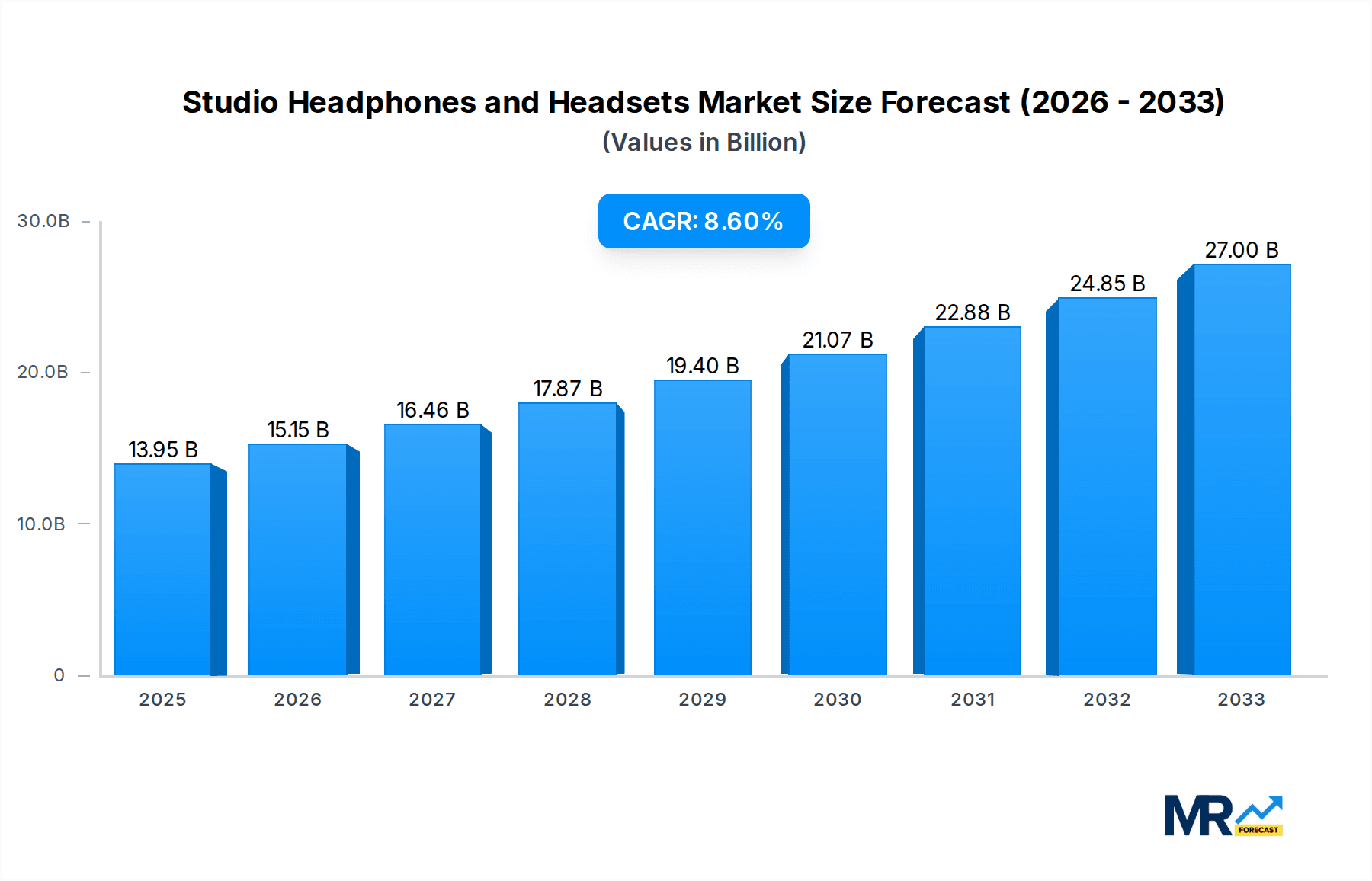

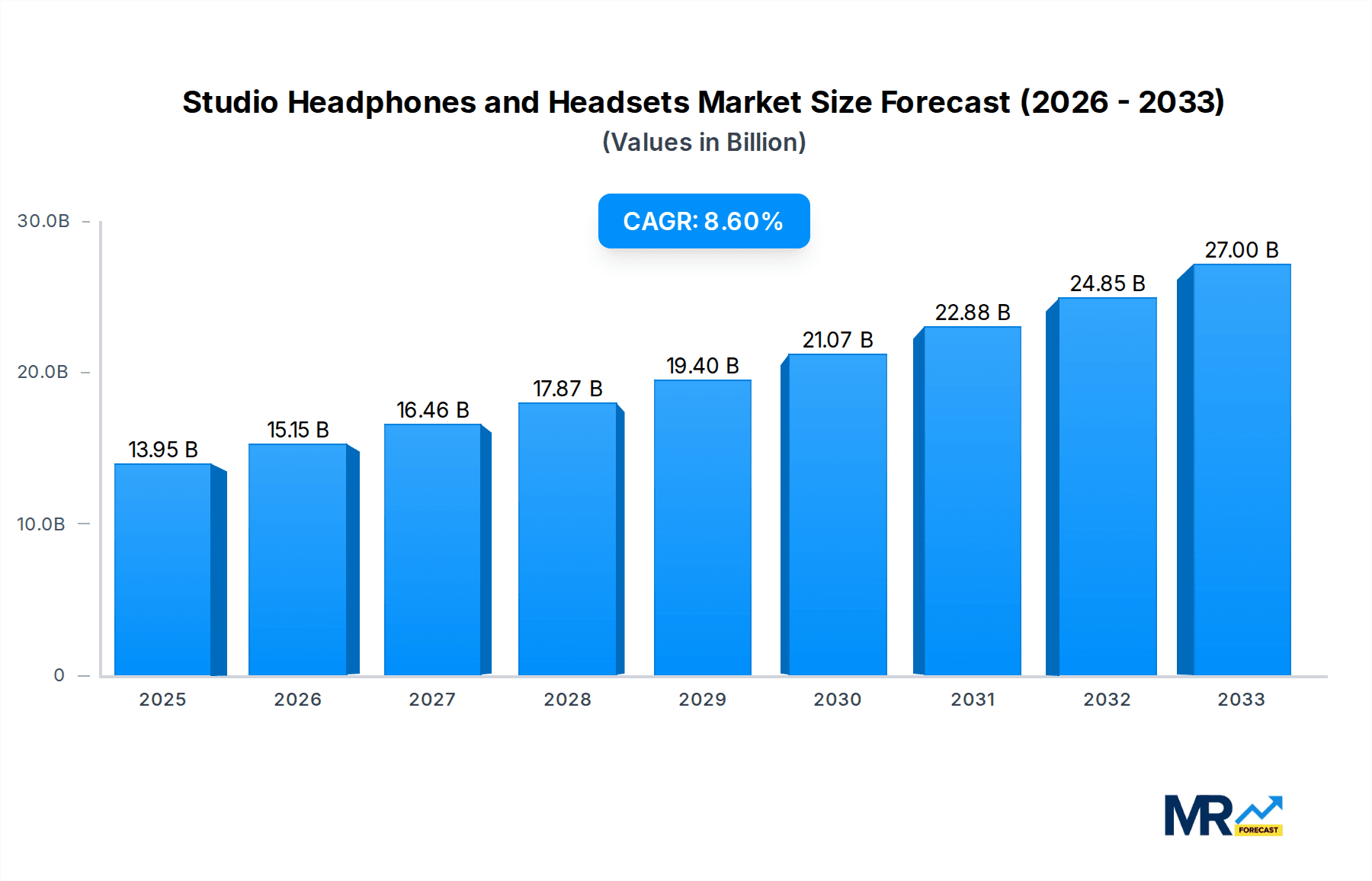

1. What is the projected Compound Annual Growth Rate (CAGR) of the Studio Headphones and Headsets?

The projected CAGR is approximately 8.66%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Studio Headphones and Headsets

