1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Oilfield Services?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart Oilfield Services

Smart Oilfield ServicesSmart Oilfield Services by Type (Well Completion Equipment and Services, Drilling Waste Management Services, Other), by Application (Oil Production), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

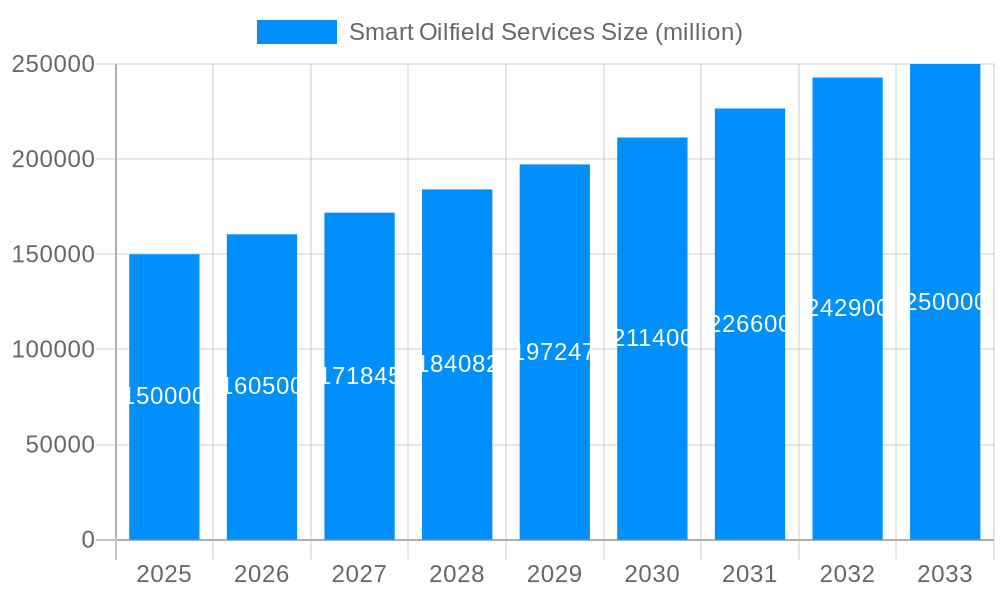

The global smart oilfield services market is poised for significant expansion, driven by the imperative for enhanced oil and gas recovery, optimized operational efficiency, and a commitment to reduced environmental impact. The market, valued at $204.53 billion in the base year of 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5%, reaching approximately $330 billion by 2033. This robust growth is underpinned by several critical factors: the pervasive digital transformation across the oil and gas sector, the accelerating adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) for real-time data analytics and predictive maintenance, and the sustained pressure to maximize production while minimizing operational expenditures. The well completion equipment and services segment currently commands the largest market share, reflecting the substantial demand for cutting-edge technologies designed to elevate well productivity and extend operational lifespan. North America leads the market, fueled by substantial industry investments and technological innovation; however, the Asia-Pacific region is emerging as a key growth engine due to escalating exploration and production activities.

While the market trajectory is promising, the smart oilfield services sector encounters distinct challenges. Substantial initial capital investment required for the implementation of novel technologies can impede widespread adoption, particularly for smaller industry participants. Furthermore, data security and cybersecurity concerns, coupled with the inherent complexity of integrating disparate technologies into existing infrastructure, present considerable obstacles. Market expansion is also subject to the volatility of oil and gas prices and prevailing geopolitical uncertainties. Nevertheless, continuous technological advancements, supported by governmental policies encouraging digitalization within the energy industry, are anticipated to counteract these challenges and ensure sustained market growth. Leading entities, including Baker Hughes, Halliburton, and Schlumberger, are making substantial investments in research and development to refine their product and service portfolios, fostering intensified competition and innovation. This dynamic competitive environment propels ongoing enhancements in efficiency, cost-effectiveness, and technological progress within the smart oilfield services market.

The global smart oilfield services market is experiencing significant growth, driven by the increasing demand for enhanced oil recovery techniques and the need for improved operational efficiency in the oil and gas industry. The market size, estimated at XXX million in 2025, is projected to reach XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). This expansion is fueled by several converging factors, including the widespread adoption of digital technologies, the growing emphasis on data analytics for optimizing production, and the imperative to reduce operational costs in a fluctuating energy market. Analysis of historical data (2019-2024) reveals a steady upward trend, indicating a strong foundation for continued growth. Key market insights suggest a shift towards integrated smart oilfield solutions, where various technologies are seamlessly interconnected to provide a holistic view of operations. This integrated approach enables real-time monitoring, predictive maintenance, and optimized resource allocation, contributing to substantial improvements in efficiency and profitability. The increasing adoption of cloud-based platforms for data storage and analysis is also contributing to the market's expansion, allowing companies to leverage advanced analytics and collaborate more effectively. Furthermore, the development of advanced sensors and automation technologies is further streamlining operations and enhancing the safety of oilfield activities, leading to increased market adoption. The competitive landscape is dynamic, with major players like Schlumberger, Baker Hughes, and Halliburton investing heavily in R&D and strategic partnerships to maintain their market positions and expand their service offerings. The market also witnesses the emergence of several niche players focusing on specific areas like drilling automation and data analytics, bringing specialized expertise and innovative solutions to the industry. The growth is not uniform across all segments, with some areas experiencing faster growth than others due to differences in technology adoption rates and regional regulatory landscapes.

