1. What is the projected Compound Annual Growth Rate (CAGR) of the Standard Medical Gas Outlets?

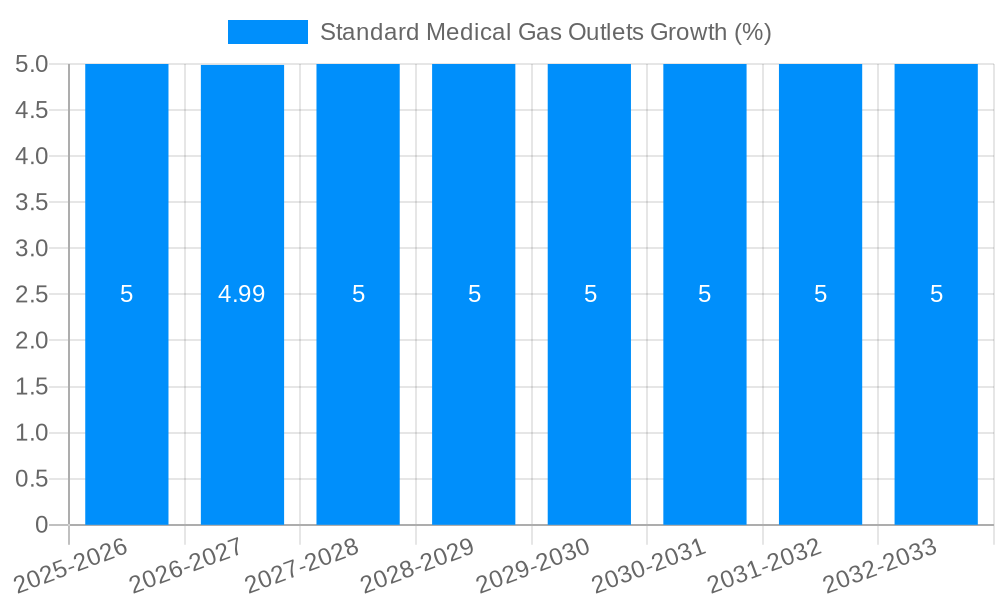

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Standard Medical Gas Outlets

Standard Medical Gas OutletsStandard Medical Gas Outlets by Application (Hospitals, Clinics, Others), by Type (Wall Outlets, Console Outlets, Celling Outlets), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

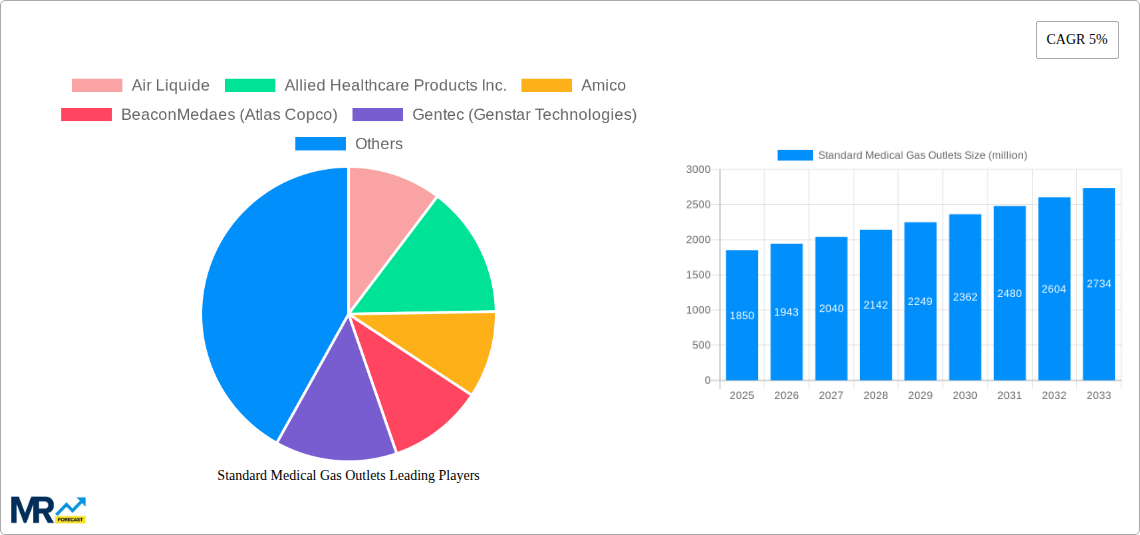

The Standard Medical Gas Outlets market is poised for robust growth, driven by increasing healthcare infrastructure development, particularly in emerging economies, and a rising demand for advanced medical facilities globally. The market, valued at approximately USD 1,850 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5% over the forecast period of 2025-2033. This sustained expansion is largely attributable to the escalating prevalence of chronic diseases, the growing elderly population requiring consistent medical care, and the continuous technological advancements in medical gas delivery systems. Furthermore, a heightened focus on patient safety and the need for reliable and standardized medical gas connections are significant catalysts fueling market adoption. The increasing number of hospital expansions and new hospital constructions worldwide, coupled with upgrades in existing healthcare facilities, directly translate into a greater demand for these essential medical gas outlets.

