1. What is the projected Compound Annual Growth Rate (CAGR) of the Stainless Steel Beverage Kegs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Stainless Steel Beverage Kegs

Stainless Steel Beverage KegsStainless Steel Beverage Kegs by Type (≤20L, 21~ 50L, > 50L, World Stainless Steel Beverage Kegs Production ), by Application (Alcoholic Products, Non-Alcoholic Products, World Stainless Steel Beverage Kegs Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

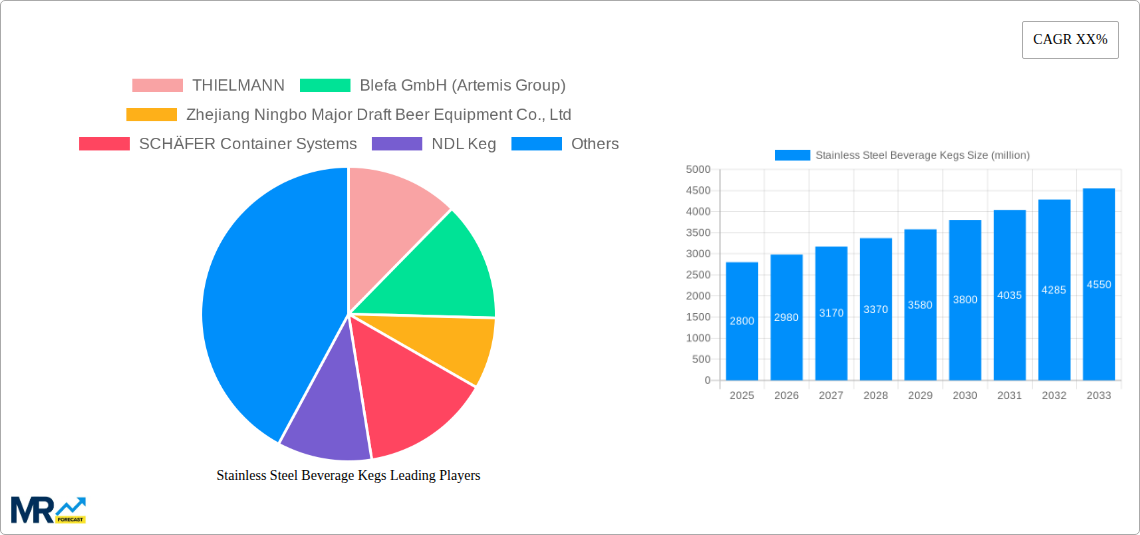

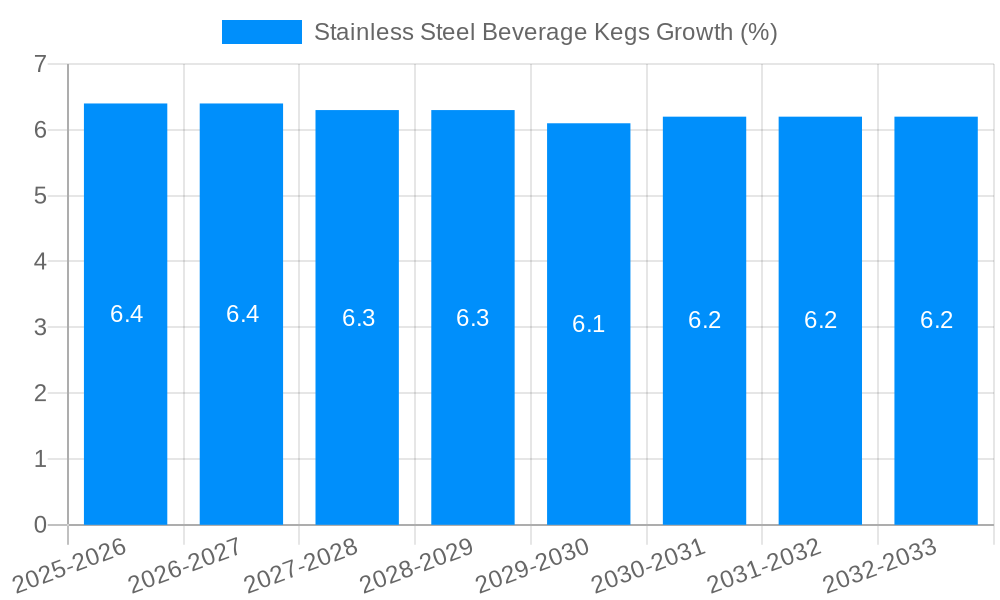

The global stainless steel beverage keg market is poised for significant expansion, driven by robust demand for both alcoholic and non-alcoholic beverages, coupled with increasing consumer preference for premium and craft options. This surge is underscored by an estimated market size of approximately $2,800 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. The market's upward trajectory is largely fueled by the growing popularity of draft beverages, which necessitate reliable and hygienic keg solutions. The convenience and sustainability offered by stainless steel kegs, compared to traditional glass bottles or single-use plastic containers, further bolster their adoption across breweries, wineries, and beverage distributors worldwide. Technological advancements in keg design, focusing on enhanced durability, ease of cleaning, and smart tracking capabilities, are also contributing to market growth. The increasing emphasis on food-grade materials and stringent hygiene standards in beverage packaging further solidifies the dominance of stainless steel in this sector.

Several key drivers are propelling the stainless steel beverage keg market. The burgeoning craft beverage industry, particularly in the beer and cider segments, is a primary engine of growth. As smaller breweries expand their reach, the demand for standardized and reusable kegs escalates. Furthermore, the rising disposable income and evolving lifestyle preferences in emerging economies are contributing to increased consumption of packaged beverages, including those served on tap. While the market enjoys strong growth, potential restraints include the initial capital investment required for keg procurement and the logistics involved in keg management and refurbishment. However, the long-term cost-effectiveness and environmental benefits of stainless steel kegs tend to outweigh these initial considerations. The market is characterized by a competitive landscape, with established players like THIELMANN and Blefa GmbH, alongside emerging companies, vying for market share by offering innovative products and catering to specific regional demands. The segmentation by type, with a notable demand for kegs in the 21-50L range, reflects the needs of both commercial establishments and growing home-drafting trends.

