1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicon & Carbon Composite Anode Materials?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Silicon & Carbon Composite Anode Materials

Silicon & Carbon Composite Anode MaterialsSilicon & Carbon Composite Anode Materials by Type (Below 400 mAh/g, 400-500 mAh/g, 500-600 mAh/g, Above 600 mAh/g), by Application (Car Batteries, Notebook Battery, Consumer Electronics, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

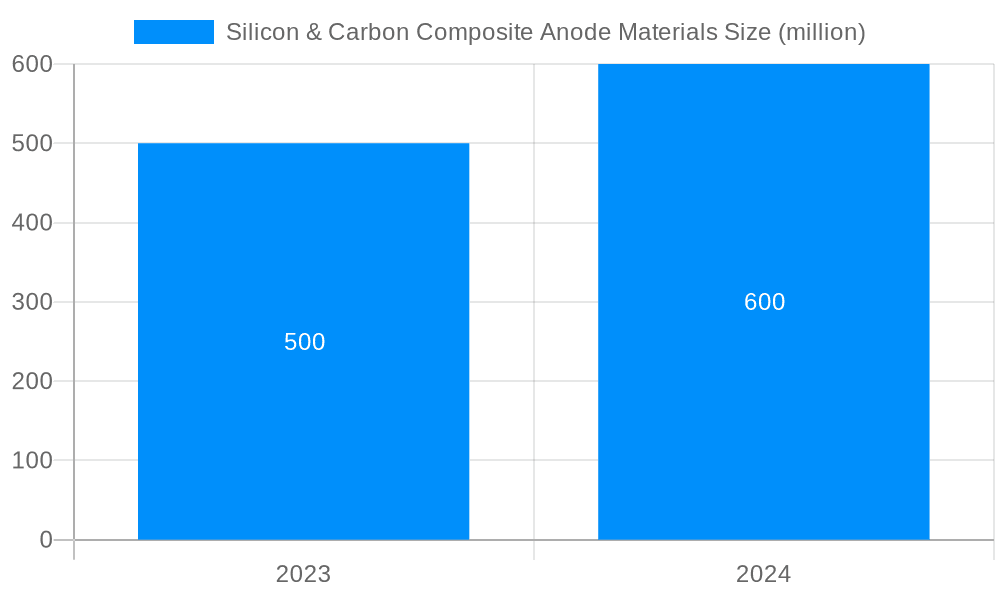

The global silicon & carbon composite anode materials market is projected to reach a value of $132.5 million by 2033, growing at a CAGR of 3.9% over the forecast period 2025-2033. The market is primarily driven by the increasing demand for high-performance batteries in electric vehicles and consumer electronics. Silicon and carbon composites offer several advantages over traditional graphite anodes, including higher capacity, longer cycle life, and improved safety.

