1. What is the projected Compound Annual Growth Rate (CAGR) of the Superfine High White Kaolin?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Superfine High White Kaolin

Superfine High White KaolinSuperfine High White Kaolin by Type (Particle Size: 0.2-1μm, Particle Size: 1-2μm, World Superfine High White Kaolin Production ), by Application (Coating, Plastic, Rubber, Ceramics, Architecture, Papermaking, Others, World Superfine High White Kaolin Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

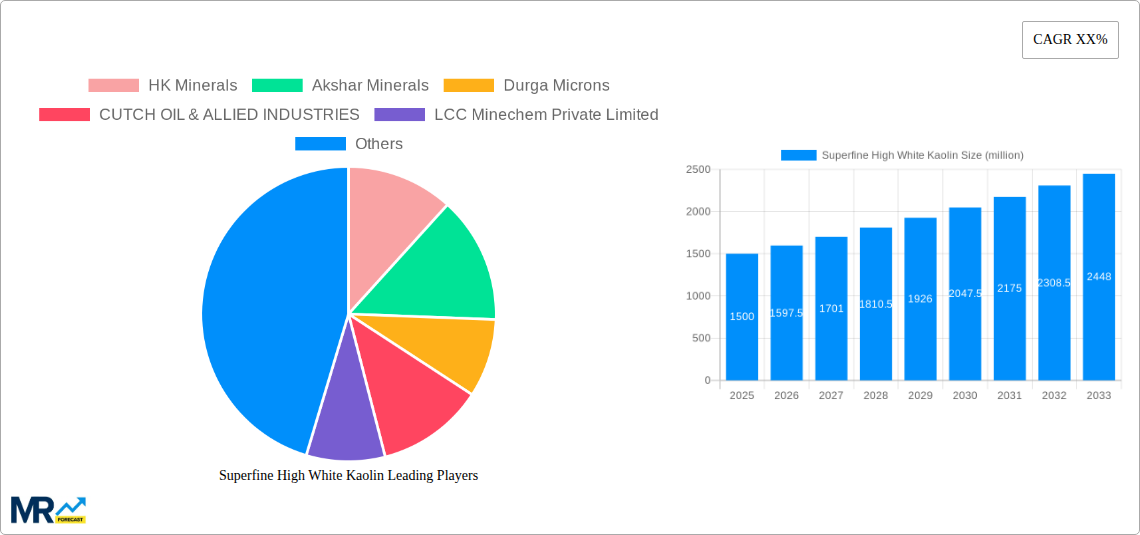

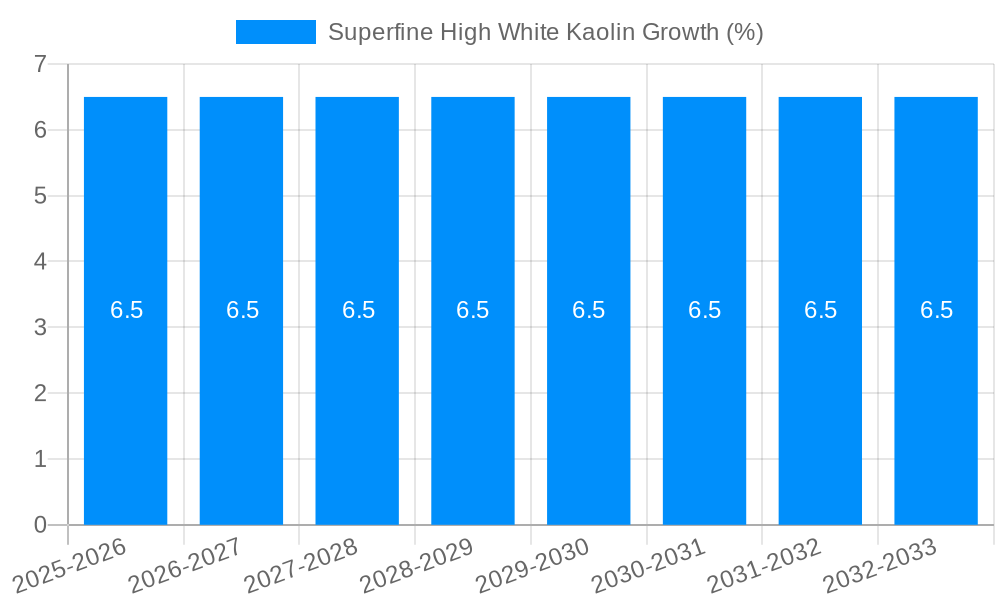

The global market for Superfine High White Kaolin is poised for significant expansion, driven by its crucial role in a multitude of industries. With an estimated market size of approximately $1.5 billion in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 6.5% over the forecast period from 2025 to 2033. This growth is primarily fueled by the increasing demand for high-quality kaolin in applications such as coatings, plastics, rubber, and papermaking, where its superior whiteness and fine particle size are critical for enhancing product performance and aesthetics. The burgeoning construction industry, particularly in emerging economies, also presents a substantial opportunity, with kaolin being a key ingredient in architectural materials like paints and cementitious products. Furthermore, advancements in processing technologies are enabling the production of even finer and brighter kaolin grades, catering to specialized applications and further stimulating market demand.

