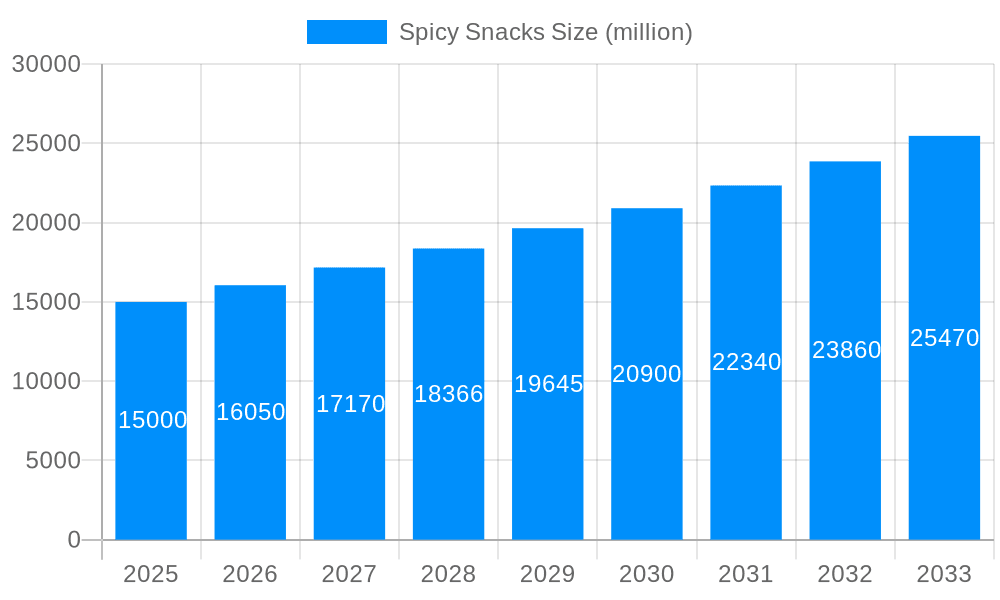

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spicy Snacks?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Spicy Snacks

Spicy SnacksSpicy Snacks by Type (Nuts and Soy Products, Seasoned Noodles, Meat Products, Puffed Food, Others, Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