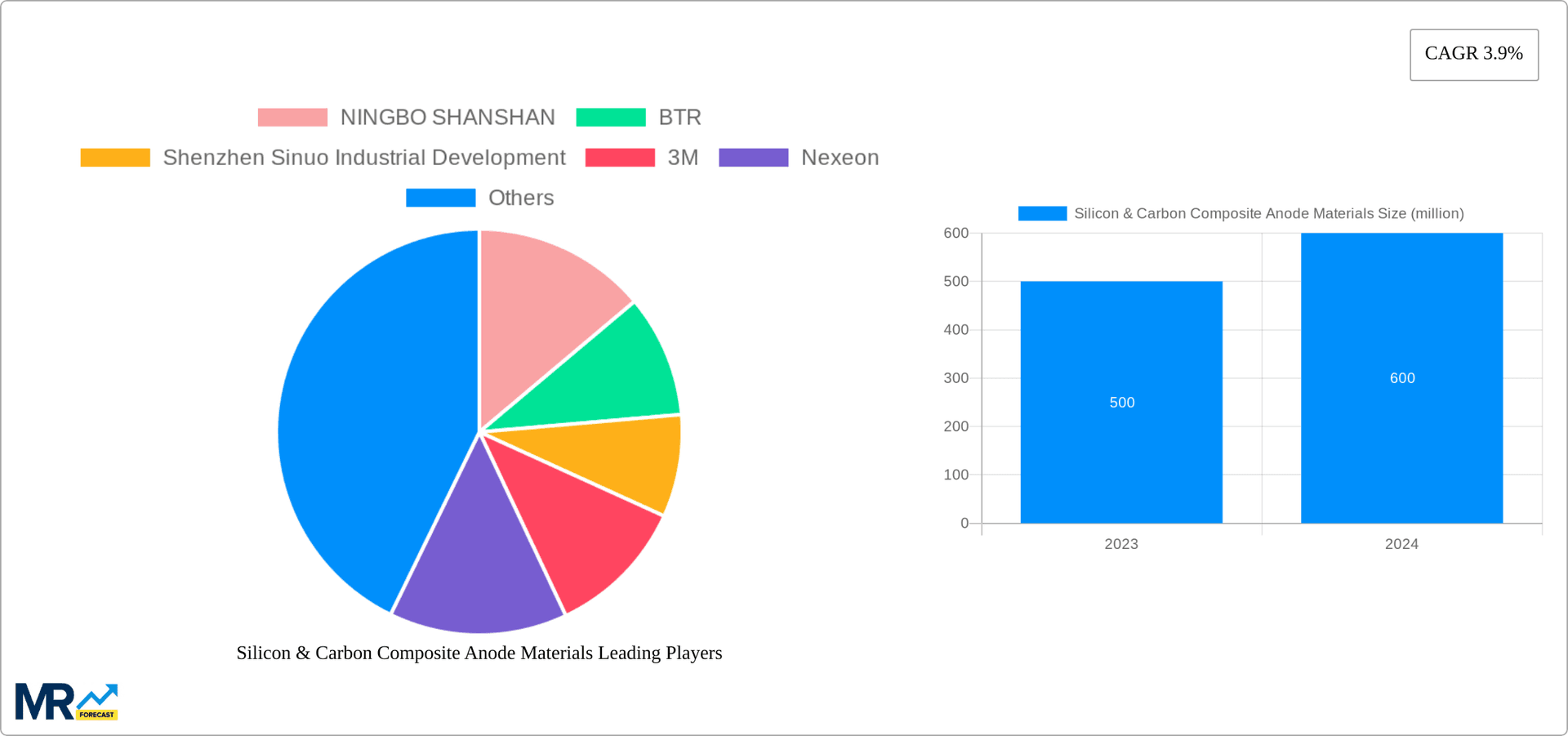

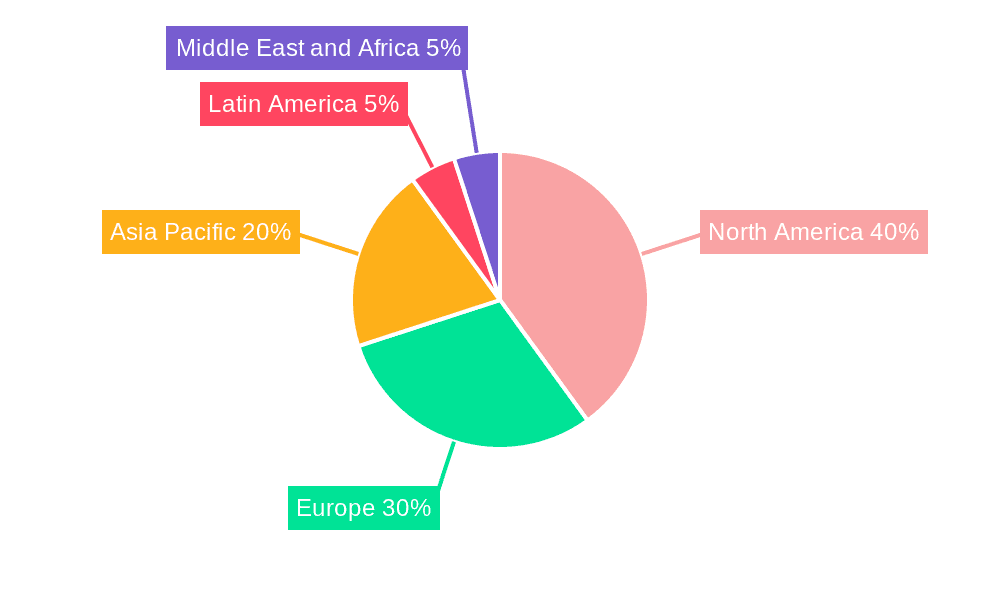

Key trends in the market include the development of new production technologies that can reduce costs and improve the performance of silicon & carbon composite anodes. Major players in the market include NINGBO SHANSHAN, BTR, Shenzhen Sinuo Industrial Development, 3M, and Nexeon. Asia-Pacific is the largest regional market for silicon & carbon composite anode materials, followed by Europe and North America.

The global market for silicon and carbon composite anode materials is expected to reach $1.5 billion by 2025, growing at a CAGR of 10.3% from 2020 to 2025. The growth of the market is primarily driven by the increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require high-performance batteries with long cycle life and high energy density. Silicon and carbon composite anode materials offer excellent specific capacity, improved cycle life, and high-rate capability compared to traditional graphite anode materials. As a result, these materials are increasingly being adopted by battery manufacturers to meet the stringent requirements of EV and HEV batteries.

In addition to the growing demand from the automotive industry, the market for silicon and carbon composite anode materials is also being driven by the rising demand for portable electronic devices, such as smartphones, laptops, and tablets. These devices require compact and lightweight batteries with high energy density to support their long operating time. Silicon and carbon composite anode materials are ideal for these applications due to their high capacity and compact size.

