1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Crop Protection Chemicals?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sustainable Crop Protection Chemicals

Sustainable Crop Protection ChemicalsSustainable Crop Protection Chemicals by Type (Biochemical Pesticides, Microbial Pesticides, Plant-incorporated Protectants, World Sustainable Crop Protection Chemicals Production ), by Application (Open Field & Protective Cultivation, Horticulture, Floriculture, Others, World Sustainable Crop Protection Chemicals Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

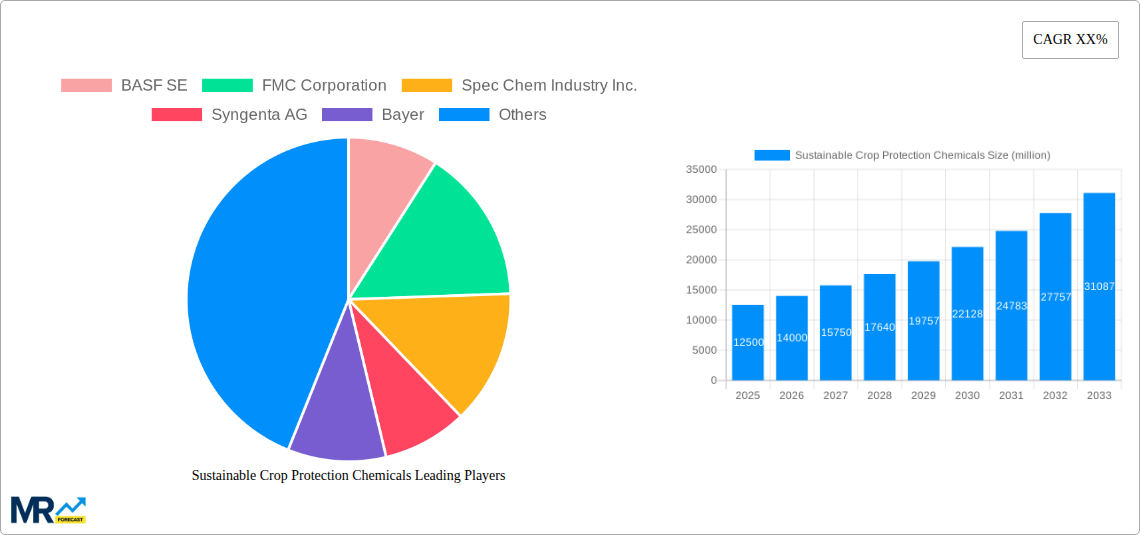

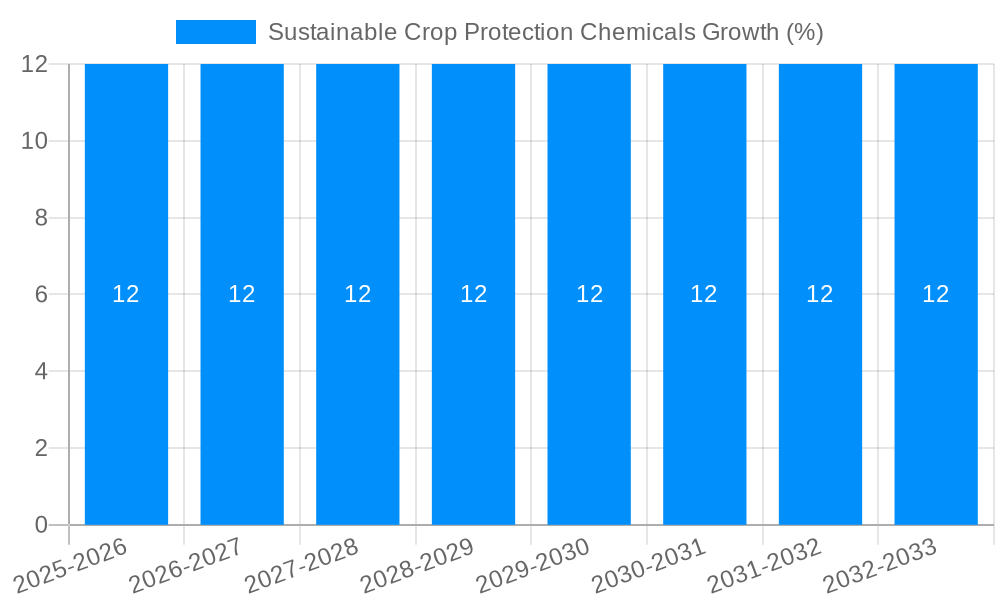

The global sustainable crop protection chemicals market is poised for significant expansion, with a projected market size of $12,500 million and an estimated CAGR of 12% from 2025 to 2033. This robust growth is propelled by an increasing global demand for food, coupled with a critical need to mitigate the environmental impact of conventional agricultural practices. Farmers worldwide are actively seeking eco-friendly alternatives to synthetic pesticides, driven by growing consumer awareness of health and environmental concerns, as well as stricter regulatory frameworks promoting biological and bio-based solutions. The market is segmented into Biochemical Pesticides, Microbial Pesticides, and Plant-incorporated Protectants, each offering distinct advantages in terms of efficacy, safety, and sustainability. Biochemical pesticides, derived from natural materials, are gaining traction due to their targeted action and biodegradability. Microbial pesticides, leveraging beneficial microorganisms, offer a highly specific and environmentally sound approach to pest management. Plant-incorporated protectants, genetically engineered traits within plants to resist pests and diseases, represent a forward-looking solution for integrated pest management. The application landscape is diverse, encompassing Open Field & Protective Cultivation, Horticulture, Floriculture, and other agricultural sectors, underscoring the broad applicability and essential role of these sustainable solutions in modern agriculture.

The sustainable crop protection chemicals market is characterized by a dynamic interplay of drivers, trends, and restraints. Key drivers include the escalating need for food security for a growing global population, stringent government regulations favoring environmentally benign pest control methods, and a rising consumer preference for organically produced food, which necessitates sustainable farming practices. Emerging trends such as the development of precision agriculture technologies, the integration of digital platforms for pest monitoring, and the increasing research and development in bio-pesticide formulations are further fueling market growth. Innovations in nanotechnology for enhanced delivery of bio-pesticides and the exploration of novel microbial strains are also contributing to market evolution. However, certain restraints, including the higher initial cost of some sustainable alternatives compared to conventional pesticides, the need for specialized knowledge and infrastructure for their application, and the variability in efficacy depending on environmental conditions and pest pressures, present challenges. Despite these hurdles, the overwhelming momentum towards sustainable agriculture, supported by leading companies like BASF SE, Bayer, Syngenta AG, and FMC Corporation, is expected to drive substantial market penetration and innovation in the coming years.

