1. What is the projected Compound Annual Growth Rate (CAGR) of the SMT Red Glue?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

SMT Red Glue

SMT Red GlueSMT Red Glue by Type (Printing Mode, Dispensing Mode, Needle Rotation Mode), by Application (Electric Engineering, Semiconductor, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

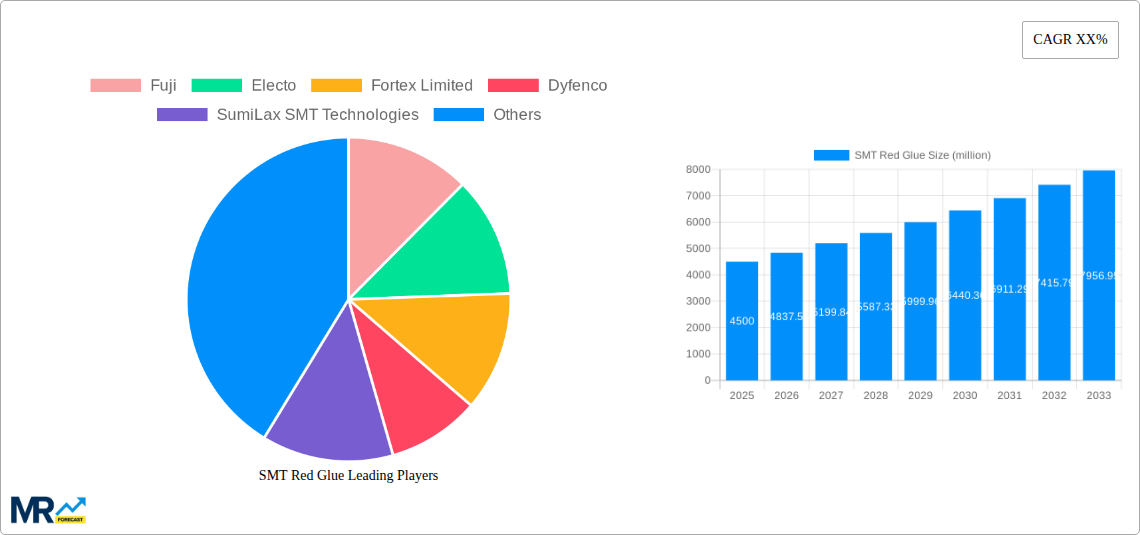

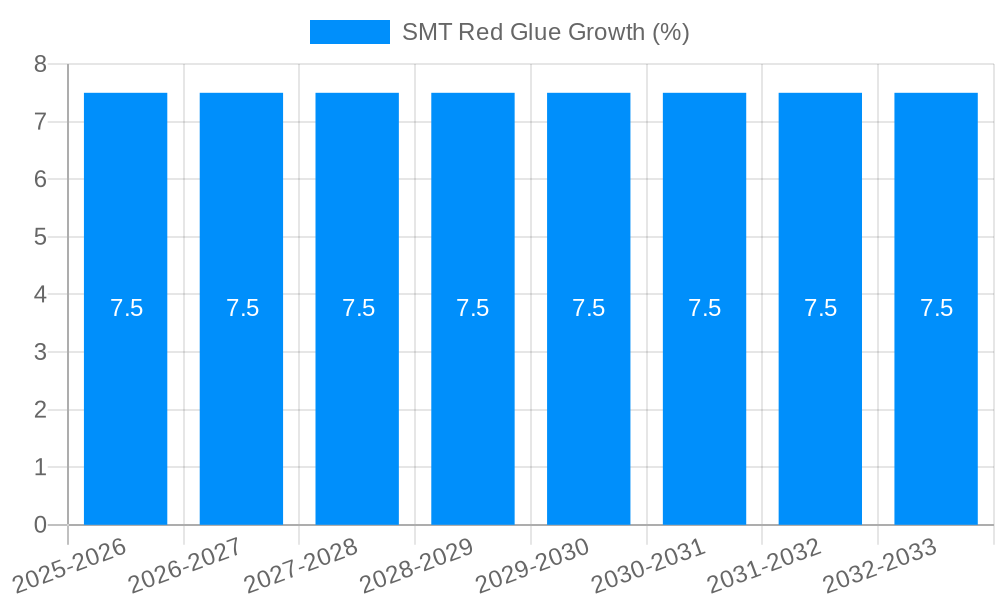

The global SMT red glue market is poised for significant expansion, projected to reach a valuation of approximately USD 4,500 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% expected throughout the forecast period of 2025-2033. This growth is underpinned by the escalating demand from the electronics manufacturing sector, particularly in the burgeoning fields of electric engineering and semiconductor production. The increasing complexity and miniaturization of electronic components necessitate advanced bonding solutions like SMT red glue, which offers superior adhesion, thermal resistance, and dispensing accuracy. This trend is further amplified by the continuous innovation in electronic devices, from smartphones and wearables to advanced automotive electronics and IoT devices, all of which rely heavily on efficient and reliable SMT processes.

Key drivers fueling this market surge include the relentless pursuit of higher manufacturing efficiency and cost-effectiveness in electronics assembly. SMT red glue’s ability to facilitate high-speed automated dispensing and its compatibility with various substrate materials make it indispensable for mass production environments. Emerging trends such as the integration of artificial intelligence and advanced robotics in manufacturing are also expected to boost the adoption of sophisticated dispensing technologies that utilize red glue. While the market enjoys strong growth, potential restraints could emerge from fluctuations in raw material prices, particularly for specialized epoxy resins, and increasing regulatory scrutiny regarding environmental impact and health safety. However, the inherent advantages and the critical role of SMT red glue in enabling the production of next-generation electronic devices are likely to ensure its continued dominance. The market segmentation by dispensing mode, needle rotation mode, and application areas such as electric engineering and semiconductor fabrication will offer nuanced growth opportunities for specialized players.

Here is a comprehensive report description on SMT Red Glue, incorporating your specified requirements:

This report provides an in-depth analysis of the global SMT Red Glue market, a critical component in modern electronics manufacturing. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this study offers invaluable insights for stakeholders navigating this dynamic industry. The report utilizes a multi-million dollar valuation approach to quantify market size and trends, providing a clear financial perspective on SMT Red Glue's economic significance.

The SMT Red Glue market is experiencing a significant upward trajectory, driven by the relentless demand for miniaturized and increasingly sophisticated electronic devices across a multitude of sectors. During the historical period of 2019-2024, the market demonstrated consistent growth, with an estimated market value reaching into the high millions of dollars annually. This growth was largely fueled by the burgeoning consumer electronics sector, including smartphones, wearables, and advanced computing devices, all of which rely heavily on SMT processes for their assembly. Furthermore, the automotive industry's increasing integration of electronics, from advanced driver-assistance systems (ADAS) to infotainment, has become a substantial contributor. The electric engineering sector, a cornerstone of this market, continues to expand its reliance on SMT Red Glue for the reliable bonding of components on printed circuit boards (PCBs). The semiconductor industry, with its ever-present drive towards smaller and more powerful chips, also represents a significant and growing segment for SMT Red Glue applications, particularly for die attachment and encapsulation. Looking ahead, the forecast period of 2025-2033 anticipates continued robust expansion. The estimated market value in 2025 is projected to surpass a significant milestone, with further substantial growth expected as new technologies emerge and existing ones become more pervasive. Key trends include the development of higher-performance SMT Red Glues with enhanced thermal conductivity, improved adhesion properties under extreme conditions, and faster curing times, catering to the demands of high-density interconnect (HDI) PCBs and complex chip-level packaging. The increasing adoption of automation in manufacturing processes also plays a pivotal role, demanding SMT Red Glues that are compatible with high-speed dispensing and printing equipment. The "Others" segment, encompassing emerging applications in medical devices, aerospace, and industrial automation, is also poised for considerable growth, further diversifying the market landscape. This report will delve into the nuances of these trends, providing granular data and expert analysis to illuminate the path forward for SMT Red Glue manufacturers and end-users. The market’s evolution is intrinsically linked to advancements in SMT equipment and the broader technological innovations that necessitate its use.