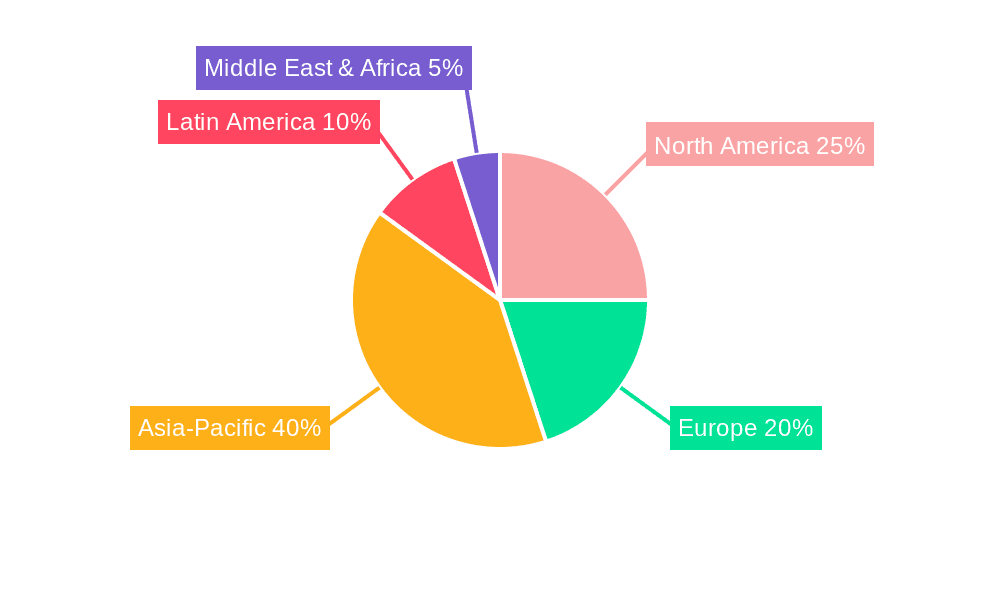

The global spicy snacks market is poised for substantial growth, driven by escalating consumer preference for convenient, flavorful, and portable food choices. Key growth drivers include rising disposable incomes in emerging economies, a pronounced shift towards bolder flavor profiles, and expanded accessibility through online retail channels. The market is segmented by product type, including nuts and soy products, seasoned noodles, meat products, puffed foods, and others, and by sales channel, encompassing online and offline segments. While offline channels currently lead, online sales are experiencing rapid growth, significantly contributing to market expansion. Leading companies such as Calbee, Shanghai Laiyifen, and Weilong Delicious Global Holdings are actively pursuing product innovation and strategic marketing to secure market positions and address evolving consumer demands. The Asia-Pacific region, particularly China and India, represents a major growth hub due to large populations and increasing snack consumption. Challenges include fluctuating raw material prices and stringent food safety regulations. The market is projected to experience continued expansion, with a notable surge in demand for healthier and innovative spicy snack options. The integration of technology, sustainable sourcing, and personalized consumer experiences will likely redefine the competitive landscape.

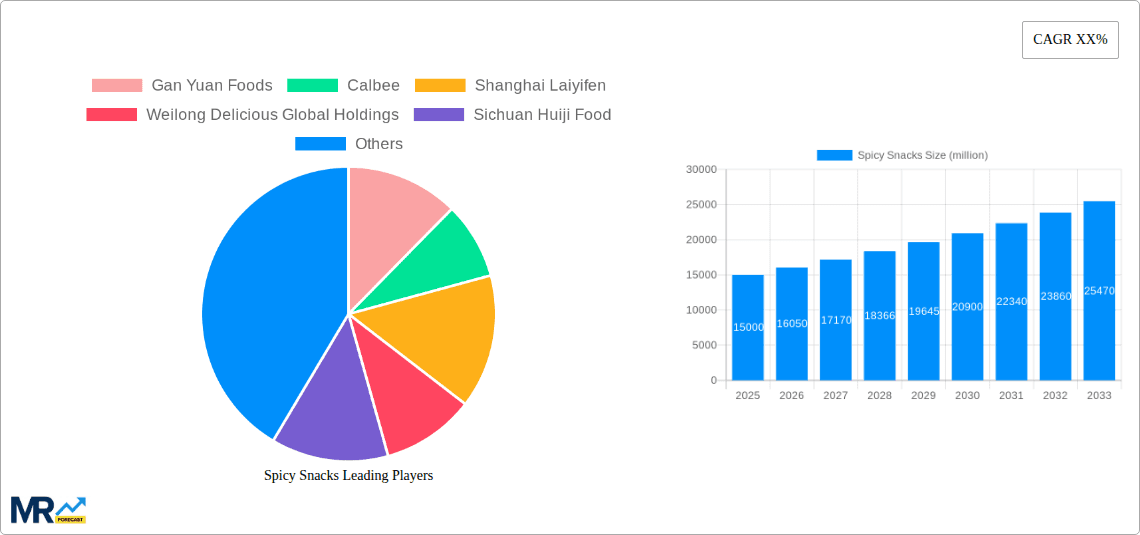

The competitive environment comprises a blend of established multinational corporations and agile regional players. Major companies are implementing strategies of product diversification and geographic expansion to fortify market share. Smaller, regional brands are concentrating on niche offerings and leveraging digital marketing for targeted outreach. Increased merger and acquisition activity is evident as larger entities seek to consolidate market positions and broaden product portfolios. Future growth will be propelled by the introduction of novel spicy snack varieties that align with evolving consumer tastes, prioritize healthier ingredients, and emphasize sustainability, including the exploration of plant-based alternatives and the reduction of artificial ingredients. Regional variations in spice preferences and cultural nuances will remain pivotal in shaping product development and marketing strategies, making the understanding of diverse consumer preferences critical for sustained success in this dynamic market.

The spicy snacks market, valued at approximately 150 million units in 2025, is experiencing robust growth, projected to reach over 280 million units by 2033. This surge is driven by several key factors. A significant trend is the increasing consumer preference for bolder, more intense flavors, with spicy snacks perfectly aligning with this evolving palate. This is particularly pronounced amongst younger demographics, who are more adventurous eaters and active users of online platforms where spicy snack brands effectively market their products. Furthermore, the convenience and portability of these snacks make them ideal for busy lifestyles. The market also showcases a notable shift towards healthier options, with manufacturers increasingly focusing on incorporating natural ingredients and reducing artificial additives while still maintaining that desired spicy kick. This caters to the growing health-conscious consumer base, which is increasingly seeking healthier alternatives without sacrificing flavor. Lastly, the expansion of online sales channels has significantly broadened the reach of spicy snack brands, facilitating convenient purchases and driving sales growth. The historical period (2019-2024) reveals a consistent upward trajectory, setting a strong foundation for sustained expansion in the forecast period (2025-2033). Competition is fierce, with established players like Calbee and Pepsico vying for market share alongside rapidly growing domestic brands like Weilong and Three Squirrels, leading to innovative product launches and aggressive marketing strategies. This dynamic competitive landscape further fuels market expansion.

