1. What is the projected Compound Annual Growth Rate (CAGR) of the Sugar-free Beer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sugar-free Beer

Sugar-free BeerSugar-free Beer by Type (Standard Beer, Flavored Beer), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

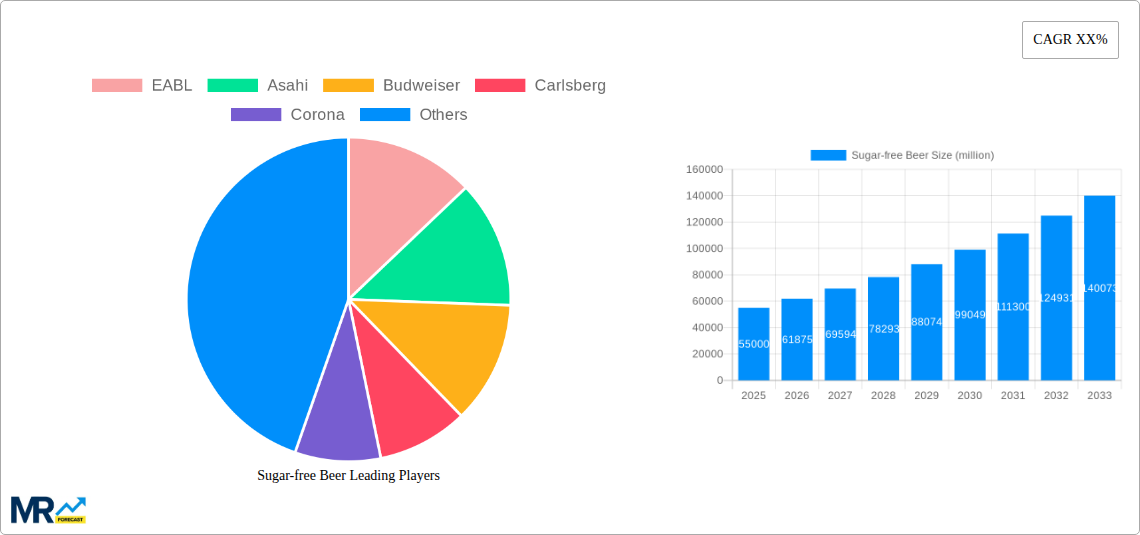

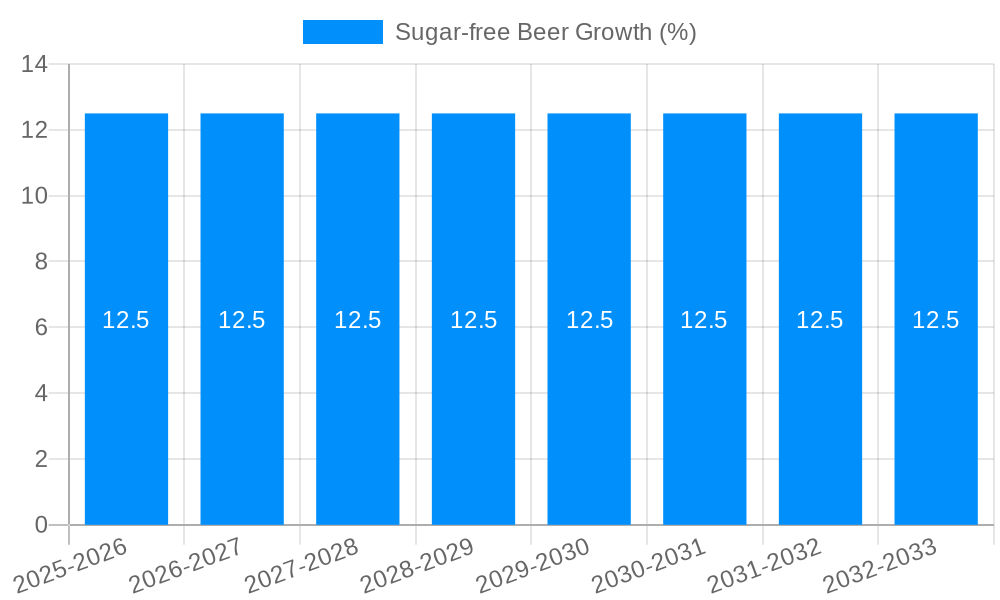

The global Sugar-free Beer market is poised for substantial expansion, projected to reach an estimated USD 55,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% anticipated throughout the forecast period of 2025-2033. This remarkable growth is propelled by a confluence of evolving consumer preferences and a heightened awareness of health and wellness. Consumers are increasingly seeking out beverage options that align with healthier lifestyles, leading to a significant surge in demand for low-sugar and sugar-free alternatives across various product categories, including alcoholic beverages. The sugar-free beer segment is particularly benefiting from this trend, as manufacturers are innovating to offer appealing taste profiles without compromising on the "healthier choice" aspect. Furthermore, advancements in brewing technology and fermentation processes are enabling producers to create high-quality sugar-free beers that rival their traditional counterparts in flavor and aroma, thus broadening their appeal to a wider consumer base. The convenience of online sales channels is also playing a crucial role in market penetration, allowing for wider reach and easier accessibility for consumers looking for specialized products.

