1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable And Bio-based Packaging?

The projected CAGR is approximately 8.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sustainable And Bio-based Packaging

Sustainable And Bio-based PackagingSustainable And Bio-based Packaging by Type (Hard Packaging, Flexible Packaging, World Sustainable And Bio-based Packaging Production ), by Application (Paper and Cardboard Packaging, Food Packaging, Others, World Sustainable And Bio-based Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

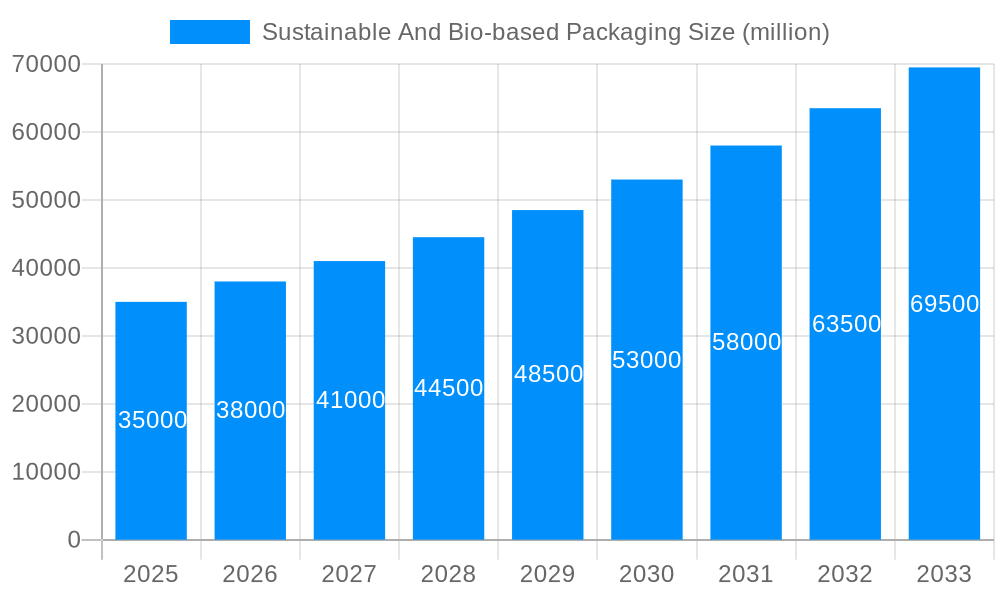

The global sustainable and bio-based packaging market is experiencing robust expansion, propelled by heightened consumer environmental awareness and stringent government mandates to curb plastic waste. The market, valued at $112.49 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.4% from 2025 to 2033. This growth is underpinned by the increasing adoption of bio-based polymers from renewable sources, a rising demand for recyclable and compostable packaging, and a growing consumer preference for eco-friendly products. Key market segments include food packaging and paper & cardboard packaging, leveraging their inherent sustainability and established infrastructure. Challenges, such as the higher cost of bio-based materials and the need for technological advancements, are being addressed through significant R&D investments, driving innovation in material science and manufacturing.

