1. What is the projected Compound Annual Growth Rate (CAGR) of the Sober Beer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sober Beer

Sober BeerSober Beer by Type (Restricted Fermentation, Dealcoholization After Normal Fermentation, World Sober Beer Production ), by Application (Bar, Catering Service, Retail, World Sober Beer Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

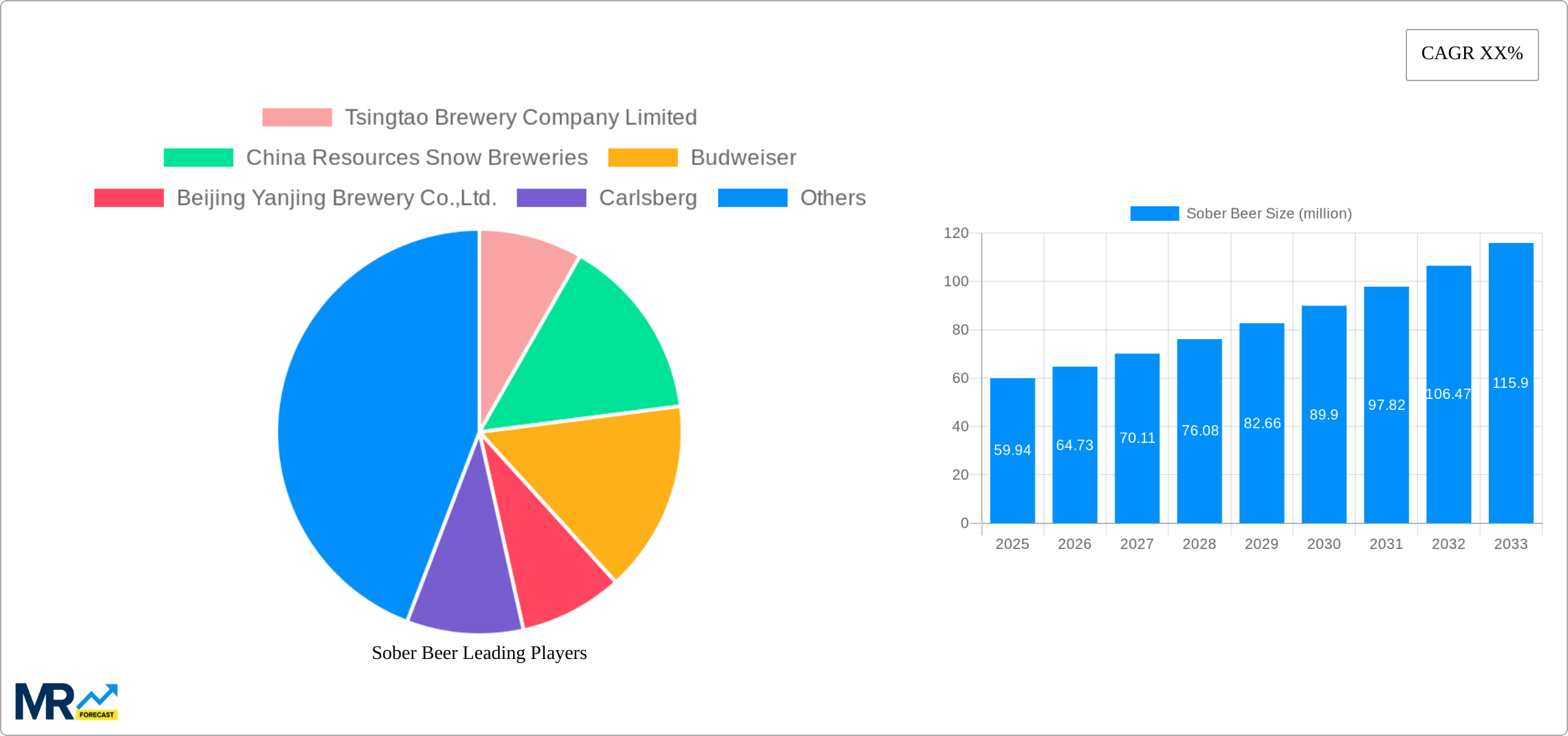

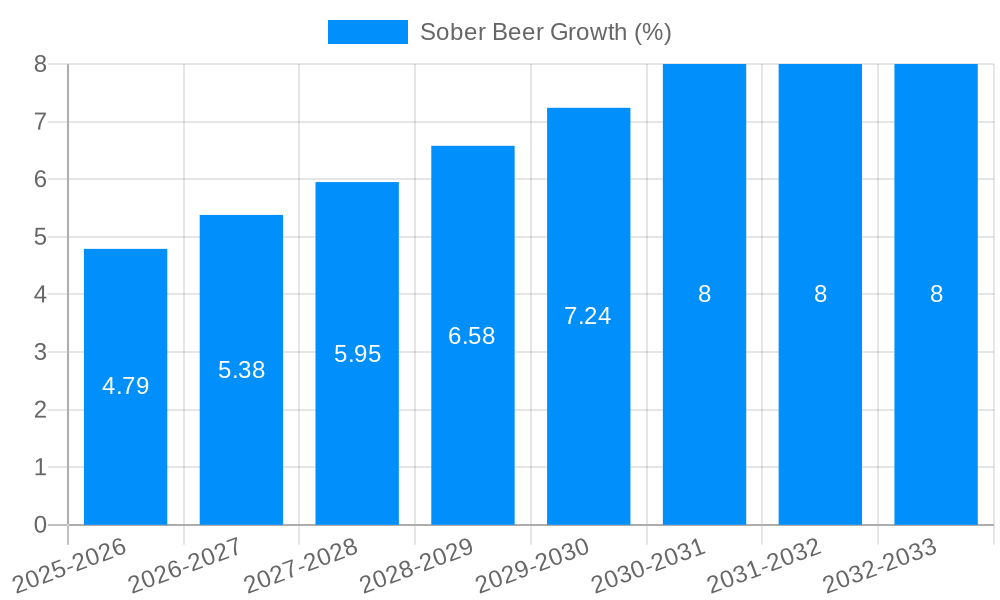

The global sober beer market, valued at $59.94 million in 2025, is experiencing significant growth driven by increasing health consciousness, the rise of mindful drinking trends, and a growing demand for low-alcohol and alcohol-free alternatives. Consumers are increasingly seeking healthier beverage options, leading to a shift away from traditional high-alcohol beers. The market is segmented by production method (restricted fermentation and dealcoholization after normal fermentation) and application (bars, catering services, and retail). Major players like Tsingtao, Carlsberg, Heineken, and Budweiser are investing in research and development to improve the taste and quality of sober beers, making them more appealing to a broader consumer base. The increasing availability of these beers in diverse settings, including bars and restaurants, is further fueling market expansion. Geographic distribution shows a strong presence across North America, Europe, and Asia Pacific, with China and the US representing key markets. While precise CAGR data is absent, a conservative estimate considering market trends and the growth of related health-conscious beverage segments would place the annual growth rate in the range of 8-12% for the forecast period (2025-2033). This growth is likely to be driven by ongoing product innovation, expansion into new markets, and increasing consumer awareness of the health benefits associated with reduced alcohol consumption.

The market's growth trajectory is expected to remain positive through 2033, propelled by factors such as rising disposable incomes in developing economies, enhanced product distribution channels, and targeted marketing campaigns emphasizing health benefits and social responsibility. However, challenges exist, including maintaining the taste and aroma profiles of sober beers to match those of their alcoholic counterparts and overcoming potential consumer perceptions of reduced quality. Further expansion hinges on overcoming these challenges and effectively communicating the premium quality and appeal of non-alcoholic beer options. The competitive landscape is dynamic, with established breweries alongside emerging craft breweries vying for market share through product differentiation, brand building, and strategic partnerships. Future market success depends on responding effectively to consumer preferences, addressing production challenges, and staying ahead of emerging trends in the broader beverage sector.

