1. What is the projected Compound Annual Growth Rate (CAGR) of the Soil Compaction Testing Service?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Soil Compaction Testing Service

Soil Compaction Testing ServiceSoil Compaction Testing Service by Type (Lab Testing, Field Testing), by Application (Utilities, Roadways, Construction), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global soil compaction testing services market is projected for significant expansion, fueled by escalating global infrastructure development and stringent construction quality mandates. Emerging economies in Asia-Pacific and the Middle East & Africa are primary drivers of this growth, emphasizing the critical role of accurate soil testing in ensuring structural integrity and mitigating costly failures. Technological innovations, including advanced nuclear density gauges and data analytics, are enhancing efficiency and precision, thereby stimulating market growth. The market is segmented by testing methodology (laboratory vs. field) and application (utilities, roadways, construction). While laboratory testing currently leads in market share, field testing is anticipated to experience accelerated growth due to its on-site convenience and efficiency.

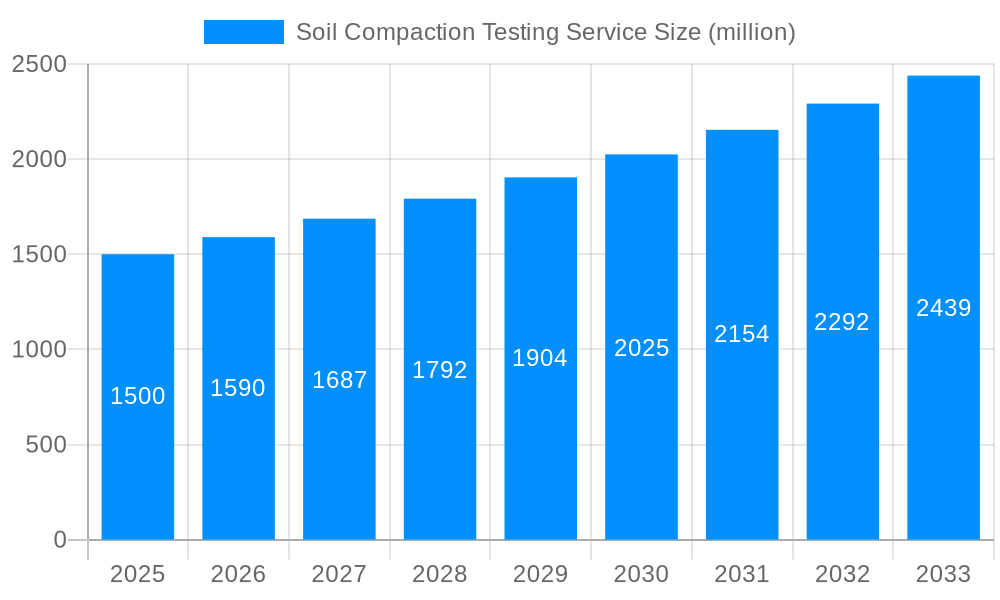

Key challenges include economic volatility impacting construction, fluctuating raw material costs for testing equipment, and the demand for skilled technicians. Despite these hurdles, sustained infrastructure investment and heightened awareness of soil compaction's importance for project success and public safety present a favorable long-term outlook. The market is forecast to achieve a CAGR of 8.1% from a market size of 1944.9 million in the base year 2025.

The global soil compaction testing service market is experiencing robust growth, projected to exceed $XX billion by 2030. This significant expansion is fueled by several key factors, including the burgeoning global construction industry, increasing infrastructure development projects (estimated at over $YYY million annually in new investment globally), and a rising emphasis on ensuring structural integrity and longevity of built environments. The demand for rigorous quality control measures throughout construction phases is driving a consistent need for precise and reliable soil compaction testing. Furthermore, stricter regulatory compliance standards regarding soil stability and environmental protection are compelling construction firms and government agencies to utilize specialized soil compaction testing services more extensively. This trend is particularly noticeable in rapidly developing economies across Asia and the Middle East, where large-scale infrastructure projects are transforming landscapes. Technological advancements, such as the incorporation of advanced sensors and data analytics in field testing equipment, are also contributing to the market’s growth. These advancements lead to faster turnaround times, increased accuracy, and improved efficiency, ultimately driving client adoption. Moreover, the incorporation of sophisticated software for data analysis provides more comprehensive reports, aiding engineers in making informed decisions. The increasing awareness of the long-term consequences of inadequate soil compaction, including structural failures and potential environmental damage, is further reinforcing the demand for these services. The integration of these services with other geotechnical investigations also augments the value proposition, fostering collaboration and providing a more holistic approach to project planning and execution. The market is witnessing a significant shift towards integrated services providers capable of offering a comprehensive suite of testing and consultancy, streamlining the process for clients and creating a more cost-effective solution. This holistic approach encompasses everything from initial site investigation and sampling to comprehensive data analysis and reporting, thus adding substantial value to the overall process. Consequently, the market exhibits a strong potential for growth, driven by a confluence of infrastructural expansion, technological enhancements, and heightened regulatory scrutiny. The competition within the market is intensifying, with firms continually striving to offer innovative testing methods and advanced analytical capabilities to maintain a competitive edge.