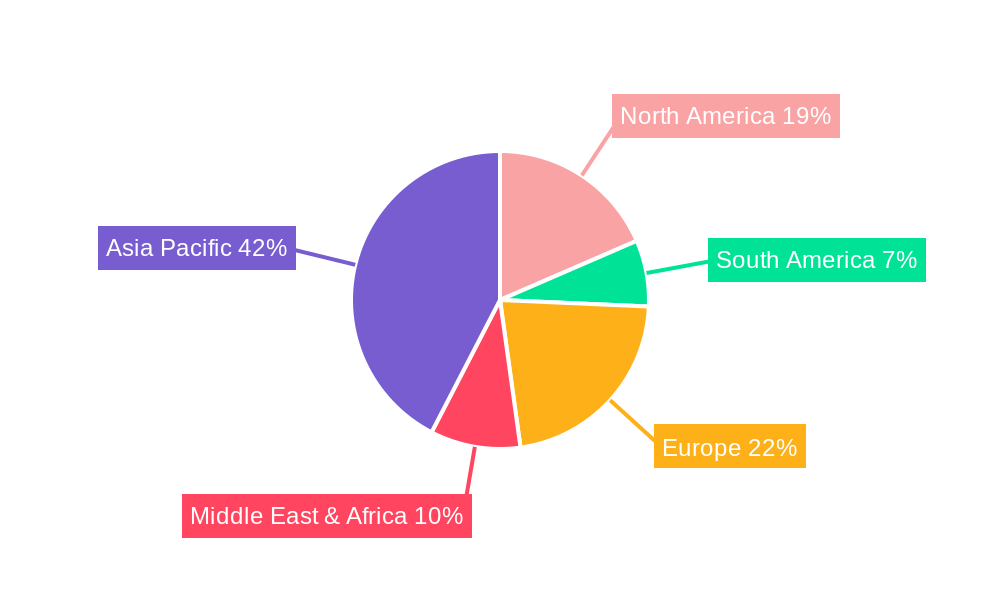

Despite the strong growth trajectory, certain factors could present challenges. Fluctuations in raw material prices and the availability of suitable high-grade kaolin deposits may influence production costs and supply chain stability. Environmental regulations concerning mining and processing operations, alongside the adoption of alternative materials in some applications, could also act as restraints. However, the inherent properties of superfine high white kaolin, such as its insulating capabilities and low abrasiveness, continue to make it an indispensable component in many manufacturing processes. The market segmentation reveals a notable demand for kaolin with particle sizes between 0.2-1μm and 1-2μm, reflecting a preference for finely processed materials. Asia Pacific, led by China and India, is expected to remain the dominant region, owing to its substantial manufacturing base and increasing industrialization.

Here is a unique report description for Superfine High White Kaolin, incorporating the specified details, headings, word counts, and formatting:

The global Superfine High White Kaolin market is poised for significant expansion, driven by escalating demand across a multitude of high-value industries. Our analysis, covering the Study Period: 2019-2033, with a Base Year: 2025 and Estimated Year: 2025, forecasts a robust trajectory. The Historical Period: 2019-2024 laid the groundwork for this growth, characterized by a steady increase in adoption due to kaolin's inherent properties. Key market insights reveal a growing preference for superfine grades, particularly those with exceptional whiteness, as manufacturers seek to enhance the aesthetic and functional qualities of their end products. The Particle Size: 0.2-1μm segment, for instance, is witnessing a surge in demand due to its ability to impart superior smoothness, brightness, and opacity, making it indispensable in advanced coating formulations and high-performance plastics. Similarly, the Particle Size: 1-2μm segment continues to be a cornerstone for applications requiring a balance of fine particle size and cost-effectiveness, such as in certain ceramic formulations and specialized rubber compounds. The World Superfine High White Kaolin Production is a critical metric, indicating the evolving supply chain dynamics and the increasing capacity of key players to meet this burgeoning demand. As industries worldwide prioritize sustainability and enhanced product performance, the role of superfine high white kaolin becomes ever more critical, acting as a crucial additive that elevates the quality and appeal of everything from premium paints and durable architectural materials to high-grade paper and advanced composite products. The market's evolution is also being shaped by technological advancements in processing and purification, enabling the production of kaolin with even finer particle sizes and higher levels of purity, thus opening new application frontiers.

