1. What is the projected Compound Annual Growth Rate (CAGR) of the Surgical Reusable Medical Gloves?

The projected CAGR is approximately 8.59%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Surgical Reusable Medical Gloves

Surgical Reusable Medical GlovesSurgical Reusable Medical Gloves by Type (Latex, Nitrile Rubber), by Application (Online, Medical Store), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

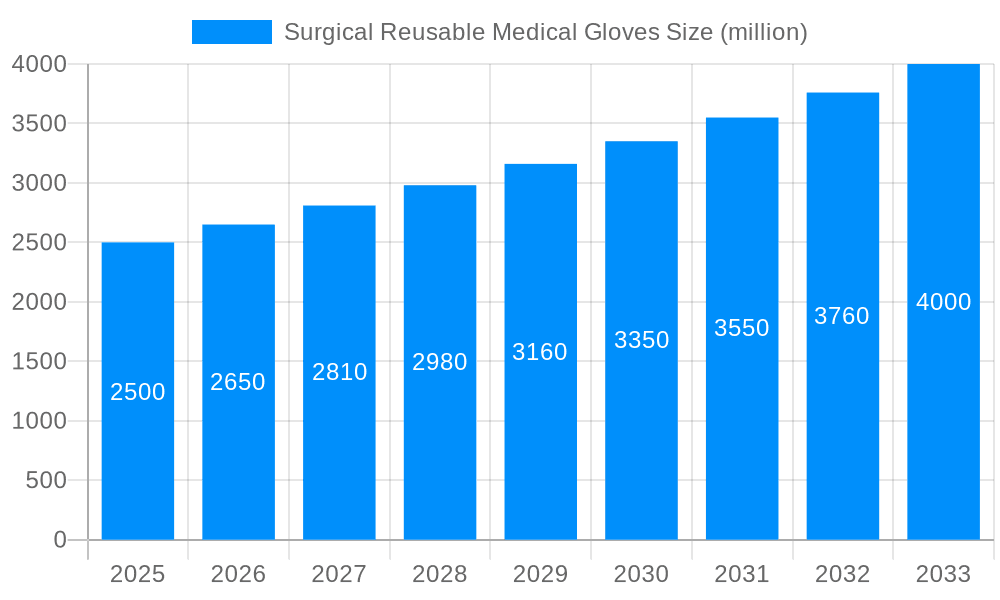

The global surgical reusable medical gloves market is poised for significant expansion, propelled by a surge in surgical procedures, an elevated focus on infection prevention, and stringent healthcare hygiene mandates. The market, valued at $16.459 billion in the base year of 2025, is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 8.59% from 2025 to 2033. Key growth catalysts include an aging global demographic, the rising incidence of chronic conditions requiring surgical intervention, and innovations in reusable glove technology. Challenges include the substantial upfront costs for sterilization equipment and the critical need for stringent adherence to sterilization protocols to mitigate cross-contamination risks. The market is segmented by material (latex, nitrile, neoprene), sterilization method (autoclave, ethylene oxide), and end-user (hospitals, ambulatory surgical centers).