Several key factors are driving the expansion of the soil compaction testing service market. The exponential growth in global infrastructure development, encompassing roadways, utilities, and large-scale construction projects valued at hundreds of billions of dollars annually, demands comprehensive soil testing to ensure project stability and longevity. Stringent government regulations and building codes, prioritizing safety and environmental protection, necessitate adherence to rigorous soil compaction standards, further fueling market growth. This regulatory pressure, coupled with increasing awareness of the potentially devastating consequences of inadequate soil compaction, such as structural failures and environmental contamination (with remediation costs potentially reaching millions of dollars per incident), incentivizes clients to invest in reliable testing services. The ongoing technological advancements in testing equipment and data analysis techniques significantly enhance the efficiency and accuracy of the process, attracting more clients to adopt these services. These include the development of advanced sensors and automated data acquisition systems, along with improvements in software capabilities for data interpretation and reporting, which streamline workflows and deliver faster results, leading to reduced project delays. Furthermore, the rising adoption of sustainable construction practices emphasizes the importance of optimizing soil compaction to minimize material usage and reduce environmental impact. This focus on sustainability further boosts the demand for precise soil compaction testing, making it an integral part of environmentally conscious construction projects.

Despite the significant growth potential, the soil compaction testing service market faces several challenges. Economic fluctuations and unpredictable construction cycles can directly impact project budgets and, consequently, the demand for testing services. Competition among numerous testing firms, both large and small, can lead to price pressures and margin erosion. Maintaining consistent quality control across different projects and locations can be demanding, particularly when dealing with diverse soil conditions and varying project scopes. The geographical reach and accessibility to remote testing sites can present logistical hurdles, potentially increasing operational costs and project timelines. Ensuring the competence and accuracy of testing personnel requires ongoing training and certification programs, representing a significant investment for firms. Furthermore, integrating new technologies and staying abreast of evolving testing standards and regulations necessitate ongoing expenditure in research and development, posing a challenge for smaller companies. The high initial investment in specialized equipment and software can create a barrier to entry for new players, concentrating market share among established firms. Finally, weather conditions can severely impact field testing operations, resulting in project delays and potentially impacting overall profitability.

The Construction segment is poised to dominate the soil compaction testing service market. This is primarily because of the substantial expansion in the global construction industry, driven by both residential and commercial development projects across the globe. The value of construction projects worldwide is in the trillions of dollars annually. Within the construction sector, large-scale infrastructure projects, such as highway construction, high-speed rail networks, and large-scale building developments are key drivers of demand. This is further amplified by government investments in infrastructure development programs in various regions, contributing to a large and sustained demand for thorough soil compaction assessments.