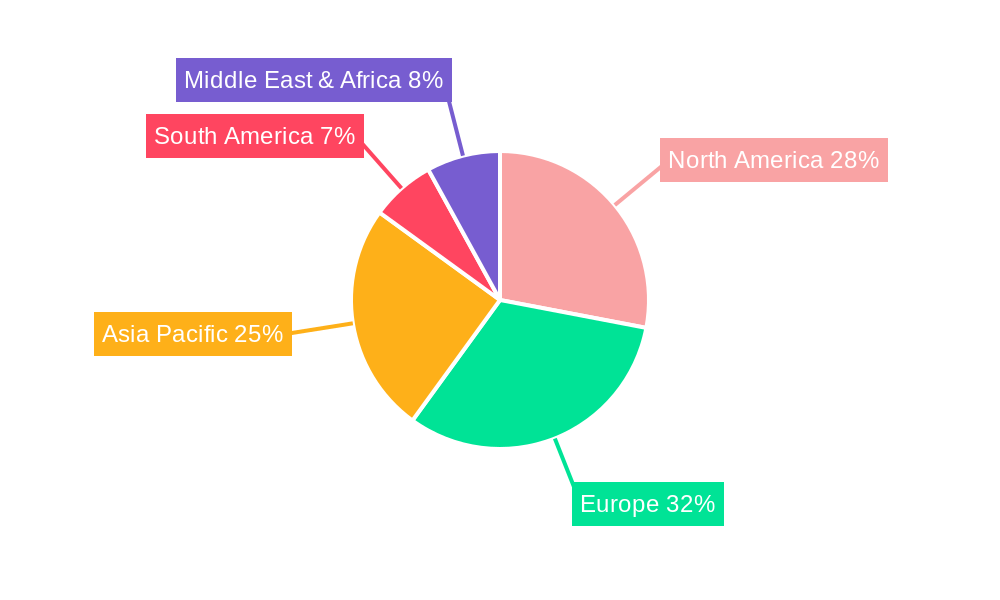

The market is characterized by a dynamic landscape driven by intense competition and continuous product innovation. Key players are actively investing in research and development to introduce novel flavored sugar-free beers, catering to the growing demand for variety and customization. The expansion of distribution networks, encompassing both online platforms and enhanced offline retail presence, is further fueling market growth. While the demand is strong, potential restraints such as higher production costs associated with sugar-free formulations and consumer perception challenges regarding taste and quality in some segments need to be addressed. However, the overarching trend towards healthier living, coupled with aggressive marketing strategies and product diversification by leading breweries like EABL, Asahi, Budweiser, and Heineken, is expected to overcome these obstacles. The Asia Pacific region, with its burgeoning middle class and increasing disposable incomes, alongside established markets in North America and Europe, will be pivotal in driving the global sugar-free beer market forward.

This report offers a granular examination of the global Sugar-free Beer market, projecting its trajectory from a baseline of 2025 through to 2033, with historical data spanning 2019-2024. The analysis delves into market dynamics, key drivers, prevailing challenges, dominant regions and segments, significant growth catalysts, and outlines the strategic moves of leading industry players. We anticipate the global sugar-free beer market to reach an estimated USD 750 million by 2025, with substantial growth expected during the forecast period.

The sugar-free beer market is experiencing a transformative shift, driven by a confluence of evolving consumer preferences and a growing health consciousness. Consumers are increasingly scrutinizing ingredient lists, actively seeking out products that align with their wellness goals. This has propelled the demand for beverages with reduced sugar content, and beer is no exception. The perception of beer as an indulgent, calorie-laden drink is being challenged by the emergence of low-sugar and sugar-free alternatives. This trend is particularly pronounced in developed markets where disposable incomes are higher, and consumers have greater access to information regarding health and nutrition. The standard beer segment, traditionally the largest, is witnessing innovation with brewers actively reformulating their classic lagers and ales to eliminate added sugars without compromising on taste and aroma. Furthermore, the flavored beer segment is embracing this sugar-free revolution by offering fruit-infused, herb-infused, and spice-infused varieties that naturally derive their sweetness from ingredients rather than added sugars. This diversification caters to a broader palate and attracts consumers who might typically shy away from traditional beer. The market is also witnessing a significant pivot towards convenience and accessibility, with online sales channels playing an increasingly crucial role in reaching a wider customer base. The ease of online ordering and direct-to-consumer delivery models are contributing to the market's expansion. Meanwhile, traditional offline sales channels, such as supermarkets, convenience stores, and dedicated liquor stores, continue to be significant contributors, particularly in regions where online penetration is still developing. The market is characterized by a dynamic landscape where established players are rapidly introducing sugar-free options to maintain market share, while nimble craft breweries are leveraging this trend to innovate and capture niche segments. The overall trend indicates a sustainable and growing demand for sugar-free beer, reflecting a fundamental shift in consumer priorities towards healthier beverage choices. The market is expected to grow from an estimated USD 680 million in 2024 to over USD 1,200 million by 2033, showcasing a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period.