The SMT Red Glue market is being propelled by an interlocking set of powerful drivers that are reshaping the landscape of electronics manufacturing. At the forefront is the unceasing demand for smaller, lighter, and more powerful electronic devices. This miniaturization trend, particularly evident in consumer electronics like smartphones and wearable technology, necessitates highly precise and reliable component mounting, where SMT Red Glue plays an indispensable role. The increasing complexity and density of printed circuit boards (PCBs) also demand advanced bonding solutions that can effectively secure tiny components without compromising signal integrity or thermal performance. Furthermore, the rapid expansion of the automotive industry into electrification and autonomous driving is a significant catalyst. Vehicles are becoming sophisticated electronic hubs, requiring robust and reliable SMT processes for a vast array of sensors, control units, and infotainment systems. This translates directly into a greater need for high-performance SMT Red Glues that can withstand the demanding environmental conditions typical of automotive applications. The growing adoption of the Internet of Things (IoT) is another major contributor. As more devices become connected, the demand for SMT-assembled electronic components across various industries, from smart homes to industrial automation, escalates, directly impacting the SMT Red Glue market. The ongoing advancements in semiconductor technology, leading to smaller and more intricate chips, further amplify the need for specialized SMT Red Glues for applications like die bonding and encapsulation. This constant push for innovation and miniaturization across multiple industries creates a fertile ground for the sustained growth of the SMT Red Glue market.

Despite the robust growth, the SMT Red Glue market is not without its challenges and restraints, which manufacturers and end-users must carefully navigate. One of the primary hurdles is the increasing demand for specialized SMT Red Glues with highly specific performance characteristics. As applications become more diverse, requiring enhanced thermal conductivity, electrical insulation, or resistance to specific chemicals and temperatures, the development and production costs for these tailored solutions can escalate significantly. This can lead to price pressures and challenges in maintaining profitability, especially for smaller manufacturers. Another significant challenge is the strict regulatory compliance and evolving environmental standards. Governments worldwide are increasingly imposing stricter regulations on the use of certain chemicals, including those found in some SMT Red Glues, due to environmental and health concerns. Manufacturers need to invest in research and development to create compliant and sustainable alternatives, which can be time-consuming and costly. The consistent need for stringent quality control and process optimization in SMT processes also presents a restraint. Any inconsistency in the application or curing of SMT Red Glue can lead to component failures, product recalls, and damage to brand reputation, necessitating rigorous validation and control measures. Furthermore, the global supply chain disruptions experienced in recent years have impacted the availability and pricing of raw materials crucial for SMT Red Glue production. This volatility can affect production schedules and ultimately the market price of the finished products. The high initial investment required for advanced SMT dispensing and curing equipment can also be a barrier for smaller manufacturing facilities, limiting their adoption of the latest SMT Red Glue technologies and thereby impacting market penetration in certain segments.

