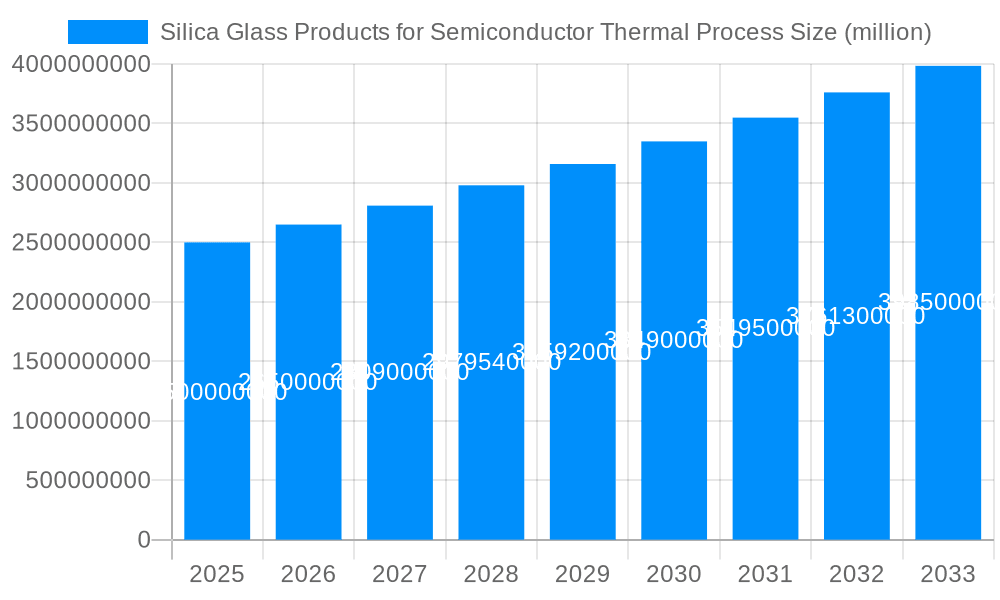

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silica Glass Products for Semiconductor Thermal Process?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Silica Glass Products for Semiconductor Thermal Process

Silica Glass Products for Semiconductor Thermal ProcessSilica Glass Products for Semiconductor Thermal Process by Type (Tube, Flange, Others, World Silica Glass Products for Semiconductor Thermal Process Production ), by Application (Atomic Layer Deposition (ALD), Low-Pressure Chemical Vapour Deposition (LPCVD), Sub Atmospheric Chemical Vapour Deposition (SACVD), Rapid Thermal Processing (RTP), Others, World Silica Glass Products for Semiconductor Thermal Process Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for Silica Glass Products for Semiconductor Thermal Process is experiencing robust growth, projected to reach an estimated $2.5 billion in 2025. Fueled by a Compound Annual Growth Rate (CAGR) of 6%, this expansion is primarily driven by the ever-increasing demand for advanced semiconductors and the critical role these specialized silica glass components play in thermal processing techniques. Technologies like Atomic Layer Deposition (ALD), Low-Pressure Chemical Vapor Deposition (LPCVD), Sub-Atmospheric Chemical Vapor Deposition (SACVD), and Rapid Thermal Processing (RTP) are fundamental to the fabrication of next-generation microchips. The intricate nature of these processes necessitates high-purity, heat-resistant, and chemically inert silica glass products, including tubes and flanges, to ensure precision, yield, and defect-free wafer production. Emerging trends such as the miniaturization of electronic devices, the proliferation of AI and machine learning, and the burgeoning automotive and IoT sectors are further amplifying the need for sophisticated semiconductor manufacturing capabilities, consequently bolstering the silica glass market.