The market segmentation by type reveals a dominant share for Wall Outlets due to their widespread integration into standard patient rooms and operating theaters, offering ease of access and installation. Console Outlets are expected to witness steady growth, driven by their application in critical care units and specialized procedure rooms requiring integrated gas management. The application segment highlights Hospitals as the largest consumer, owing to their high volume of patient admissions and diverse medical gas needs. Clinics and "Others" (including home healthcare settings and specialized medical centers) represent growing segments as decentralized healthcare models gain traction. Despite the strong growth trajectory, potential restraints such as stringent regulatory approvals for medical devices and the high initial investment costs for advanced outlet systems could pose challenges. However, the persistent need for safe and efficient medical gas supply in an evolving healthcare landscape ensures a positive outlook for the Standard Medical Gas Outlets market.

Here is a unique report description for Standard Medical Gas Outlets, incorporating your specified details and format:

The global Standard Medical Gas Outlets market is poised for substantial growth, projected to reach a value of approximately 3,200 million USD by 2033. The study period, spanning from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, highlights a dynamic trajectory shaped by increasing healthcare infrastructure development and a growing demand for reliable medical gas delivery systems. The historical period (2019-2024) witnessed a steady upward trend, driven by the essential role of medical gases in patient care. The forecast period (2025-2033) is expected to see an accelerated expansion as advancements in medical technology and a renewed focus on patient safety and efficiency in healthcare facilities become paramount. Key market insights reveal a significant shift towards integrated medical gas systems, where outlets are not merely standalone components but part of a sophisticated delivery network. The increasing prevalence of chronic diseases and the aging global population are indirectly fueling the demand for medical gases, consequently boosting the market for their delivery mechanisms. Furthermore, stringent regulatory frameworks concerning the quality and safety of medical gas supply are compelling healthcare providers to invest in compliant and high-performance outlet solutions. The market's expansion is also intricately linked to the increasing number of surgical procedures performed globally, requiring a constant and secure supply of gases like oxygen, nitrous oxide, and medical air. The trend towards modular and customizable outlet solutions catering to specific clinical needs is another noteworthy development. This adaptability ensures that different medical environments, from large-scale hospitals to specialized clinics, can optimize their gas distribution. The adoption of smart technologies and remote monitoring capabilities within medical gas systems is also gaining traction, offering enhanced operational efficiency and proactive maintenance, which will further shape the market landscape in the coming years.

The Standard Medical Gas Outlets market is experiencing a significant upward momentum, propelled by a confluence of critical factors. Foremost among these is the ever-increasing global demand for healthcare services, driven by a burgeoning population, an aging demographic, and a rise in the incidence of various medical conditions requiring constant medical gas support. Hospitals and clinics worldwide are expanding their capacities and upgrading their infrastructure to cater to this demand, directly translating into a higher need for robust and compliant medical gas outlet systems. Another potent driver is the rapid advancement in medical technologies and procedures. Innovations in surgery, anesthesiology, and critical care necessitate more sophisticated and reliable methods for delivering medical gases. This includes the development of specialized gas mixtures and the need for precise flow control, all of which are dependent on the quality and functionality of the outlet connections. Furthermore, the growing emphasis on patient safety and infection control in healthcare settings is a significant impetus. Standardized and well-maintained medical gas outlets are crucial for preventing cross-contamination and ensuring the correct gas is delivered to the patient, thereby minimizing the risk of medical errors and adverse events. Government initiatives and regulatory bodies are also playing a crucial role by enforcing stricter standards for medical gas installations and maintenance, compelling healthcare facilities to invest in certified and high-quality outlet solutions. The increasing number of new hospital constructions and the renovation of existing facilities, particularly in emerging economies, also represent a substantial growth avenue for this market.

Despite the promising growth trajectory, the Standard Medical Gas Outlets market is not without its hurdles. A primary challenge is the significant capital investment required for the initial installation and subsequent upgrades of medical gas pipeline systems. Healthcare facilities, especially in resource-constrained regions, may find these costs prohibitive, leading to delays or the adoption of less advanced solutions. Stringent regulatory compliance and the need for rigorous testing and certification for medical gas outlets add another layer of complexity and cost. Ensuring that all outlets meet international safety standards and are regularly inspected requires dedicated resources and expertise, which can be a strain for smaller healthcare providers. The threat of counterfeit or substandard products also poses a risk to market integrity and patient safety. The availability of cheaper, non-compliant outlets can undercut legitimate manufacturers and compromise the reliability of medical gas delivery. Furthermore, the maintenance and servicing of medical gas outlets can be a recurring challenge. Regular inspections, cleaning, and replacement of worn-out parts are essential to prevent malfunctions and ensure consistent gas supply. This requires a skilled workforce and a proactive maintenance schedule, which may not always be readily available. The integration of new and advanced medical gas systems with existing legacy infrastructure can also present technical difficulties and compatibility issues, hindering the seamless adoption of the latest outlet technologies. Finally, economic downturns and global health crises, while sometimes indirectly boosting demand for medical gases, can also lead to budget cuts and reprioritization of healthcare spending, potentially impacting investment in new medical gas outlet infrastructure.

