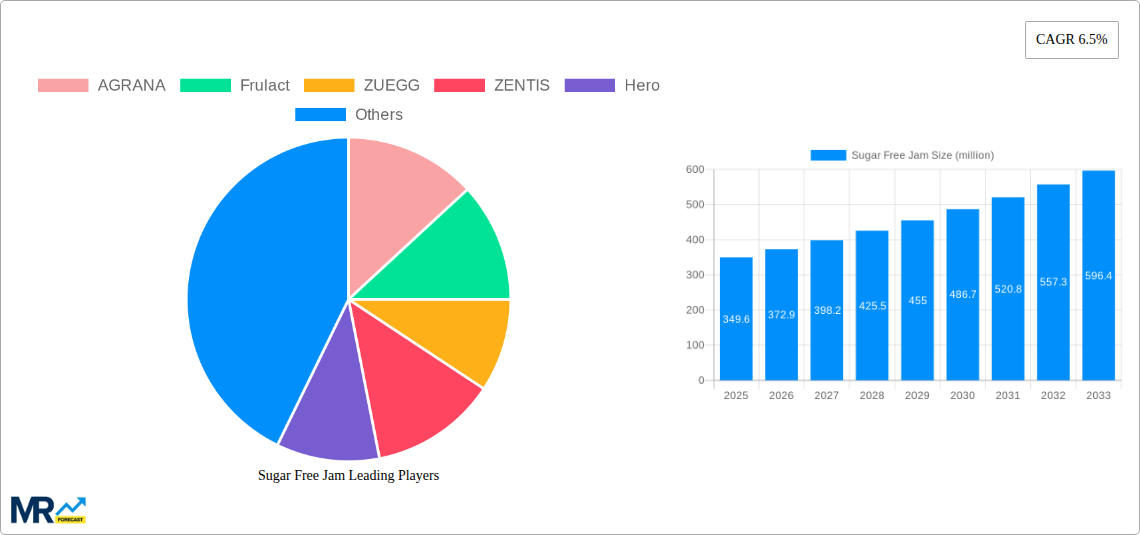

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sugar Free Jam?

The projected CAGR is approximately 6.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sugar Free Jam

Sugar Free JamSugar Free Jam by Type (Peach Jam, Apricot Jam, Plum Jam, Winter Melon Jam, Date Jam, Other Categories), by Application (Dairy Industry, Bakery Products Industry, Ice Cream Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

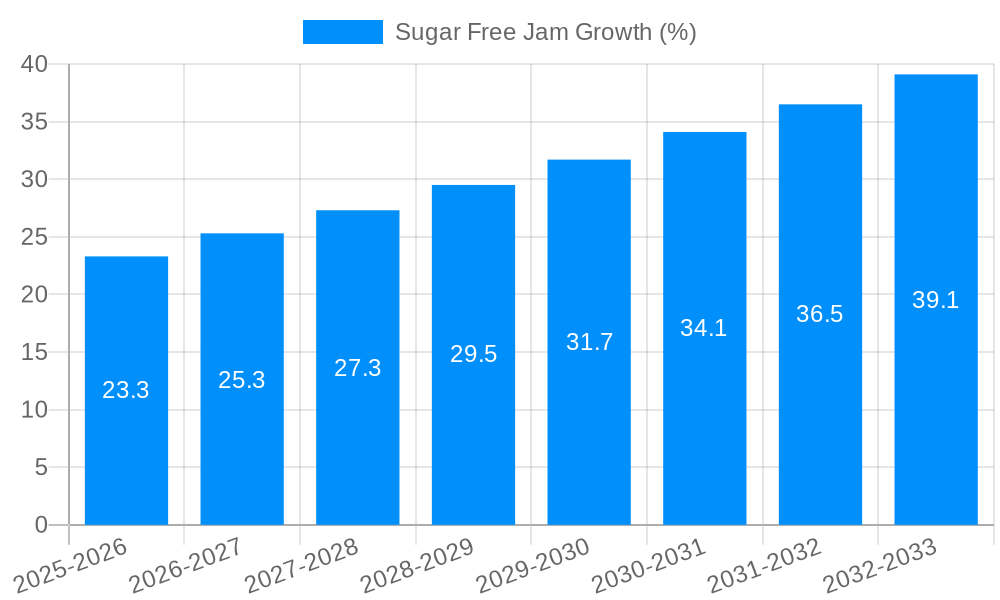

The global Sugar Free Jam market is poised for significant expansion, projected to reach a market size of $349.6 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025-2033, indicating sustained and dynamic market development. Key drivers fueling this upward trajectory include the increasing consumer preference for healthier food options, a growing awareness of the detrimental effects of sugar consumption on health, and a rising incidence of lifestyle diseases like diabetes and obesity. Manufacturers are responding to these demands by innovating with a wider variety of fruit bases and sugar alternatives, thereby expanding the product portfolio and appealing to a broader consumer base. The market is witnessing a surge in demand for jams made from fruits like peaches, apricots, and plums, which naturally contain less sugar or can be effectively processed into delicious sugar-free alternatives.