The remarkable growth trajectory of the Superfine High White Kaolin market is propelled by a confluence of powerful driving forces, primarily stemming from the insatiable demand for enhanced product performance and aesthetic appeal across diverse industrial sectors. The coatings industry, a significant consumer, is constantly seeking advanced pigments and extenders that offer superior opacity, brightness, and durability. Superfine high white kaolin fulfills these requirements exceptionally well, leading to its increased incorporation in premium paints, varnishes, and inks. Furthermore, the burgeoning plastics industry leverages superfine kaolin to improve mechanical properties such as stiffness, tensile strength, and impact resistance, while also contributing to surface finish. This is particularly true for applications demanding lightweight yet robust materials. In the rubber sector, superfine kaolin acts as a reinforcing filler, enhancing wear resistance and tensile strength, crucial for automotive components and industrial goods. The construction industry's need for high-performance materials in architectural applications, such as façade coatings and joint compounds, also contributes significantly. The inherent properties of superfine high white kaolin, including its low abrasiveness, chemical inertness, and excellent dispersion capabilities, make it a preferred choice for these demanding applications. The increasing global population and rising disposable incomes further fuel the demand for end products that utilize these advanced materials, thereby creating a sustained demand for superfine high white kaolin.

Despite the robust growth prospects, the Superfine High White Kaolin market is not without its challenges and restraints, which could potentially temper its expansion. One significant challenge revolves around the World Superfine High White Kaolin Production and its geographic concentration. While production is increasing, a considerable portion of high-quality superfine white kaolin reserves are located in specific regions, leading to potential supply chain vulnerabilities and price volatility due to geopolitical factors or natural resource limitations. The extraction and processing of superfine kaolin are also energy-intensive, which can lead to increased operational costs, particularly in regions with rising energy prices. Furthermore, stringent environmental regulations concerning mining operations and mineral processing can add to the compliance costs for manufacturers. The development and maintenance of sophisticated processing technologies required to achieve superfine particle sizes and high levels of whiteness demand substantial capital investment, creating a barrier to entry for smaller players. Competition from alternative mineral fillers and synthetic materials, although often at a higher price point, can also pose a restraint, especially in price-sensitive applications. Fluctuations in the global economic climate can impact the demand from key end-user industries such as construction and automotive, thereby influencing the overall market growth. Ensuring consistent quality and purity across large-scale production batches can also be a complex undertaking for manufacturers.

The Superfine High White Kaolin market is characterized by distinct regional dominance and segment leadership, painting a clear picture of where the most significant activity and future growth are likely to be concentrated.

Key Dominant Regions/Countries:

Key Dominant Segments:

The Superfine High White Kaolin industry is experiencing growth catalysts fueled by an increasing global demand for enhanced product performance and aesthetic appeal. The relentless pursuit of superior opacity, brightness, and durability in the coatings sector, alongside the need for improved mechanical properties and surface finishes in plastics and rubber, are significant catalysts. Furthermore, advancements in processing technologies that enable the production of ultra-fine kaolin with exceptional purity and consistency are opening up new application avenues and reinforcing existing ones. The growing emphasis on sustainable and eco-friendly materials, where kaolin can act as a partial replacement for more resource-intensive or environmentally impactful additives, also serves as a key growth catalyst.

This comprehensive report delves deeply into the global Superfine High White Kaolin market, offering an in-depth analysis from 2019-2033, with a specific focus on the Base Year: 2025 and Estimated Year: 2025. It provides a meticulous examination of market dynamics, including historical trends (2019-2024), current estimations, and future projections. The report meticulously dissects the key market drivers and growth catalysts, such as the increasing demand for high-performance coatings, advanced plastics, and specialized rubber compounds, all of which are critically dependent on the unique properties of superfine white kaolin. It also thoroughly investigates the challenges and restraints impacting the market, such as the geographical concentration of reserves and the energy-intensive nature of processing. Furthermore, the report highlights the dominant regions and segments, with particular emphasis on China's pivotal role in World Superfine High White Kaolin Production and the significant market share held by applications like Coating, Plastic, and Papermaking, alongside the critical Particle Size: 0.2-1μm and Particle Size: 1-2μm segments. Key players and their strategic developments are also detailed, offering a holistic view of the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include HK Minerals, Akshar Minerals, Durga Microns, CUTCH OIL & ALLIED INDUSTRIES, LCC Minechem Private Limited, Inner Mongolia Sanxin Kaolin Co., Ltd, Longyan Kaolin Co., Ltd, China Kaolin Co., Ltd, Maoming Maoqun Kaolin Co., Ltd, Tianjin Yandong Mineral Products Co., Ltd, Shanxi Jinyang Calcined Kaolin Co., Ltd, Shijiazhuang Chenxing Industrial Co., Ltd.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Superfine High White Kaolin," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Superfine High White Kaolin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.