1. What is the projected Compound Annual Growth Rate (CAGR) of the Stationary Fuel Cells For Commercial Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Stationary Fuel Cells For Commercial Vehicle

Stationary Fuel Cells For Commercial VehicleStationary Fuel Cells For Commercial Vehicle by Type (SOFC, PEMFC, PAFC, MCFC), by Application (Bus, Logistics Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

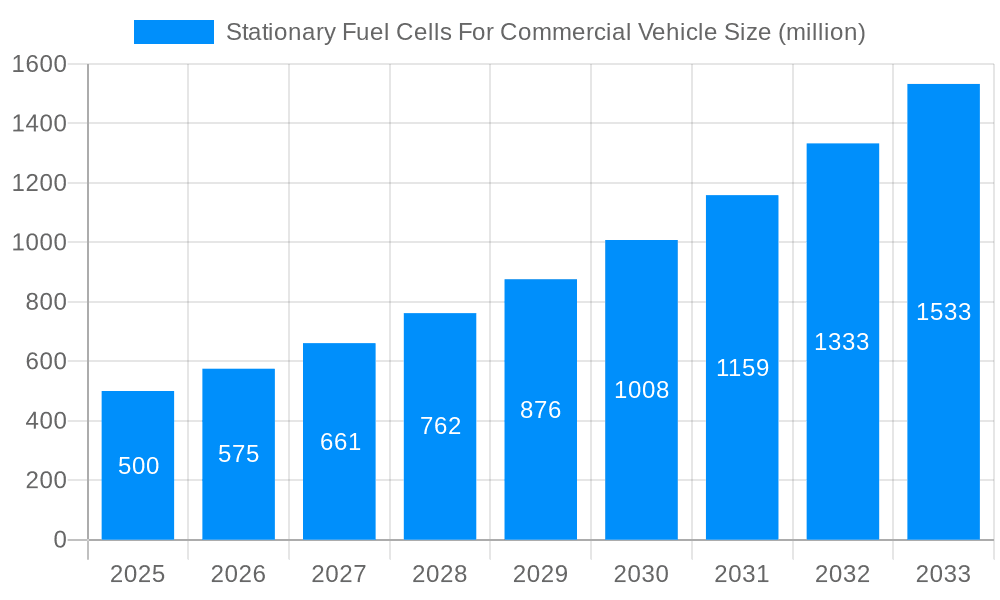

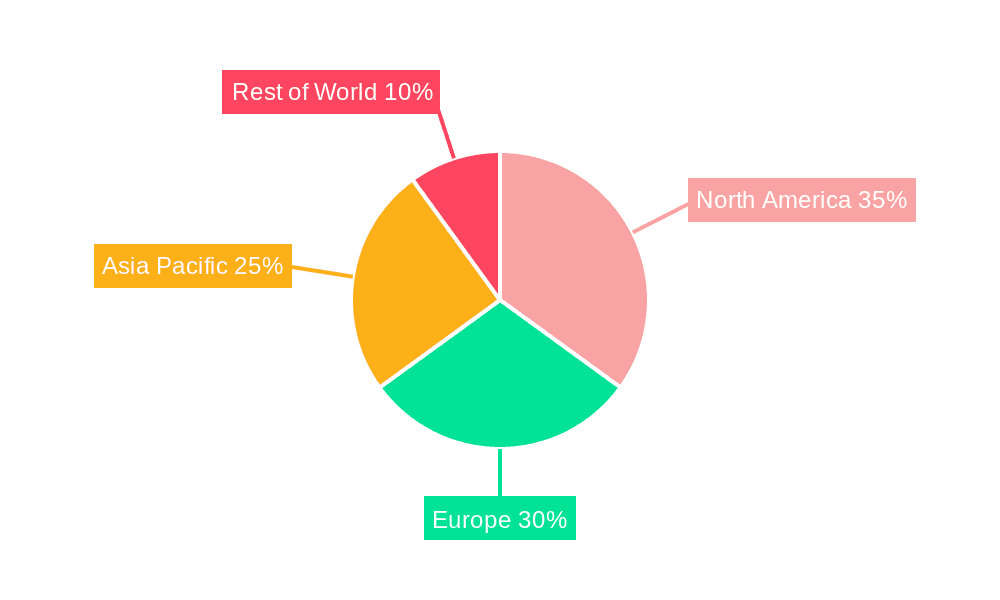

The global market for stationary fuel cells in commercial vehicles is poised for significant growth, driven by increasing environmental concerns and the need for cleaner transportation solutions. While precise market size figures aren't provided, considering the involvement of major players like Toyota, Hyundai, and several bus manufacturers, a conservative estimate for the 2025 market size could be in the range of $500 million, given the substantial investment and development in fuel cell technology. A Compound Annual Growth Rate (CAGR) of 15% over the forecast period (2025-2033) appears realistic, reflecting the expected increase in adoption across various vehicle types and regions. Key drivers include stringent emission regulations, government incentives promoting sustainable transportation, and the increasing operational efficiency offered by fuel cell technology compared to traditional combustion engines, particularly in long-haul applications. The market segmentation reveals a strong focus on buses and logistics vehicles, indicating high demand within these segments. Potential restraints include the high initial investment cost of fuel cell systems, the need for wider hydrogen refueling infrastructure, and ongoing technological advancements required to improve fuel cell durability and cost-effectiveness. The geographic distribution will likely see strong growth in North America and Europe due to established regulatory frameworks and early adoption of clean technologies, with Asia-Pacific also exhibiting rapid expansion in the coming years, particularly in China and India.

The competitive landscape is dynamic, with a mix of established automotive manufacturers and specialized fuel cell companies vying for market share. Success will hinge on the ability to deliver cost-competitive and reliable fuel cell systems, coupled with strong partnerships across the hydrogen value chain. Further market penetration will depend on advancements in fuel cell technology, including improved efficiency, reduced costs, and extended lifespan. Ongoing research and development efforts, coupled with supportive government policies, will be crucial to overcoming the challenges and unlocking the full potential of stationary fuel cells in the commercial vehicle sector. The integration of fuel cell technology into hybrid systems may also play a significant role in driving market expansion, offering a more gradual transition towards complete fuel cell adoption. Market success will involve navigating the evolving technological landscape, securing favorable regulatory environments, and strategically establishing robust distribution and maintenance networks.