This comprehensive report delves into the dynamic and rapidly evolving Sustainable Crop Protection Chemicals market, providing an in-depth analysis of its trajectory from the Historical Period (2019-2024) through the Study Period (2019-2033), with a specific focus on the Base Year (2025) and the Forecast Period (2025-2033). The World Sustainable Crop Protection Chemicals Production is projected to witness significant growth, reaching an estimated value of USD 12,500 million in 2025. This report offers critical insights into market trends, driving forces, challenges, key regional and segmental dominance, growth catalysts, leading players, and significant industry developments.

The global landscape of crop protection is undergoing a profound transformation, shifting away from conventional, synthetic pesticides towards more environmentally benign and sustainable alternatives. This paradigm shift is driven by a confluence of factors, including increasing consumer demand for organically produced food, stringent government regulations aimed at reducing chemical residues in food and water, and a growing awareness among farmers regarding the long-term ecological and health impacts of synthetic chemicals. The World Sustainable Crop Protection Chemicals Production is on an upward trajectory, estimated to reach USD 12,500 million by 2025, a figure poised for substantial expansion in the coming years. Key trends shaping this market include the burgeoning adoption of Biochemical Pesticides, which leverage natural compounds and biological processes to manage pests and diseases. Within this segment, biopesticides derived from microbial sources, botanical extracts, and pheromones are gaining significant traction. Furthermore, Microbial Pesticides, utilizing bacteria, fungi, viruses, and protozoa to control pests, are witnessing robust growth due to their specificity and minimal impact on non-target organisms. The increasing sophistication of genetic engineering and biotechnology is also fueling the development and adoption of Plant-incorporated Protectants (PIPs), where plants are engineered to produce their own defense mechanisms against pests and diseases. This trend is expected to revolutionize the way crops are protected, offering inherent resistance and reducing the need for external applications. The report meticulously analyzes the market share and growth potential of these segments, providing granular data from 2019 to 2033. Consumer preferences are increasingly leaning towards products with fewer chemical residues, driving demand for sustainable solutions in both Open Field & Protective Cultivation and specialized applications like Horticulture and Floriculture. The market is also observing innovative applications in Others, encompassing seed treatments and soil amendments. The estimated production of World Sustainable Crop Protection Chemicals is a critical metric that this report quantifies, providing a benchmark for future market projections.

