1. What is the projected Compound Annual Growth Rate (CAGR) of the Sugar-free Coffee Capsules and Pods?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sugar-free Coffee Capsules and Pods

Sugar-free Coffee Capsules and PodsSugar-free Coffee Capsules and Pods by Type (Coffee Capsules, Coffee Pods), by Application (Online Shopping, Retailer, Supermarket, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

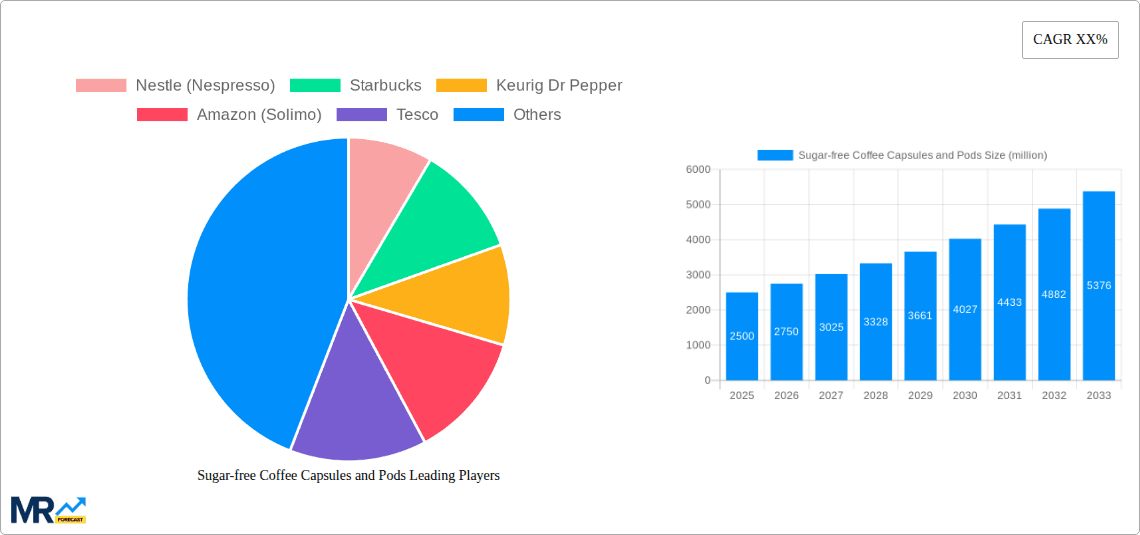

The sugar-free coffee capsules and pods market is experiencing robust growth, driven by the increasing health consciousness among consumers and the rising prevalence of diabetes and other health conditions. The market's expansion is fueled by several key factors: the convenience and ease of use of single-serve coffee brewing systems, the growing demand for healthier beverage options, and the increasing availability of a wider variety of sugar-free coffee blends and flavors from major players like Nestlé (Nespresso), Starbucks, and Keurig Dr Pepper, as well as emerging brands. Technological advancements in sweetener alternatives, such as stevia and erythritol, are also contributing to the market's growth. The market is segmented based on product type (pods vs. capsules), coffee type (espresso, regular coffee, etc.), and distribution channels (online, retail). While precise market size figures are not provided, considering a CAGR (Compound Annual Growth Rate) and current market trends, a reasonable estimate for the 2025 market size could be in the range of $2-3 billion USD, based on comparable markets in the coffee and health-food industries. This estimate reflects substantial year-over-year growth and anticipates consistent expansion throughout the forecast period (2025-2033). The competitive landscape is marked by established players and emerging brands, fostering innovation and consumer choice. However, factors like the higher cost of sugar-free alternatives compared to regular coffee and potential concerns about the long-term health impacts of certain artificial sweeteners could present challenges for market expansion.