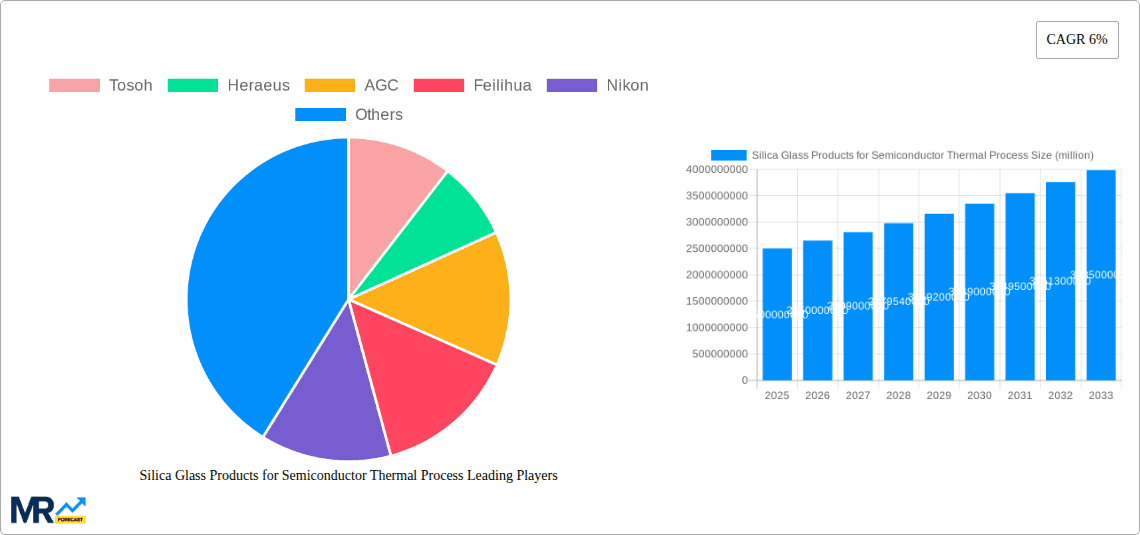

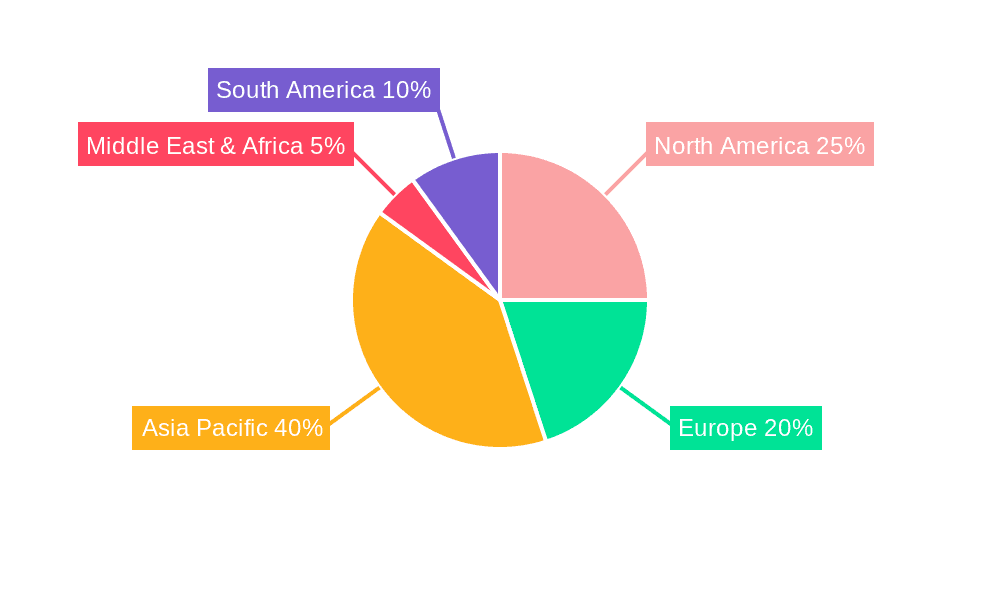

Despite a generally positive outlook, the market faces certain restraints that could temper its growth trajectory. Fluctuations in raw material prices, particularly for high-purity quartz, can impact manufacturing costs and profit margins for key players like Tosoh, Heraeus, and AGC. Furthermore, stringent environmental regulations and the increasing complexity of semiconductor manufacturing processes require significant R&D investment, potentially posing a barrier for smaller manufacturers. Geopolitical tensions and supply chain disruptions, as evidenced in recent years, also present risks to the stable supply of these critical components. Nevertheless, the continuous innovation in semiconductor technology, coupled with the indispensable nature of silica glass in thermal processing, ensures a strong underlying demand. The market is segmented by product type into Tubes, Flanges, and Others, with Tubes holding a significant share due to their widespread application in thermal processing equipment. Geographically, Asia Pacific, led by China, Japan, and South Korea, is a dominant region due to its extensive semiconductor manufacturing base, followed by North America and Europe, which are also crucial hubs for advanced chip production and technological development.

