1. What is the projected Compound Annual Growth Rate (CAGR) of the Specific Absorption Rate Testing System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Specific Absorption Rate Testing System

Specific Absorption Rate Testing SystemSpecific Absorption Rate Testing System by Type (Traditional SAR Measurement System, Fast SAR Measurement System), by Application (Test Labs, Wireless Companies, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

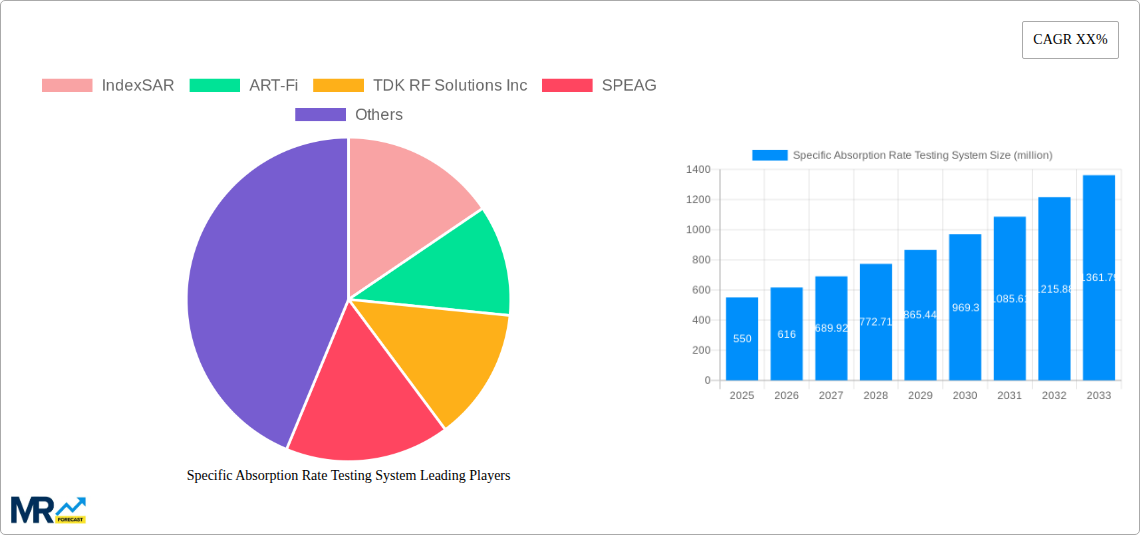

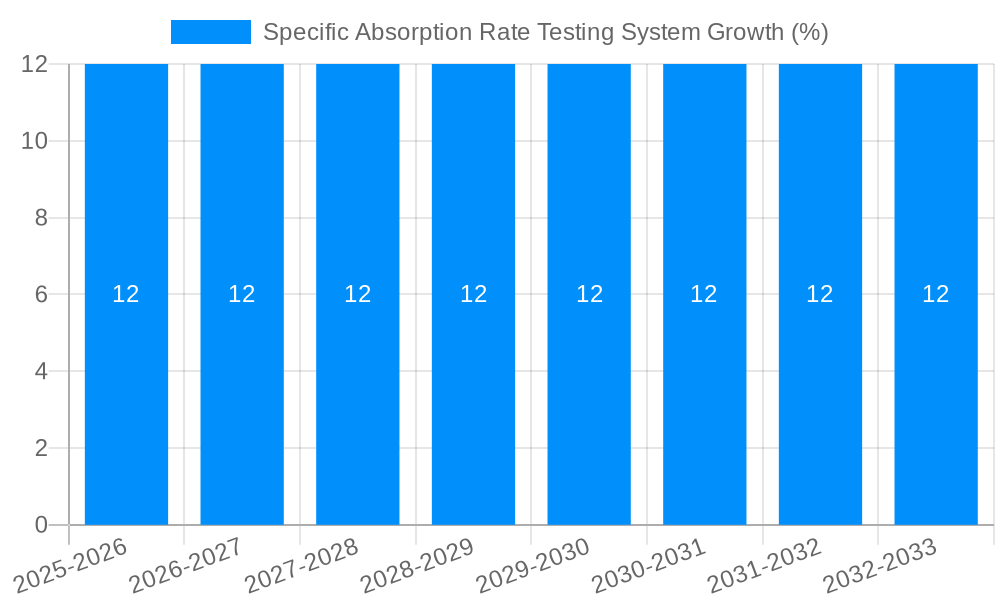

The global Specific Absorption Rate (SAR) Testing System market is poised for significant expansion, projected to reach a substantial market size of approximately $550 million by 2025, and is anticipated to grow at a robust Compound Annual Growth Rate (CAGR) of around 12% from 2025 to 2033. This impressive trajectory is primarily fueled by the escalating demand for wireless devices, including smartphones, tablets, and wearable technology, all of which necessitate stringent SAR testing to ensure public safety and regulatory compliance. The increasing adoption of 5G technology, with its higher frequencies and new transmission methods, further amplifies the need for advanced and accurate SAR measurement systems. Moreover, evolving government regulations and international standards mandating rigorous testing for electromagnetic field (EMF) exposure