1. What is the projected Compound Annual Growth Rate (CAGR) of the SMR Band Reject Filter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

SMR Band Reject Filter

SMR Band Reject FilterSMR Band Reject Filter by Application (Commercial, Communication, Military, Radar, Others, World SMR Band Reject Filter Production ), by Type (Greater than 10 W, Under 1 W, 1 to 5 W, 5 to 10 W, World SMR Band Reject Filter Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

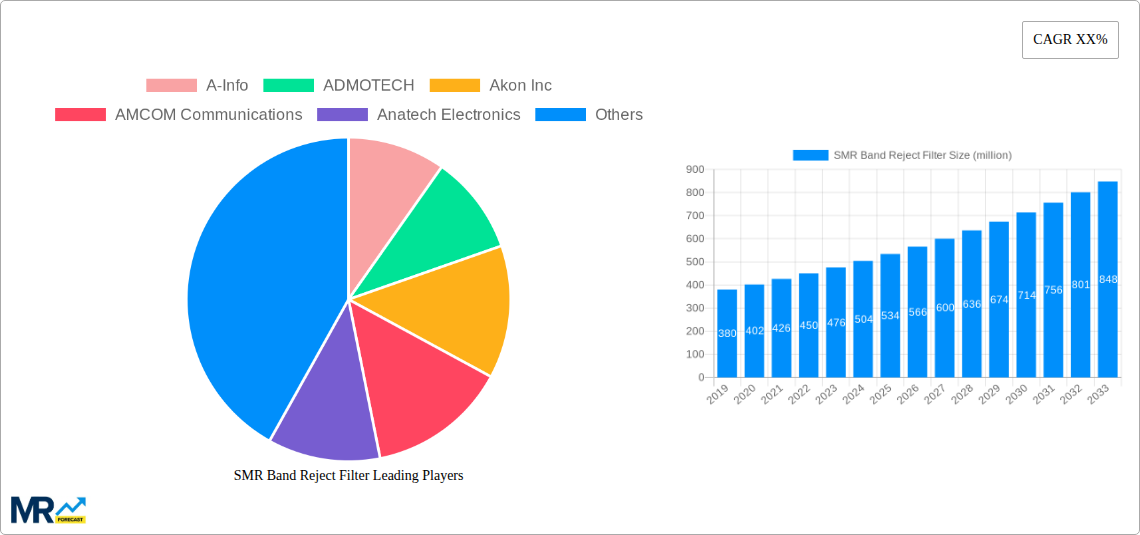

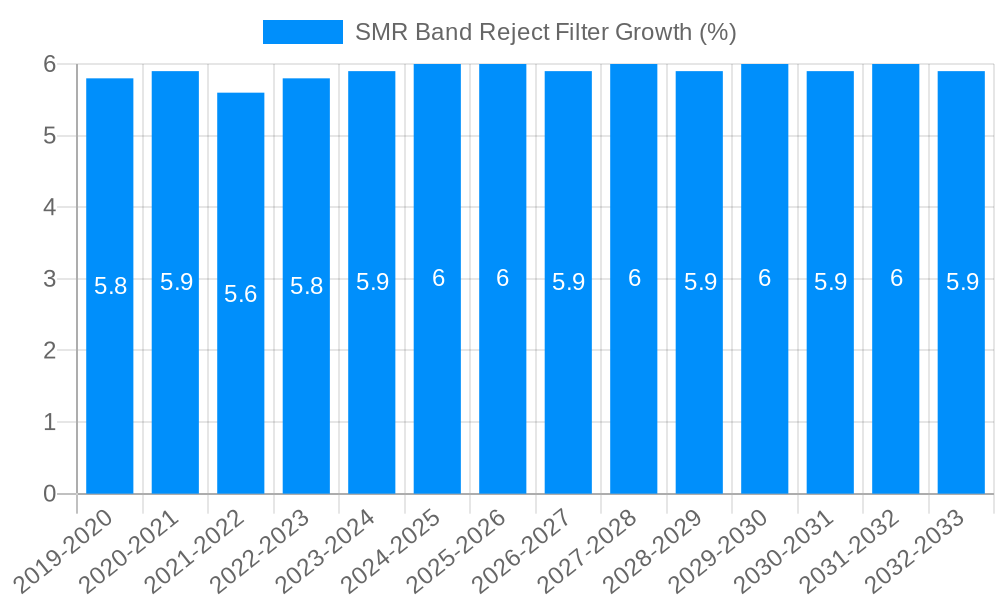

The SMR Band Reject Filter market is poised for significant expansion, projected to reach a substantial market size of approximately USD 550 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth is primarily fueled by the escalating demand across critical sectors such as commercial aviation, advanced telecommunications, and increasingly sophisticated military applications. The proliferation of new wireless communication standards and the continuous evolution of radar technologies necessitate highly selective filtering solutions to mitigate interference and ensure optimal signal integrity. Furthermore, the growing adoption of SMR band reject filters in next-generation communication systems, including 5G deployments and satellite communications, is a major growth driver. The market's dynamism is also shaped by the increasing complexity of electronic warfare systems and the need for precise signal filtering in defense applications, all contributing to a positive outlook for the SMR Band Reject Filter industry.

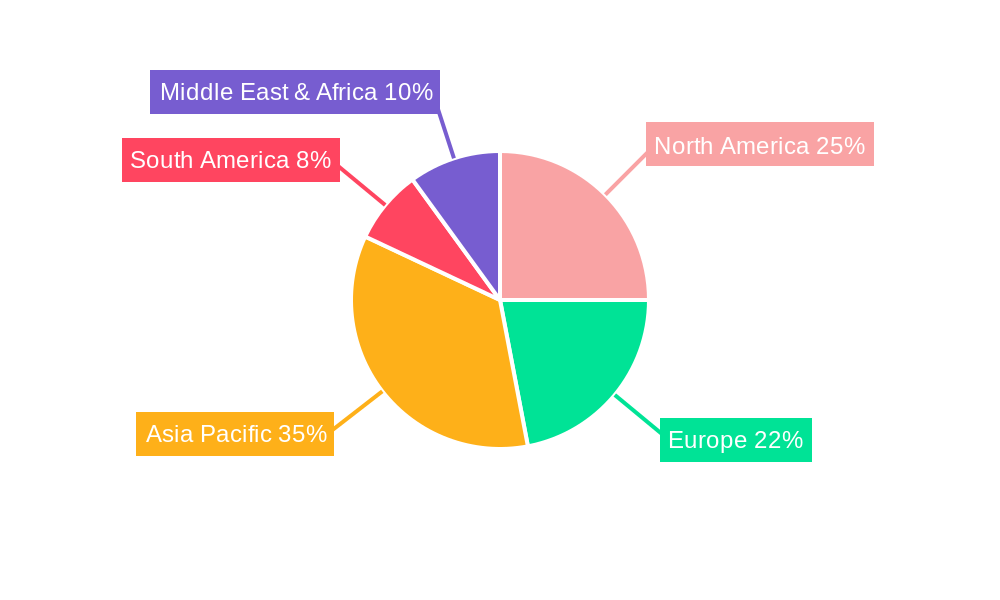