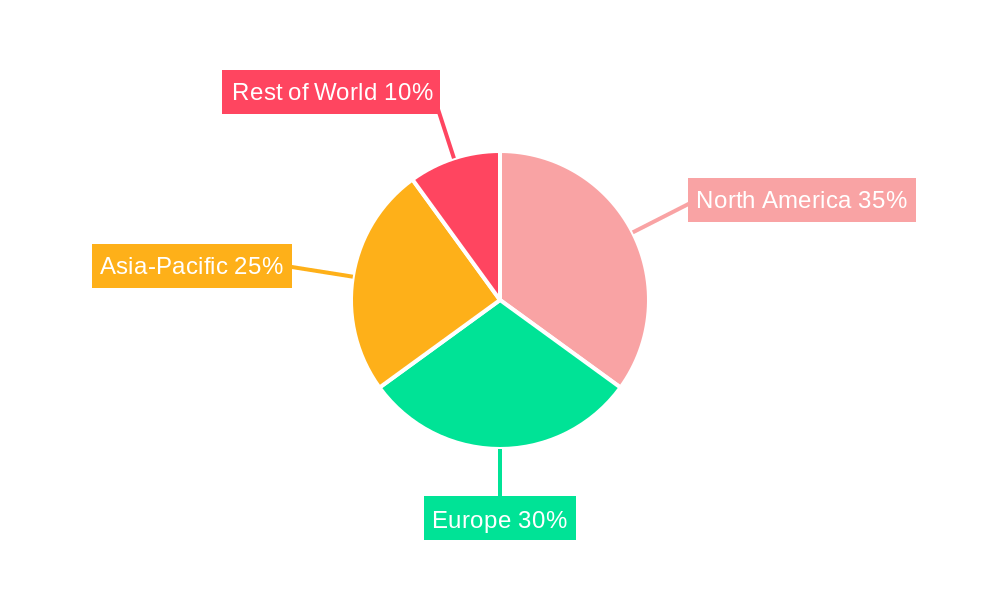

The sugar-free jam market is also being shaped by evolving consumer lifestyles and dietary trends. The bakery products industry, dairy industry, and ice cream industry are increasingly incorporating sugar-free jams as ingredients and toppings, catering to health-conscious consumers who do not want to compromise on taste. While the market exhibits strong growth potential, certain restraints such as the higher cost of natural sweeteners compared to traditional sugar and potential taste discrepancies that may require extensive product development can pose challenges. However, advancements in food technology and the exploration of novel natural sweeteners are expected to mitigate these concerns. Geographically, North America and Europe are expected to remain dominant markets due to high disposable incomes and established health and wellness trends. Asia Pacific, with its rapidly growing middle class and increasing health consciousness, presents a substantial opportunity for future market penetration.

This comprehensive report delves into the dynamic global sugar-free jam market, providing an in-depth analysis of its evolution and future trajectory. Covering the Study Period (2019-2033), with a Base Year and Estimated Year of 2025, and a robust Forecast Period (2025-2033) building upon Historical Period (2019-2024) data, this research offers invaluable insights for stakeholders. The global sugar-free jam market is projected to witness significant expansion, driven by evolving consumer preferences and increasing health consciousness. The market size, valued in the millions, is expected to reach substantial figures by the end of the forecast period. This report meticulously examines the intricate interplay of trends, driving forces, challenges, and growth catalysts shaping this burgeoning sector. We also provide a detailed overview of key market players and significant industry developments.

The global sugar-free jam market is experiencing a profound transformation, largely driven by a paradigm shift in consumer health perceptions and dietary habits. XXX, a key market insight, indicates a growing demand for products that cater to specific dietary needs, such as diabetes management and weight control. Consumers are actively seeking alternatives to traditional, high-sugar jams, leading to an accelerated adoption of sugar-free variants. This trend is further amplified by the increasing prevalence of lifestyle diseases globally, compelling individuals to make more informed food choices. The market is also witnessing an innovation surge in terms of natural sweeteners and alternative gelling agents, moving away from artificial substitutes. This focus on natural ingredients resonates deeply with health-conscious consumers, who are increasingly scrutinizing ingredient lists. The appeal of sugar-free jams extends beyond the health-conscious demographic; it is increasingly embraced by families looking for healthier options for their children, signaling a broader market acceptance. Furthermore, advancements in processing technologies are enabling the creation of sugar-free jams with improved taste profiles and textures, effectively replicating the sensory experience of conventional jams. This has been crucial in overcoming initial consumer skepticism regarding the palatability of sugar-free alternatives. The diversification of product offerings, including exotic fruit flavors and functional sugar-free jams incorporating probiotics or added vitamins, is also contributing to market expansion. The retail landscape is adapting, with a growing shelf space dedicated to sugar-free jams in mainstream supermarkets, alongside specialized health food stores. Online retail platforms are also playing a pivotal role in increasing accessibility and product discovery. The projected market size, measured in the millions, underscores the substantial economic opportunity within this segment.

