1. What is the projected Compound Annual Growth Rate (CAGR) of the Single-use Bioprocessing Probes & Sensors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Single-use Bioprocessing Probes & Sensors

Single-use Bioprocessing Probes & SensorsSingle-use Bioprocessing Probes & Sensors by Type (pH Sensor, Oxygen Sensor, Pressure Sensors, Temperature Sensors, Conductivity Sensors, Flow Meters & Sensors, Others, World Single-use Bioprocessing Probes & Sensors Production ), by Application (Biopharmaceutical Manufacturer, OEM, Others, World Single-use Bioprocessing Probes & Sensors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

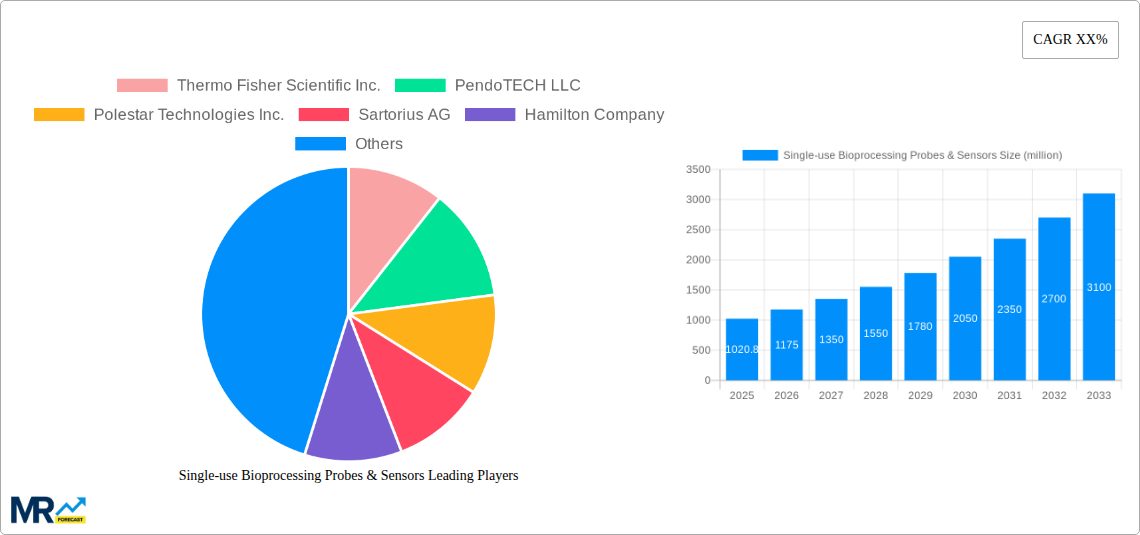

The global market for single-use bioprocessing probes and sensors is poised for significant expansion, projected to reach approximately $1020.8 million by 2025. This robust growth is primarily fueled by the increasing adoption of single-use technologies in biopharmaceutical manufacturing. The inherent advantages of single-use systems, such as reduced contamination risks, faster turnaround times, and lower capital expenditure, are driving their widespread implementation. Key market drivers include the burgeoning biopharmaceutical industry, the escalating demand for advanced therapies like monoclonal antibodies and vaccines, and stringent regulatory requirements for product safety and quality. The market is segmented by sensor type, with pH sensors, oxygen sensors, and temperature sensors expected to dominate due to their critical roles in cell culture and fermentation processes. The burgeoning biopharmaceutical sector, coupled with the continuous innovation in sensor technology leading to improved accuracy and data reliability, underpins this substantial market valuation.