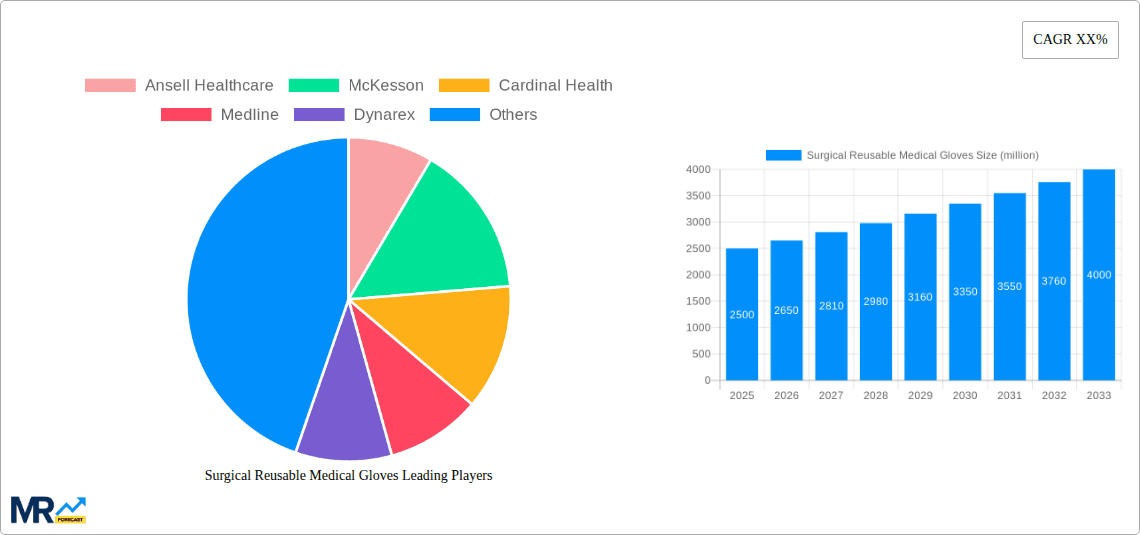

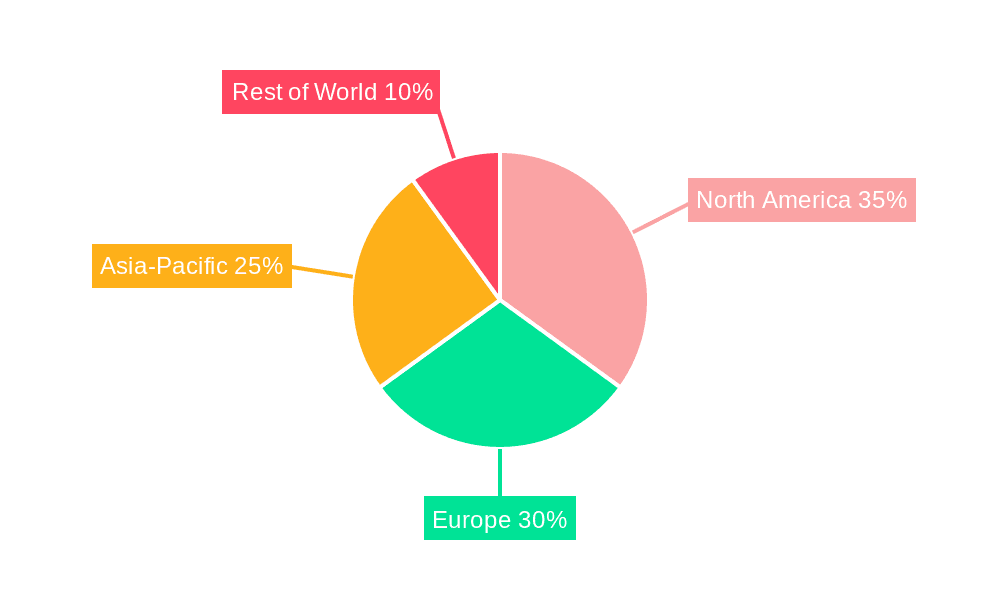

Key industry leaders such as Ansell Healthcare, McKesson, Cardinal Health, Medline, and Dynarex are actively pursuing product enhancements and strategic alliances to solidify their market standing. Regional disparities in healthcare infrastructure and regulatory frameworks influence market dynamics, with North America and Europe currently dominating market share. The competitive arena features established corporations and new entrants competing through product innovation, advanced sterilization technologies, and strategic mergers and acquisitions. Increased investment in R&D is directed towards improving glove durability, user comfort, and sterilization efficacy. Furthermore, the integration of sustainable manufacturing and eco-friendly sterilization techniques is becoming a priority, reflecting a global commitment to environmental responsibility. Future market trajectory will be shaped by evolving regulations, advancements in sterilization processes, and the growing demand for cost-efficient healthcare solutions. The unwavering commitment to infection control and patient safety will continue to be a principal driver of market growth throughout the forecast period.

The global surgical reusable medical gloves market is experiencing significant transformation, driven by a complex interplay of factors. While disposable gloves have historically dominated the market due to perceived hygiene benefits and cost-effectiveness in single-use scenarios, reusable gloves are witnessing a resurgence, particularly in specific niches. This resurgence is fueled by growing environmental concerns regarding the massive waste generated by disposable gloves, coupled with increasing cost pressures within healthcare systems. The market is witnessing a shift towards innovative materials and sterilization techniques, improving the durability and safety of reusable gloves. This allows for more cost-effective utilization in the long run, offsetting the initial higher investment. The market is segmented by material type (e.g., latex, nitrile, neoprene), sterilization method (e.g., ethylene oxide, steam), and end-user (e.g., hospitals, clinics, ambulatory surgical centers). While the overall market size remains significantly smaller than disposable gloves (estimated at several billion units annually, compared to disposable glove markets measured in hundreds of billions of units), the reusable segment is exhibiting above-average growth rates. This is especially true in settings where cost-effectiveness and environmental sustainability are paramount considerations. Technological advancements are focusing on enhancing the reusability lifespan, improving sterilization processes to minimize damage, and improving the glove's comfort and dexterity for surgeons. The market is also grappling with regulatory hurdles concerning sterilization validation and the establishment of clear guidelines for safe and effective reuse protocols. This dynamic market is ripe for innovation, promising lucrative opportunities for companies that successfully navigate the challenges and tap into growing demand for sustainable healthcare solutions. The overall trend points to a gradual but steady increase in market share for reusable surgical gloves, driven by a confluence of economic, environmental, and technological factors.

