1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Pet Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart Pet Camera

Smart Pet CameraSmart Pet Camera by Type (Wired, Wireless, World Smart Pet Camera Production ), by Application (Home, Commercial, World Smart Pet Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

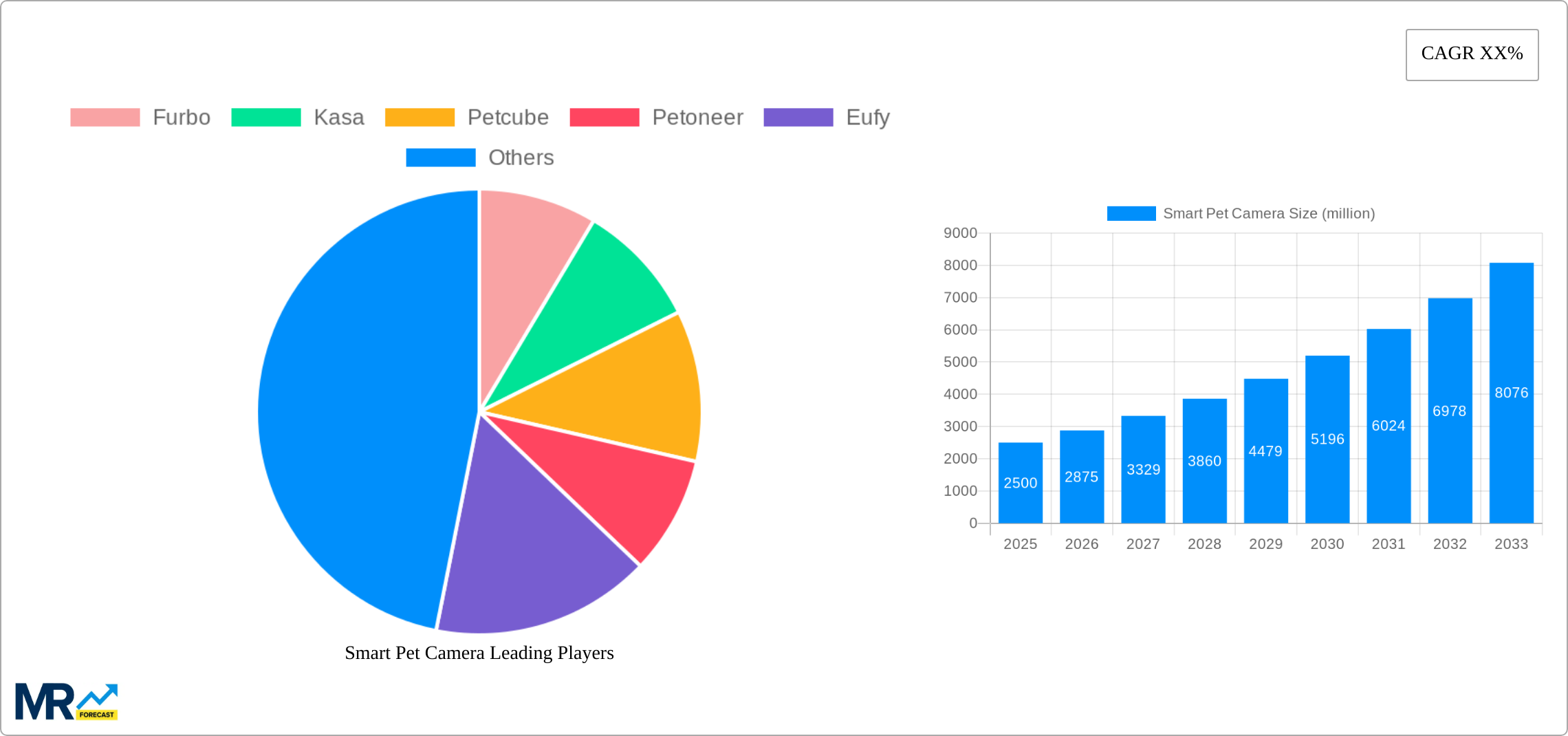

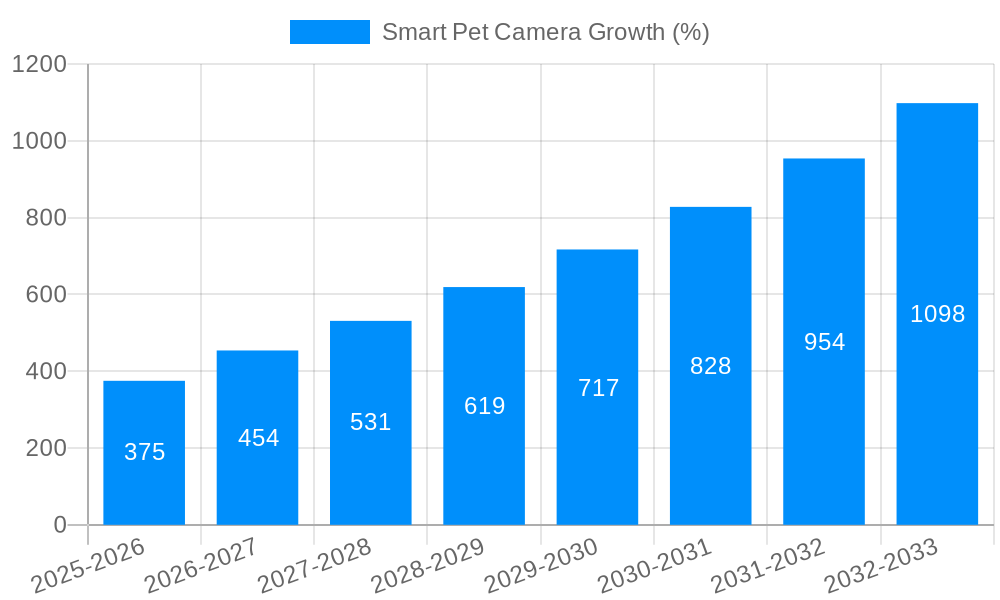

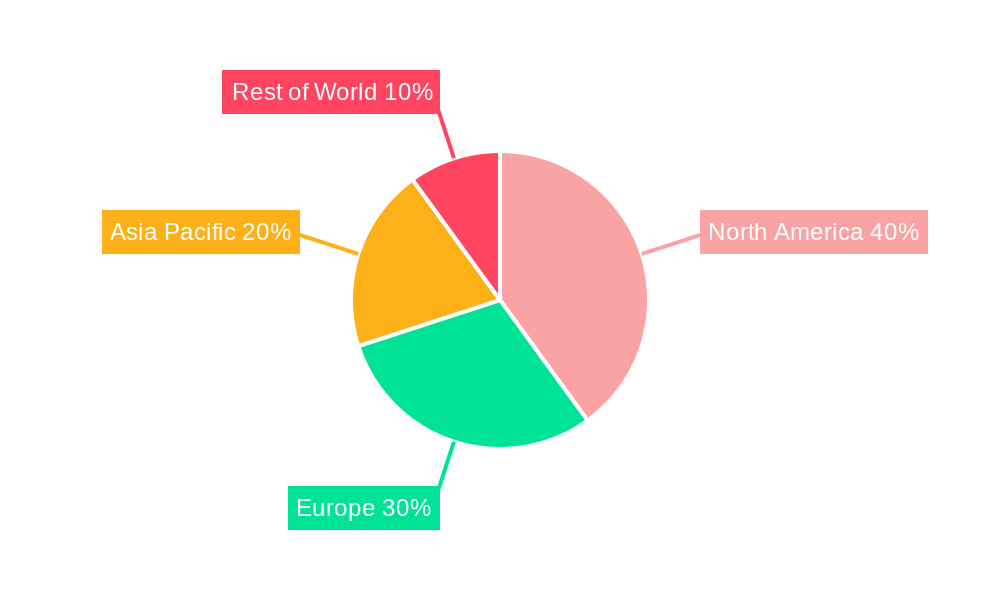

The global smart pet camera market is experiencing robust growth, driven by increasing pet ownership, rising disposable incomes, and the growing adoption of smart home technologies. The market, valued at approximately $2.5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an estimated $8 billion by 2033. This expansion is fueled by several key factors: consumers' desire for enhanced pet monitoring and security, advancements in camera technology offering features like high-definition video, two-way audio, treat dispensing, and interactive play, and the integration of smart pet cameras into broader smart home ecosystems. The wireless segment dominates the market due to its convenience and flexibility, while the home application segment holds the largest market share, reflecting the primary use case for pet monitoring. However, the commercial segment, encompassing pet boarding facilities and veterinary clinics, presents a significant growth opportunity. Key players like Furbo, Petcube, and Kasa are constantly innovating, introducing new features and enhancing user experiences to maintain a competitive edge. The market's geographic distribution is diverse, with North America and Europe holding substantial market shares currently, while the Asia-Pacific region exhibits strong growth potential due to rising pet ownership and increasing disposable incomes in emerging economies.