Studio Headphones and HeadsetsStudio Headphones and Headsets by Type (Closed Back, Semi-open Back, Fully-open Back, World Studio Headphones and Headsets Production ), by Application (Studio, Stage, Critical Listening, Mixing, Others, World Studio Headphones and Headsets Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global studio headphones and headsets market is poised for substantial growth, projected to reach an estimated USD 13.95 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.66% anticipated to extend through 2033. This upward trajectory is fueled by several dynamic factors, chief among them the burgeoning audio production industry, which demands high-fidelity monitoring tools for professional recording, mixing, and mastering. The proliferation of home studios, driven by the accessibility of digital audio workstations (DAWs) and affordable recording equipment, further amplifies demand. Advancements in acoustic engineering and driver technology are leading to the development of headphones offering superior sound accuracy, comfort, and durability, catering to the discerning needs of audiophiles and music professionals alike. The increasing focus on immersive audio experiences and the rise of content creation across platforms like YouTube and streaming services are also significant drivers, necessitating specialized audio equipment.

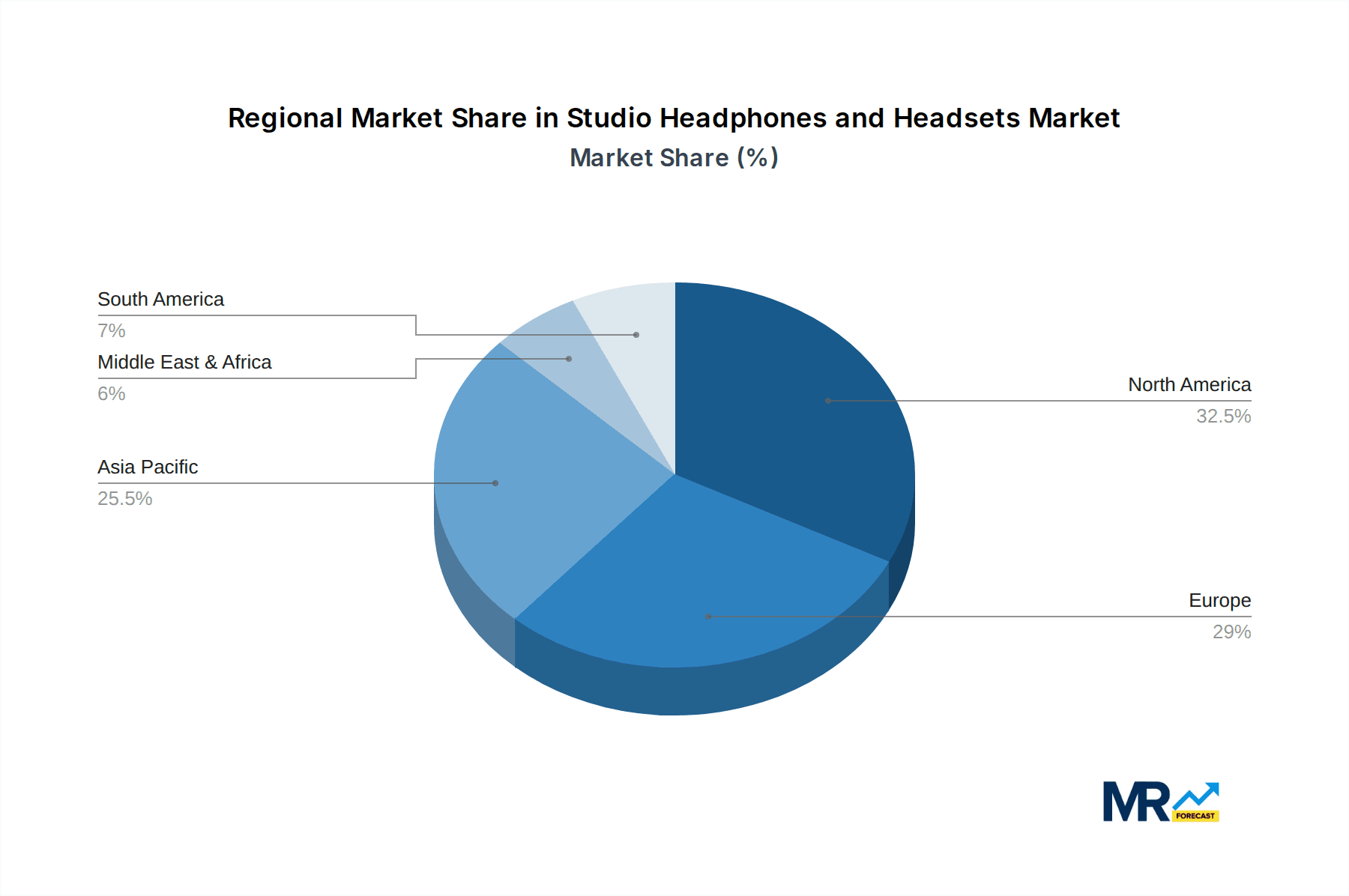

The market segmentation reveals a dynamic landscape with distinct preferences across different headphone types and applications. While closed-back headphones continue to dominate due to their superior isolation for recording environments, semi-open and fully-open back designs are gaining traction among audiophiles and mastering engineers seeking a more natural and expansive soundstage for critical listening and mixing. Geographically, North America and Europe currently hold significant market share, driven by established music industries and a high concentration of professional studios. However, the Asia Pacific region, particularly China and India, is emerging as a rapid growth engine, propelled by a growing middle class, increasing investment in local entertainment industries, and a surge in independent music production. Key players such as Beyerdynamic, Sennheiser, and AKG are at the forefront, investing heavily in research and development to innovate and capture market share in this competitive and evolving sector.

