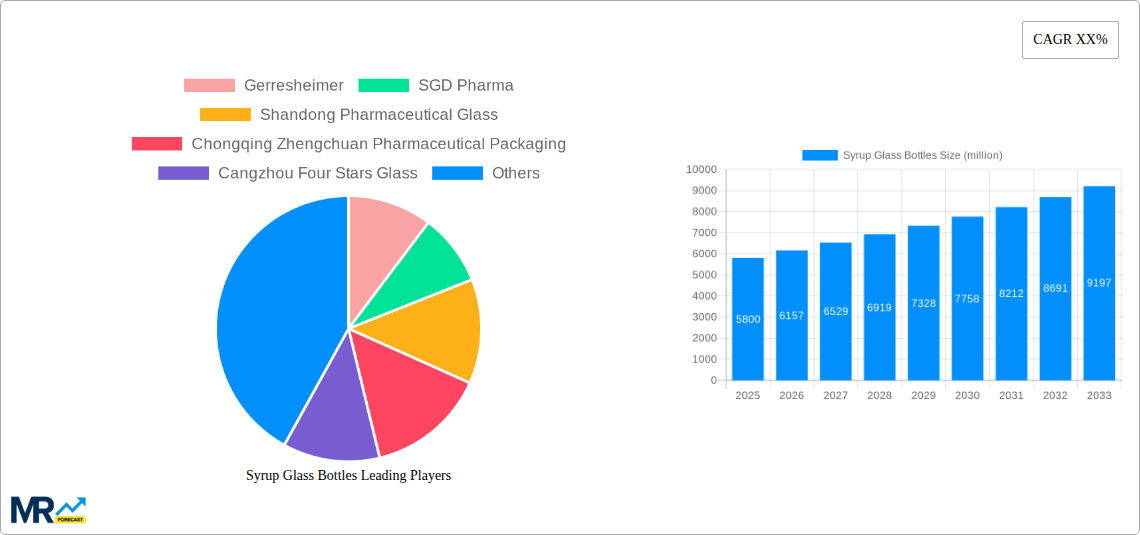

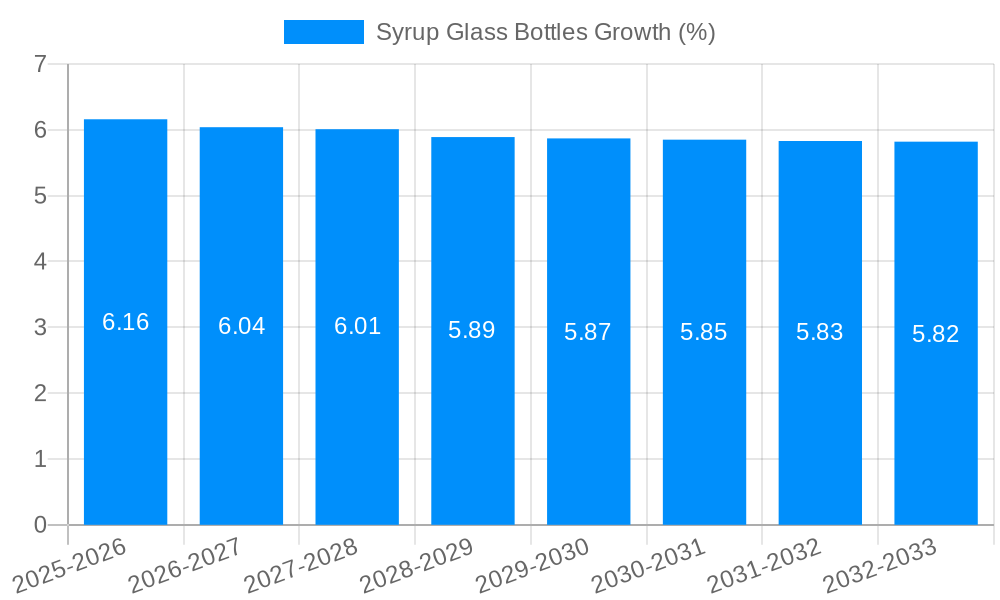

The global Syrup Glass Bottles market is poised for robust growth, with an estimated market size of USD 5,800 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This expansion is primarily fueled by the increasing global demand for pharmaceutical syrup formulations, driven by a growing incidence of respiratory ailments, chronic diseases, and a rising preference for oral liquid medications due to their ease of administration and faster absorption rates. The inherent inertness and excellent barrier properties of glass, particularly low borosilicate and soda lime glass, make them the preferred material for preserving the efficacy and stability of sensitive pharmaceutical ingredients, thus reinforcing their dominance in this segment. Furthermore, a growing awareness of the environmental impact of plastic packaging is steering consumers and manufacturers towards sustainable alternatives like glass, further bolstering market expansion. The market is segmented by type, with Low Borosilicate Glass and Soda Lime Glass holding significant shares, and by application, where 10ml and 20ml oral solution bottles are expected to witness the highest demand due to their common usage in pediatric and adult medication dosages. Key players like Gerresheimer, SGD Pharma, and Shandong Pharmaceutical Glass are at the forefront, investing in innovation and expanding production capacities to meet the escalating global demand.