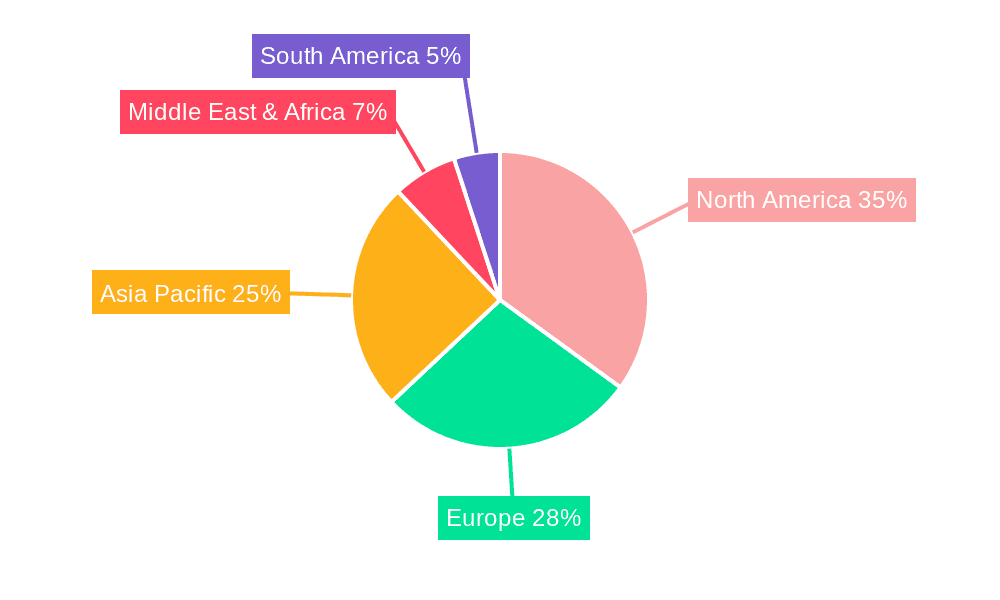

High Growth in Emerging Markets: Rapid urbanization and industrialization in developing nations in Asia (specifically, India, China, and Southeast Asia), the Middle East, and Africa are creating massive opportunities for the soil compaction testing service market. These regions are experiencing an unprecedented boom in construction and infrastructure projects, pushing the demand for robust quality control measures, including meticulous soil compaction analysis.

North America & Europe Remain Significant: While emerging markets display exceptional growth rates, North America and Europe remain significant markets due to ongoing infrastructure upgrades and renovation projects. The need for ensuring structural integrity and compliance with stringent safety regulations necessitates regular soil testing and evaluation in these regions.

Field Testing Dominance: While both lab and field testing are crucial, field testing currently holds a larger market share due to its on-site capabilities, which offers immediate results and faster turnaround times. This allows construction projects to proceed more efficiently, thereby contributing to its higher adoption rate. However, laboratory testing is crucial for detailed analyses requiring specialized equipment and expertise, ensuring comprehensive quality control throughout the construction process.

Several factors are acting as catalysts for growth within the soil compaction testing service industry. The increased adoption of Building Information Modeling (BIM) and integrated project delivery methods is driving demand for more comprehensive data and precise soil compaction assessment to streamline project workflows and minimize uncertainties. Furthermore, the growing emphasis on sustainable construction practices, which includes material optimization and waste reduction, mandates more detailed soil analyses to ensure the efficiency of compaction techniques. Governments worldwide are enacting stricter building codes and regulations, promoting higher safety standards and environmental protection, thereby increasing the need for soil compaction testing services to ensure compliance. The growing deployment of advanced technologies, such as drone surveys, remote sensing, and IoT-enabled sensors, enhances the speed, efficiency, and accuracy of soil testing, leading to wider adoption within the industry. Finally, the rising availability of specialized training programs and skilled professionals further boosts the market's expansion.

Recent significant developments include the increased adoption of non-destructive testing methods, reducing the need for extensive soil sampling and minimizing environmental disruption. The integration of advanced data analytics and machine learning algorithms improves the accuracy and efficiency of compaction data interpretation, offering more predictive capabilities to engineers. The introduction of innovative sensors and testing equipment is leading to faster turnaround times and more precise data acquisition. Furthermore, the rise of cloud-based data management systems facilitates seamless data sharing and collaboration among project stakeholders.

This report provides a comprehensive overview of the soil compaction testing service market, encompassing market size estimations, detailed segment analysis (by type, application, and region), key growth drivers, challenges, and a competitive landscape analysis. It includes forecasts for future market growth and identifies key players and their market positions. The report also incorporates an in-depth analysis of recent technological advancements, regulatory changes, and their impact on the market. The information provided serves as a valuable resource for industry stakeholders, investors, and researchers seeking a thorough understanding of this dynamic market. Remember to replace the "XXX" and "YYY" placeholders with actual market value estimations. Also, ensure that you insert the correct website links for each company, remembering to include the rel="nofollow" attribute.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