The global stationary fuel cell market for commercial vehicles is poised for significant growth throughout the forecast period (2025-2033). Driven by increasing environmental concerns and the need for cleaner transportation solutions, the market is witnessing a substantial shift towards fuel cell technology. The estimated market value in 2025 is projected to be in the hundreds of millions of USD, experiencing a compound annual growth rate (CAGR) exceeding X% during the forecast period. This growth is fueled by several factors including stringent emission regulations, government incentives promoting the adoption of zero-emission vehicles, and advancements in fuel cell technology resulting in improved efficiency, durability, and cost-effectiveness. The historical period (2019-2024) showcased initial market penetration, primarily driven by pilot projects and early adoption by forward-thinking companies. However, the forecast period anticipates wider commercial deployment, especially within the bus and logistics vehicle segments, propelled by decreasing production costs and increasing economies of scale. Different fuel cell types, like PEMFC and SOFC, are finding applications across various commercial vehicle types, each offering specific advantages depending on the application's power requirements and operating conditions. This comprehensive report analyzes these trends across various geographical regions, highlighting key market players and providing a detailed outlook on the future of stationary fuel cells in the commercial vehicle sector. The consumption value is expected to reach billions of USD by 2033, underscoring the immense potential of this emerging market. Specific details regarding the exact figures and CAGR will be available in the full report. The report also delves into regional variations, analyzing the adoption rates and market drivers specific to different regions.

Several powerful forces are accelerating the adoption of stationary fuel cells in commercial vehicles. Stringent emission regulations globally are pushing fleet operators to decarbonize their operations, making fuel cell technology a compelling alternative to traditional diesel and gasoline engines. Government incentives, including subsidies, tax breaks, and grants, significantly reduce the upfront costs associated with purchasing and deploying fuel cell vehicles, making them financially viable for a broader range of businesses. Advancements in fuel cell technology, such as increased efficiency, extended lifespan, and reduced cost, are making them more competitive with traditional power sources. The rising awareness of environmental sustainability amongst consumers and businesses is creating pressure on companies to adopt greener practices, driving the demand for environmentally friendly transportation solutions. Furthermore, the increasing availability of hydrogen refueling infrastructure is gradually removing a key barrier to wider fuel cell adoption, enhancing the practicality and convenience of these vehicles for commercial operations. The improved performance and operational characteristics of fuel cell vehicles, such as faster refueling times compared to battery electric vehicles, and the ability to operate under varied weather conditions, are further bolstering their appeal in the commercial vehicle sector. Finally, the decreasing cost of hydrogen production is also playing a pivotal role in driving down the overall cost of ownership, thereby making stationary fuel cells a more attractive proposition.