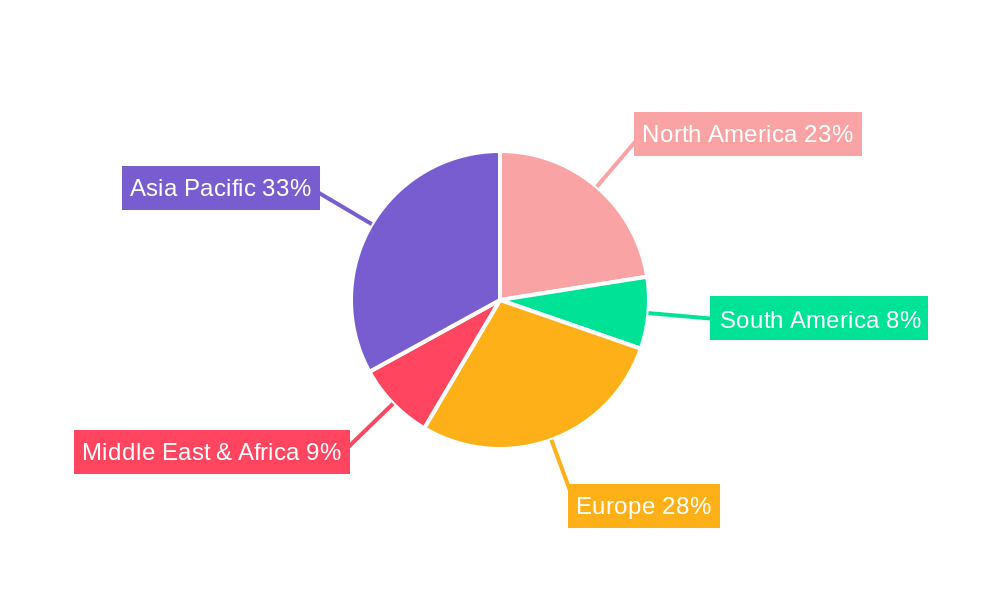

Geographically, the Asia Pacific region, particularly China and India, is emerging as a major growth engine, owing to the expanding pharmaceutical manufacturing base, increasing healthcare expenditure, and a large population base. North America and Europe, established markets with stringent quality regulations and a high prevalence of chronic diseases, will continue to contribute substantially to market revenue. However, challenges such as the higher cost of glass compared to plastic and the risk of breakage during transportation need to be addressed to ensure sustained growth. Despite these restraints, the superior safety, recyclability, and premium perception associated with glass syrup bottles are expected to maintain their strong appeal in the pharmaceutical packaging sector. The study encompasses a comprehensive analysis from 2019 to 2033, with a baseline year of 2025, providing valuable insights for stakeholders navigating this dynamic market.

Here is a unique report description for Syrup Glass Bottles, incorporating the provided details:

The global syrup glass bottles market is poised for substantial evolution, with projected production volumes reaching an impressive XXX million units by the end of the forecast period in 2033. This upward trajectory is underpinned by a confluence of factors, including the enduring preference for glass as a primary packaging material for pharmaceutical syrups and oral solutions, owing to its inertness, superior barrier properties, and chemical stability. The historical period from 2019 to 2024 witnessed a steady increase in demand, fueled by the growing pharmaceutical industry and an escalating awareness of product integrity and safety. The base year of 2025, with its estimated production of XXX million units, serves as a critical benchmark, from which significant growth is anticipated. Market research indicates a sustained interest in specific applications, with 10ml oral solution and 15ml oral solution formats expected to continue dominating consumption due to their widespread use in pediatric and adult medications. Furthermore, the demand for Low Borosilicate Glass is projected to ascend, driven by its enhanced chemical resistance and thermal shock properties, making it ideal for a wider range of pharmaceutical formulations. The "Other" application segment, encompassing a variety of specialized syrup volumes and formulations, is also expected to contribute significantly to market expansion, reflecting the dynamic nature of pharmaceutical product development. Industry developments throughout the study period (2019-2033) are anticipated to focus on enhancing manufacturing efficiencies, exploring sustainable glass production techniques, and innovating bottle designs to meet evolving regulatory requirements and consumer preferences. The World Syrup Glass Bottles Production is a testament to the consistent and vital role these containers play in global healthcare supply chains, with intricate interdependencies between raw material sourcing, manufacturing capabilities, and end-user demand shaping the market landscape.

