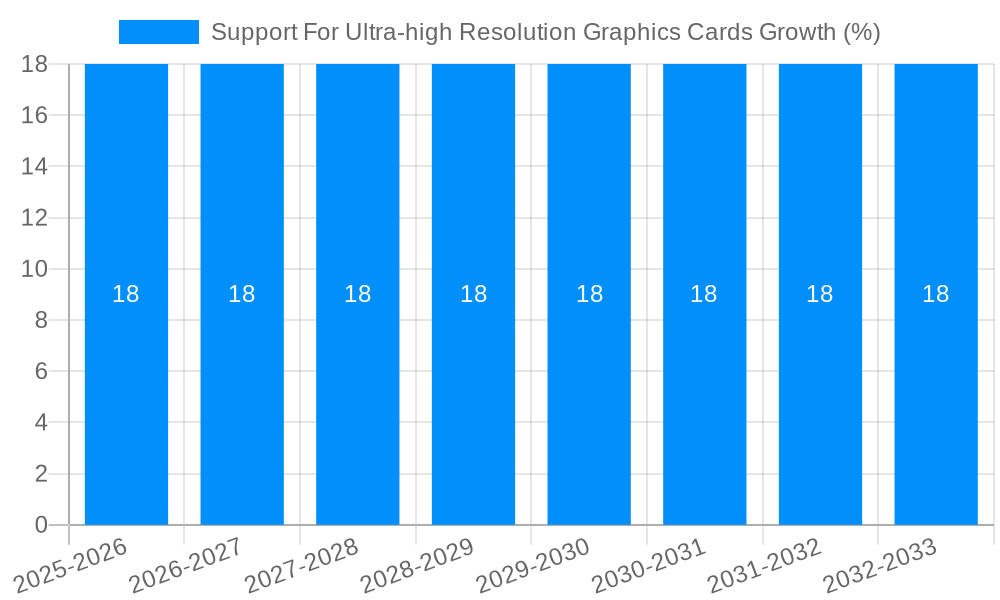

1. What is the projected Compound Annual Growth Rate (CAGR) of the Support For Ultra-high Resolution Graphics Cards?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Support For Ultra-high Resolution Graphics Cards

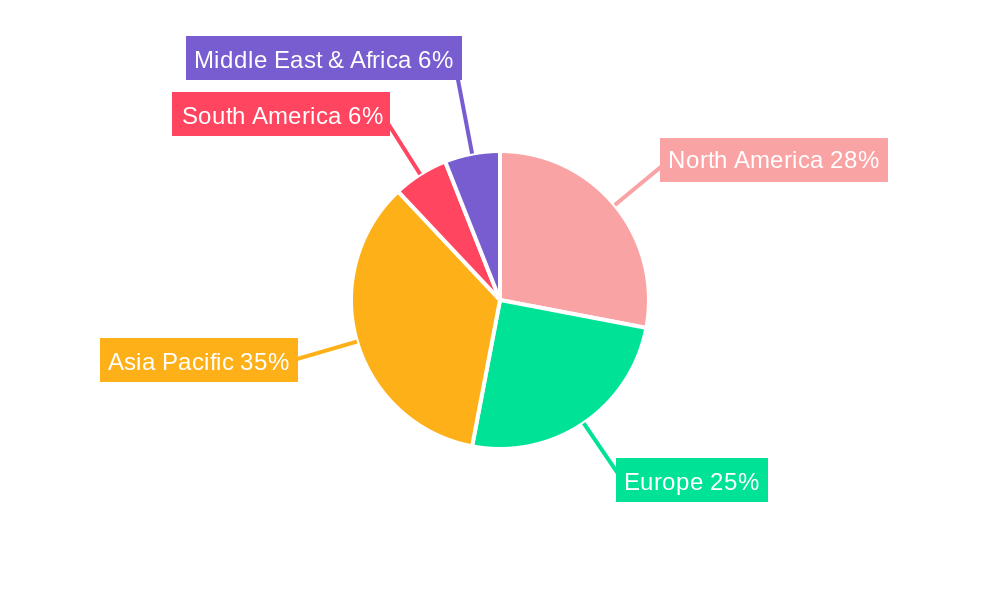

Support For Ultra-high Resolution Graphics CardsSupport For Ultra-high Resolution Graphics Cards by Type (Single Fan, Multiple Fans, World Support For Ultra-high Resolution Graphics Cards Production ), by Application (Online Sales, Offline Sales, World Support For Ultra-high Resolution Graphics Cards Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