Geographic variations in market penetration exist due to differences in pet ownership rates, technological adoption, and economic development. North America, with its high pet ownership rates and established smart home markets, leads the way, followed by Europe. However, rapidly developing economies in Asia-Pacific, particularly China and India, are expected to witness significant market growth, fueled by a rising middle class with increasing disposable income and a growing interest in pet care solutions. Restraints on market growth include concerns regarding data privacy and security, the cost of premium features in certain smart pet camera models, and the potential for technical malfunctions. Nevertheless, continuous technological advancements, coupled with innovative marketing strategies targeting specific consumer segments, are poised to drive market expansion in the coming years, maintaining a positive growth trajectory.

The global smart pet camera market is experiencing explosive growth, projected to reach multi-million unit sales within the forecast period (2025-2033). Driven by increasing pet ownership, technological advancements, and a rising demand for pet monitoring and security solutions, this sector shows immense potential. The market's evolution is marked by a shift towards sophisticated features beyond basic video streaming. We're seeing an integration of AI-powered functionalities such as advanced motion detection, pet recognition, two-way audio with enhanced clarity, treat dispensing, and even interactive play features. This trend caters to the growing desire of pet owners for improved interaction and enhanced care for their companions, even when physically distant. Furthermore, the increasing affordability of these devices and their integration with smart home ecosystems are expanding the market's reach. The historical period (2019-2024) witnessed substantial growth, laying a strong foundation for the impressive forecast. The estimated year 2025 represents a pivotal point, reflecting the culmination of several years of market expansion and the anticipation of even faster growth in the coming