Despite the promising outlook, the stationary fuel cell market for commercial vehicles faces several challenges. The high initial investment cost associated with fuel cell technology remains a major barrier to entry for many businesses, particularly smaller operators with limited capital. The limited availability of hydrogen refueling infrastructure in many regions presents a significant logistical hurdle. Building out this infrastructure requires substantial investment and careful planning, posing a chicken-and-egg problem for wider adoption. The durability and lifespan of fuel cells, while improving, still need further enhancements to compete with the longevity of conventional engines. Concerns about the safety and handling of hydrogen fuel, although well-mitigated by current technologies, also need to be addressed to ensure widespread public acceptance. Additionally, technological advancements are needed to further reduce production costs to enable broader market penetration. The energy density of current fuel cell technology is another consideration to be improved compared to traditional combustion engines. The complexity involved in maintaining and servicing fuel cell systems requires specialized training and expertise, leading to higher maintenance costs compared to simpler internal combustion engines. Finally, the overall efficiency of the entire hydrogen production and distribution chain needs optimization to maximize the environmental benefits of this technology.

The Bus segment is projected to dominate the stationary fuel cell market for commercial vehicles throughout the forecast period (2025-2033). This dominance is attributable to the increasing focus on reducing emissions in public transportation, coupled with government incentives supporting the adoption of zero-emission buses in major cities worldwide. Several regions are likely to see significantly higher growth.

Europe: Stringent emission regulations in Europe, along with government support for clean transportation, are driving strong adoption of fuel cell buses in countries like Germany, the UK, and the Netherlands. Extensive experience and research in fuel cell technology within the region are further contributing to this growth.

North America: North American cities are rapidly embracing zero-emission public transportation solutions, leading to a significant demand for fuel cell buses in the US and Canada. Government funding initiatives and corporate social responsibility commitments by bus operators are driving market expansion.

Asia-Pacific: Countries like China, Japan, and South Korea are investing heavily in fuel cell technology development and infrastructure, expecting significant growth in the adoption of fuel cell buses for public transit systems. The focus on sustainable urban mobility and large-scale public transportation systems provides significant market potential.

PEMFC (Proton Exchange Membrane Fuel Cells) is expected to be the dominant type of fuel cell used in this segment, offering a good balance of cost, efficiency, and power output suitable for bus applications. While other types like SOFC (Solid Oxide Fuel Cells) may have advantages in terms of efficiency, the higher initial costs and operational requirements may limit their widespread adoption in the near term within the bus segment. The report will provide a detailed breakdown of the market share held by each fuel cell type and its projected growth across different regions. The market's projected value for buses equipped with stationary fuel cells is expected to reach the hundreds of millions of USD by 2033.

The convergence of multiple factors is driving the growth of stationary fuel cells in the commercial vehicle industry. These include increasing government regulations targeting emissions, substantial advancements in fuel cell technology leading to improved performance and reduced costs, and a growing societal awareness of environmental sustainability. This confluence of factors fosters a favorable environment for the rapid expansion of the stationary fuel cell market, making it an increasingly attractive solution for commercial vehicle operators seeking to lower their environmental impact and comply with stricter emission standards.