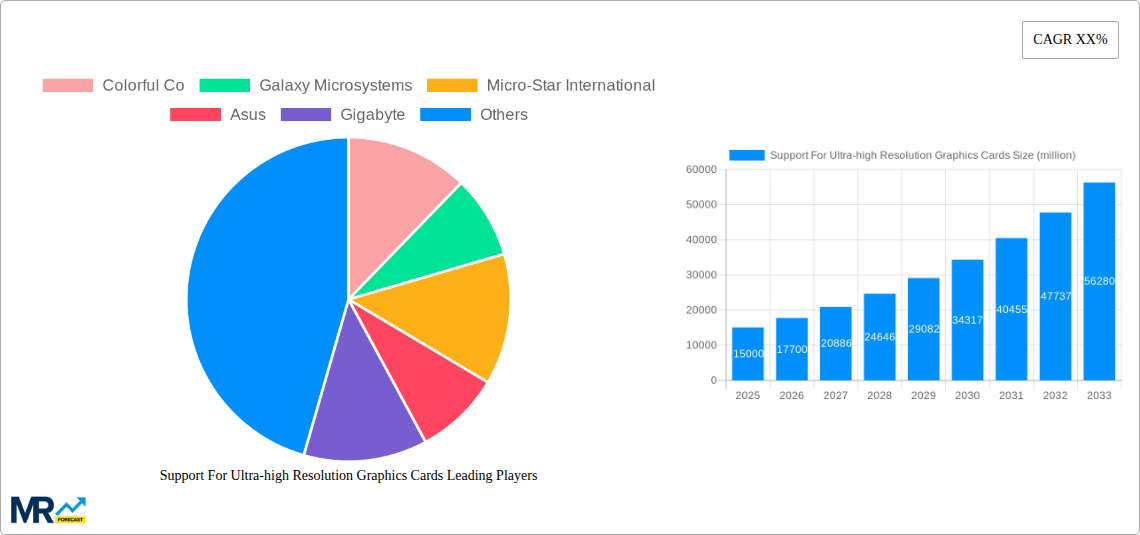

The market for support for ultra-high-resolution graphics cards is experiencing robust growth, driven by the increasing demand for high-resolution displays in gaming, professional applications, and virtual reality (VR) experiences. The rising adoption of 4K and 8K displays, coupled with advancements in graphics processing unit (GPU) technology, is fueling this expansion. Major players like Nvidia, AMD, and Intel are continuously innovating to meet the escalating processing power requirements of these high-resolution displays. The market is segmented by fan type (single and multiple) and sales channel (online and offline), with online sales currently demonstrating faster growth due to increased e-commerce penetration and convenient access. Geographic regions like North America and Asia Pacific are key contributors to the overall market size, reflecting high consumer spending on gaming and technological advancements. While the cost of high-end graphics cards remains a restraint for some consumers, the long-term market outlook remains positive, driven by continued technological advancements and the growing popularity of visually intensive applications. We estimate the market size in 2025 to be around $15 billion USD, growing at a compound annual growth rate (CAGR) of 12% from 2025-2033. This projection considers the historical growth trend, the continuous introduction of new GPU technologies and the steady growth of gaming and professional markets requiring high-resolution graphics capabilities.

The competitive landscape is highly concentrated, with major players like Nvidia and AMD dominating the market, though other manufacturers like MSI, Asus, and Gigabyte also hold significant shares. These companies are constantly engaged in innovation to enhance performance, reduce energy consumption, and improve the overall user experience. The market is characterized by fierce competition, pushing companies to release new products frequently and offer various price points to cater to diverse consumer needs. This competitiveness drives innovation, benefiting the overall market and ensuring consumers have access to advanced graphics solutions. The continued development of VR/AR technologies and the increasing adoption of high-resolution displays in professional fields like medical imaging, architectural design, and video editing will further boost the market. This signifies a significant long-term opportunity for growth.

The global market for support services related to ultra-high-resolution graphics cards experienced robust growth throughout the historical period (2019-2024), driven primarily by the increasing adoption of high-resolution displays in gaming, professional applications, and virtual reality (VR). The market witnessed a surge in demand for technical support, repair services, and extended warranties as consumers and businesses invested in increasingly sophisticated graphics hardware. This trend is projected to continue throughout the forecast period (2025-2033), albeit at a potentially moderated pace as the market matures. The base year 2025 shows an estimated market value of XXX million units, reflecting a healthy level of existing support needs and anticipation of future growth tied to technological advancements. Key market insights reveal a significant shift towards online support channels, mirroring broader consumer trends towards digital self-service. However, the need for specialized, in-person support remains significant, particularly for high-value professional-grade graphics cards. The increasing complexity of graphics card technology, alongside the growing integration of these cards into diverse applications (from gaming to AI processing), contributes to a sustained demand for expert support services. The competitive landscape is characterized by a mix of large, established players and smaller, specialized providers, each vying for market share by offering differentiated support packages and service levels. The transition towards increasingly powerful and energy-efficient cards further impacts support needs, requiring technicians to stay abreast of the latest hardware and software developments. This continual evolution ensures that the market for support services remains dynamic and responsive to the ever-changing landscape of high-resolution graphics technology. The market shows a notable reliance on established brands' support channels, underscoring consumer trust in established names in the hardware sector. Finally, the rising prevalence of cloud gaming and remote work presents both opportunities and challenges for the support sector, demanding adaptable and scalable service models.