Several powerful forces are driving the growth of the global sugar-free jam market. Foremost among these is the escalating global awareness surrounding the detrimental health effects of excessive sugar consumption. This awareness, fueled by public health campaigns, scientific research, and readily available information, has empowered consumers to actively seek out low-sugar and sugar-free food options. The increasing incidence of chronic diseases such as diabetes, obesity, and cardiovascular conditions directly correlates with the demand for sugar-free alternatives, making these products not just a preference but often a necessity for a significant portion of the population. Furthermore, the growing popularity of health and wellness trends, encompassing low-carbohydrate diets, ketogenic lifestyles, and general mindful eating, has created a fertile ground for sugar-free jams to thrive. These dietary trends often necessitate the elimination or significant reduction of added sugars, positioning sugar-free jams as an ideal accompaniment. The innovation pipeline within the food industry is also a crucial propellant. Manufacturers are investing heavily in research and development to create sugar-free jams that rival the taste, texture, and shelf-life of their traditional counterparts. This includes the exploration and successful implementation of natural sweeteners derived from sources like stevia, erythritol, and monk fruit, which are perceived more favorably by consumers than artificial sweeteners. The expanding accessibility of these sugar-free options through diverse distribution channels, from supermarkets to online retailers, further fuels their adoption.

Despite the robust growth potential, the sugar-free jam market faces several challenges and restraints that could impede its full realization. A primary hurdle is the perception of taste and texture. While advancements have been made, some consumers still perceive sugar-free jams as having an inferior flavor profile or an undesirable artificial sweetness compared to traditional jams. Achieving a truly comparable sensory experience, particularly replicating the mouthfeel and sweetness intensity of sugar, remains an ongoing challenge for formulators. The cost of production is another significant restraint. The alternative sweeteners and specialized ingredients used in sugar-free jams are often more expensive than conventional sugar. This can translate into higher retail prices for sugar-free jams, making them less accessible to price-sensitive consumers and potentially limiting market penetration, especially in developing economies where affordability is a key purchasing factor. Regulatory hurdles and ingredient scrutiny can also pose challenges. While a growing number of sweeteners are approved, consumer concerns about the long-term health effects of certain artificial or even natural sweeteners can lead to ingredient avoidance and a preference for products with simpler, more recognizable ingredient lists. Furthermore, the relatively nascent stage of market development in certain regions means that consumer awareness and demand may still be building, requiring significant marketing and educational efforts. Finally, the competition from other sugar-free spreads and breakfast accompaniments can also present a restraint, as consumers have a growing array of options to choose from.

The global sugar-free jam market is poised for significant growth, with certain regions and product segments emerging as key dominators.

Dominant Regions/Countries:

Dominant Segments:

The synergy between the demand for healthier dairy options and the availability of sugar-free jams creates a powerful market dynamic. As consumers become more discerning about the sugar content in their overall diet, the demand for sugar-free jam as a complementary ingredient within the dairy sector is projected to reach substantial figures in the millions.

The sugar-free jam industry is fueled by several potent growth catalysts. Increasing global health awareness, particularly concerning the detrimental effects of sugar consumption, is a primary driver. This heightened consciousness directly translates into a higher demand for products that cater to specific dietary needs, such as low-sugar and sugar-free options. Furthermore, the growing prevalence of lifestyle diseases like diabetes and obesity necessitates the adoption of healthier food alternatives, positioning sugar-free jams as an essential product for a significant consumer segment. The continuous innovation in natural sweeteners, moving away from artificial alternatives towards options like stevia and monk fruit, is also a critical catalyst. These natural sweeteners are more consumer-friendly and align with the growing preference for clean-label products.

This report offers a comprehensive examination of the global sugar-free jam market, providing granular insights for stakeholders across the value chain. Our analysis spans a significant period, from 2019 to 2033, with a detailed focus on the Base Year (2025) and a forward-looking Forecast Period (2025-2033), building upon the Historical Period (2019-2024). The market size, measured in the millions, is meticulously projected, offering a clear picture of the economic potential. The report meticulously details the intricate web of Sugar Free Jam Trends, highlighting the evolving consumer preferences towards healthier, low-sugar alternatives and the impact of natural sweetener innovations. We delve into the Driving Forces, such as the increasing global awareness of sugar's health implications and the burgeoning popularity of wellness trends, which are fundamentally reshaping consumer choices. Conversely, the report also addresses the significant Challenges and Restraints, including taste perception concerns, production costs, and regulatory complexities, providing a balanced perspective on market dynamics. Furthermore, we identify the Key Region or Country & Segment to Dominate the Market, with a deep dive into North America and Europe as leading geographical markets, and the burgeoning "Other Categories" of fruit types and the Dairy Industry application as key segment drivers. The Growth Catalysts are clearly outlined, emphasizing the role of R&D and expanding distribution networks. Finally, we present a comprehensive list of Leading Players and a chronological overview of Significant Developments to provide a holistic understanding of this dynamic and promising market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.5%.

Key companies in the market include AGRANA, Frulact, ZUEGG, ZENTIS, Hero, Valio, BINA, Fourayes, Fresh Food Industries, Smucker, Ingredion, Puratos, Dohler GmbH, SVZ International, Tree Top, ANDROS, .

The market segments include Type, Application.

The market size is estimated to be USD 349.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sugar Free Jam," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sugar Free Jam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.