Here's a comprehensive report description for Stainless Steel Beverage Kegs, incorporating your specified elements:

The global stainless steel beverage keg market is poised for robust growth, driven by an escalating demand for premium and craft beverages, alongside a sustained emphasis on hygiene and sustainability. Throughout the study period of 2019-2033, the market has witnessed a significant evolution, with the Base Year of 2025 serving as a critical benchmark for future projections. In 2025, the estimated global production of stainless steel beverage kegs is anticipated to reach XX million units, a testament to the sector's growing importance. This upward trajectory is underpinned by several key market insights. Firstly, the increasing preference for draught beer, wine, and other beverages in both commercial and domestic settings is directly fueling the need for reliable and reusable keg solutions. Consumers are increasingly seeking authentic and high-quality drinking experiences, which often involve draught options. Secondly, the inherent advantages of stainless steel – its durability, corrosion resistance, and ease of cleaning – make it the material of choice for beverage containment, ensuring product integrity and safety. This is particularly crucial in the alcoholic products segment, where maintaining flavor and preventing contamination are paramount. The non-alcoholic products segment is also contributing significantly, with a rise in demand for specialty sodas, cold brew coffee, and kombucha served on tap. The market is witnessing a growing adoption of kegging solutions for a wider array of beverages beyond traditional beer. Furthermore, the increasing focus on environmental sustainability is a major trend. Stainless steel kegs are highly recyclable and offer a significantly longer lifespan compared to single-use alternatives, aligning with global efforts to reduce waste. This circular economy approach resonates strongly with both manufacturers and end-users. The World Stainless Steel Beverage Kegs Production is expected to see a continuous expansion, with the Forecast Period of 2025-2033 projecting sustained year-on-year growth. The Historical Period of 2019-2024 has laid the foundation for this expansion, marked by a steady increase in adoption and technological advancements in keg manufacturing. The market is also influenced by evolving regulatory landscapes that prioritize food-grade materials and safe beverage handling, further solidifying the position of stainless steel kegs. The overall market sentiment points towards a future where stainless steel beverage kegs are indispensable for the efficient and responsible distribution of a diverse range of beverages, from craft breweries to large-scale beverage manufacturers.