are acting as powerful catalysts for market growth. The "Fast SAR Measurement System" segment, in particular, is expected to witness accelerated adoption due to its ability to reduce testing times and improve overall efficiency for manufacturers.

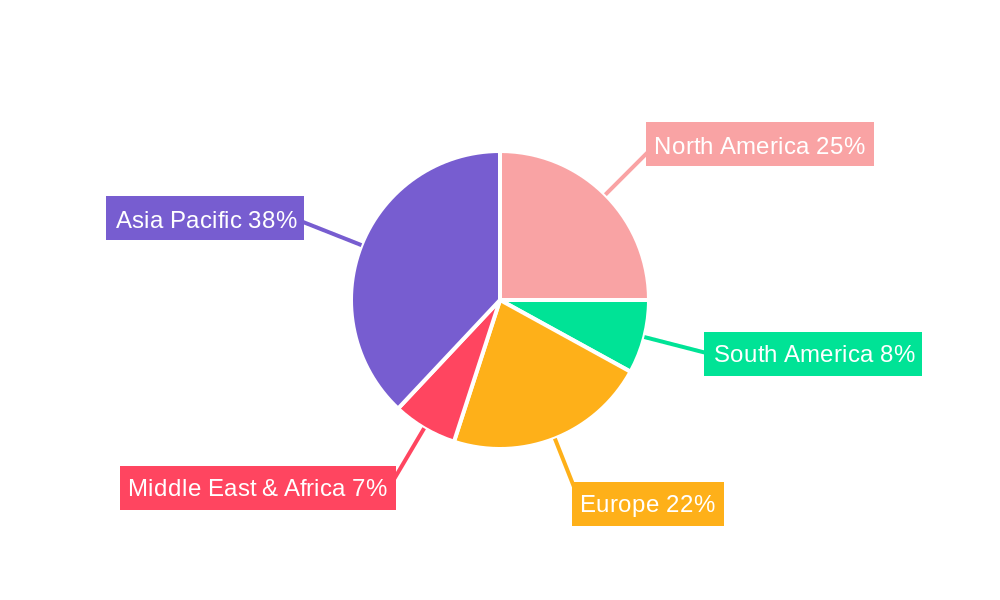

Key drivers underpinning this market growth include the continuous innovation in wireless communication technologies and the expanding product portfolios of leading electronics manufacturers. The "Test Labs" and "Wireless Companies" segments are expected to dominate the application landscape, reflecting their direct involvement in product development and compliance. Geographically, Asia Pacific, led by China and India, is anticipated to emerge as a leading region, driven by its massive consumer base for wireless devices and increasing investments in R&D and manufacturing. North America and Europe will also maintain significant market shares, supported by well-established regulatory frameworks and a strong presence of key industry players like SPEAG and TDK RF Solutions Inc. Challenges such as the high cost of sophisticated SAR testing equipment and the need for skilled personnel to operate them may present some restraints, but these are expected to be outweighed by the overarching need for safety compliance and the rapid pace of technological advancement in the wireless sector.