The primary engine driving the growth of the syrup glass bottles market is the unshakeable trust placed in glass as a packaging medium for pharmaceuticals. Its inherent inertness ensures that it does not react with the medicinal contents, preserving the efficacy and purity of syrups and oral solutions. This is paramount in the pharmaceutical sector, where product integrity is non-negotiable and patient safety is of utmost concern. The escalating global prevalence of chronic diseases and the continuous development of new pharmaceutical formulations, particularly those requiring precise dosage and long shelf life, further bolster demand. The historical period (2019-2024) saw this trend intensify, with an increasing number of manufacturers prioritizing glass packaging for their high-value liquid medications. Looking ahead, the forecast period (2025-2033) is expected to witness an even greater reliance on these containers as healthcare systems worldwide expand and the demand for accessible and reliable medication packaging grows. The convenience and ease of dispensing associated with specific oral solution volumes, such as 10ml oral solution and 15ml oral solution, also contribute significantly to their sustained popularity. Moreover, regulatory bodies worldwide increasingly favor glass packaging for certain drug classes due to its proven track record of safety and its ability to provide a robust barrier against external contaminants.

Despite the promising outlook, the syrup glass bottles market is not without its hurdles. One significant challenge is the inherent fragility of glass, which necessitates careful handling throughout the supply chain, from manufacturing to transportation and storage. This can lead to increased logistics costs and potential product loss due to breakage. The energy-intensive nature of glass production also presents an environmental concern, with rising energy prices and increasing pressure for sustainable manufacturing practices posing a challenge for producers. Furthermore, the weight of glass bottles, when compared to alternative packaging materials like plastic, can result in higher transportation costs, especially for long-distance shipments. The market also faces competition from other packaging materials, such as high-barrier plastics and specialized polymers, which offer advantages in terms of weight and break resistance, though they often lack the same level of inertness and chemical compatibility as glass. The ongoing development and adoption of these alternatives, particularly in less sensitive pharmaceutical applications, could pose a restraint on the overall growth of the syrup glass bottles market in certain niches. Additionally, fluctuations in the cost of raw materials, such as silica sand, soda ash, and limestone, can impact production costs and consequently, the pricing of syrup glass bottles, influencing market dynamics.

The global syrup glass bottles market is characterized by a dynamic interplay between regional strengths and segment preferences, with the Asia Pacific region emerging as a dominant force, projected to lead both in terms of World Syrup Glass Bottles Production and consumption throughout the study period (2019-2033). This ascendancy is attributed to several pivotal factors.

Beyond regional dominance, the 10ml Oral Solution and 15ml Oral Solution segments are poised to collectively capture a significant share of the syrup glass bottles market, owing to their ubiquitous application.

While Low Borosilicate Glass is gaining traction due to its superior properties, the sheer volume of production and established infrastructure for Soda Lime Glass in many regions, particularly in meeting the demands for standard oral solutions, means that Soda Lime Glass will continue to hold a substantial market share. However, the growth rate for Low Borosilicate Glass is expected to be higher as pharmaceutical companies increasingly opt for enhanced protection for sensitive formulations. The "Other" application segment is also expected to see robust growth, driven by the development of specialized syrups and personalized medicine approaches that require tailored packaging solutions.

Several factors are acting as significant growth catalysts for the syrup glass bottles industry. The escalating global demand for pharmaceuticals, driven by an aging population and the rising incidence of chronic diseases, directly translates to increased consumption of syrup glass bottles. Furthermore, the growing awareness among consumers and pharmaceutical manufacturers regarding the superior barrier properties and inertness of glass, which ensures product integrity and shelf-life, is a major driver. The continuous innovation in bottle designs, coupled with advancements in manufacturing technologies leading to improved production efficiency and cost-effectiveness, also fuels market expansion. Lastly, the increasing focus on sustainable packaging solutions, where glass is often perceived as a more environmentally friendly option than certain plastics, is further bolstering its appeal.

This comprehensive report delves into the intricate landscape of the syrup glass bottles market, offering in-depth analysis across various facets. It provides a detailed examination of the market dynamics, including historical trends from 2019-2024 and future projections up to 2033, with 2025 serving as a pivotal base and estimated year. The report meticulously outlines the key growth drivers, such as the unwavering demand for safe and inert pharmaceutical packaging and the expanding global pharmaceutical industry. It also scrutinizes the challenges and restraints impacting market expansion, including fragility and production costs. Furthermore, the report highlights the dominant regions and segments, such as the Asia Pacific and the 10ml and 15ml oral solution applications, underscoring their significance. Leading industry players and their strategic initiatives are profiled, alongside a timeline of significant developments that have shaped the sector. The report utilizes a robust methodology, incorporating a vast array of data points to deliver actionable insights for stakeholders, including manufacturers, suppliers, and end-users, enabling informed strategic decision-making within the evolving syrup glass bottles industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Gerresheimer, SGD Pharma, Shandong Pharmaceutical Glass, Chongqing Zhengchuan Pharmaceutical Packaging, Cangzhou Four Stars Glass, Cangzhou Xingchgen Glass Products, Chengdu Jingu Pharma-Pack, Bormioli Pharma, Stoelzle Pharm, Jiangsu Chaohua Glasswork, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Syrup Glass Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Syrup Glass Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.