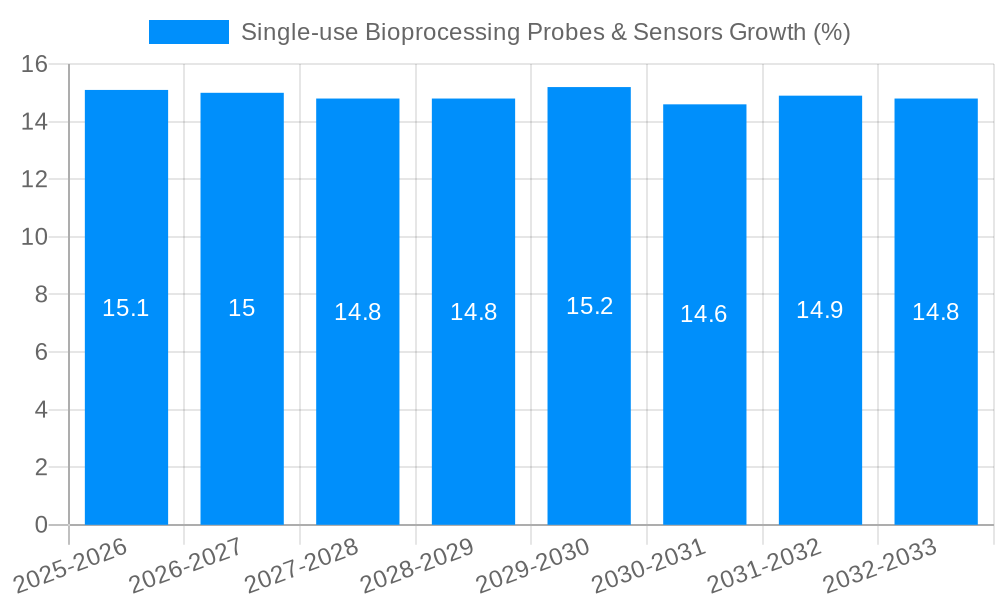

The forecast period from 2025 to 2033 anticipates a compound annual growth rate (CAGR) in the range of 10-15%, driven by technological advancements and increasing R&D investments in bioprocessing. Emerging economies, particularly in the Asia Pacific region, are presenting new growth avenues due to the expanding biopharmaceutical manufacturing footprint and supportive government initiatives. The market restrains, such as the initial cost of integration and the need for robust validation protocols, are being mitigated by the long-term cost-effectiveness and operational efficiencies offered by single-use solutions. Key industry players like Thermo Fisher Scientific, Sartorius AG, and Hamilton Company are actively investing in product development and strategic collaborations to capture market share. The growing focus on process analytical technology (PAT) and real-time monitoring further enhances the demand for sophisticated single-use probes and sensors, solidifying their indispensable role in modern biopharmaceutical production.

The global single-use bioprocessing probes and sensors market is poised for significant expansion, projected to witness a compound annual growth rate (CAGR) of approximately 8.5% during the study period of 2019-2033. This growth is underpinned by a burgeoning demand for advanced biopharmaceutical manufacturing solutions, where the inherent advantages of single-use technologies are increasingly recognized. The market, which is anticipated to reach substantial production volumes in the millions of units by 2025, is driven by the inherent need for sterile, disposable, and efficient monitoring and control in bioprocessing workflows. Traditional stainless-steel probes, while robust, often come with the encumbrance of extensive cleaning, validation, and sterilization protocols, leading to significant downtime and increased operational costs. Single-use alternatives, by contrast, eliminate these complexities, offering plug-and-play convenience and reduced risk of cross-contamination. This shift is particularly pronounced in the development and production of biologics, including monoclonal antibodies, vaccines, and gene therapies, where product purity and process integrity are paramount. The increasing prevalence of chronic diseases and the growing geriatric population globally are fueling the demand for advanced biopharmaceuticals, consequently bolstering the market for their enabling technologies. Furthermore, regulatory bodies worldwide are increasingly approving single-use systems, fostering confidence and driving adoption across various biopharmaceutical manufacturing stages, from research and development to full-scale commercial production. The estimated production in millions of units for 2025 highlights the scale of this transition. The market's trajectory is further shaped by technological advancements, with manufacturers continually innovating to introduce more accurate, sensitive, and integrated sensing solutions that can provide real-time data for better process control and optimization. The focus on miniaturization and enhanced connectivity is also a key trend, enabling seamless integration into complex bioprocessing setups. The historical period of 2019-2024 has laid a strong foundation, with increasing awareness and early adoption setting the stage for accelerated growth in the forecast period of 2025-2033.

