1. What is the projected Compound Annual Growth Rate (CAGR) of the Small Companion Animal Drug?

The projected CAGR is approximately 11.22%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Small Companion Animal Drug

Small Companion Animal DrugSmall Companion Animal Drug by Type (External Use, Internal Use), by Application (Dogs, Cats, Birds, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

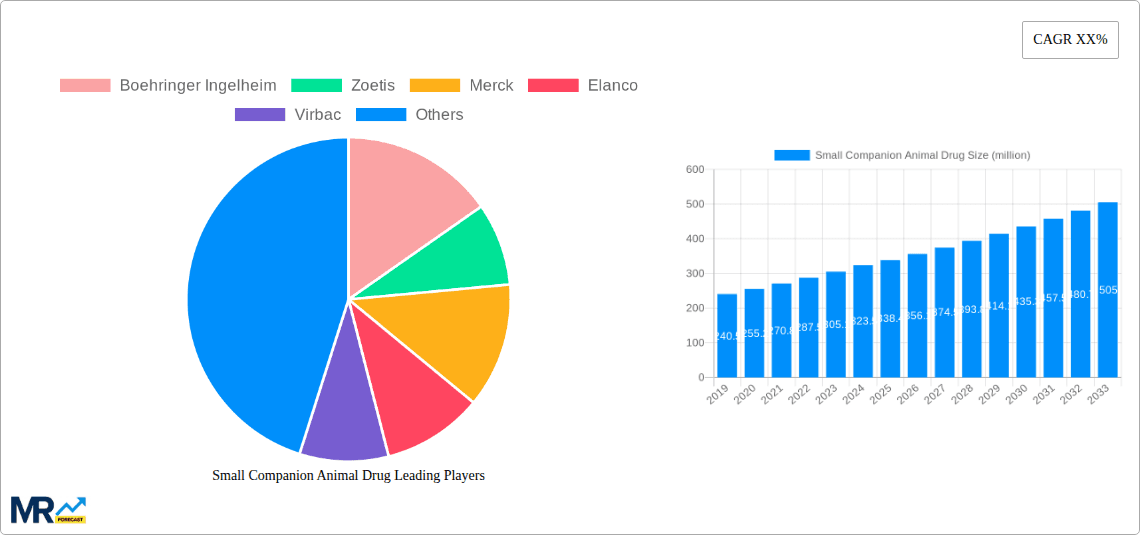

The global small companion animal drug market is projected to reach $25.88 billion by 2033, expanding at a compound annual growth rate (CAGR) of 11.22% from the 2025 base year. This robust growth is attributed to escalating global pet ownership, the pet humanization trend driving increased investment in veterinary care, and the continuous innovation in therapeutic drug development for companion animals. The market sees significant demand for preventive treatments, including vaccines and parasiticides, reflecting a growing emphasis on proactive pet health management. The rising incidence of chronic conditions in aging pets further stimulates the need for specialized pharmaceuticals and treatments. Leading companies such as Boehringer Ingelheim, Zoetis, Merck, and Elanco are at the forefront of research and development, introducing novel products and expanding their portfolios to meet evolving market demands. Intense competition is fueled by innovation, including advancements in drug delivery systems and formulations.

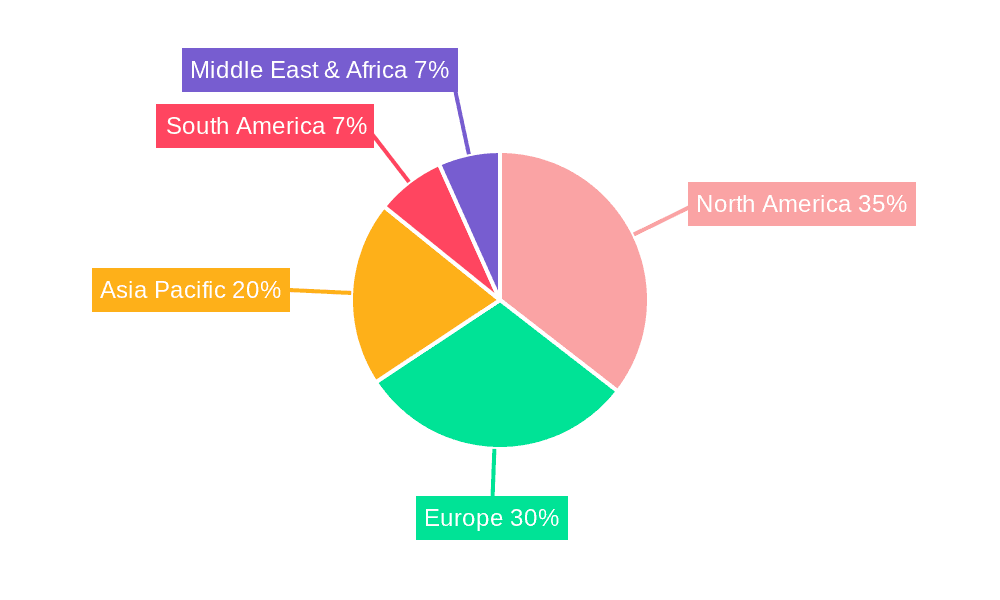

While specific segmentation details are proprietary, the market is broadly categorized by animal type (e.g., dogs, cats), drug classification (e.g., antibiotics, antiparasitics, cardiovascular treatments), and administration routes. Geographic market distribution is expected to show substantial variations. Developed markets, particularly North America and Europe, are anticipated to maintain significant shares due to high pet adoption rates and elevated per capita expenditure on pet healthcare. Conversely, emerging economies are poised for substantial growth, driven by increasing disposable incomes and a rise in pet adoption. Regulatory frameworks and diverse veterinary practices across regions present both strategic opportunities and operational challenges for stakeholders. Future market expansion will likely be influenced by advancements in veterinary diagnostics, the adoption of personalized medicine, and the increasing prevalence of pet insurance.