This report delves into the dynamic world of Studio Headphones and Headsets, providing an in-depth analysis of its global market landscape. Spanning from 2019 to 2033, with a keen focus on the Base and Estimated Year of 2025, and a comprehensive Forecast Period of 2025-2033, this study meticulously examines historical trends during 2019-2024. The report will offer a granular view of market size, projected growth, and influencing factors, with a projected global market value expected to reach $3.2 billion by 2025 and potentially soaring to $4.9 billion by 2033. The analysis will meticulously dissect various product types, including Closed Back, Semi-open Back, and Fully-open Back designs, alongside a detailed examination of their applications across Studio, Stage, Critical Listening, Mixing, and Other sectors. Furthermore, the report will explore the intricate interplay of industry developments and technological advancements shaping the production and consumption of these essential audio tools.

The global Studio Headphones and Headsets market is experiencing a significant evolutionary phase, driven by a confluence of technological innovation, evolving professional audio requirements, and a burgeoning creator economy. XXX, a key insight into the market’s trajectory, reveals a consistent upward trend in demand, fueled by the increasing accessibility of professional-grade audio production tools and the proliferation of home studios. The historical period of 2019-2024 witnessed a robust growth, with market revenues estimated to have expanded from approximately $2.5 billion to $3.0 billion. This growth was underpinned by advancements in driver technology, material science for enhanced comfort and durability, and the integration of smart features. The market is increasingly segmenting, with specialized headphones catering to specific applications like critical listening and mixing gaining prominence. The rise of immersive audio formats, such as Dolby Atmos, is also creating new opportunities and demanding headphones capable of delivering precise spatial audio reproduction. Furthermore, the growing influence of online content creators across platforms like YouTube and Twitch has significantly broadened the consumer base for high-quality audio monitoring solutions, moving beyond traditional studio professionals. This expansion into broader creative spheres signifies a paradigm shift, democratizing access to professional audio gear and contributing to sustained market expansion. The anticipated market value of $3.2 billion in 2025 is a testament to these ongoing trends, with projections indicating a continued upward trajectory to $4.9 billion by 2033, highlighting the enduring importance and adaptability of studio-grade headphones and headsets in the modern audio landscape. This sustained growth underscores the market's resilience and its integral role in both established and emerging audio production workflows.