The surge in demand for sustainable crop protection chemicals is propelled by a multifaceted array of factors, all coalescing to redefine agricultural practices. Foremost among these is the escalating global population, which necessitates higher agricultural yields while simultaneously demanding safer and healthier food sources. Consumers are more informed than ever about the origins of their food and are actively seeking products free from harmful chemical residues. This consumer-driven demand is a powerful catalyst, compelling food manufacturers and retailers to prioritize produce cultivated using sustainable methods. Regulatory bodies worldwide are also playing a pivotal role by implementing stricter guidelines on the use of synthetic pesticides. These regulations, driven by environmental concerns and public health imperatives, are gradually phasing out or restricting the application of older, more toxic chemicals, creating a fertile ground for the adoption of sustainable alternatives. Furthermore, the inherent limitations and negative externalities associated with conventional pesticides, such as the development of pest resistance, harm to beneficial insects, and soil degradation, are prompting a strategic shift towards more eco-friendly solutions. The economic viability of sustainable crop protection is also improving, with advancements in technology and scaling of production leading to more competitive pricing. Farmers, increasingly aware of the long-term benefits, including improved soil health, biodiversity, and reduced labor costs associated with fewer applications, are embracing these innovations. The projected World Sustainable Crop Protection Chemicals Production of USD 12,500 million in 2025 is a testament to the strong impetus behind this market.

Despite the undeniable momentum, the sustainable crop protection chemicals market is not without its hurdles. One significant challenge pertains to the perceived efficacy and speed of action of some biological and biochemical solutions when compared to their synthetic counterparts. Farmers, accustomed to the rapid and broad-spectrum control offered by conventional pesticides, may exhibit hesitancy in adopting alternatives that might require a more proactive and integrated approach. This can lead to a knowledge gap and the need for extensive farmer education and training on the optimal application methods and timing for sustainable products. The initial cost of some sustainable solutions can also be a barrier to entry, particularly for smallholder farmers or those operating in price-sensitive markets. While the long-term cost-effectiveness is often superior, the upfront investment can be prohibitive. Scalability and consistent availability of certain biological agents or specialized biochemicals can also pose challenges, especially in meeting the demands of large-scale agricultural operations. The shelf life and storage requirements of biological pesticides can be more demanding than synthetic chemicals, requiring specialized infrastructure and handling protocols. Moreover, regulatory frameworks, while evolving, can sometimes be fragmented and slow to adapt to the rapid pace of innovation in the sustainable sector, leading to uncertainties and delays in product approvals. Finally, resistance development, though less common, can still occur in pests and pathogens to sustainable control agents, necessitating ongoing research and development of new solutions.

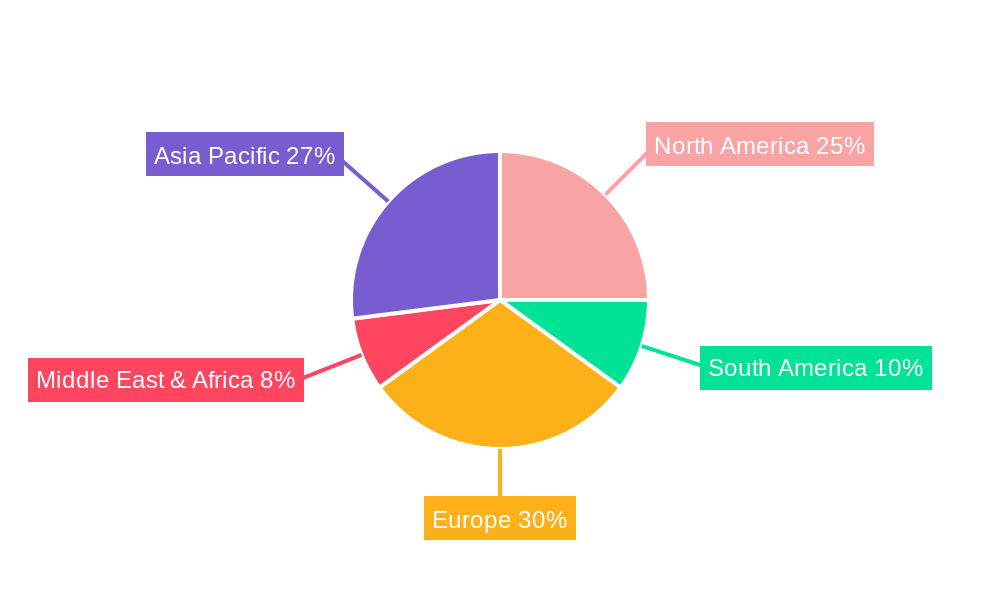

The global sustainable crop protection chemicals market exhibits distinct regional and segmental dominance, driven by varying agricultural practices, regulatory landscapes, and market demands.