The global small companion animal drug market experienced robust growth during the historical period (2019-2024), exceeding 100 million units in 2024. This surge is primarily attributed to the increasing pet ownership globally, coupled with rising pet humanization trends. Owners are increasingly viewing their pets as family members, leading to greater investment in their healthcare, including preventative and therapeutic medications. The market is witnessing a shift towards premium and specialized products, driven by a growing awareness of animal health and wellness. This includes a rise in demand for products addressing specific health conditions, like osteoarthritis and allergies, as well as a focus on preventative care such as vaccinations and parasite control. Furthermore, advancements in veterinary medicine, such as the development of novel drugs and delivery systems, are contributing to market expansion. The forecast period (2025-2033) is projected to witness continued growth, driven by factors such as increasing disposable incomes in developing economies, the growing prevalence of chronic diseases in companion animals, and expanding access to veterinary care. While the market is competitive, with numerous multinational players vying for market share, opportunities exist for companies offering innovative solutions and targeted products catering to specific animal breeds or health concerns. The estimated market size in 2025 is projected to be significantly higher than in previous years, indicating a sustained positive trajectory. The market is expected to reach 150 million units by 2033. This growth is fueled by a combination of factors ranging from demographic shifts to technological advancements within the veterinary sector. The market's overall health, marked by significant growth and ongoing innovation, makes it an attractive sector for investment and further development.

Several key factors are driving the growth of the small companion animal drug market. The rising pet ownership worldwide is a primary driver, particularly in developing economies experiencing increased disposable incomes and urbanization. Pet owners are increasingly willing to spend more on their pets' healthcare, mirroring human healthcare trends. The increasing humanization of pets, where pets are considered family members, also significantly contributes to this trend. This leads to greater demand for preventative healthcare, including vaccinations, parasite control, and regular veterinary check-ups, as well as a willingness to invest in treatment for more complex health conditions. Moreover, advancements in veterinary medicine, including the development of novel drugs and more effective treatments, are creating opportunities for market expansion. The development of more targeted therapies for specific breeds or diseases is further fueling this growth. Finally, the increased accessibility of veterinary care, both through traditional clinics and online platforms, contributes to higher medication usage and a wider reach for these products.

Despite the significant growth potential, the small companion animal drug market faces several challenges. Stringent regulatory requirements for drug approvals pose a barrier to market entry for new products, increasing development costs and timelines. Competition among established pharmaceutical companies is intense, requiring companies to invest heavily in research and development to maintain a competitive edge. The pricing of medications can be a significant constraint, especially for owners with limited financial resources. Furthermore, the market is susceptible to fluctuations in pet ownership trends, influenced by economic conditions and societal changes. Counterfeit drugs represent a growing concern, impacting both animal health and consumer trust. The effective distribution and logistics of animal health products, especially in remote areas, can pose logistical challenges. Finally, varying treatment protocols and practices across different geographic regions and veterinary practices can affect market penetration and consistency.

North America (United States and Canada): This region consistently holds the largest market share due to high pet ownership rates, substantial disposable income, and advanced veterinary infrastructure. The strong pet humanization trend fuels demand for premium and specialized products.

Europe (Western Europe): This region displays high pet ownership and a strong focus on animal welfare, driving demand for high-quality medications. The regulated market ensures a high standard of care and products.

Asia-Pacific (Japan, China, Australia): This region demonstrates significant growth potential due to increasing pet ownership, particularly in countries like China, coupled with rising disposable incomes and increased awareness of pet healthcare.

Segments: The therapeutic segments such as antiparasitic drugs (flea, tick, and heartworm prevention), dermatology medications, and cardiovascular drugs are experiencing significant growth due to high prevalence of these conditions and effective treatments available.

Paragraph: The North American market, particularly the United States, continues to be the dominant force, fueled by a strong pet ownership culture and high expenditure on animal healthcare. However, the Asia-Pacific region shows immense potential for future growth, given the expanding pet owner base and increasing disposable incomes. Within segments, the consistent demand for antiparasitic medications, driven by the prevalence of parasites, highlights its substantial contribution to the market's overall expansion. Other key therapeutic areas, addressing conditions like arthritis and allergies, also showcase steady growth reflecting the increasing awareness and focus on companion animal wellness. The market's dynamics are complex, with various factors influencing regional and segmental dominance, constantly shifting based on evolving pet ownership trends and healthcare practices.

Several factors are accelerating growth within the small companion animal drug industry. Firstly, an increasing awareness of animal health and wellness among pet owners drives demand for preventative and therapeutic medications. Secondly, technological advancements in drug delivery, diagnostics, and treatment options are continually improving healthcare outcomes, further stimulating the market. The growing humanization of pets, treating them as family members, reinforces the willingness to invest in their healthcare. Lastly, the expansion of veterinary services and accessibility contributes to greater usage of these medications.

This report provides a comprehensive overview of the small companion animal drug market, analyzing historical trends, current market dynamics, and future growth projections. It delves into key drivers, challenges, and opportunities within the sector, offering valuable insights into the competitive landscape and providing a detailed forecast for the coming years. The report will be invaluable to industry stakeholders, including pharmaceutical companies, veterinary professionals, investors, and researchers seeking to understand and navigate this expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.22% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.22%.

Key companies in the market include Boehringer Ingelheim, Zoetis, Merck, Elanco, Virbac, Ceva Sante Animale, Vetoquinol, Bimeda Animal Health, Dechra Pharmaceuticals, Daewoong, GNT Pharma, .

The market segments include Type, Application.

The market size is estimated to be USD 25.88 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Small Companion Animal Drug," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Small Companion Animal Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.