Several powerful forces are propelling the global Studio Headphones and Headsets market forward. The relentless pursuit of audio fidelity and accuracy by professionals and discerning enthusiasts remains a primary driver. As the complexity of audio production increases and the demand for pristine sound quality rises, so too does the need for reliable monitoring tools. The democratization of music production, facilitated by accessible digital audio workstations (DAWs) and affordable recording equipment, has led to a surge in home studio setups, thereby expanding the market for studio-grade headphones beyond traditional professional environments. Furthermore, the exponential growth of the content creation industry, encompassing streamers, podcasters, and video editors, has created a significant new segment of users requiring high-quality audio monitoring for their work. Technological advancements, including the development of planar magnetic drivers, improved acoustic isolation, and enhanced comfort designs, continue to push the boundaries of performance and user experience, making these products more appealing. The increasing adoption of wireless technologies, while traditionally a concern for latency in professional settings, is slowly gaining traction in certain semi-professional and content creation applications, offering greater convenience. The global market, valued at an estimated $3.2 billion in 2025, is poised for substantial growth, projected to reach $4.9 billion by 2033, a testament to the enduring and expanding appeal of these critical audio components.

Despite the robust growth trajectory, the Studio Headphones and Headsets market faces several challenges and restraints that could temper its expansion. The highly competitive nature of the market, with numerous established players and emerging brands vying for market share, can lead to price pressures and reduced profit margins, particularly for smaller manufacturers. The initial cost of high-end studio-grade headphones and headsets can also be a significant barrier for aspiring creators or those on a limited budget, potentially hindering adoption in certain emerging markets. Furthermore, the rapid pace of technological innovation, while a driver of growth, also presents a challenge. Companies must continuously invest in research and development to remain competitive, which can be resource-intensive. The evolution of audio technologies, such as the increasing adoption of personalized audio solutions and AI-driven sound processing, may necessitate significant shifts in product design and functionality, requiring adaptation from both manufacturers and consumers. The perceived complexity of some advanced features or the specialized knowledge required to fully utilize them can also deter adoption by less experienced users. Moreover, supply chain disruptions, as witnessed in recent years, can impact production timelines and raw material costs, affecting market availability and pricing. The market, projected to reach $4.9 billion by 2033, must navigate these obstacles to ensure sustained and equitable growth.

The global Studio Headphones and Headsets market exhibits distinct regional dynamics and segment dominance, crucial for understanding future growth patterns.

Dominant Segments:

Type: Closed Back: The Closed Back segment is projected to maintain its leading position throughout the study period (2019-2033). This dominance is attributed to its versatility and suitability for a wide range of applications, particularly in noisy environments like live recording studios and on stage. Their ability to provide excellent sound isolation, both for the listener and preventing sound leakage into microphones, makes them indispensable for vocalists, drummers, and live sound engineers. The market for Closed Back headphones is expected to represent a substantial portion of the overall market value, estimated to contribute $1.8 billion to the $3.2 billion global market in 2025. Their widespread adoption in professional studios for tracking and monitoring, as well as their increasing use by content creators in less-than-ideal acoustic settings, solidifies their market leadership.

Application: Studio: The "Studio" application segment is another powerhouse, intrinsically linked to the demand for high-quality monitoring. Professionals in music production, post-production for film and television, and broadcast all rely heavily on studio headphones for accurate sound assessment. This segment's value is projected to reach approximately $1.5 billion by 2025, representing a significant portion of the total market. The need for precise frequency response, detailed imaging, and minimal coloration makes dedicated studio headphones the preferred choice for critical mixing and mastering tasks.