This report delves into the intricate landscape of Specific Absorption Rate (SAR) Testing Systems, providing an exhaustive analysis of market dynamics, technological advancements, and future projections. The study encompasses a comprehensive Study Period from 2019-2033, with 2025 serving as both the Base Year and Estimated Year. The Forecast Period extends from 2025-2033, building upon the Historical Period of 2019-2024. Our analysis aims to equip stakeholders with a nuanced understanding of market trends, driving forces, challenges, and opportunities within this critical sector. The report meticulously examines the market in terms of value, projecting a significant market size in the million unit range, reflecting the escalating demand for robust and accurate SAR testing solutions. This report is meticulously crafted for various stakeholders, including Test Labs, Wireless Companies, and Others within the broader industry ecosystem.

The global Specific Absorption Rate (SAR) Testing System market is poised for substantial expansion, driven by an unwavering commitment to public health and evolving regulatory frameworks governing electromagnetic field (EMF) exposure from electronic devices. During the Study Period of 2019-2033, the market has witnessed a consistent upward trajectory, with the Base Year of 2025 marking a pivotal point for anticipated growth. The Forecast Period from 2025-2033 is expected to see the market value reach the hundreds of millions of units, underscoring the increasing adoption of sophisticated SAR testing solutions. A significant trend observed throughout the Historical Period (2019-2024) and projected into the future is the transition towards Fast SAR Measurement Systems. These advanced systems offer considerably reduced testing times, a critical advantage in the rapidly innovating wireless device industry, allowing manufacturers to accelerate product development cycles while maintaining stringent safety standards. Concurrently, traditional Traditional SAR Measurement Systems continue to hold a significant market share, particularly in established Test Labs that prioritize time-tested accuracy and validation protocols. The integration of AI and machine learning into SAR testing software is another emerging trend, promising enhanced data analysis, automated test execution, and predictive modeling for EMF exposure, further contributing to the market's value in the millions. The increasing proliferation of 5G devices and the exploration of higher frequency bands necessitate continuous advancements in SAR testing methodologies and equipment, ensuring compliance with ever-evolving international safety guidelines and contributing to the overall market value in the tens of millions. The competitive landscape is characterized by continuous innovation and strategic collaborations among key players like IndexSAR, ART-Fi, TDK RF Solutions Inc, and SPEAG, all vying to capture a substantial share of this growing market, further pushing the market value into the hundreds of millions.

Several potent forces are propelling the growth of the Specific Absorption Rate (SAR) Testing System market. Foremost among these is the escalating global concern for public health and the potential long-term effects of radiofrequency (RF) EMF exposure from an ever-expanding array of wireless devices. Regulatory bodies worldwide, from the FCC in the United States to the ISED in Canada and various European agencies, are continuously updating and enforcing stringent SAR limits. This regulatory imperative directly translates into an increased demand for reliable and accurate SAR testing systems for all wireless devices, from smartphones and wearable technology to IoT devices and medical implants, contributing to a market value in the millions. Furthermore, the rapid pace of technological innovation, particularly with the widespread adoption of 5G and the ongoing development of 6G technologies, introduces new challenges and complexities in EMF exposure. Testing systems must evolve to accommodate higher frequencies, diverse antenna designs, and novel communication protocols, thereby fueling the need for advanced and adaptable SAR testing solutions. The burgeoning consumer electronics market, with its insatiable demand for new and improved devices, also plays a crucial role. Manufacturers are under immense pressure to bring products to market quickly while ensuring they meet all safety standards, making efficient and accurate SAR testing systems indispensable. The increasing number of Wireless Companies investing heavily in research and development for new wireless technologies directly translates to increased procurement of SAR testing equipment, pushing market values into the tens of millions. Finally, the growing awareness among consumers about the health implications of EMF exposure is prompting a greater demand for transparency and validated safety certifications, further reinforcing the importance of robust SAR testing.