Several powerful forces are collectively propelling the growth of the stainless steel beverage keg market. The most significant driver is the burgeoning global craft beverage revolution. As consumers increasingly seek unique and artisanal alcoholic and non-alcoholic drinks, the demand for draught options has surged. This trend necessitates robust, reusable, and hygienic packaging solutions, a role perfectly fulfilled by stainless steel kegs. Furthermore, the inherent durability and longevity of stainless steel make it an economically viable choice for beverage producers over time. Unlike single-use packaging, kegs can be refilled and reused thousands of times, leading to significant cost savings and a reduced environmental footprint. The emphasis on product safety and quality assurance by regulatory bodies and consumers alike further bolsters the adoption of stainless steel. Its non-reactive nature prevents contamination and preserves the pristine taste of beverages, a critical factor in the success of premium and specialty drinks. The expansion of the foodservice industry, including bars, restaurants, and hospitality venues, which rely heavily on draught systems, also contributes to the sustained demand for stainless steel kegs. As these establishments grow and diversify their offerings, the need for a reliable keg supply chain intensifies. The growing awareness and preference for sustainable packaging solutions among consumers and businesses are also playing a pivotal role. Stainless steel is highly recyclable and contributes to a circular economy, aligning with corporate social responsibility initiatives and environmental regulations. This increasing eco-consciousness is a powerful trend that directly favors the adoption of stainless steel beverage kegs.

Despite the robust growth, the stainless steel beverage keg market is not without its hurdles. One of the primary challenges is the initial capital investment required for purchasing stainless steel kegs. For smaller craft breweries or emerging beverage companies, the upfront cost can be a significant barrier, especially when compared to cheaper, disposable packaging alternatives. This can slow down the adoption rate for these entities. Another considerable restraint is the complexity of logistics and supply chain management associated with kegs. While reusable, kegs require efficient systems for collection, cleaning, and redistribution. Managing these reverse logistics can be logistically challenging and costly, especially for businesses operating across wide geographical areas. Furthermore, the risk of damage and loss of kegs during transit and storage, though infrequent, can contribute to overall costs and operational inefficiencies. While stainless steel is durable, mishandling can lead to dents or structural damage, rendering them unusable until repaired. The availability and cost of raw materials, specifically stainless steel itself, can also pose a challenge. Fluctuations in global stainless steel prices, influenced by factors like energy costs, ore availability, and geopolitical events, can directly impact the manufacturing cost of kegs and, consequently, their market price. This price volatility can create uncertainty for both manufacturers and buyers. Finally, while the long-term cost-effectiveness of stainless steel kegs is a major advantage, the perceived higher unit cost compared to disposable alternatives can still deter some price-sensitive segments of the market, particularly in regions with less developed infrastructure or a less mature craft beverage scene. Addressing these challenges will be crucial for unlocking the full potential of the stainless steel beverage keg market.