Several potent forces are collectively fueling the expansion of the sugar-free beer market. At its core, a pervasive shift towards healthier lifestyles among consumers is the primary engine. Growing awareness about the detrimental effects of excessive sugar consumption, including weight gain, diabetes, and other chronic diseases, is prompting individuals to make conscious choices about their beverage intake. This heightened health consciousness extends to alcoholic beverages, with consumers actively seeking out "better-for-you" options. Furthermore, the increasing prevalence of diet-related health conditions like diabetes and metabolic syndrome has created a specific demand for sugar-free alternatives, enabling individuals to enjoy their favorite beverages without compromising their health management. The innovative product development by major breweries and craft beer producers also plays a pivotal role. Companies are investing in research and development to create sugar-free formulations that retain the authentic taste and mouthfeel of traditional beers, thereby appealing to a wider audience. The accessibility and convenience offered by online sales platforms are also significant drivers, allowing consumers to easily discover and purchase sugar-free beer varieties from the comfort of their homes. This expands the reach of brands and introduces sugar-free options to consumers who might not encounter them in their local retail outlets. Finally, the influence of fitness trends and the "wellness culture" are contributing to this demand, as consumers are increasingly aligning their dietary choices with their active lifestyles.

Despite its promising growth, the sugar-free beer market is not without its hurdles. A significant challenge lies in the perception of taste and quality. Historically, sugar in beer contributes to its body, mouthfeel, and overall flavor profile. Crafting a sugar-free beer that successfully replicates these attributes without introducing artificial sweeteners or compromising on taste remains a complex technical challenge for brewers. Consumers may also associate "sugar-free" with artificiality, leading to hesitations and a preference for naturally produced beverages. The cost of production can also be a restraining factor. Developing and sourcing ingredients for sugar-free beer might incur higher costs compared to traditional brewing methods, which could translate into higher retail prices, potentially limiting affordability for some consumer segments. Another restraint is the relatively nascent stage of the market in certain geographies. While developed markets are embracing sugar-free options, many emerging economies are still developing their awareness and acceptance of such specialized beverage categories. This requires significant market education and distribution network development to penetrate these regions effectively. Regulatory landscapes regarding labeling and marketing of "sugar-free" claims can also vary across countries, creating complexities for global brands. Lastly, the significant marketing efforts required to educate consumers and differentiate sugar-free offerings from conventional beers can be a substantial investment for manufacturers.

The global sugar-free beer market is poised for significant dominance by specific regions and segments, driven by a combination of consumer demographics, economic prosperity, and evolving lifestyle trends.

Dominant Regions/Countries:

Dominant Segments:

Type: Standard Beer

Application: Offline Sales

Several key factors are acting as potent growth catalysts for the sugar-free beer industry. Firstly, ongoing innovations in brewing technology are enabling the creation of sugar-free beers with superior taste profiles, addressing a major consumer concern. Secondly, targeted marketing campaigns by beverage companies highlighting the health benefits and low-calorie attributes of these products are increasing consumer awareness and demand. Thirdly, the expanding distribution channels, particularly the growth of e-commerce and direct-to-consumer sales, are making sugar-free beer more accessible to a wider audience. Finally, the increasing number of partnerships and collaborations between breweries and health and wellness influencers are further driving adoption and normalizing sugar-free beer as a viable beverage choice.

This comprehensive report provides an in-depth analysis of the global Sugar-free Beer market, covering the period from 2019 to 2033, with a strong focus on the Base Year of 2025 and the Forecast Period of 2025-2033. It meticulously examines market trends, key drivers of growth, prevailing challenges and restraints, and identifies the dominant regions and market segments poised for significant expansion. Furthermore, the report highlights crucial growth catalysts, profiles leading industry players, and details significant market developments. The analysis utilizes data and projections to offer strategic insights for stakeholders aiming to navigate and capitalize on the evolving landscape of the sugar-free beer industry, predicting the market to reach an estimated USD 750 million by 2025.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include EABL, Asahi, Budweiser, Carlsberg, Corona, Guinness, Heineken, Kirin Brewery, Molson Coors, Sapporo, Suntory Beer Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sugar-free Beer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sugar-free Beer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.