Despite the robust growth trajectory, the Specific Absorption Rate (SAR) Testing System market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the substantial initial investment required for acquiring advanced SAR testing systems. These sophisticated pieces of equipment, particularly those capable of handling the complexities of newer technologies like 5G mmWave or future 6G frequencies, can cost in the hundreds of thousands to millions of units, posing a barrier for smaller Test Labs or emerging companies. The rapid evolution of wireless technologies also presents a continuous challenge. SAR testing systems need to be constantly updated or replaced to remain compliant with evolving standards and to accurately measure EMF exposure from new device designs and frequency bands. This necessitates ongoing expenditure for software upgrades, hardware modifications, and recalibration, adding to the operational costs. The complexity of SAR testing itself, requiring highly skilled personnel for operation, calibration, and data interpretation, also presents a restraint. A shortage of qualified technicians and scientists can lead to delays in testing and an increased risk of errors. Furthermore, the standardization and harmonization of SAR testing regulations across different regions and countries are not yet fully realized. This lack of global uniformity can create confusion and necessitate different testing protocols for devices intended for various markets, increasing the testing burden and costs, potentially limiting market growth in the millions. The growing concern about the environmental impact of electronic waste, including obsolete testing equipment, also contributes to a restraint, pushing for more sustainable and long-lasting testing solutions.

The Traditional SAR Measurement System segment is expected to continue its dominance, particularly within established markets and for Test Labs that have long-standing validation protocols and significant investments in existing infrastructure. These systems, while slower than their advanced counterparts, offer proven accuracy and reliability, making them the go-to choice for many regulatory compliance testing scenarios. The market value for these systems, though perhaps growing at a slower pace compared to newer technologies, remains substantial, contributing to the overall market in the tens of millions.

In terms of regions, North America, particularly the United States, is anticipated to be a dominant force in the SAR Testing System market. This is driven by several factors:

Simultaneously, Asia Pacific, especially China, is emerging as a rapidly growing market for SAR Testing Systems. This growth is fueled by:

The Fast SAR Measurement System segment, while a smaller portion of the overall market value currently, is poised for the highest growth rate during the Forecast Period (2025-2033). The increasing pressure on manufacturers to accelerate product development cycles and the ever-growing volume of wireless devices entering the market make the efficiency gains offered by fast SAR systems highly attractive. Companies that adopt these systems can significantly reduce their testing timelines, leading to faster market entry and competitive advantage. The market value of this segment is projected to grow rapidly, potentially reaching the tens of millions by the end of the forecast period.

The Specific Absorption Rate (SAR) Testing System industry is experiencing significant growth catalyzed by a confluence of factors. The relentless proliferation of wireless-connected devices, ranging from smartphones and wearables to the burgeoning Internet of Things (IoT) ecosystem, directly amplifies the need for robust SAR testing to ensure consumer safety. Furthermore, increasingly stringent government regulations and international safety standards governing radiofrequency (RF) electromagnetic field (EMF) exposure are compelling manufacturers to invest in compliant testing solutions, contributing to market value in the millions. The rapid advancement of wireless technologies, particularly the widespread adoption of 5G and the early stages of 6G research, introduces new frequency bands and transmission methods that necessitate continuous updates and enhancements in SAR testing methodologies and equipment.

This comprehensive report provides an in-depth analysis of the Specific Absorption Rate (SAR) Testing System market, meticulously covering the Study Period of 2019-2033, with 2025 as the Base Year and Estimated Year. The Forecast Period (2025-2033) builds upon the Historical Period (2019-2024), offering valuable insights into market trends, driving forces, challenges, and key growth catalysts. The report quantifies market opportunities in the million unit range and identifies leading players such as IndexSAR, ART-Fi, TDK RF Solutions Inc, and SPEAG. It offers detailed segment analysis across Traditional SAR Measurement System and Fast SAR Measurement System types, as well as application segments including Test Labs and Wireless Companies, providing a holistic view for stakeholders to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IndexSAR, ART-Fi, TDK RF Solutions Inc, SPEAG.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Specific Absorption Rate Testing System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Specific Absorption Rate Testing System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.