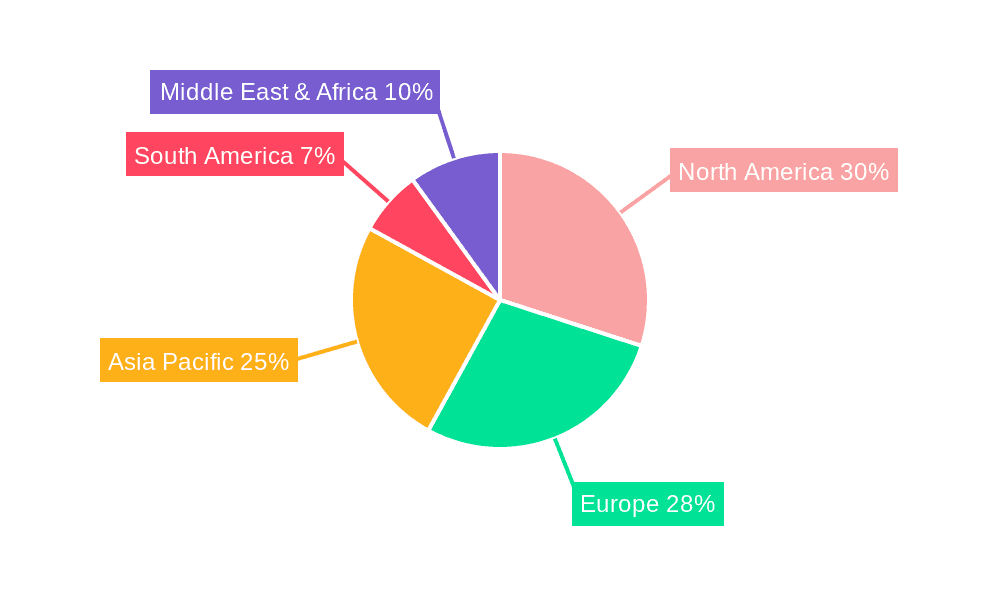

Regionally, North America and Europe lead due to strong consumer awareness and regulations. However, the Asia-Pacific region is set for rapid growth, fueled by urbanization, rising disposable incomes, and an expanding middle class prioritizing eco-friendly choices. The competitive landscape features established players and innovative startups, fostering market dynamism. The long-term outlook for sustainable and bio-based packaging is exceptionally positive, driven by a global shift towards sustainability and environmental stewardship.

The global sustainable and bio-based packaging market is experiencing explosive growth, projected to reach tens of billions of units by 2033. This surge is driven by a confluence of factors, including escalating consumer demand for eco-friendly products, stringent government regulations aimed at reducing plastic waste, and the increasing awareness of the environmental impact of traditional packaging materials. The shift towards sustainable practices is no longer a niche market trend but a mainstream necessity, reshaping the entire packaging landscape. The market's evolution is marked by significant innovation in bio-based materials, such as PLA (polylactic acid) derived from renewable resources like corn starch, and innovative packaging designs focused on minimizing material usage and maximizing recyclability. We are seeing a diversification of applications, with bio-based packaging increasingly adopted across diverse sectors, from food and beverages to cosmetics and pharmaceuticals. Furthermore, advancements in bio-based polymers are expanding the range of functionalities available, allowing sustainable packaging to compete effectively with conventional options in terms of performance and cost-effectiveness. The industry is characterized by collaborations between established packaging giants and innovative start-ups, fostering rapid technological advancement and market expansion. This collaborative approach is crucial in overcoming challenges associated with scale-up, standardization, and ensuring the wide-spread adoption of sustainable alternatives. The market is expected to witness continued consolidation and strategic partnerships, as companies strive to capture market share and enhance their sustainability profiles. This dynamic environment presents exciting opportunities for companies willing to embrace innovation and contribute to a more circular economy. The study period (2019-2033), with a base year of 2025 and forecast period of 2025-2033, indicates significant upward trajectory for this market, with the estimated year 2025 showcasing a strong momentum for growth. The historical period (2019-2024) offers valuable insights to understand the foundation of this growth.

Several powerful forces are accelerating the adoption of sustainable and bio-based packaging. Firstly, heightened consumer awareness of environmental issues and a growing preference for eco-friendly products are driving significant demand. Consumers are increasingly scrutinizing product packaging, favoring brands that prioritize sustainability. This shift in consumer behavior is a major catalyst for market expansion. Secondly, governments worldwide are implementing stricter regulations and policies to curb plastic pollution and promote the use of sustainable materials. These regulations often include bans on certain types of plastics, extended producer responsibility (EPR) schemes, and incentives for using bio-based materials. This regulatory push is creating a more favorable environment for the sustainable packaging industry. Thirdly, the increasing cost and scarcity of fossil fuels are making bio-based alternatives more economically attractive. As the price of petroleum-based materials rises, the relative cost-competitiveness of sustainable options improves, making them a more viable choice for businesses. Finally, technological advancements in bio-based materials science are leading to the development of more efficient and versatile sustainable packaging solutions. Improvements in material properties, such as strength, barrier properties, and printability, are crucial in making these options as effective as their traditional counterparts. These converging forces are creating a powerful impetus for the continued growth and adoption of sustainable and bio-based packaging.