years. Key market insights reveal a preference for wireless models due to their flexibility and ease of installation, with the home application segment dominating overall sales. The rising popularity of subscription services offering cloud storage and advanced features further contributes to market revenue. Competition among leading manufacturers is fierce, leading to continuous innovation and a wider range of features and price points to cater to diverse consumer needs and budgets. The market's future growth depends heavily on continued innovation, competitive pricing, and the successful integration of smart pet cameras into broader smart home ecosystems.

Several factors contribute to the robust growth of the smart pet camera market. The increasing number of pet owners globally is a primary driver, as more people seek ways to monitor and interact with their pets remotely. The convenience offered by these cameras, allowing owners to check on their pets at any time, is highly appealing. Technological advancements play a crucial role, with improved image quality, advanced AI capabilities (like facial recognition and activity monitoring), and better integration with smart home devices enhancing the appeal and functionality of smart pet cameras. The growing trend of pet humanization, where pets are increasingly treated as family members, fuels the demand for products that prioritize pet well-being and security. This contributes to the acceptance and widespread adoption of smart pet cameras. The rise of subscription-based services provides an additional revenue stream for manufacturers, enhancing profitability and driving innovation. Furthermore, the decreasing cost of smart pet cameras makes them more accessible to a larger consumer base, furthering market penetration. Marketing and advertising campaigns that effectively highlight the benefits of these cameras also play a vital role in driving consumer demand and establishing brand recognition within a competitive market.