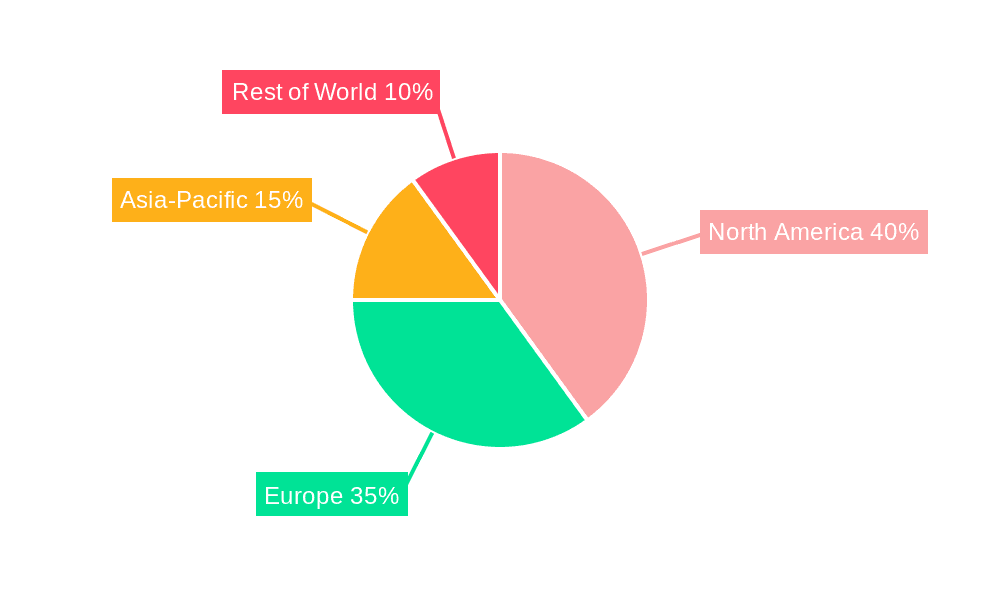

Despite potential restraints, the long-term outlook for the sugar-free coffee capsules and pods market remains positive. The increasing demand for convenient, healthy, and ethically sourced coffee products will continue to drive growth. Furthermore, the market is expected to benefit from expanding distribution channels and strategic partnerships between coffee brands and health-focused companies. This synergistic approach will likely result in more product innovation and targeted marketing campaigns, further enhancing the market's reach and penetration. The geographic spread of this market is expected to be significant, with substantial growth anticipated in regions such as North America and Europe, followed by increasing adoption in Asia and other developing markets, where awareness of health-conscious lifestyles is growing. The focus on sustainability and ethical sourcing in the coffee industry will also significantly contribute to the overall growth trajectory of the sugar-free segment.

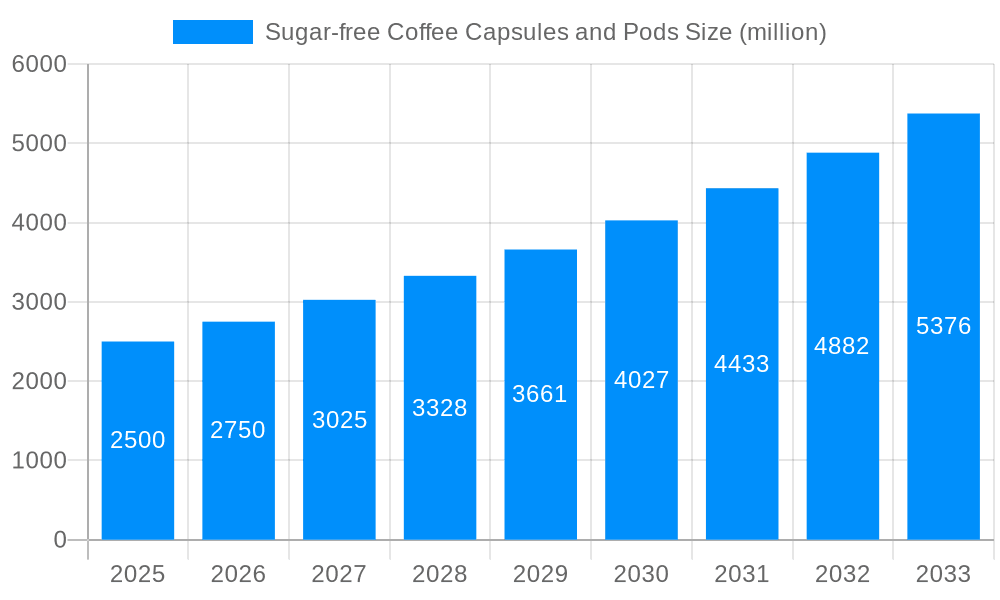

The sugar-free coffee capsules and pods market is experiencing robust growth, driven by the increasing health consciousness among consumers globally. The market, valued at approximately 200 million units in 2024, is projected to reach 500 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 10%. This surge is fueled by several factors, including the rising prevalence of diabetes and obesity, increasing awareness of the detrimental effects of excessive sugar intake, and the growing popularity of convenient, single-serve brewing systems. The demand for healthier alternatives to traditional sugary coffee options is a key driver, pushing manufacturers to innovate and introduce a wider variety of sugar-free options. This trend is not limited to specific demographics; it spans across age groups and socioeconomic strata, reflecting a broader societal shift towards healthier lifestyles. The market is witnessing an influx of new players, alongside established brands expanding their sugar-free offerings. This competitive landscape fosters innovation in flavor profiles and brewing technologies, catering to diverse consumer preferences and further driving market expansion. Furthermore, the rise of online retail channels and subscription services has significantly boosted accessibility and convenience, allowing sugar-free coffee capsules to reach a wider consumer base. The historical period (2019-2024) showed steady growth, laying the foundation for the impressive forecast period (2025-2033) expansion. The estimated market size in 2025 is 250 million units, indicating strong momentum going forward.