This report offers a comprehensive and in-depth analysis of the stationary fuel cells for commercial vehicles market, including detailed market sizing, segmentation, regional breakdowns, and competitive landscapes. The report provides an invaluable resource for businesses, investors, and policymakers looking to understand the opportunities and challenges facing this rapidly growing sector. It offers insights into market drivers, restraints, growth catalysts, and future trends, providing a robust foundation for strategic decision-making within the fuel cell industry. The inclusion of key company profiles, financial projections, and extensive market data enables stakeholders to make informed decisions related to market entry, investment opportunities, and technological developments.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

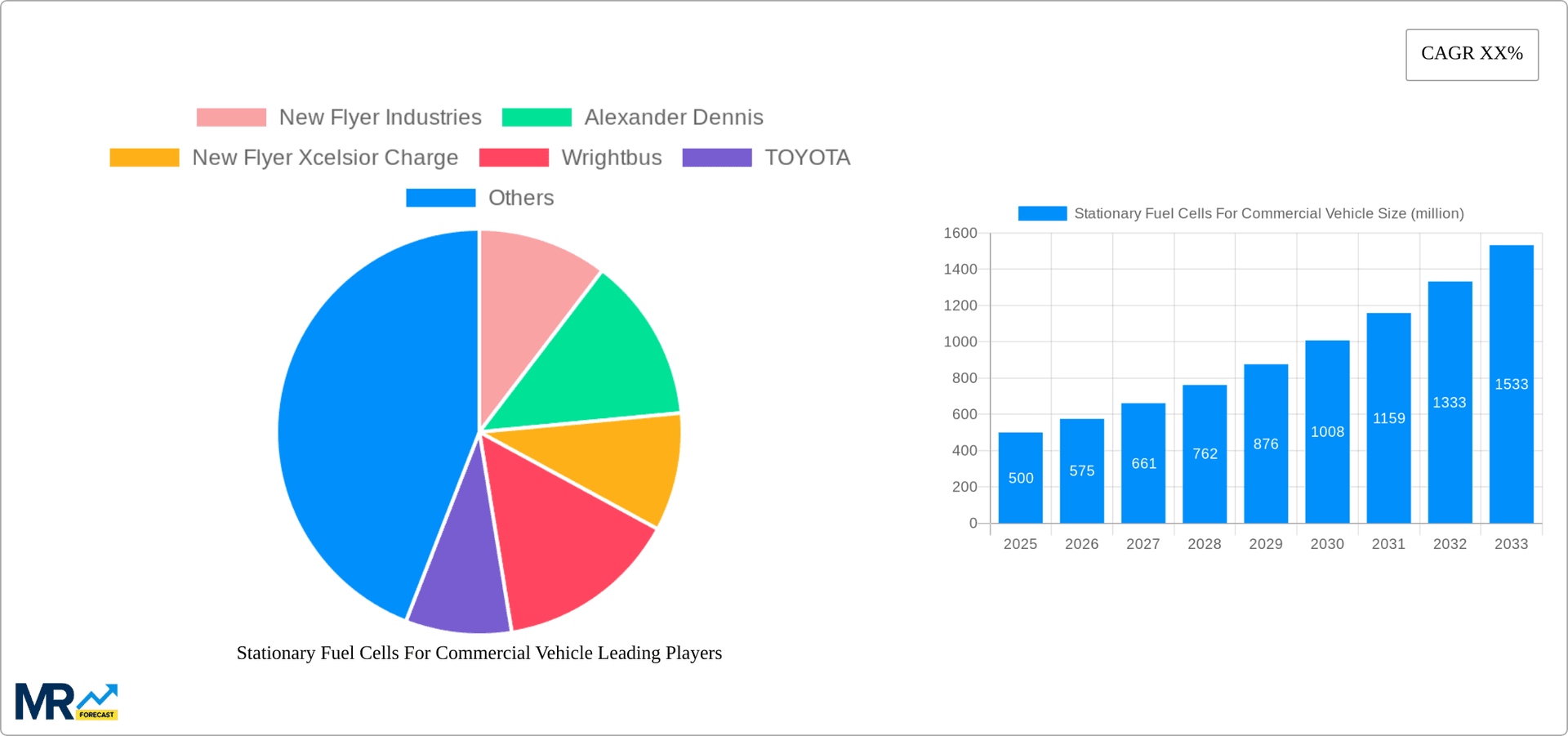

Key companies in the market include New Flyer Industries, Alexander Dennis, New Flyer Xcelsior Charge, Wrightbus, TOYOTA, Van Hool, Solaris, Hyundai, HYZON Motor, Wrightbus, New Flyer, ENC Group, Tata Motors, Foton AUV, Yutong, Zhongtong, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Stationary Fuel Cells For Commercial Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Stationary Fuel Cells For Commercial Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.