Despite the significant growth potential, several challenges hinder the market's expansion. Privacy concerns regarding data security and the potential for misuse of recorded footage remain a significant obstacle. Consumers are increasingly aware of data privacy issues and may be hesitant to adopt devices that collect sensitive information about their pets and their homes. Battery life and connectivity issues in wireless cameras can be frustrating for users, leading to negative reviews and impacting brand loyalty. The need for reliable internet connectivity for many features limits the usability in areas with poor internet access. High initial costs of some high-end models with advanced features can exclude budget-conscious consumers, restricting market penetration. Competition in the market is intense, necessitating continuous innovation and cost-effective manufacturing to maintain profitability. Furthermore, concerns about the potential for malfunctions and technical issues can lead to consumer dissatisfaction and negatively impact market growth. Effective addressing these concerns through enhanced data security measures, improved product reliability, and transparent communication with consumers is crucial for sustained market success.

The global smart pet camera market shows strong growth across multiple regions, but North America and Europe currently lead in terms of adoption and market share due to higher pet ownership rates and a greater willingness to adopt smart home technologies. Within these regions, the United States and certain European countries such as Germany and the United Kingdom represent significant markets.

Wireless Segment Dominance: The wireless segment is expected to continue its dominance throughout the forecast period (2025-2033). Wireless cameras offer greater flexibility in placement and setup, appealing to a wider range of consumers. This is fueled by advancements in wireless technology, leading to improved reliability and extended battery life.

Home Application: The vast majority of smart pet cameras are used in residential settings. The home application segment represents the largest portion of the market, reflecting the high demand for pet monitoring and security within the home environment. This preference is driven by the desire to keep pets safe and secure, allowing owners to keep an eye on them remotely and address any potential issues promptly. The convenience and peace of mind offered by home-based smart pet cameras significantly contribute to this segment's continued growth.

The growth in Asia-Pacific is also noteworthy, with countries like China and Japan witnessing increasing adoption rates as living standards improve and pet ownership increases. The commercial application segment, though currently smaller than the home segment, exhibits promising growth potential, especially in areas like veterinary clinics, pet boarding facilities, and animal shelters. These businesses are increasingly leveraging smart pet cameras for enhanced monitoring, security, and customer service. This segment is expected to grow steadily as these businesses recognize the efficiency benefits of remotely monitoring their pets. The forecast shows that continued innovation in wireless technology, combined with the expanding market in Asia-Pacific and the gradual rise of the commercial segment, will drive the overall market growth.

The smart pet camera industry’s growth is spurred by several key factors. These include the increasing affordability of smart devices, technological advancements leading to enhanced features and functionality, and the growing integration with smart home ecosystems. Further fueling this growth is the rise of subscription-based services which add recurring revenue streams for manufacturers and offer valuable features to consumers. The increasing adoption of cloud storage solutions for recorded footage also contributes to this expanding market. Lastly, effective marketing campaigns emphasizing the benefits of smart pet cameras play a vital role in driving consumer awareness and adoption.

This report provides a detailed analysis of the smart pet camera market, covering historical data (2019-2024), the estimated year (2025), and a comprehensive forecast up to 2033. It offers insights into market trends, driving forces, challenges, and key players, providing a comprehensive overview of this rapidly expanding sector. The report also delves into regional and segment-specific analyses, offering a granular understanding of market dynamics. This in-depth analysis allows businesses to make informed decisions, identify potential opportunities, and navigate the competitive landscape of the smart pet camera industry effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Furbo, Kasa, Petcube, Petoneer, Eufy, Wyze, Skymee, WOpet, Arlo, Pawbo, Xiaomi, EZVIZ, HUAWEI, Enabot.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Smart Pet Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart Pet Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.