Dominant Regions/Countries:

North America (USA and Canada): North America, particularly the United States, is expected to continue its dominance in the Studio Headphones and Headsets market. This is driven by a mature and highly developed music and entertainment industry, a large number of professional recording studios, a thriving independent music scene, and a significant concentration of content creators. The high disposable income, coupled with a strong appreciation for audio quality, fuels the demand for premium products. The US market alone is anticipated to account for over 35% of the global market share in 2025, with an estimated market value of $1.1 billion. The strong presence of leading global brands and a robust ecosystem of audio professionals and enthusiasts further solidify its position.

Europe (Germany, UK, France): Europe is another crucial region, characterized by a strong cultural heritage in music and a well-established professional audio infrastructure. Countries like Germany, the UK, and France are major contributors to the market. Germany, in particular, with its strong engineering and manufacturing base (home to Beyerdynamic and Sennheiser), plays a significant role. The UK boasts a vibrant music production scene, and France has a growing presence in post-production and gaming audio. The European market is projected to hold approximately 28% of the global market share by 2025, valued at around $0.9 billion. The presence of influential audio companies and a discerning consumer base that values sound quality and durability contribute to its strength.

Asia-Pacific (China, Japan, South Korea): The Asia-Pacific region is emerging as a significant growth engine, driven by increasing investments in the entertainment industry, a rapidly expanding middle class with growing disposable incomes, and a surge in audio-visual content creation. China, with its massive consumer base and expanding digital economy, is becoming a dominant force. Japan's long-standing reputation for audio innovation and high-quality consumer electronics also contributes significantly. South Korea's booming K-Pop industry and its global influence on music production further boost demand. While currently holding a smaller share, the Asia-Pacific region is expected to witness the fastest growth rate throughout the forecast period, potentially reaching $1.2 billion by 2033.

The interplay between these dominant segments and regions creates a complex yet lucrative market. The continued demand for Closed Back designs in professional and home studio environments, coupled with the substantial influence of North America and Europe, will shape the market's evolution. However, the rapid growth potential of the Asia-Pacific region, particularly driven by China, cannot be overlooked in the long-term outlook for the Studio Headphones and Headsets market, which is projected to reach $4.9 billion by 2033.

Several key catalysts are fueling the expansion of the Studio Headphones and Headsets industry. The burgeoning creator economy, with its insatiable demand for high-quality audio for content creation, is a primary driver. Advances in driver technology, leading to more accurate sound reproduction and improved user comfort, are attracting both professionals and hobbyists. The increasing accessibility of digital audio workstations and home recording setups democratizes music production, expanding the user base. Furthermore, the growing adoption of immersive audio formats necessitates specialized headphones for accurate spatial audio monitoring, creating a new avenue for growth. The market is expected to reach $4.9 billion by 2033.

This report offers an exhaustive analysis of the global Studio Headphones and Headsets market, providing a comprehensive view of its landscape from 2019 to 2033. It delves into market size projections, reaching an estimated $3.2 billion in 2025 and a projected $4.9 billion by 2033, examining key market drivers, challenges, and regional dynamics. The report dissects various product types (Closed Back, Semi-open Back, Fully-open Back) and applications (Studio, Stage, Critical Listening, Mixing, Others). It highlights significant technological advancements and industry developments, alongside an in-depth profile of leading market players. This report is an indispensable resource for manufacturers, suppliers, investors, and industry stakeholders seeking to understand and capitalize on the evolving opportunities within this critical segment of the audio industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.66% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.66%.

Key companies in the market include Beyerdynamic, Sennheiser, AKG, Grado, Audio-Technica, Beats, KOSS, Sony, Pioneer, Shure, Samson Technologies, Denon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Studio Headphones and Headsets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Studio Headphones and Headsets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.