The market segmentation reveals a diverse landscape, with applications spanning commercial, communication, military, and radar sectors, each contributing to the overall market value. The "Greater than 10 W" power category is expected to lead in market share due to its essential role in high-power transmission systems, followed by the "5 to 10 W" and "1 to 5 W" segments catering to a broader range of electronic devices. Geographically, Asia Pacific is emerging as a powerhouse, driven by rapid industrialization, substantial investments in communication infrastructure, and a burgeoning defense sector, particularly in China and India. North America and Europe also represent mature yet consistently growing markets, driven by technological advancements and ongoing upgrades in existing infrastructure. Restraints in the market, such as stringent regulatory compliance and the high cost of specialized filter manufacturing, are being gradually overcome by technological innovation and economies of scale, paving the way for sustained market development and increased adoption.

The global SMR (Self-Managed Radio) Band Reject Filter market is poised for substantial growth and evolution over the Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025 setting the stage for a dynamic Forecast Period: 2025-2033. The Historical Period: 2019-2024 has laid a strong foundation, witnessing an increasing adoption of SMR technology across various sectors, driven by the fundamental need for signal integrity and interference mitigation. As wireless communication systems become more sophisticated and dense, the demand for highly selective filters that can effectively reject unwanted SMR bands – often adjacent to critical operational frequencies – will only intensify. In the Base Year: 2025, the market is projected to reach multi-million dollar figures, with projections indicating a compound annual growth rate (CAGR) that will push these figures into even higher million units by 2033.