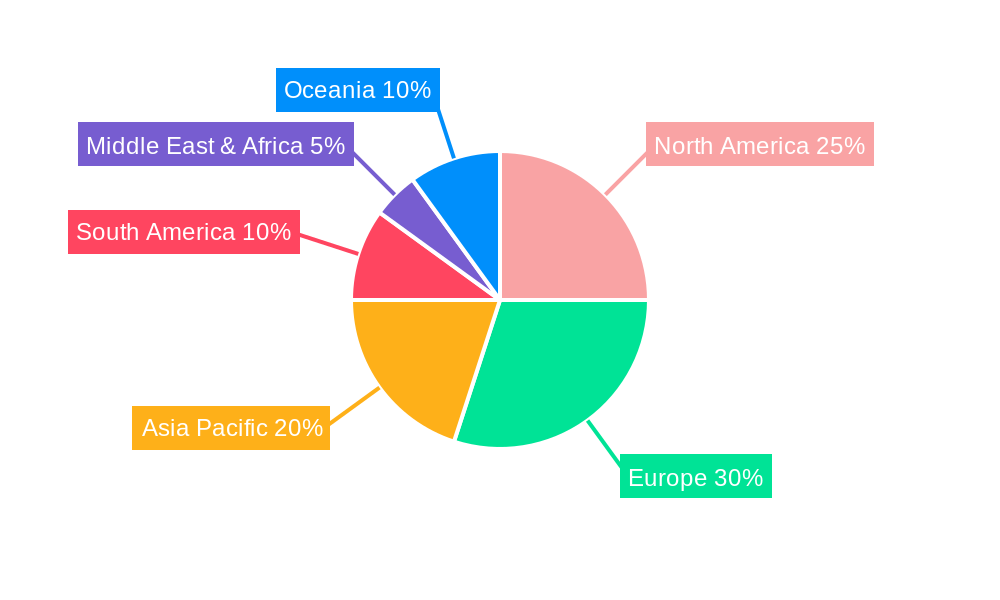

The global stainless steel beverage keg market exhibits distinct dominance across various regions and segments, driven by a confluence of economic factors, consumer preferences, and industry maturity.

Dominant Segments:

Type: > 50L Segment:

Application: Alcoholic Products:

Dominant Region/Country:

North America (specifically the United States):

Europe:

The interplay of these dominant segments and regions, supported by the projected growth in World Stainless Steel Beverage Kegs Production and the specific demands of alcoholic and non-alcoholic products, paints a clear picture of where the market's key activity and future expansion will likely occur.

Several key factors are acting as potent growth catalysts for the stainless steel beverage keg industry. The relentless expansion of the craft beverage sector, encompassing beer, cider, wine, and even non-alcoholic options like kombucha and cold brew coffee, is a primary driver. Consumers' growing preference for draught versions of these beverages fuels demand for reliable kegging solutions. Furthermore, increasing global awareness and adoption of sustainable practices are pushing industries towards reusable and recyclable packaging, with stainless steel kegs offering a superior environmental profile compared to single-use alternatives. The robust growth of the foodservice industry worldwide, with a continuous rise in bars, restaurants, and hospitality venues, directly translates to an increased need for draught dispensing systems, hence kegs.

This comprehensive report provides an in-depth analysis of the global stainless steel beverage keg market, meticulously covering the study period from 2019 to 2033, with a specific focus on the Base Year of 2025 and the Forecast Period of 2025-2033. The report delves into the market's intricate dynamics, dissecting key trends, driving forces, and the challenges that shape its trajectory. It offers granular insights into market segmentation, including by type (≤20L, 21-50L, >50L) and application (Alcoholic Products, Non-Alcoholic Products), alongside detailed analysis of World Stainless Steel Beverage Kegs Production. The report further identifies dominant regions and countries, highlighting their contributions to market growth. Leading players and significant developments within the sector are comprehensively profiled, offering a holistic view of the industry landscape and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include THIELMANN, Blefa GmbH (Artemis Group), Zhejiang Ningbo Major Draft Beer Equipment Co., Ltd, SCHÄFER Container Systems, NDL Keg, Ningbo BestFriends Beverage Containers, American Keg Company, INOXCVA (Inox), WorldKeg, Cubic Container Systems, Shinhan Industrial Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Stainless Steel Beverage Kegs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Stainless Steel Beverage Kegs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.