Several key factors are propelling the growth of the sugar-free coffee capsules and pods market. Firstly, the escalating global health crisis, characterized by rising rates of obesity, diabetes, and other diet-related illnesses, has prompted consumers to actively seek healthier alternatives to their daily routines. Sugar-free coffee options directly address this concern, offering a convenient and guilt-free way to enjoy a daily caffeine fix. Secondly, increasing consumer awareness of the negative impacts of added sugar on health is significantly impacting purchasing decisions. Consumers are becoming more discerning about ingredient lists and actively seeking products with reduced or no added sugar. Thirdly, the ongoing advancements in sweetener technology have led to the development of more palatable and effective sugar substitutes, enhancing the taste and overall appeal of sugar-free coffee capsules. These improvements have significantly reduced the negative perceptions often associated with artificial sweeteners, making sugar-free options more appealing to a wider audience. Finally, the increasing convenience and ease of use offered by single-serve brewing systems contribute to the market's growth. The ready availability of sugar-free options in this convenient format further reinforces their appeal to busy individuals and those seeking a quick and hassle-free coffee experience.

Despite the promising growth trajectory, the sugar-free coffee capsules and pods market faces certain challenges. One significant hurdle is the potential for consumer perception of reduced taste and quality compared to their traditional counterparts. While advancements in sweetener technology have improved the taste profile, some consumers may still perceive sugar-free options as less satisfying. Furthermore, the cost of sugar-free alternatives can sometimes be higher than those with added sugar, potentially limiting market penetration amongst price-sensitive consumers. The negative perception surrounding artificial sweeteners, despite advancements in the field, remains a challenge. Some consumers remain wary of artificial sweeteners, prioritizing natural sugar alternatives even if they contain added sugar. This necessitates further efforts by manufacturers to educate consumers about the safety and efficacy of modern sugar substitutes. Finally, maintaining a consistent supply chain and managing the sustainability aspects of packaging are crucial considerations for long-term market success. The environmental impact of single-use pods remains a concern for eco-conscious consumers, requiring innovative solutions from manufacturers.

North America: This region is expected to dominate the market due to high disposable incomes, high prevalence of health-conscious consumers, and widespread adoption of single-serve coffee brewing systems. The US, in particular, is anticipated to be a major contributor to this regional dominance.

Europe: A strong preference for specialty coffee and a growing focus on health and wellness contribute to significant market growth in Western European countries like Germany, France, and the UK.

Asia-Pacific: Rapid urbanization, rising disposable incomes, and increasing adoption of Western coffee culture are driving market growth in this region, specifically in China, Japan, and South Korea.

Segments:

Intensity/Roast: The segment offering medium to dark roasts is expected to lead, given the widespread appeal of bold coffee flavors. However, the light roast segment is also experiencing growth due to the increase in preference for less bitter brews.

Flavor Profiles: Vanilla, hazelnut, and caramel remain popular, while sugar-free options incorporating fruit flavors (e.g., berry, citrus) are gaining traction.

Retail Channels: Online sales and subscriptions are growing rapidly, complementing strong sales in supermarkets and specialty coffee shops.

The overall market dominance is largely driven by the combination of high consumer demand in developed markets and the emerging demand in rapidly developing economies. The preference for convenient, single-serving portions is also a significant factor. The projected growth signifies not only the preference for sugar-free alternatives, but also the ongoing consumer preference for the convenience and efficiency associated with capsule-based coffee systems.

The sugar-free coffee capsule and pod industry is experiencing growth spurred by several factors: increasing health consciousness, advancements in artificial sweetener technology yielding tastier alternatives, and growing preference for convenient single-serve brewing systems. The rise of online retail and subscription models also expands access and consumer choice.

This report provides a comprehensive analysis of the sugar-free coffee capsules and pods market, encompassing historical data, current market dynamics, and future projections. It examines key drivers, restraints, and emerging trends, offering valuable insights for stakeholders across the value chain. The report also provides detailed profiles of major players, alongside regional and segment-specific analyses, facilitating informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nestle (Nespresso), Starbucks, Keurig Dr Pepper, Amazon (Solimo), Tesco, PODiSTA, Illy, Vittoria Food & Beverage, Lavazza, Caffitaly system, Belmoca, Mera, BORBOBE, Gourmesso, Bosch Tassimo(Germany), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sugar-free Coffee Capsules and Pods," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sugar-free Coffee Capsules and Pods, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.