Several key factors are propelling the growth of the smart oilfield services market. Firstly, the increasing demand for enhanced oil recovery (EOR) techniques is pushing companies to adopt advanced technologies that optimize production from mature fields. Smart oilfield technologies, with their ability to analyze vast amounts of data and predict potential issues, enable improved reservoir management and optimized injection strategies. Secondly, the imperative to reduce operational costs in the face of volatile oil prices is driving the adoption of automation and data analytics. Smart oilfield solutions can significantly reduce labor costs, optimize energy consumption, and minimize downtime, leading to substantial cost savings. Thirdly, the growing emphasis on safety and environmental regulations is leading to increased investment in smart oilfield technologies. These technologies enable real-time monitoring of equipment and processes, facilitating early detection and prevention of potential hazards and environmental incidents. Finally, advancements in technologies such as IoT (Internet of Things), big data analytics, artificial intelligence, and cloud computing are continually improving the capabilities of smart oilfield services, making them more efficient, reliable, and cost-effective. These technological advancements, coupled with the industry's increasing digitalization efforts, are fostering a rapid expansion of the smart oilfield services market. The convergence of these factors creates a synergistic effect, significantly accelerating the growth trajectory of the market.

Despite the significant growth potential, the smart oilfield services market faces certain challenges. High initial investment costs associated with implementing smart oilfield technologies can be a significant barrier for smaller companies, especially in emerging markets. This financial burden can hinder wider adoption, particularly for companies with limited budgets. Secondly, the complexity of integrating various smart technologies and the need for specialized expertise can pose significant operational challenges. Effective integration requires a robust infrastructure, skilled personnel, and comprehensive data management strategies, all of which can be costly and difficult to implement. Data security and cybersecurity are also significant concerns, as smart oilfield technologies generate and transmit large amounts of sensitive data, making them potential targets for cyberattacks. Robust security measures are essential to protect this data, increasing both the cost and complexity of implementation. Furthermore, the lack of standardization across different smart oilfield technologies can hinder interoperability and data sharing, limiting the potential benefits of integration. Finally, the reliability and robustness of smart oilfield technologies in harsh environmental conditions can be a concern. The oil and gas industry operates in challenging environments, and the technologies must be able to withstand these conditions without compromising their functionality or reliability. Addressing these challenges is crucial for realizing the full potential of smart oilfield services and ensuring widespread adoption across the industry.

The smart oilfield services market demonstrates varied growth patterns across different regions and segments. While North America currently holds a significant market share due to extensive oil and gas operations and early adoption of smart technologies, the Asia-Pacific region is poised for substantial growth due to increasing investments in oil and gas infrastructure and rapid technological advancements. The Middle East also presents a significant market opportunity given its substantial oil reserves and ongoing efforts to optimize production efficiency. Within the segments, the Well Completion Equipment and Services segment is expected to dominate the market in terms of revenue generation due to the significant investment made in improving well completion efficiency and maximizing hydrocarbon recovery. This segment involves specialized equipment and services that enhance well productivity, reducing operational costs and increasing overall production. The increasing demand for automation in well completion processes further fuels the segment's growth. The segment's dominance is also fueled by the ongoing development of advanced technologies, such as smart completion systems and intelligent well monitoring systems, which offer significant improvements in well completion and production management. These technologies significantly reduce operational downtime, allowing for better resource optimization and increased overall production. Moreover, the development of new materials and improved design of equipment is contributing to enhanced well longevity and productivity, positively influencing the segment's growth trajectory.

The Oil Production application segment is also showing significant growth, driven by the need for real-time monitoring and optimization of production processes.

The smart oilfield services industry is experiencing robust growth primarily due to the convergence of several factors: the increasing demand for enhanced oil recovery (EOR) to maximize production from existing fields, the need to reduce operational costs through automation and data analytics, the push for improved safety and environmental compliance, and the continuous advancements in digital technologies like IoT, AI, and cloud computing. These advancements, combined with the industry's ongoing digitalization efforts, are propelling the market forward at a rapid pace.

This report provides a comprehensive overview of the smart oilfield services market, encompassing detailed market sizing, trend analysis, and growth forecasts. It also offers valuable insights into the leading players, key technological developments, and regional market dynamics. The report is designed to equip stakeholders with the critical information needed to make informed business decisions in this rapidly evolving market, addressing the challenges and opportunities presented by the adoption of smart technologies in oil and gas operations.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Baker Hughes, Halliburton, Schlumberger, Weatherford, BJ Energy Solutions, Nabors Industries, NOV Inc, Superior Energy Services, Aker Solutions, Fluor Corporation, Hytera, Transocean, Welltec, Petrofac, Zibo Hongyang Petroleum Equipment Group, TechnipFMC, Kongsberg Gruppen, Pason Systems, Petrolink, .

The market segments include Type, Application.

The market size is estimated to be USD 204.53 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Smart Oilfield Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart Oilfield Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.