The global sober beer market is experiencing a significant surge, driven by evolving consumer preferences and a growing awareness of health and wellness. The market, valued at several million units in 2025, is projected to witness robust growth throughout the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including the increasing popularity of mindful drinking, the rise of the health-conscious consumer, and a broader shift towards moderation in alcohol consumption. Consumers are increasingly seeking alternatives to traditional alcoholic beverages without compromising on taste or the social experience associated with beer. This trend is particularly pronounced among younger demographics, who are more likely to adopt healthier lifestyles and prioritize well-being. The market's growth is also being shaped by innovation within the brewing industry itself. Brewers are constantly developing new and improved methods for creating delicious, low-alcohol or alcohol-free beers that closely mimic the taste and texture of their alcoholic counterparts. This focus on superior taste and quality is crucial for overcoming any perceived compromises associated with sober beer. The increasing availability of these products across various retail channels, from bars and restaurants to supermarkets and online stores, further contributes to market growth. Finally, the expanding global focus on responsible alcohol consumption and the initiatives to promote moderate drinking are also creating a more receptive environment for sober beer. Over the study period (2019-2033), the market has demonstrated considerable resilience even amidst broader economic fluctuations, highlighting the strength and enduring nature of this emerging category.

Several key factors are propelling the growth of the sober beer market. The rising health consciousness among consumers is a primary driver, with individuals increasingly seeking lower-calorie and healthier beverage options. This is particularly true for younger demographics who are actively seeking ways to maintain a balanced lifestyle. The growing awareness of the negative health consequences associated with excessive alcohol consumption is also a significant factor, encouraging consumers to opt for low or non-alcoholic alternatives. Furthermore, the increasing prevalence of designated driver situations and the broader societal push for responsible drinking contribute to the demand for sober beer. The rise of mindful drinking, a conscious approach to alcohol consumption emphasizing moderation and awareness, has also significantly boosted the market. Consumers are becoming more discerning about their alcohol choices, seeking products that align with their health and lifestyle goals. The improved quality and taste of non-alcoholic beers play a pivotal role in this market growth. Modern production techniques have led to beers that closely replicate the sensory experience of traditional beers, overcoming past limitations and removing a key barrier to adoption. Finally, the marketing and promotion strategies employed by breweries, highlighting the health benefits and sophisticated taste profiles of sober beers, successfully attract new customers and increase market penetration.

Despite its promising trajectory, the sober beer market faces several challenges. A significant hurdle is the perception among some consumers that non-alcoholic beers are inferior in taste and quality compared to their alcoholic counterparts. This misconception stems from older formulations that lacked the nuanced flavor profiles now available with modern brewing techniques. Overcoming this perception requires continuous innovation and improvement in the brewing process to ensure that sober beers deliver a truly satisfying experience. Another challenge lies in the pricing. Producing high-quality non-alcoholic beer often entails more complex and resource-intensive processes, which can lead to higher prices compared to traditional beers. This price differential can pose a barrier to entry for some price-sensitive consumers. Furthermore, distribution and availability remain an issue in certain regions. While availability is steadily improving, there are still markets where non-alcoholic beers are limited, hindering market expansion. Finally, the potential for consumer fatigue or market saturation in the long-term needs to be considered. Maintaining consistent growth requires continuous innovation and a constant focus on evolving consumer needs and expectations.