The rapid expansion of the single-use bioprocessing probes and sensors market is primarily propelled by the overarching trend towards single-use manufacturing in the biopharmaceutical industry. This paradigm shift is driven by several compelling factors. Foremost is the critical need to minimize contamination risks and ensure product sterility, a non-negotiable requirement in the production of sensitive biologics. Single-use probes and sensors eliminate the laborious and validation-intensive cleaning and sterilization processes associated with reusable counterparts, thereby significantly reducing the potential for microbial contamination and cross-product contamination. This inherent sterility assurance translates directly into enhanced product quality and patient safety. Furthermore, the adoption of single-use technologies offers considerable advantages in terms of operational efficiency and flexibility. The reduction in downtime associated with cleaning cycles allows for faster batch turnaround times, accelerating the drug development and manufacturing timelines. This agility is particularly crucial in the dynamic biopharmaceutical landscape, where rapid responses to market demands and the need for quick clinical trial material production are essential. The decreasing costs associated with single-use systems, coupled with the elimination of capital investment in sterilization equipment, also presents a strong economic incentive for manufacturers, especially for smaller and mid-sized companies. The increasing complexity of biopharmaceutical manufacturing processes, involving intricate control parameters for optimal cell growth and product yield, necessitates sophisticated and reliable sensing capabilities. Single-use probes and sensors are being developed to meet these evolving needs, offering enhanced accuracy and real-time data acquisition.

Despite the robust growth trajectory, the single-use bioprocessing probes and sensors market is not without its challenges and restraints. A significant hurdle remains the perceived higher upfront cost of individual single-use probes and sensors compared to their reusable counterparts, even though the total cost of ownership can often be lower when considering the elimination of cleaning, validation, and associated labor. This perception can act as a deterrent, particularly for organizations with established infrastructure and strong commitments to traditional reusable systems. Another concern revolves around the environmental impact and disposal of a large volume of single-use plastic components. While efforts are underway to develop more sustainable materials and improve recycling processes, the accumulation of waste from bioprocessing remains a significant consideration and a point of scrutiny from regulatory bodies and the public. Furthermore, the validation of single-use components, while simpler than for reusable systems, still requires rigorous testing to ensure biocompatibility, extractables, and leachables. Manufacturers and end-users must invest time and resources to qualify these components for specific applications, which can be a time-consuming process. Supply chain reliability is also a critical factor. Disruptions in the supply of raw materials or manufacturing capabilities for single-use probes and sensors can have a significant impact on biopharmaceutical production, highlighting the need for robust and diversified supply chains. Finally, the integration of certain advanced single-use sensors into existing legacy systems can sometimes present compatibility challenges, requiring specialized adapters or modifications, which can add to the complexity and cost of implementation.