The increasing complexity of radio frequency (RF) spectrum utilization is a paramount driver. Modern communication systems, including 5G and beyond, operate within increasingly crowded spectrums. SMR bands, while enabling localized, self-managed radio communication, can inadvertently generate interference that degrades the performance of other vital communication or sensing systems. Consequently, the development and deployment of advanced SMR Band Reject Filters are becoming indispensable for ensuring efficient and reliable spectrum management. This trend is further fueled by the growing ubiquity of IoT devices, smart infrastructure, and advanced radar systems, all of which necessitate pristine signal environments. The market's expansion will be characterized by innovation in filter design, material science, and manufacturing techniques to achieve higher rejection ratios, lower insertion loss, and a smaller form factor. The investment in research and development by key players, aiming to miniaturize and enhance the performance of these filters, will be a defining characteristic of the market's trajectory. Furthermore, the burgeoning adoption of SMR technology in specialized applications within the commercial, communication, and military segments is creating new avenues for market penetration. The sheer volume of wireless devices and the ever-increasing demand for reliable connectivity underpin the robust upward trend for SMR Band Reject Filters. The market’s value, currently in the multi-million unit range, is on track to witness significant expansion, likely reaching hundreds of millions of units by the end of the Forecast Period: 2025-2033. This growth is not merely about volume but also about the increasing sophistication and integration of these filters into next-generation wireless solutions.

Several potent forces are propelling the SMR Band Reject Filter market forward, creating a favorable environment for growth and innovation throughout the Study Period: 2019-2033. A primary driver is the escalating complexity and density of the RF spectrum. As more wireless devices and communication systems vie for limited spectrum real estate, the potential for interference, particularly from SMR bands, intensifies. This necessitates the deployment of highly effective band reject filters to isolate critical signals and prevent performance degradation. The exponential growth in wireless communication technologies, including the rollout of 5G networks, the expansion of IoT ecosystems, and the increasing sophistication of radar systems, all contribute significantly. These technologies rely on pristine signal environments, making SMR Band Reject Filters crucial for maintaining signal integrity.

Furthermore, stringent regulatory mandates aimed at optimizing spectrum utilization and minimizing interference are indirectly driving demand. Governments and regulatory bodies are increasingly enforcing rules that require effective interference management, pushing manufacturers and system integrators to adopt advanced filtering solutions. The ongoing miniaturization trend in electronic components also plays a role. As devices become smaller and more portable, there is a continuous need for compact, high-performance filters that can be integrated into space-constrained designs. This pursuit of smaller form factors without compromising filtering capabilities is a key impetus for research and development in the SMR Band Reject Filter sector. Finally, the evolving landscape of military and defense applications, which often operate in highly contested and sensitive RF environments, presents a substantial demand for robust and reliable SMR Band Reject Filters to ensure secure and uninterrupted communication and sensing operations. The market's current multi-million unit valuation is set to surge due to these powerful underlying trends.

Despite the robust growth prospects, the SMR Band Reject Filter market faces several significant challenges and restraints that could temper its expansion during the Study Period: 2019-2033. A primary hurdle is the inherent complexity and cost associated with designing and manufacturing high-performance band reject filters. Achieving very sharp rejection skirts and extremely low insertion loss, especially for wide-band SMR frequencies, often requires intricate designs and specialized manufacturing processes, leading to higher production costs. This can make cost-sensitive applications hesitant to adopt these advanced solutions. Another challenge lies in the rapid pace of technological evolution in wireless communication. New frequency bands are constantly being introduced, and existing ones are being reallocated, meaning that SMR Band Reject Filter designs must be adaptable and agile to remain relevant. Developing filters that can effectively reject a broad range of potential SMR interference bands while also being cost-effective for widespread deployment is a significant engineering challenge.