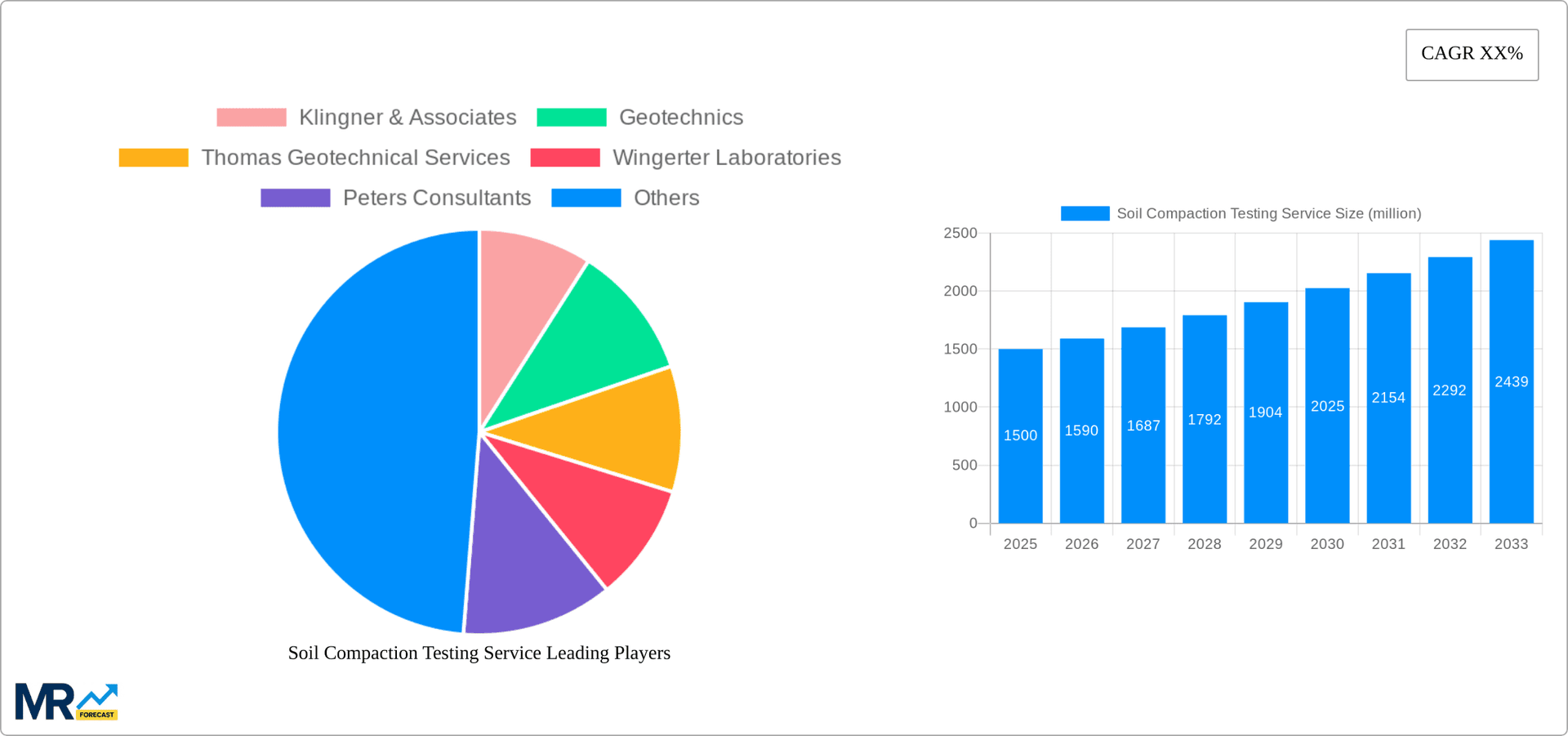

Key companies in the market include Klingner & Associates, Geotechnics, Thomas Geotechnical Services, Wingerter Laboratories, Peters Consultants, Alliance Laboratories, Lindmark Engineering, Geotechnical Testing Services, Building & Earth Sciences, CMT Engineering, RMA Group, Midlantic Engineering, Dulles Geotechnical and Material Testing Services, Geo-Science Engineering and Testing, Alpha Adroit Engineering, .

The market segments include Type, Application.

The market size is estimated to be USD 1944.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Soil Compaction Testing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Soil Compaction Testing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.