The spicy snacks market's remarkable growth is fueled by a confluence of factors. Firstly, the rising popularity of global cuisines, particularly those featuring spicy flavors from regions like South Asia, Mexico, and Southeast Asia, is introducing consumers to a wider range of spicy food experiences, driving demand for corresponding snack products. Secondly, the increasing urbanization and changing lifestyles contribute significantly. Busy schedules and on-the-go consumption patterns increase the demand for convenient, readily available snacks, with spicy options providing a satisfying and flavorful indulgence. Moreover, the growing disposable incomes, especially in emerging economies, allow consumers to spend more on premium and diverse snack options, including spicy varieties. The power of social media and influencer marketing cannot be ignored, playing a crucial role in shaping consumer preferences and driving product awareness. Viral trends and online reviews significantly impact purchasing decisions, especially for younger consumers. Finally, the constant innovation within the industry—from introducing novel spicy flavors to experimenting with different textures and healthier ingredients—keeps the market exciting and attracts a broader customer base. These combined forces are projected to sustain the market's growth throughout the forecast period.

Despite the promising growth trajectory, the spicy snacks market faces several challenges. Maintaining consistent product quality and safety is paramount. Concerns regarding food safety and the use of artificial ingredients can negatively impact consumer trust and sales. Furthermore, intense competition, particularly from both established multinational corporations and emerging local brands, necessitates constant innovation and aggressive marketing strategies to maintain market share. Fluctuating raw material prices, particularly for spices and other key ingredients, can directly impact production costs and profitability. Governments’ regulatory changes concerning food labeling and ingredients also pose challenges, requiring manufacturers to adapt to evolving standards. Finally, the increasing health consciousness of consumers necessitates a continuous effort to develop healthier, lower-sodium, and potentially lower-calorie options without compromising the signature spicy flavor profile. Successfully navigating these challenges will be vital for sustained growth within this dynamic market.

The online sales segment is poised for significant dominance within the spicy snacks market.

Rapid Growth: Online sales channels offer unparalleled convenience and reach, allowing brands to tap into a vast consumer base, particularly younger demographics who are digitally savvy and prefer online shopping.

Targeted Marketing: Online platforms provide opportunities for targeted marketing campaigns, allowing brands to tailor their messaging and promotions to specific consumer segments based on their preferences and online behavior.

Increased Accessibility: E-commerce platforms transcend geographical barriers, making spicy snacks accessible to a wider customer base across various regions and countries.

Data-Driven Insights: Online sales channels offer valuable data on consumer preferences, purchasing patterns, and brand engagement, providing brands with insights to optimize their product offerings and marketing strategies.

Market Leaders: Major players are actively investing in their online presence, expanding their e-commerce capabilities, and partnering with online marketplaces to maximize their reach and market share.

In terms of geographical dominance, Asia, particularly China and India, is expected to hold a significant share due to their large populations, burgeoning middle class, and rising disposable incomes, fueling demand for both online and offline consumption of spicy snacks.

The continuous innovation in flavor profiles, packaging, and ingredient sourcing is a key growth catalyst. The growing adoption of healthier ingredients while maintaining the desired spicy taste is also driving increased market penetration. Effective marketing strategies leveraging both online and offline channels, and focusing on the younger demographic, will further propel growth.

This report provides a comprehensive overview of the spicy snacks market, analyzing historical trends, current market dynamics, and future growth projections. The report covers key market segments, leading players, and significant developments, providing valuable insights for businesses operating in or planning to enter this dynamic market. The in-depth analysis, combined with detailed data and forecasts, offers a complete understanding of the market's evolution and provides informed decision-making support for market participants.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Gan Yuan Foods, Calbee, Shanghai Laiyifen, Weilong Delicious Global Holdings, Sichuan Huiji Food, Yanjin Shop Food, Jinzai Food Group, Suzhou Youi Foods, Zuming Bean Products, Oishi, Want Want Holdings, Qiaqia Food, YouYou Foods Co, Bestore, Wantwant, Pepsico, Orion, Fujian Qinqin Holdings, Three Squirrels, .

The market segments include Type.

The market size is estimated to be USD 569.2 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Spicy Snacks," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Spicy Snacks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.