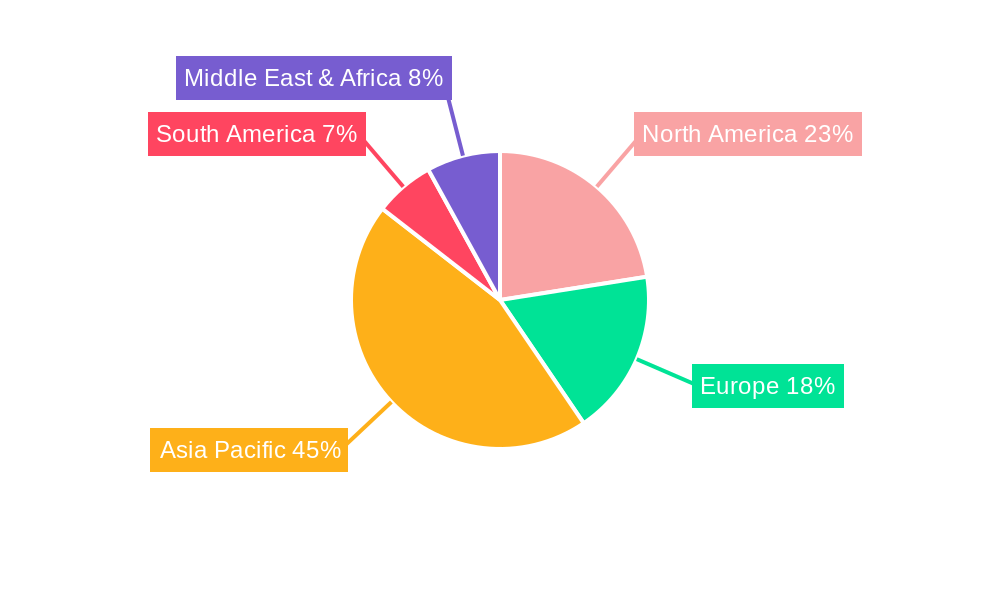

The SMT Red Glue market exhibits distinct regional and segment dominance, driven by a confluence of manufacturing prowess, technological adoption, and end-user industry concentration.

Dominant Regions/Countries:

Asia-Pacific: This region is unequivocally the powerhouse of the global SMT Red Glue market. Its dominance is anchored by several key factors:

North America: While not on the same scale as Asia-Pacific, North America holds a significant share, driven by advanced manufacturing and specific industry demands:

Dominant Segments:

Type: Printing Mode: The Printing Mode segment is poised for significant dominance. SMT Red Glues designed for stencil printing offer high throughput and cost-effectiveness for mass production of PCBs. The increasing adoption of advanced printing techniques that allow for finer feature definition and higher component densities further solidify its leadership. This mode is crucial for high-volume manufacturing across consumer electronics, telecommunications, and increasingly, automotive sectors.

Application: Electric Engineering: The Electric Engineering application segment will continue to be a foundational pillar of the SMT Red Glue market. This broad category encompasses the assembly of a vast array of electronic components onto PCBs for virtually every electronic device. The constant innovation in power electronics, control systems, and general electronic circuits ensures a perpetual demand for reliable SMT Red Glues. The sheer volume of PCBs manufactured for diverse electrical engineering applications makes this segment a consistent and substantial consumer of SMT Red Glues.

Application: Semiconductor: While Electric Engineering represents the broader base, the Semiconductor application segment is expected to witness the most rapid growth and commands a premium. The intricate nature of semiconductor packaging, including die attach, underfill, and encapsulation, demands highly specialized SMT Red Glues with exceptional thermal management, electrical isolation, and mechanical stress-buffering properties. As semiconductors become smaller, more powerful, and more integrated, the requirements for SMT Red Glues become increasingly sophisticated, driving innovation and higher market valuations within this segment. The continuous advancement in wafer-level packaging and 3D IC integration will further amplify the demand for advanced SMT Red Glues in this sector.

Several key factors are acting as significant growth catalysts for the SMT Red Glue industry. The relentless innovation in consumer electronics, driving miniaturization and feature enhancement, directly fuels the demand for advanced SMT Red Glues. The expanding automotive sector's embrace of electrification and autonomous driving technologies, with their complex electronic architectures, is another major propellant. Furthermore, the burgeoning adoption of the Internet of Things (IoT) across various industries necessitates a surge in SMT-assembled components, thereby increasing the consumption of SMT Red Glues. Government initiatives promoting domestic manufacturing and technological advancement in key regions also provide a supportive environment for market expansion.

Here is a list of leading companies in the SMT Red Glue market:

This comprehensive report offers an exhaustive examination of the SMT Red Glue market, providing actionable intelligence for strategic decision-making. It delves into market dynamics, technological advancements, and the competitive landscape, enabling stakeholders to identify opportunities and mitigate risks. The report's meticulous analysis of historical trends, current market conditions, and future projections, including a detailed forecast for the period 2025-2033, equips businesses with the foresight needed to capitalize on evolving market demands. By understanding the intricate interplay of driving forces, challenges, and growth catalysts, companies can formulate effective strategies for market penetration, product development, and sustained profitability within this vital segment of the electronics manufacturing industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fuji, Electo, Fortex Limited, Dyfenco, SumiLax SMT Technologies, MAG CHEMICAL, AROINDIA ELECTROMECH PVT LTD, Panacol-Elosol GmbH, BBIEN, scikou, JUFENG, Dongguan Sheen Electronic Technology Co., Ltd, Tensan, DeepMaterial (Shenzhen) Co., Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "SMT Red Glue," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the SMT Red Glue, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.