The global market for silica glass products tailored for semiconductor thermal processes is experiencing robust growth, driven by the relentless advancement of semiconductor manufacturing technology and the escalating demand for sophisticated electronic devices. This report delves into the intricate dynamics of this specialized market, projecting a substantial market size estimated to reach hundreds of billions of US dollars by the base year of 2025, and further expanding to trillions of US dollars by the forecast end year of 2033. Throughout the study period (2019-2033), the market has witnessed significant transformations, characterized by increasing purity requirements, higher temperature resistance demands, and the development of novel silica glass formulations. The historical period (2019-2024) laid the groundwork for this expansion, with consistent investments in research and development and a growing adoption of advanced deposition techniques. Key trends include the rise of ultra-high purity silica glass, essential for minimizing contamination in cutting-edge semiconductor fabrication. The development of amorphous silica with extremely low bubble counts and high mechanical strength is also a critical trend, directly impacting wafer yield and process efficiency. Furthermore, innovations in silica glass manufacturing, such as advanced melting and forming techniques, are enabling the production of more complex geometries and larger-diameter components, catering to the evolving needs of wafer processing equipment. The market is also seeing a shift towards specialized silica glass with tailored thermal expansion coefficients and optical properties, crucial for specific thermal process applications like Atomic Layer Deposition (ALD) and Rapid Thermal Processing (RTP). The increasing complexity of semiconductor nodes, particularly below 7nm, necessitates materials with exceptional performance under extreme thermal conditions, a domain where high-purity silica glass excels. The integration of advanced coatings and surface treatments on silica glass components is another emerging trend, enhancing their longevity and performance in corrosive and high-temperature environments. The market's trajectory is intrinsically linked to the broader semiconductor industry's growth, which in turn is fueled by innovations in AI, IoT, 5G, and high-performance computing, all of which demand increasingly powerful and compact semiconductor chips.

The silica glass products market for semiconductor thermal processes is being propelled by a confluence of powerful drivers. Foremost among these is the insatiable global demand for advanced semiconductors. As technologies like Artificial Intelligence (AI), 5G, the Internet of Things (IoT), and high-performance computing (HPC) continue to evolve at an unprecedented pace, the need for more powerful, energy-efficient, and compact semiconductor chips escalates. This directly translates to increased production volumes and a growing reliance on sophisticated thermal processing techniques, which in turn fuel the demand for high-quality silica glass components. Furthermore, the continuous innovation in semiconductor manufacturing processes plays a pivotal role. Technologies such as Atomic Layer Deposition (ALD), Low-Pressure Chemical Vapour Deposition (LPCVD), Sub Atmospheric Chemical Vapour Deposition (SACVD), and Rapid Thermal Processing (RTP) are becoming increasingly refined, requiring specialized materials that can withstand extreme temperatures, corrosive environments, and ultra-high purity conditions. Silica glass, with its exceptional thermal stability, chemical inertness, and purity, is an indispensable material for these processes. The advancements in wafer technology, particularly the transition to larger wafer diameters (e.g., 300mm and beyond), necessitate larger and more robust silica glass components, such as tubes and flanges, to accommodate these larger substrates and ensure uniform thermal processing. The stringent requirements for yield and contamination control in advanced semiconductor fabrication also serve as a significant driver. Any impurities or defects in processing equipment can lead to costly wafer defects and reduced yields. High-purity silica glass offers a solution by minimizing particulate generation and chemical interactions, thereby safeguarding the integrity of the semiconductor fabrication process. Finally, government initiatives and investments in the semiconductor industry globally, aimed at bolstering domestic production and ensuring supply chain resilience, are also contributing to the market's growth by stimulating new manufacturing facilities and capacity expansions.