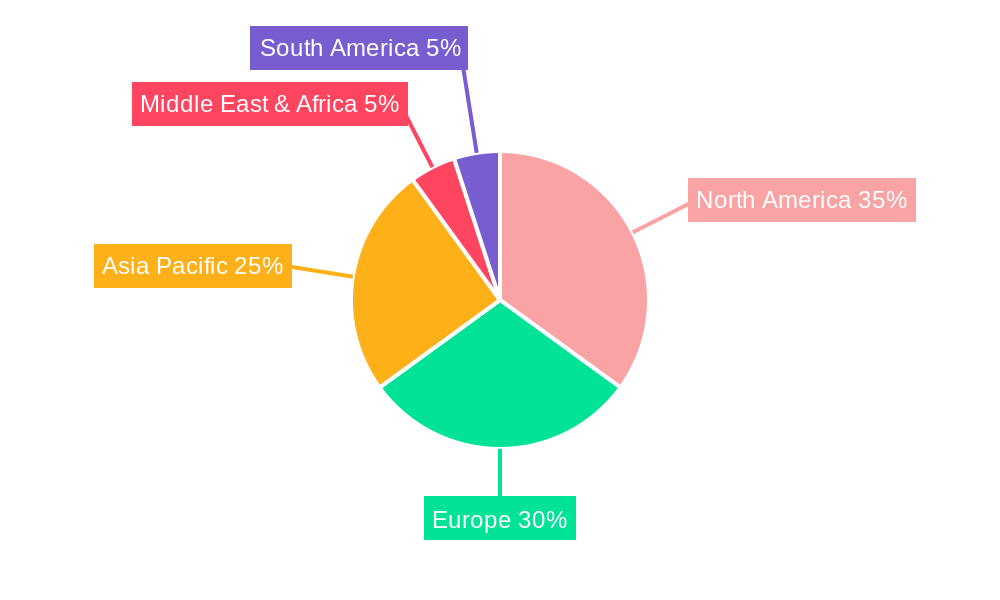

The sober beer market is experiencing growth across numerous regions, but several key areas stand out. Europe and North America currently represent substantial markets, driven by strong health-conscious consumer bases and well-established brewing industries. However, significant growth potential exists in Asia, particularly in countries experiencing rapid economic development and a rising middle class. This is due to changing lifestyles and increased disposable income leading to increased spending on premium beverages, including premium sober beers.

Key Regions: Europe, North America, Asia (specifically Japan and China)

Dominant Segment: Dealcoholization After Normal Fermentation This segment holds a significant market share due to the superior taste and aroma profiles of beers produced using this method. Many established breweries utilize this technique, ensuring wider availability and greater consumer recognition. Restricted Fermentation, while growing in popularity, still possesses a smaller market share.

Detailed explanation: The dealcoholization process allows for the creation of non-alcoholic beers with a flavor profile that is extremely close to their alcoholic counterparts. Consumers are drawn to this high level of quality and authenticity, making this segment particularly attractive. In contrast, while Restricted Fermentation offers an alternative route to producing sober beers, the process may lead to compromises in taste and aroma that some consumers find unappealing. The preference for high-quality, authentic tasting sober beer largely dictates the success of the dealcoholization segment. Retail channels, including supermarkets and online retailers, contribute greatly to the growth, particularly for convenient and familiar brands. The high demand for dealcoholized beer from bars and catering services, however, is driving sales further. The industry is also growing due to the increasing production of sober beers using this method. This expansion is supported by technological advancements, reducing the cost and complexity of production. The ongoing demand for premium sober beer variants and the expansion of distribution channels reinforce the dominance of this segment in the global market.

The sober beer market is fueled by several key growth catalysts. The expanding health and wellness movement globally has significantly contributed to the growing demand for healthier beverage options, including low-alcohol or non-alcoholic beers. Simultaneously, advancements in brewing technology have resulted in significantly improved taste and quality, addressing previous shortcomings associated with sober beer. This, combined with targeted marketing campaigns highlighting these improvements, has broadened the appeal of the products to a wider audience. Moreover, the increasing availability of sober beer across various retail channels – from bars and restaurants to supermarkets – has increased market accessibility, thus further boosting growth.

This report offers a comprehensive analysis of the sober beer market, encompassing trends, drivers, challenges, and key players. It provides detailed insights into market segmentation, regional analysis, and future growth prospects. The report also explores the impact of technological advancements and shifting consumer preferences on the industry's development. This in-depth analysis allows businesses to understand the market landscape and formulate effective strategies for growth and market penetration.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tsingtao Brewery Company Limited, China Resources Snow Breweries, Budweiser, Beijing Yanjing Brewery Co.,Ltd., Carlsberg, HeineKen, STELLA ARTOIS, Asahi, Krombacher, Oettinger, Suntory Beer, Arpanoosh, Erdinger Weibbrau, Kirin, Behnoush Iran, .

The market segments include Type, Application.

The market size is estimated to be USD 59940 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sober Beer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sober Beer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.