Dominating Segments:

Biochemical Pesticides: This segment is projected to hold a significant market share due to its broad applicability, relatively rapid development cycles, and increasing acceptance by both regulators and consumers. The inherent versatility of biochemical pesticides, encompassing biopesticides derived from natural compounds like plant extracts (e.g., neem oil, pyrethrins), microbial metabolites, and even synthetic biology-derived compounds, makes them a cornerstone of sustainable agriculture. Their ability to target specific pests with minimal impact on beneficial organisms and the environment further enhances their appeal. The World Sustainable Crop Protection Chemicals Production is heavily influenced by the growth in this segment, which is expected to contribute substantially to the estimated USD 12,500 million in 2025.

Microbial Pesticides: This sub-segment of biochemicals is experiencing explosive growth. The discovery and application of beneficial microbes, such as Bacillus thuringiensis (Bt) for insect control and various fungal and bacterial species for disease suppression, are revolutionizing pest management. Their specificity, low toxicity, and ability to colonize plant surfaces or the soil ecosystem provide long-lasting protection. The increasing investment in research and development for novel microbial strains with enhanced efficacy and broader spectrum of activity further fuels this dominance.

Open Field & Protective Cultivation: The majority of global crop production occurs in open fields, making this application segment the largest consumer of crop protection chemicals. The demand for sustainable solutions in large-scale row crop farming, as well as in more controlled environments like greenhouses and high tunnels, is immense. As farmers in these sectors seek to reduce their environmental footprint and meet evolving market demands for sustainably grown produce, the adoption of sustainable crop protection chemicals is accelerating. The need for both broad-spectrum and targeted solutions in these diverse agricultural settings drives the demand for a range of sustainable products.

Dominating Regions:

North America: This region, particularly the United States, is a frontrunner in the adoption of sustainable agriculture. Driven by consumer demand for organic and conventionally grown produce with reduced pesticide residues, strong regulatory support for biopesticides, and significant investments in agricultural R&D, North America is a key market. Farmers here are increasingly integrating sustainable practices into their Integrated Pest Management (IPM) programs. The high value of agricultural output and the presence of major agricultural technology companies also contribute to its dominance.

Europe: With its stringent environmental regulations and a strong consumer movement towards organic and eco-friendly food, Europe is another powerhouse in the sustainable crop protection market. Countries like Germany, France, and the Netherlands are at the forefront of promoting biological and biochemical solutions. The European Union's "Farm to Fork" strategy, which aims to make food systems fairer, healthier, and more environmentally friendly, is a significant driver for the market. The emphasis on biodiversity preservation and soil health further bolsters the demand for sustainable crop protection.

The synergistic growth of these segments and regions, coupled with ongoing technological advancements, is shaping the future of crop protection globally. The World Sustainable Crop Protection Chemicals Production figures are a direct reflection of these dominant forces at play.

Several factors are acting as potent catalysts for growth in the sustainable crop protection chemicals industry. The increasing consumer awareness and demand for healthier, residue-free food products are compelling agricultural stakeholders to adopt eco-friendly solutions. Simultaneously, stringent government regulations worldwide are progressively phasing out or restricting the use of conventional synthetic pesticides, creating a significant market opportunity for sustainable alternatives. Furthermore, advancements in biotechnology and research are leading to the development of more effective and cost-competitive biological and biochemical crop protection agents. The growing recognition of the long-term benefits of sustainable practices, such as improved soil health and biodiversity, is also encouraging widespread adoption.

This report provides a holistic and exhaustive analysis of the sustainable crop protection chemicals market, offering unparalleled depth and breadth of coverage. It meticulously traces the market's evolution from the Historical Period (2019-2024), analyzes the pivotal Base Year (2025), and projects future trends through the extensive Forecast Period (2025-2033). The report delves into the intricate interplay of market drivers, challenges, and opportunities, providing actionable insights for stakeholders. It quantifies the World Sustainable Crop Protection Chemicals Production, estimating it at USD 12,500 million in 2025. Furthermore, the report offers a granular breakdown of market segmentation by Type (Biochemical Pesticides, Microbial Pesticides, Plant-incorporated Protectants) and Application (Open Field & Protective Cultivation, Horticulture, Floriculture, Others), highlighting regional dominance and future growth pockets. The competitive landscape is thoroughly examined, featuring key players and their strategic initiatives. This comprehensive report is an indispensable resource for anyone seeking to understand and capitalize on the transformative growth of the sustainable crop protection chemicals sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BASF SE, FMC Corporation, Spec Chem Industry Inc., Syngenta AG, Bayer, Marrone Bio Innovations, Novozymes, Koppert Biological Systems, BioWorks Inc., Gowan Group, Sumitomo Chemical Co., Ltd., Certis USA LLC..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sustainable Crop Protection Chemicals," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainable Crop Protection Chemicals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.