Moreover, the market is subject to intense competition among a multitude of players, both established and emerging. This competitive landscape can lead to price pressures, squeezing profit margins for manufacturers. The existence of alternative filtering technologies, although perhaps less specific to SMR bands, could also pose a restraint, especially if they offer a lower cost-to-performance ratio for certain less demanding applications. Additionally, the global supply chain for specialized materials and components required for advanced filter manufacturing can be susceptible to disruptions, impacting production volumes and delivery timelines. Ensuring consistent quality and availability of these critical components is an ongoing concern. The need for rigorous testing and validation to meet stringent performance specifications in critical applications like military and aerospace also adds to development time and costs. The multi-million dollar market, while growing, must navigate these intricate obstacles to realize its full potential.

The SMR Band Reject Filter market is expected to witness significant regional and segmental dominance during the Study Period: 2019-2033.

Dominant Region/Country:

Dominant Segments:

Application Segment: Communication: This segment is projected to be a primary driver of market growth. The relentless expansion of wireless communication networks, including cellular (4G, 5G, and future generations), Wi-Fi, and satellite communication systems, necessitates sophisticated interference mitigation techniques. SMR Band Reject Filters are crucial for ensuring signal integrity and preventing interference between adjacent frequency bands used by these diverse communication systems. The increasing data traffic and the demand for seamless connectivity worldwide directly translate into a higher need for effective filtering solutions.

Type Segment: Greater than 10 W: While filters across all power ranges will see demand, the "Greater than 10 W" category is anticipated to witness robust growth. This is primarily driven by high-power applications in sectors such as:

The combination of these dominant regions and segments, particularly the pervasive need within the Communication application and the increasing requirements in Greater than 10 W type filters, will shape the market landscape, driving innovation and significant revenue generation. The World SMR Band Reject Filter Production is thus strategically influenced by these concentrated areas of demand and technological advancement.

The SMR Band Reject Filter industry is experiencing several key growth catalysts that are expected to propel its expansion throughout the Study Period: 2019-2033. The rapid evolution of wireless technologies, including the widespread deployment of 5G and the emergence of 6G, is a significant catalyst. These advanced networks operate within increasingly complex and congested spectrums, necessitating highly effective filters to manage interference and ensure optimal performance. Furthermore, the escalating proliferation of the Internet of Things (IoT) devices, from smart home appliances to industrial sensors, generates a vast array of wireless signals, increasing the potential for SMR band interference and, consequently, the demand for robust filtering solutions. The defense and aerospace sectors are also proving to be strong growth catalysts, as modern military operations rely heavily on secure and interference-free communication and sensing systems. The continuous drive for miniaturization and higher integration in electronic devices is another catalyst, pushing manufacturers to develop smaller, more efficient SMR Band Reject Filters.

The SMR Band Reject Filter market is characterized by the presence of several key industry players that are actively involved in innovation, production, and market expansion. These companies contribute significantly to the technological advancements and market dynamics.

The SMR Band Reject Filter sector has witnessed several significant developments over the Historical Period: 2019-2024 and is expected to see continued innovation:

This comprehensive report provides an in-depth analysis of the SMR Band Reject Filter market, spanning the Study Period: 2019-2033. It meticulously examines market trends, growth drivers, and potential challenges, offering valuable insights for stakeholders. The report delves into the intricate details of market segmentation by application (Commercial, Communication, Military, Radar, Others), power type (Greater than 10 W, Under 1 W, 1 to 5 W, 5 to 10 W), and production volumes. It further identifies and analyzes key regions and countries poised for market dominance, offering a granular view of regional dynamics. The leading players in the industry are profiled, alongside an overview of their product portfolios and strategic initiatives. Significant historical and forecasted developments are highlighted, providing a roadmap of technological advancements and market shifts. The report aims to equip industry participants with the knowledge necessary to navigate this dynamic market, capitalize on emerging opportunities, and make informed strategic decisions, projecting a multi-million unit market with substantial growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include A-Info, ADMOTECH, Akon Inc, AMCOM Communications, Anatech Electronics, Mini Circuits, Wainwright Instruments, Murata, Phonon, Planar Monolithics Industries, CTS Electronic Components, Dynamic Engineers, ECHO Microwave, Shoulder Electronics, Sirius Microwave, Tai-Saw Technology, Vectron International, UIY Technology.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "SMR Band Reject Filter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the SMR Band Reject Filter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.