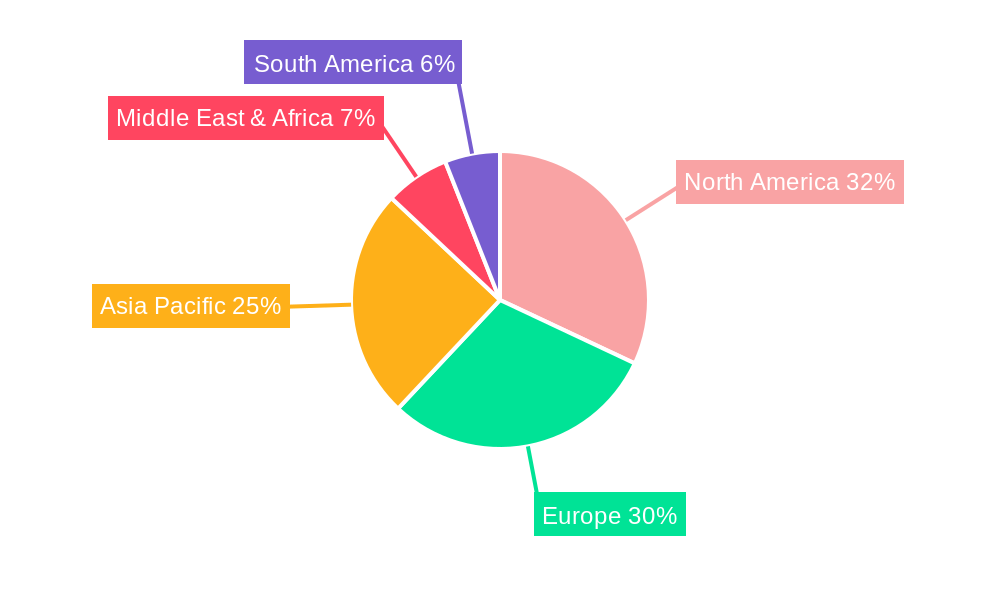

The North America region is poised to exhibit significant dominance in the global single-use bioprocessing probes and sensors market, driven by a confluence of factors that favor rapid adoption and innovation. The presence of a highly developed biopharmaceutical industry, with a substantial number of leading drug manufacturers and research institutions, forms the bedrock of this dominance. Countries like the United States are at the forefront of biopharmaceutical research and development, particularly in the areas of biologics, advanced therapies, and personalized medicine, all of which heavily rely on sophisticated bioprocessing technologies. The robust investment in biopharmaceutical R&D by both private and public entities further fuels the demand for cutting-edge solutions like single-use probes and sensors. Regulatory support from agencies like the U.S. Food and Drug Administration (FDA) has also been instrumental in fostering the acceptance and implementation of single-use technologies, including probes and sensors, by providing clear guidelines and frameworks for their use.

Within this dominant region, the pH Sensor segment, under the broader Type category, is expected to be a key contributor to market growth.

Furthermore, the Biopharmaceutical Manufacturer segment, within the Application category, will undoubtedly be the primary driver of demand.

The synergy between North America's strong biopharmaceutical R&D ecosystem, the critical importance of accurate pH monitoring in biologics production, and the extensive application by biopharmaceutical manufacturers creates a formidable market dynamic, positioning these elements as key dominators of the global single-use bioprocessing probes and sensors market.

Several potent growth catalysts are propelling the single-use bioprocessing probes and sensors industry forward. The accelerating development and commercialization of biologics, including complex cell and gene therapies, demand sterile and highly controlled manufacturing environments, a need perfectly met by single-use solutions. The ongoing pursuit of process intensification and continuous manufacturing methodologies within the biopharmaceutical sector also necessitates real-time, inline monitoring, where disposable sensors play a crucial role. Furthermore, increasing regulatory scrutiny and the emphasis on process validation and PAT (Process Analytical Technology) initiatives favor the adoption of advanced, disposable sensing technologies that offer robust data acquisition and traceability. Lastly, government initiatives and funding aimed at boosting domestic biopharmaceutical production and research are also stimulating the demand for these critical components.

This comprehensive report offers an in-depth analysis of the global single-use bioprocessing probes and sensors market, providing invaluable insights for stakeholders. The study delves into market segmentation by type, application, and region, offering a detailed breakdown of production volumes in millions of units and market shares. It meticulously examines market trends, driving forces, and potential restraints, utilizing a study period spanning 2019-2033 with a base and estimated year of 2025. The report highlights key regions and countries poised for dominance, alongside critical segments that will shape market dynamics. Furthermore, it identifies growth catalysts and presents a detailed overview of leading players and their significant developments. This report is an essential resource for understanding the current landscape and future trajectory of this vital segment of the biopharmaceutical industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thermo Fisher Scientific Inc., PendoTECH LLC, Polestar Technologies Inc., Sartorius AG, Hamilton Company, Parker Hannifin Corporation.

The market segments include Type, Application.

The market size is estimated to be USD 1020.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Single-use Bioprocessing Probes & Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single-use Bioprocessing Probes & Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.