The Hospitals segment is overwhelmingly poised to dominate the Standard Medical Gas Outlets market, both globally and across key regions. This dominance is directly attributable to the comprehensive and diverse range of medical gas applications within hospital settings. Hospitals, by their very nature, are the epicenters of critical care, surgical procedures, emergency services, and long-term patient management, all of which rely heavily on a constant and secure supply of medical gases.

Hospitals:

Wall Outlets: Among the different types of outlets, Wall Outlets are expected to maintain their dominance within the Standard Medical Gas Outlets market. Their ubiquity, ease of installation, and versatility make them the go-to solution for a vast majority of medical gas delivery needs.

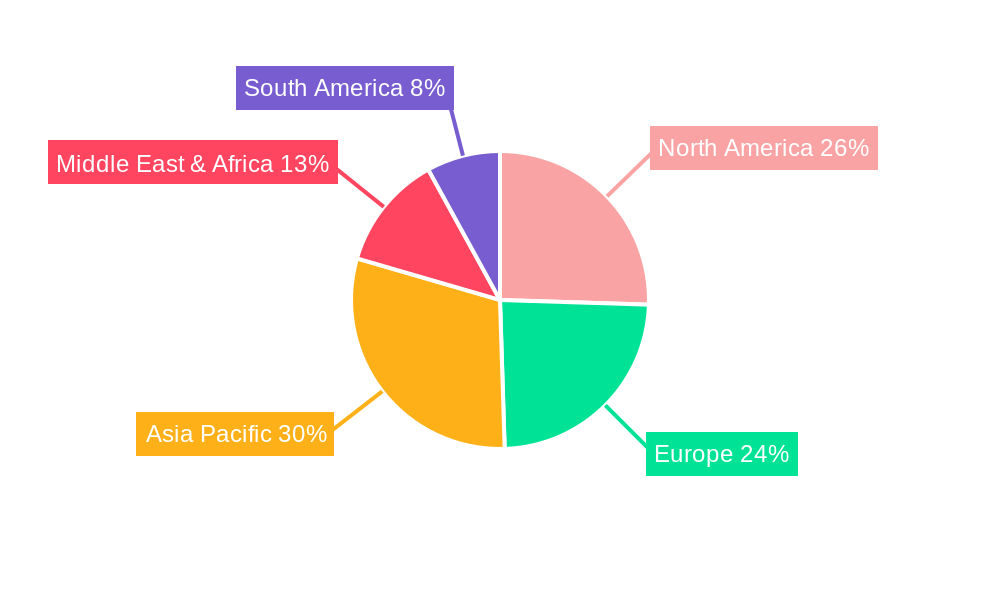

Geographically, North America and Europe are anticipated to remain dominant regions in the Standard Medical Gas Outlets market due to their well-established healthcare infrastructure, high per capita healthcare spending, and stringent regulatory environments that mandate advanced medical gas systems. However, the Asia-Pacific region is projected to exhibit the fastest growth rate, driven by increasing healthcare expenditure, a rising number of new hospital constructions, and a growing awareness of the importance of reliable medical gas supply in countries like China, India, and Southeast Asian nations.

Several factors are acting as potent growth catalysts for the Standard Medical Gas Outlets industry. The increasing global healthcare expenditure is a primary driver, enabling healthcare providers to invest in advanced medical infrastructure, including sophisticated medical gas systems. Furthermore, the rising prevalence of respiratory diseases and the expanding geriatric population are creating a sustained demand for medical oxygen and other essential gases, directly boosting the need for reliable outlet solutions. Technological advancements in medical equipment that require precise and secure medical gas connections also act as a significant catalyst, pushing for innovation and adoption of higher-quality outlets.

This comprehensive report delves deep into the global Standard Medical Gas Outlets market, offering an in-depth analysis from 2019 to 2033. It provides crucial insights into market dynamics, growth drivers, and potential restraints, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines key market segments, including applications such as Hospitals, Clinics, and Others, and outlet types like Wall Outlets, Console Outlets, and Ceiling Outlets. Furthermore, it highlights significant industry developments, identifies leading players, and forecasts market size estimations in millions of USD. The analysis is grounded in a thorough understanding of the healthcare landscape and the indispensable role of reliable medical gas delivery systems in modern patient care.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Air Liquide, Allied Healthcare Products Inc., Amico, BeaconMedaes (Atlas Copco), Gentec (Genstar Technologies), ASB System, Ohio Medical, Powerex, ESCO Medicon, GCE Group, Dräger, Pattons Medical, Randall, Novair Medical, Silbermann Technologies, G. SAMARAS SA, Precision UK Ltd, Tri-Tech Medical, Medicop, CBMTECH, INMED-Karczewscy, INSPITAL, Medical Technologies, Pneumatech, Radon Med-tech, Acare Technology, Gloor Medical, Amcaremed Technology, Ningbo Leibo Medical Technology, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Standard Medical Gas Outlets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Standard Medical Gas Outlets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.