Several factors are driving the growth of the support market for ultra-high-resolution graphics cards. The escalating adoption of 4K, 8K, and beyond displays across gaming, professional visualization (CAD, video editing), and VR applications fuels the need for specialized support. These high-resolution graphics cards are complex pieces of technology, prone to malfunctions and requiring expert troubleshooting. The increasing computational demands of modern games and professional software push the limits of even the most advanced hardware, leading to a higher frequency of support requests. Furthermore, the extended lifespan of high-end graphics cards contributes to the longevity of the support market. Consumers and businesses are increasingly investing in longer warranties and preventative maintenance plans, guaranteeing a continuous revenue stream for support providers. The growth of e-sports and the professional gaming industry also plays a crucial role, as these fields necessitate flawless graphics performance and prompt technical assistance to minimize downtime. This growing market segment generates substantial demand for high-quality support services. The proliferation of online gaming and virtual work environments further emphasizes the importance of reliable technical support. Disruptions to these crucial digital services can have significant consequences, leading users to prioritize rapid and effective resolutions. The market is also seeing a growth in demand for specialized support services such as data recovery from failed graphics cards and customized solutions for high-end applications.

Despite the robust growth potential, several challenges and restraints impact the support market for ultra-high-resolution graphics cards. The rapid pace of technological innovation presents a significant obstacle, requiring support personnel to continuously update their knowledge and skills to maintain competency. The complexity of the hardware and software involved often necessitates specialized expertise, resulting in higher support costs and potentially longer resolution times. The geographic dispersion of customers, particularly in global markets, poses logistical challenges for providing efficient and timely support. Maintaining consistent service quality across diverse regions and languages requires significant investment in infrastructure and training. Furthermore, the competitive landscape is intense, with numerous players vying for market share, leading to price pressure and the need for constant differentiation in service offerings. The ever-increasing demand for faster and more effective support solutions also places pressure on support providers to optimize their processes and invest in advanced diagnostic tools. Lastly, the increasing reliance on online support channels poses challenges regarding the ability to effectively handle complex technical issues remotely. The limitations of remote diagnosis necessitate a combination of online and offline support channels to cater effectively to the diverse needs of customers.

The North American and Asian markets are expected to dominate the ultra-high-resolution graphics card support market throughout the forecast period. These regions boast significant concentrations of gaming enthusiasts, professional users, and manufacturers, leading to higher demand for support services.

North America: The strong gaming culture and substantial presence of technology companies in the region fuel a substantial need for graphics card support. The high disposable income among consumers further contributes to the market's size.

Asia (specifically, China and Japan): These countries are experiencing rapid growth in the gaming and professional visualization sectors, creating high demand for both hardware and associated support.

Dominant Segment: Multiple Fans Graphics Cards

The segment of multiple-fan graphics cards will likely experience significant growth, exceeding the single-fan segment. This is due to several factors:

Higher Performance: Multiple-fan cards are generally associated with higher-end products offering superior performance capabilities and thus attracting more users who demand higher levels of support in case of malfunction or degradation.

Increased Complexity: The increased complexity of cooling systems within multiple-fan graphics cards often translates to more intricate troubleshooting procedures, increasing the demand for specialized support.

Premium Pricing: High-end multiple-fan graphics cards typically command premium prices, leading consumers to invest in extended warranties and premium support packages.

Heat Dissipation: The advanced cooling mechanisms required for such cards are more susceptible to failure, which in turn elevates the demand for replacement and repair services.

In a paragraph: The multiple-fan segment is poised for substantial growth due to the higher performance and complexity associated with this type of graphics card. This translates to a greater demand for specialized troubleshooting and repair services, as well as premium support packages, driving up overall market value in comparison to single-fan cards.

Several factors will catalyze growth within the ultra-high-resolution graphics card support industry. The increasing prevalence of virtual and augmented reality (VR/AR) applications will drive the need for robust and reliable support. The continued development and adoption of advanced graphics technologies, such as ray tracing and AI-powered rendering, will also contribute to market expansion. Furthermore, the rise of cloud gaming platforms and the growing demand for remote work solutions necessitate highly responsive and scalable support services. Finally, proactive maintenance plans and preventative support offerings will play a crucial role in boosting market growth.

This report offers a comprehensive analysis of the support market for ultra-high-resolution graphics cards, providing valuable insights for businesses operating within this dynamic sector. It offers in-depth information on market trends, driving forces, challenges, key regions, leading players, and significant industry developments. The report’s data-driven projections and analyses provide valuable strategic guidance for businesses seeking to navigate the complexities of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Colorful Co, Galaxy Microsystems, Micro-Star International, Asus, Gigabyte, ZOTAC, Nvidia, AMD, MSI Global, VisionTek, XFX, Matrox, EVGA.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Support For Ultra-high Resolution Graphics Cards," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Support For Ultra-high Resolution Graphics Cards, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.