Several key factors are driving the growth of the surgical reusable medical gloves market. Firstly, the escalating global concern over the environmental impact of single-use plastics is significantly impacting purchasing decisions within the healthcare sector. Hospitals and clinics are increasingly adopting sustainable practices, and the reduced waste associated with reusable gloves is a highly attractive proposition. Secondly, cost-effectiveness plays a crucial role. While the initial investment in reusable gloves may be higher, the long-term cost savings due to repeated use can be substantial, especially in high-volume settings. This is particularly relevant given the increasing financial pressures faced by healthcare providers worldwide. Thirdly, advancements in sterilization techniques are making reusable gloves safer and more reliable. Improved sterilization methods ensure the effective elimination of pathogens, addressing a key concern about the safety of reused medical devices. Finally, the ongoing focus on infection prevention and control is another significant driver. Reusable gloves, when properly sterilized and managed, can offer a comparable level of protection against infection compared to disposable counterparts, making them a viable alternative in many applications. These factors collectively contribute to the rising adoption of reusable surgical medical gloves across various healthcare settings.

Despite the growing demand, the surgical reusable medical gloves market faces several challenges. Firstly, the perception of reusable gloves as less hygienic than disposable ones persists, hindering their widespread acceptance among healthcare professionals. This requires continued education and demonstration of effective sterilization protocols to build trust and confidence. Secondly, the initial investment cost of reusable gloves is higher than disposable ones, potentially posing a barrier to adoption, particularly for smaller clinics or practices with limited budgets. Thirdly, implementing and maintaining effective sterilization and reuse protocols requires careful attention to detail and adherence to strict guidelines. Failure to do so may lead to potential infections and compromise patient safety, making rigorous training and quality control paramount. Fourthly, the durability and lifespan of reusable gloves can vary, depending on the material and usage. This can create uncertainty about cost predictability and make accurate cost-benefit analyses challenging. Lastly, regulatory requirements and compliance standards vary across different regions, which can add complexity to market entry and global expansion for manufacturers.

North America and Europe: These regions are expected to hold significant market shares due to high healthcare expenditure, stringent regulatory frameworks, and growing awareness of environmental sustainability. The established healthcare infrastructure and high adoption rates of advanced medical technologies contribute to this dominance. These regions also have a stronger emphasis on infection control practices, which indirectly benefits the reusable glove market.

Asia-Pacific: This region exhibits high growth potential due to rapid economic development, increasing healthcare infrastructure investment, and a rising middle class with improved access to healthcare. However, regulatory frameworks may be less stringent in certain areas compared to North America or Europe, impacting market dynamics. The region is also a major manufacturing hub for medical gloves, potentially influencing price points and availability.

Material Segment: Nitrile: Nitrile gloves are predicted to hold a significant segment share due to their superior strength, elasticity, and resistance to punctures compared to latex. This translates to increased durability and reusability, making them a cost-effective and safe choice for many healthcare settings. The reduced risk of allergic reactions compared to latex is also a critical factor driving this dominance.

Sterilization Method Segment: Ethylene Oxide (EtO): EtO sterilization is widely used in the reusable glove market due to its efficacy in eliminating a broad range of microorganisms. While other methods like steam sterilization exist, EtO is often preferred for its compatibility with a wider range of glove materials. However, EtO's environmental impact is a concern, and the industry is actively exploring eco-friendlier sterilization alternatives.

The market is driven by a combination of regional factors, reflecting varied healthcare expenditure, regulatory compliance, and consumer awareness levels. The high growth potential in the Asia-Pacific region, coupled with the cost-effectiveness and safety advantages of nitrile materials, suggests these factors will significantly influence the market's composition in the coming years. The millions of units sold annually across these segments reflect a growing and evolving market.

The industry is experiencing significant growth spurred by a convergence of factors. Rising environmental concerns about single-use plastic waste are pushing hospitals and clinics to explore sustainable alternatives. Simultaneously, increasing healthcare costs are driving the search for cost-effective solutions, with reusable gloves offering long-term savings. Technological advancements in sterilization methods and improved glove materials enhance their durability and hygiene, reinforcing their viability as a reliable alternative to disposable gloves. These factors, combined with an increased focus on infection prevention and control, strongly support the continuous growth and expansion of the reusable surgical medical gloves market.

This report provides an in-depth analysis of the surgical reusable medical gloves market, covering market size and growth projections (millions of units) for the study period (2019-2033). It offers detailed segmentation by material, sterilization method, and end-user, along with regional breakdowns, identifying key growth opportunities. Furthermore, the report profiles leading market players, analyzes their strategies, and discusses significant industry developments. It provides valuable insights for businesses involved in the manufacture, distribution, and use of surgical reusable medical gloves, enabling data-driven decision-making for effective market navigation and strategic planning. The forecast period (2025-2033) and detailed historical period data (2019-2024) offer both short-term and long-term perspectives for informed strategy development.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.59% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.59%.

Key companies in the market include Ansell Healthcare, McKesson, Cardinal Health, Medline, Dynarex, Top Glove, Hartalega Holdings Berhad, Semperit, Kimberly-Clark, .

The market segments include Type, Application.

The market size is estimated to be USD 16.459 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Surgical Reusable Medical Gloves," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Surgical Reusable Medical Gloves, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.