The market for silicon and carbon composite anode materials is still in its early stages of development, but it is expected to grow rapidly in the coming years. As the technology continues to improve and the cost of production decreases, these materials are expected to become even more widely adopted in the automotive and electronics industries.

The primary driving force behind the growth of the silicon and carbon composite anode materials market is the increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). EVs and HEVs require high-performance batteries with long cycle life and high energy density. Traditional graphite anode materials do not meet these requirements, which has led to the development of new anode materials, such as silicon and carbon composites.

Silicon and carbon composite anode materials offer several advantages over traditional graphite anode materials. First, silicon has a much higher specific capacity than graphite, which means that it can store more charge in a smaller volume. Second, carbon is a good conductor of electricity, which helps to improve the rate capability of the anode. Third, silicon and carbon are both relatively inexpensive materials, which makes them a cost-effective option for battery manufacturers.

In addition to the growing demand from the automotive industry, the market for silicon and carbon composite anode materials is also being driven by the rising demand for portable electronic devices, such as smartphones, laptops, and tablets. These devices require compact and lightweight batteries with high energy density to support their long operating time. Silicon and carbon composite anode materials are ideal for these applications due to their high capacity and compact size.

Despite the many advantages of silicon and carbon composite anode materials, there are still some challenges and restraints that need to be addressed before these materials can be widely adopted in commercial applications.

One of the main challenges with silicon and carbon composite anode materials is their poor cycling stability. Silicon has a high volume expansion during the charge and discharge process, which can lead to the formation of cracks and the loss of electrical contact between the anode and the current collector. This can result in a rapid capacity fade and a shortened battery life.

Another challenge with silicon and carbon composite anode materials is their low initial coulombic efficiency (ICE). The ICE is the ratio of the discharge capacity to the charge capacity during the first cycle. Silicon and carbon composite anode materials typically have a low ICE due to the formation of a solid electrolyte interphase (SEI) layer on the surface of the anode. The SEI layer is necessary to protect the anode from further degradation, but it also reduces the amount of charge that can be stored in the anode.

Finally, silicon and carbon composite anode materials are still relatively expensive to produce. This is due to the high cost of silicon and the complex manufacturing process. As the demand for these materials increases, the cost of production is expected to decrease. However, it is still a significant barrier to the widespread adoption of these materials.

The Asia-Pacific region is expected to dominate the global silicon and carbon composite anode materials market throughout the forecast period. The region is home to some of the world's largest battery manufacturers, such as Panasonic, Samsung SDI, and LG Chem. These companies are investing heavily in the development and production of silicon and carbon composite anode materials to meet the growing demand from the automotive and electronics industries.

China is the largest market for silicon and carbon composite anode materials in the Asia-Pacific region. The country is a major producer of electric vehicles and portable electronic devices, which is driving the demand for high-performance batteries. The Chinese government is also supportive of the development of the electric vehicle industry, which is providing further impetus to the growth of the silicon and carbon composite anode materials market.

Other key markets for silicon and carbon composite anode materials in the Asia-Pacific region include Japan, South Korea, and Taiwan. These countries are home to a number of leading battery manufacturers and are also major markets for electric vehicles and portable electronic devices.

The 500-600 mAh/g segment is expected to dominate the global silicon and carbon composite anode materials market throughout the forecast period. This segment is expected to account for over 40% of the total market share in 2025. The growth of this segment is being driven by the increasing demand for high-energy-density batteries for electric vehicles and portable electronic devices.

The 400-500 mAh/g segment is expected to be the second-largest segment in the global silicon and carbon composite anode materials market. This segment is expected to account for over 30% of the total market share in 2025. The growth of this segment is being driven by the demand for batteries with moderate energy density and long cycle life for electric vehicles and portable electronic devices.

The below 400 mAh/g and above 600 mAh/g segments are expected to account for a smaller share of the global silicon and carbon composite anode materials market. The below 400 mAh/g segment is expected to be used in low-end electric vehicles and portable electronic devices, while the above 600 mAh/g segment is expected to be used in high-end electric vehicles and portable electronic devices.

Several factors are expected to drive the growth of the silicon and carbon composite anode materials market in the coming years.

Some of the leading players in the silicon and carbon composite anode materials market include:

Several significant developments have taken place in the silicon and carbon composite anode materials sector in recent years.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

Key companies in the market include NINGBO SHANSHAN, BTR, Shenzhen Sinuo Industrial Development, 3M, Nexeon, Jiangxi Zichen Technology, Kuraray, JFE-Chem, Showa Denko, Szsinuo, .

The market segments include Type, Application.

The market size is estimated to be USD 132.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Silicon & Carbon Composite Anode Materials," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Silicon & Carbon Composite Anode Materials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.