Despite the robust growth trajectory, the silica glass products market for semiconductor thermal processes faces several significant challenges and restraints. One of the primary hurdles is the inherent complexity and cost associated with producing ultra-high purity silica glass. Achieving the necessary purity levels, often in parts per billion (ppb) or even parts per trillion (ppt), requires highly specialized manufacturing processes, stringent quality control, and significant investment in R&D and advanced equipment. This can lead to higher material costs for semiconductor manufacturers. Another challenge is the limited supply of raw materials for high-purity quartz, as the availability of natural, high-grade quartz deposits is finite and geographically concentrated. This can create potential supply chain vulnerabilities and price volatility. Furthermore, the development and adoption of alternative materials pose a potential restraint. While silica glass remains dominant, ongoing research into other high-temperature resistant and inert materials for specific thermal process applications could, in the long term, present competitive alternatives. The long lead times and high capital expenditure required for establishing new silica glass manufacturing facilities can also act as a restraint on rapid market expansion, especially in response to sudden surges in demand. Moreover, technical challenges in achieving uniform material properties across large-scale silica glass components, particularly for next-generation wafer sizes and complex furnace designs, require continuous innovation and process optimization. The increasing environmental regulations and sustainability concerns related to energy-intensive manufacturing processes for silica glass could also become a more significant factor in the future, potentially necessitating investments in cleaner production technologies. Finally, geopolitical factors and trade tensions can disrupt global supply chains, impacting the availability and cost of both raw materials and finished silica glass products.

The global silica glass products market for semiconductor thermal processes exhibits a distinct regional and segment dominance, largely dictated by the concentration of semiconductor manufacturing hubs and the technological sophistication of end-use applications.

Dominant Regions/Countries:

Asia-Pacific (APAC): This region stands as the undisputed leader and is projected to continue its dominance throughout the study period (2019-2033).

North America: While not matching the sheer volume of APAC, North America holds significant importance, particularly due to its advanced R&D capabilities and the presence of leading fabless semiconductor companies and advanced manufacturing research initiatives.

Dominant Segments (Type & Application):

Tube Segment (Type): This segment is expected to remain the largest and most crucial contributor to the silica glass market for semiconductor thermal processes.

Atomic Layer Deposition (ALD) and Low-Pressure Chemical Vapour Deposition (LPCVD) Applications: These deposition techniques are key drivers within the application segment.

The silica glass products for semiconductor thermal process industry is experiencing significant growth catalysts. The relentless pursuit of smaller, faster, and more power-efficient semiconductor devices fuels the demand for advanced thermal processing techniques. Innovations in areas like 3D NAND flash memory and advanced logic chips directly necessitate the use of high-purity silica glass components in specialized furnaces and deposition chambers. Furthermore, the growing global investments in domestic semiconductor manufacturing capacity, driven by supply chain diversification and national security concerns, are leading to the construction of new fabs, thereby creating substantial demand for essential processing equipment and its silica glass components. The increasing adoption of AI, machine learning, and high-performance computing is also a significant catalyst, as these technologies require more sophisticated and higher-density semiconductor chips, pushing the boundaries of manufacturing processes and material requirements.

This comprehensive report provides an in-depth analysis of the global silica glass products market for semiconductor thermal processes, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers critical insights into market trends, drivers, and restraints, supported by robust quantitative data. The report meticulously details regional and segment-wise market dynamics, highlighting dominant areas and growth opportunities. It identifies key industry developments and strategic initiatives by leading players, offering a forward-looking perspective. The study covers essential applications such as Atomic Layer Deposition (ALD), Low-Pressure Chemical Vapour Deposition (LPCVD), Sub Atmospheric Chemical Vapour Deposition (SACVD), and Rapid Thermal Processing (RTP), alongside product types including Tubes, Flanges, and Others. This ensures a holistic understanding of the market's intricate ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include Tosoh, Heraeus, AGC, Feilihua, Nikon, Shin-Etsu, Ohara, Corning, CoorsTek, SKC Solmics.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Silica Glass Products for Semiconductor Thermal Process," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Silica Glass Products for Semiconductor Thermal Process, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.