Despite the significant market potential, several challenges hinder the widespread adoption of sustainable and bio-based packaging. One major hurdle is the higher cost of production compared to traditional petroleum-based packaging. While the cost gap is narrowing, bio-based materials often require more complex manufacturing processes, resulting in a higher initial investment. Another significant challenge is the scalability of production. Many bio-based materials are currently produced on a smaller scale, limiting their availability and hindering their ability to meet the growing market demand. Maintaining the quality and consistency of bio-based materials can also be challenging, as they are often derived from renewable resources that can vary in quality depending on factors like weather conditions and agricultural practices. Furthermore, the performance characteristics of some bio-based materials may not yet match those of conventional packaging in terms of barrier properties, strength, or shelf-life extension. This requires ongoing research and development to improve the functionality of bio-based materials and make them suitable for a wider range of applications. Finally, establishing a robust and efficient recycling infrastructure for bio-based materials is crucial. Without proper recycling systems, the environmental benefits of these materials can be significantly diminished.

The sustainable and bio-based packaging market exhibits strong regional variations. Europe is currently a leading market, driven by stringent environmental regulations, high consumer awareness, and a strong focus on circular economy initiatives. North America is also witnessing substantial growth, propelled by similar factors, though at a potentially slower pace. Asia-Pacific holds immense growth potential, owing to its large population and rapidly expanding consumer base, although infrastructure development and regulatory frameworks are key factors impacting its speed of adoption.

Segments Dominating the Market:

Food Packaging: This segment dominates due to the growing demand for sustainable solutions in the food and beverage industry, driven by consumer preferences and regulatory pressure to reduce food waste and plastic pollution. The high volume of food packaging produced globally makes it a major target for the adoption of sustainable alternatives. This segment is projected to witness substantial growth, exceeding billions of units within the forecast period.

Paper and Cardboard Packaging: This segment consistently holds a significant market share owing to the already established infrastructure for paper-based packaging and the relatively low cost compared to many bio-based alternatives. The increasing use of recycled paper and sustainable forestry practices further boost its popularity.

Flexible Packaging: This segment is experiencing rapid growth due to increasing demand for lightweight, versatile, and cost-effective packaging options. Bio-based flexible films and pouches are gaining traction, but challenges remain in achieving the same performance levels as traditional plastics in certain applications.

In terms of packaging type, the flexible packaging segment is projected to experience significant growth due to its adaptability and suitability for various applications, while hard packaging segments may experience growth that is slightly less pronounced but still substantial, driven by the need for durable, protective packaging for various products.

The overall market is characterized by a dynamic interplay between these segments, with innovations in bio-based materials and packaging technologies constantly reshaping the market landscape.

Several factors are accelerating growth: increasing consumer demand for eco-friendly products, stringent government regulations promoting sustainable practices, rising costs of fossil fuels, and continuous technological advancements leading to the development of improved bio-based materials are key drivers for the market expansion. These converging factors create a supportive environment for sustained growth in the sustainable and bio-based packaging industry.

This report provides a comprehensive overview of the sustainable and bio-based packaging market, analyzing key trends, drivers, challenges, and opportunities. It includes detailed market forecasts, competitive landscapes, and profiles of leading companies, offering valuable insights for businesses operating in or considering entry into this rapidly evolving sector. The report's detailed analysis across various segments and geographical regions provides a holistic understanding of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.4%.

Key companies in the market include Alterpacks, Anellotech, Arekapak, Arkema, Avantium, BIOLO, Biovox, BlockTexx, Carbiolice, Cellugy, DuFor Resins BV, Earthodic, Esbottle Oy, Fiberwood Oy, Full Cycle Bioplastics, Futamura Chemical, Futurity Bio-Ventures, Genecis Bioindustries, Huhtamaki, Kaneka Corporation, Kelpi Industries, Lactips SA, Loliware, Marea, Mitsubishi Chemical Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD 112.49 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Sustainable And Bio-based Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainable And Bio-based Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.